Usufruct Rules

Description

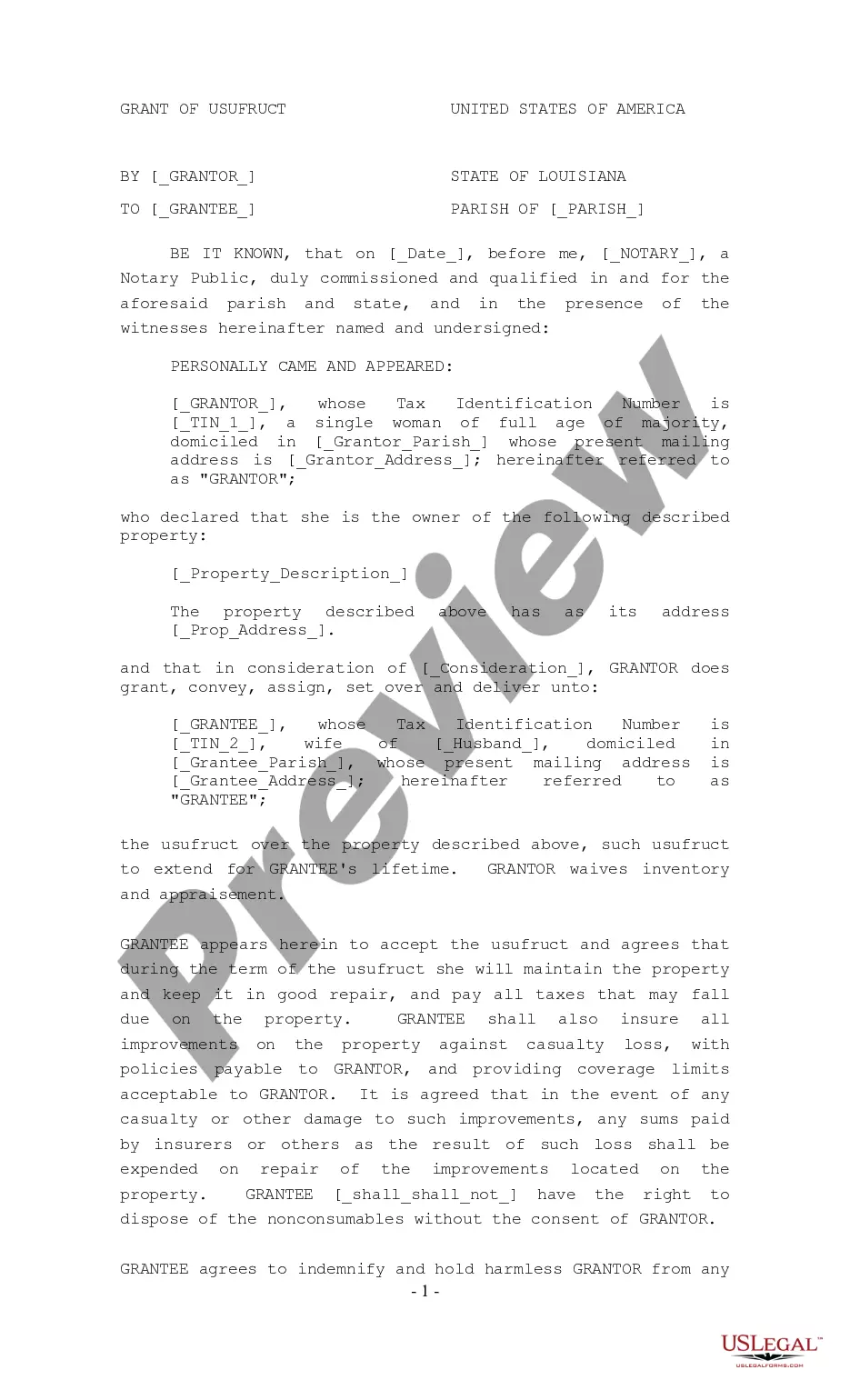

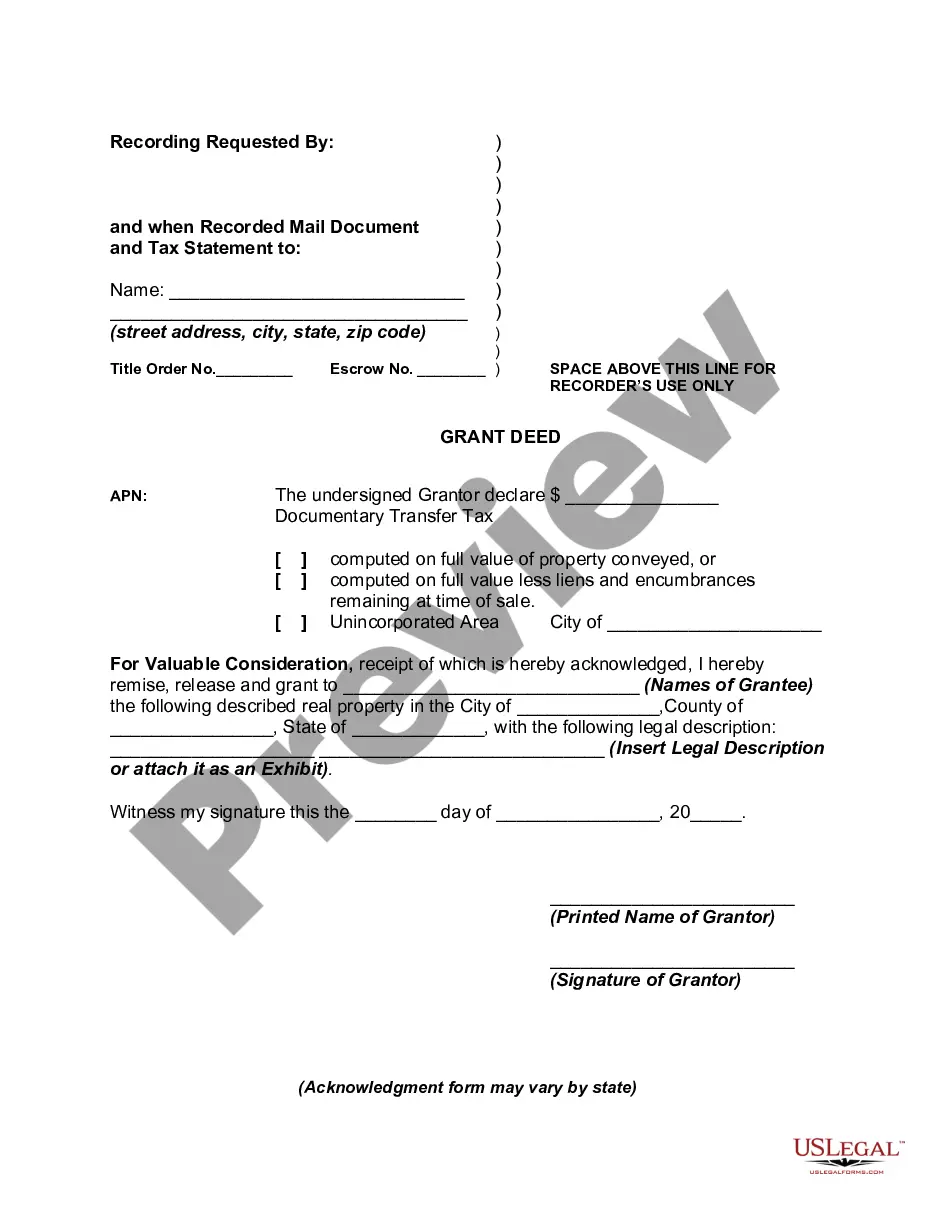

How to fill out Louisiana Grant Of Usufruct?

- Log in to your account on the US Legal Forms website by clicking here if you're a returning user. Ensure your subscription remains active; renew it if necessary.

- For first-time users, begin by browsing through the preview mode of the available forms. Confirm that you choose one that fits your requirements and adheres to local legal standards.

- Should your initial choice prove unsuitable, utilize the Search tab to locate an appropriate template. Once satisfied, proceed to purchase.

- Click the Buy Now button on the selected document and select your preferred subscription plan. Creating an account is necessary for access to the full form library.

- Enter your payment details, using a credit card or PayPal, to finalize your subscription purchase.

- Download the completed form to your device. You can access this document later in the My Forms section of your account.

Once you've followed these steps, you’re well on your way to effectively handling your legal documentation. Thanks to US Legal Forms' extensive resources and expert guidance, you can feel confident in your ability to navigate usufruct rules.

Ready to get started? Visit US Legal Forms today to explore the vast library of templates and take control of your legal documentation!

Form popularity

FAQ

The rule of usufruct dictates that the usufructuary can use and enjoy the property as if they were the owner, but they must also preserve its substance. This means taking care not to damage or deplete the resources of the property. For individuals entering such agreements, knowing the usufruct rules can ensure adherence to responsibilities while benefiting from the rights granted. Using platforms like US Legal Forms can help you easily access documents and advice about these rules.

The derivative of usufruct refers to relationships established through legal agreements, whereby one party gains the right to use and benefit from the property owned by another. This often occurs in contexts like inheritance or financial contracts. Recognizing the derivative nature of usufruct can clarify rights and responsibilities for each party involved. Familiarity with usufruct rules is essential to avoid conflicts in these scenarios.

