Release Of Mortgage Lien

Description

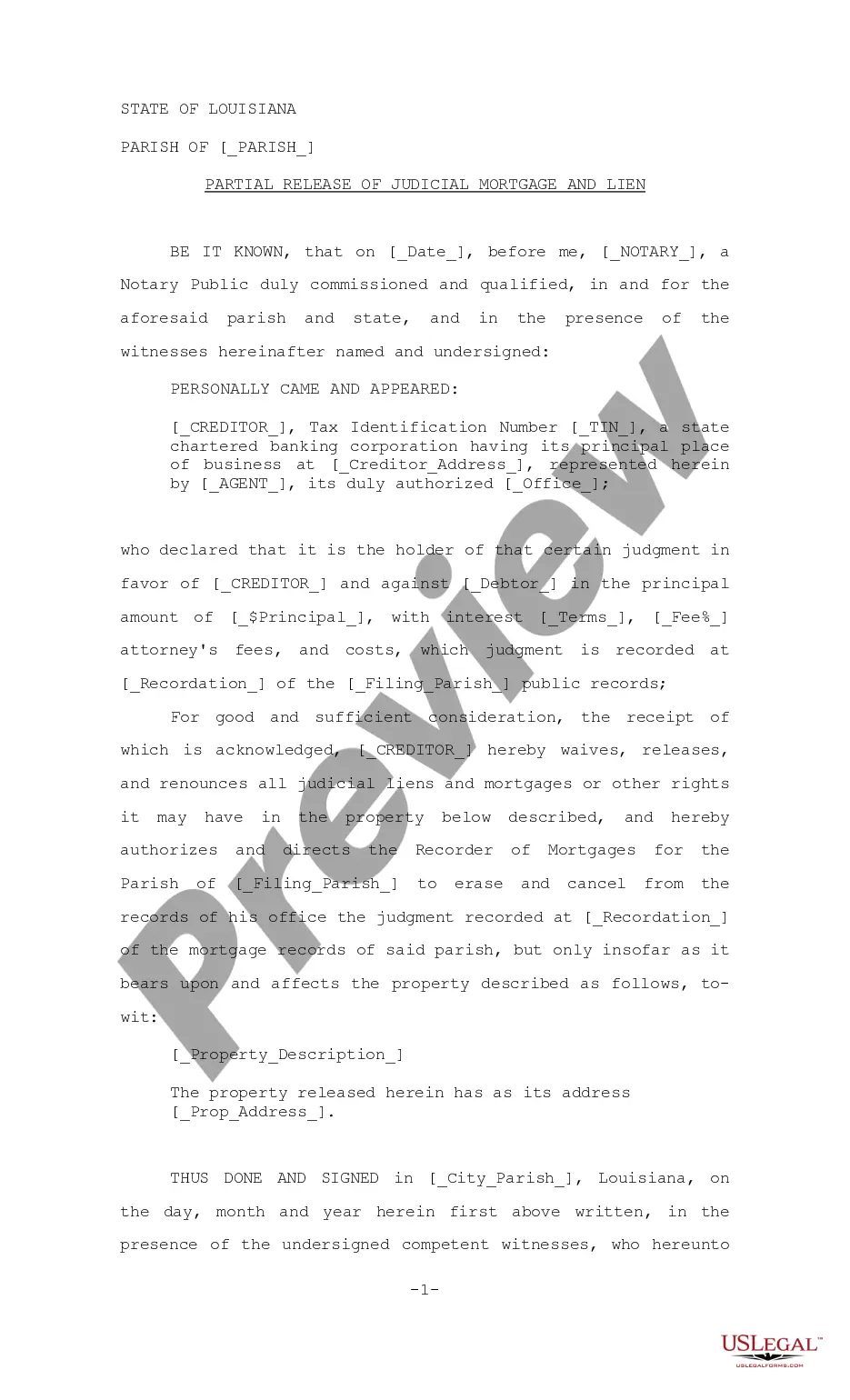

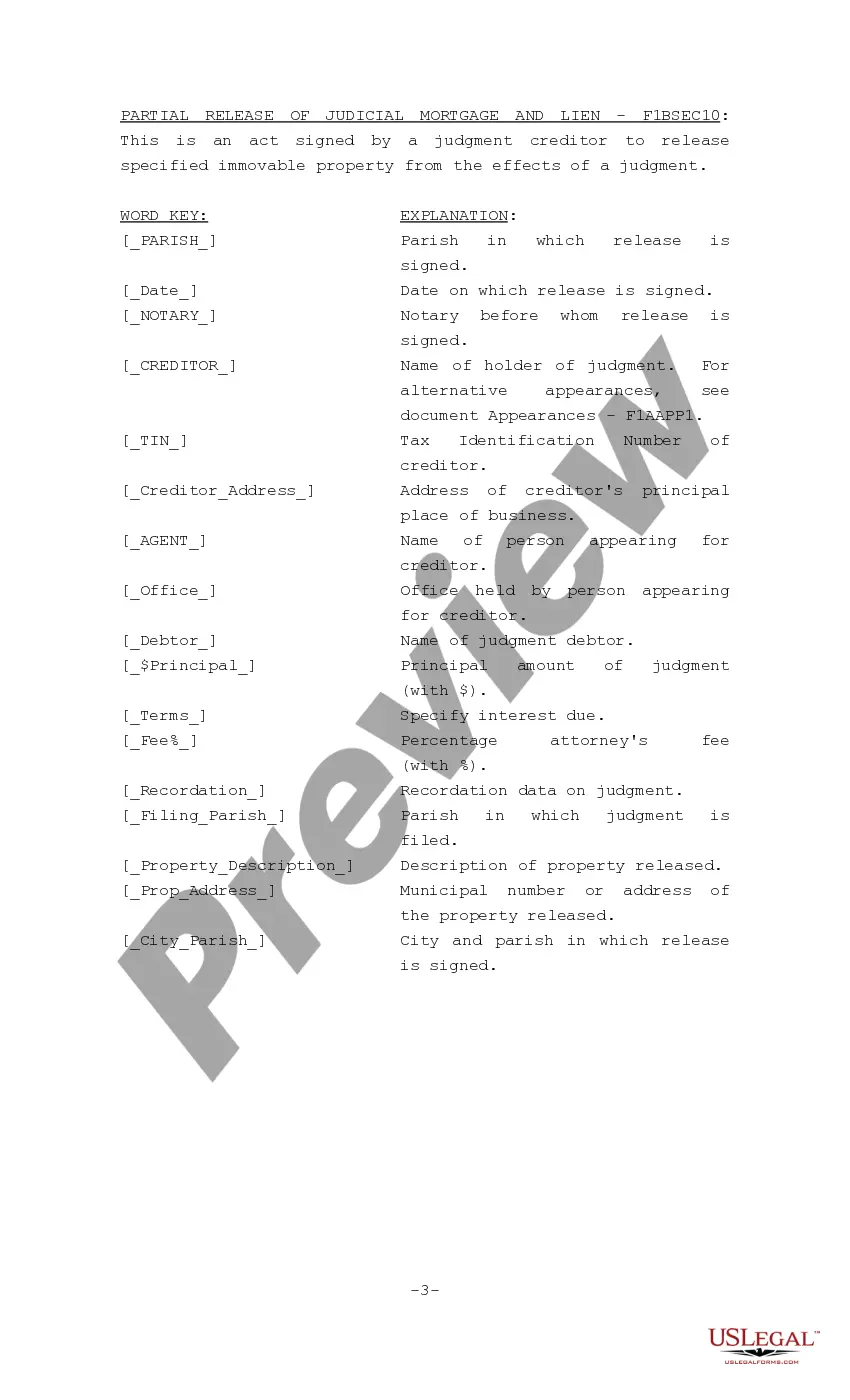

How to fill out Louisiana Partial Release Of Judicial Mortgage And Lien?

Individuals frequently link legal documentation with a notion of intricacy that only an expert can handle.

In some respects, this is accurate, as formulating a Release Of Mortgage Lien necessitates comprehensive understanding of subject parameters, including regional and state regulations.

Nevertheless, with the US Legal Forms, accessibility has improved: ready-made legal documents for any personal or business situation pertinent to state laws are compiled in a single online directory and are now within reach for everyone.

Establish an account or Log In to continue to the payment page. Complete your payment for the subscription using PayPal or a credit card. Select the desired format for your file and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once purchased, they are saved in your profile, granting you access to them whenever needed via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Enroll today!

- US Legal Forms provides over 85k current documents categorized by state and application area, allowing the search for a Release Of Mortgage Lien or any other specific template to only take a few moments.

- Previously registered users with a valid subscription must Log In to their account and click Download to obtain the form.

- New users to the service will need to register for an account and subscribe prior to storing any documentation.

- Here’s a step-by-step guide on how to obtain the Release Of Mortgage Lien.

- Carefully review the page content to ensure it meets your requirements.

- Read the form description or check it through the Preview option.

- If the previous sample doesn't meet your needs, search for another one using the Search field above.

- Once you find the accurate Release Of Mortgage Lien, click Buy Now.

- Choose a subscription plan that aligns with your needs and financial considerations.

Form popularity

FAQ

The lender will record the Deed of Trust or Mortgage document in the public records with the appropriate agency in the county where the property is located. Once the loan is repaid, the lender should provide a recordable lien release document.

If the mortgage has been registered, then you should take an NOC from registrar's office to get the lien removed. For this both the parties, borrower and representative of the bank need to be present there. In case, the mortgage is not registered, the bank will simply return your documents.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

Loan Release means the process that Party B issues an instruction to Party A to cancel the suspension of payment of all bidding funds for certain subject in the case of fulfillment of the conditions of loan release, and transfer them to the payment account designated by the borrower, and to credit any amount receivable

You can remove a name from your mortgage without refinancing by informing your lender that you are taking over the mortgage, and you want a loan assumption. Under a loan assumption, you take full responsibility for the mortgage and remove the other person from the note.