What Is Usufruct And Its Purpose

Description

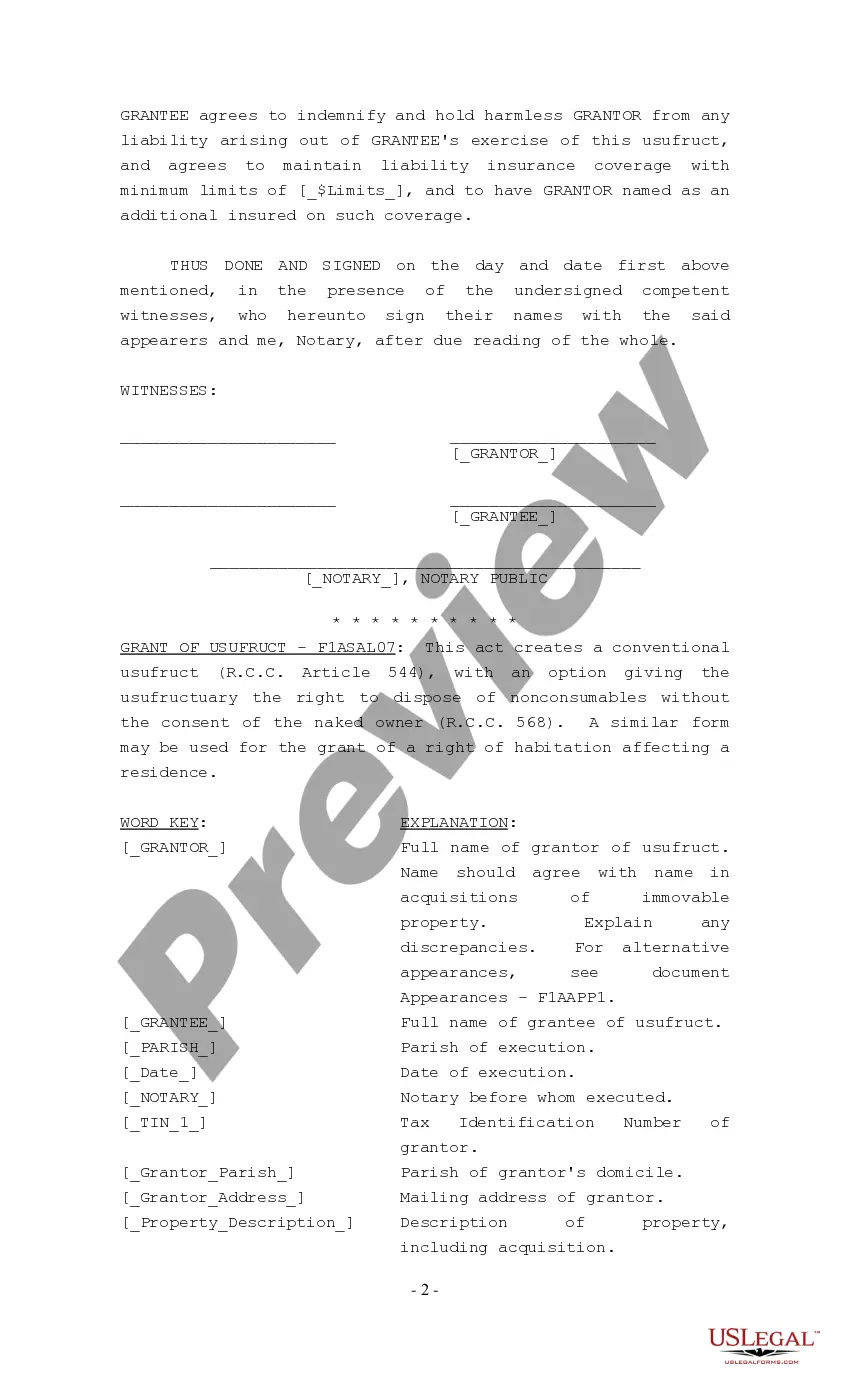

How to fill out Louisiana Grant Of Usufruct?