A common example of a usufruct right is when a person is allowed to live in a home owned by another individual. In this case, that person enjoys the use of the property without owning it. This arrangement can be beneficial, especially in family situations where an elderly relative wishes to continue living in their home. Understanding usufruct rules can help you navigate these arrangements more effectively.

The biggest tax implications often involve property taxes and potential income taxes on rental income if the usufructuary rents the property. Understanding these nuances is essential as the usufruct rules can affect both parties' tax responsibilities. Consulting a professional or using resources like USLegalForms can help clarify these implications and ensure compliance with applicable laws.

A common example of usufruct rights is when a parent grants their child the right to live in their home for a certain period while retaining ownership. The child can use the home, make repairs, and benefit from it, but the parent retains the title. Such arrangements are covered under usufruct rules, and you might find useful templates on USLegalForms to establish clear terms.

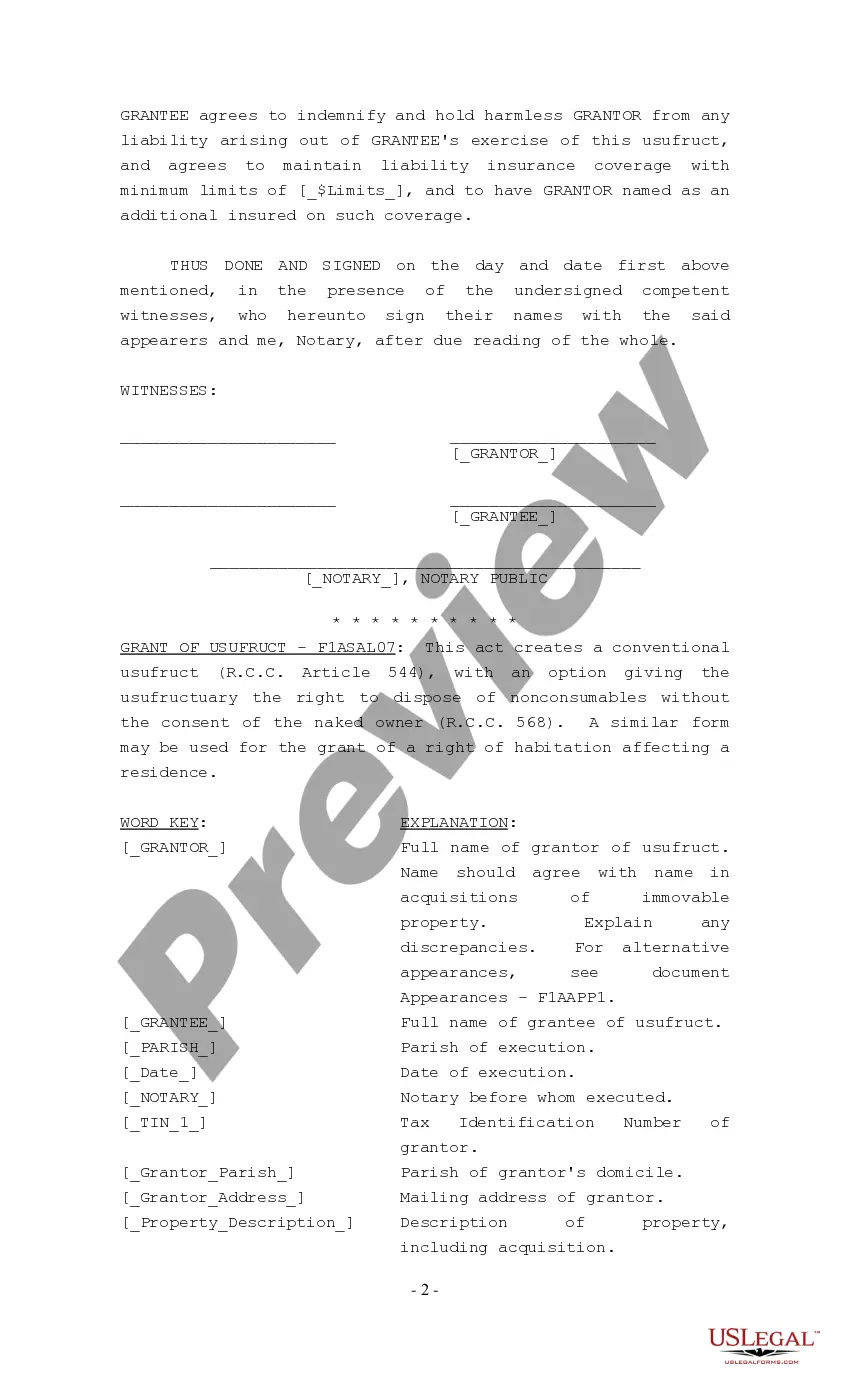

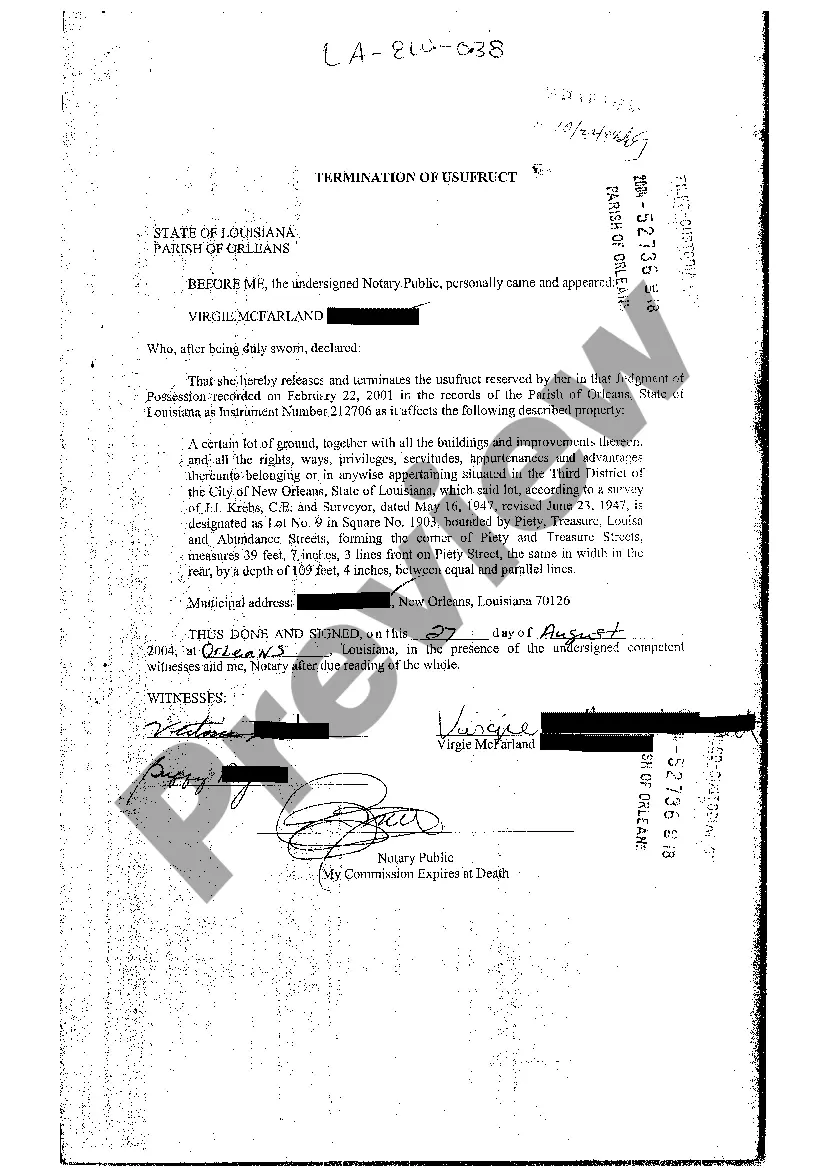

When a usufructuary passes away, the usufruct terminates, and the property returns to the owner or their heirs. This transition is governed by usufruct rules which dictate that the rights and responsibilities associated with the property revert to the original owner. It's important to have a clear succession plan, and platforms like USLegalForms can help draft a plan that meets your needs.

Typically, the person holding the usufruct is responsible for paying tangible personal property taxes. This is because the usufructuary enjoys the benefits of the property during the usufruct period. However, the specific obligations can vary depending on the terms of the usufruct arrangement and local laws, so reviewing your agreement or seeking guidance from professionals at USLegalForms is beneficial.

Under usufruct rules, the usufructuary holds the right to use and manage the property but cannot sell it without obtaining permission from the owner. Selling items that are part of the usufruct may depend on the specific terms outlined in the usufruct agreement. It is wise to consult a legal expert or utilize services like USLegalForms to ensure compliance with the rules and to protect your interests.

The maximum period for a usufruct can vary depending on state laws and the specific conditions of the agreement. Generally, usufruct rules suggest that a usufruct can exist for a fixed term or for the life of the usufructuary. Understanding these limits can help both parties navigate the arrangement effectively.

A lifetime usufruct grants the usufructuary the right to use and enjoy a property for the duration of their life. Under usufruct rules, this type of arrangement provides security and stability for the usufructuary, ensuring they have ongoing access to the property. It's crucial to document these terms accurately to uphold the agreement's intentions.