- If you are a returning user, log in to your account and download the required form by clicking the Download button. Ensure your subscription is up to date to avoid access issues.

- For first-time users, start by checking the Preview mode and description of your chosen form to ensure it meets all requirements for your local jurisdiction.

- If the form doesn’t fully match your needs, utilize the Search tab to find a suitable alternative that aligns with your requirements.

- To proceed, click on the Buy Now button and select your preferred subscription plan. Creating an account is necessary to access the extensive library of resources.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Finally, download your form to your device, saving it for convenience, and access it anytime from the My Forms section of your profile.

US Legal Forms benefits users with an extensive online library, containing over 85,000 easy-to-fill legal forms. This vast collection ensures that individuals and attorneys can quickly find and execute the documents they need.

In conclusion, leveraging US Legal Forms can simplify the process of managing usufruct and other legal agreements. Don't hesitate to explore the collection today!

Form popularity

FAQ

The owner of the usufruct is the person who holds the legal right to enjoy and use the property for a specified period, but does not own the property itself. In terms of what is usufruct and its purpose, this arrangement allows the usufructuary to benefit from the property while respecting the owner's rights. The property remains in the ownership of the original titleholder, who retains the right to reclaim it after the usufruct term expires. Understanding these dynamics is crucial, and platforms like US Legal Forms can clarify these roles.

In the context of what is usufruct and its purpose, the usufructuary typically cannot sell the property itself. However, they may be allowed to sell items that are considered movable and do not alter the essential value of the property. It's important for usufructuaries to clearly understand their rights and limitations in this regard. To ensure compliance and avoid disputes, consulting legal resources, such as those provided by US Legal Forms, can be very helpful.

When the usufructuary dies, the usufruct typically ends, and the property reverts to the owner or their heirs. This transition can create a range of effects based on the original terms of the usufruct agreement. Therefore, knowing what is usufruct and its purpose is vital for all parties involved to understand their rights and responsibilities. If you face questions regarding this process, UsLegalForms can provide valuable resources and forms to simplify your estate planning.

Tax implications in a usufruct agreement can be significant, particularly in relation to property taxes and inheritance taxes. When determining what is usufruct and its purpose, it is essential to recognize that the usufructuary may need to report income generated from the property on their tax returns. Additionally, the structure of a usufruct may influence how property is taxed upon the death of the usufructuary, leading to further complexities.

In a usufruct arrangement, the usufructuary typically pays tangible personal property taxes. This is because the usufructuary has the right to use and benefit from the property during the term of the usufruct. As a result, they are responsible for any taxes that arise from the property's use. Understanding the fiscal responsibilities in a usufruct can help prevent misunderstandings or disputes.

Usufruct is a legal right that allows one person to use and enjoy the property owned by another, without altering the property's substance. The primary purpose of usufruct is to balance the owner's rights with the needs and benefits of the usufructuary, creating an equitable arrangement. Understanding what usufruct and its purpose reveals how it can facilitate family agreements, investment opportunities, and estate planning. Resources like uslegalforms can assist you in formalizing these agreements effectively.

The maximum period of an usufruct often depends on the laws of the jurisdiction where the property is located. Generally, while a lifetime usufruct lasts for the life of the usufructuary, other types can be designed for a limited number of years, often not exceeding 30 years. Therefore, understanding what usufruct and its purpose entails includes knowing the limitations of duration in your state. Legal resources like uslegalforms can guide you on your region's specific regulations.

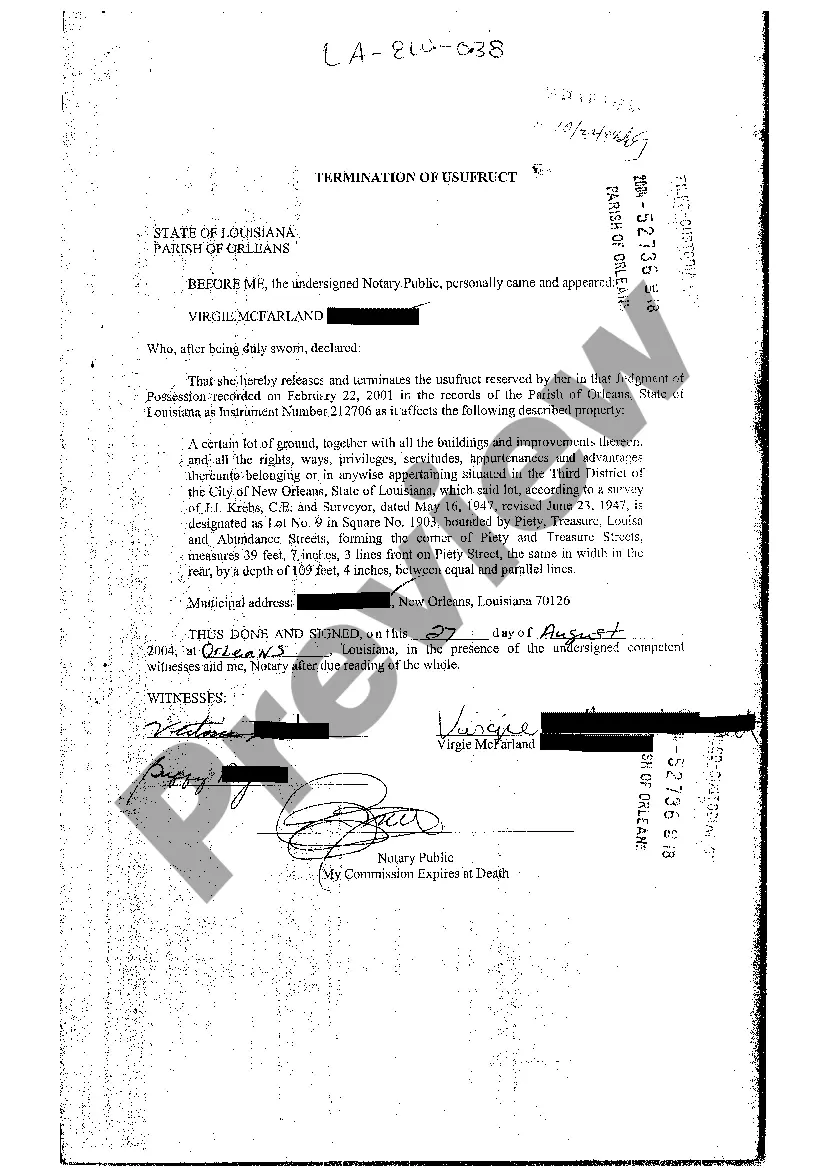

An usufruct can be terminated through mutual agreement between the usufructuary and the property owner, through expiration, or via the death of the usufructuary. Additionally, it can end if the usufructuary fails to meet their obligations, such as paying taxes or maintaining the property. Clarifying how usufruct works will provide insights into situations that can lead to termination. Utilizing resources like uslegalforms can simplify this process.

When a usufructuary dies, the usufruct typically ends, and the rights to the property revert back to the original owner or their heirs. This transition should be clearly outlined in any legal documents to ensure smooth transfers. Consequently, understanding what usufruct and its purpose can help stakeholders prepare for such eventualities. Using legal platforms, like uslegalforms, can guide you through drafting necessary documents to clarify terms.

A lifetime usufruct is a specific type of usufruct where the right to use and enjoy the property lasts for the entire life of the usufructuary. Once the usufructuary passes away, the rights typically revert to the owner of the property. This arrangement helps ensure that the property is cared for and used during the usufructuary’s lifetime. Grasping what usufruct and its purpose highlights the importance of such arrangements in estate planning.