Louisiana Restraining Order Form With Google Docs

Description

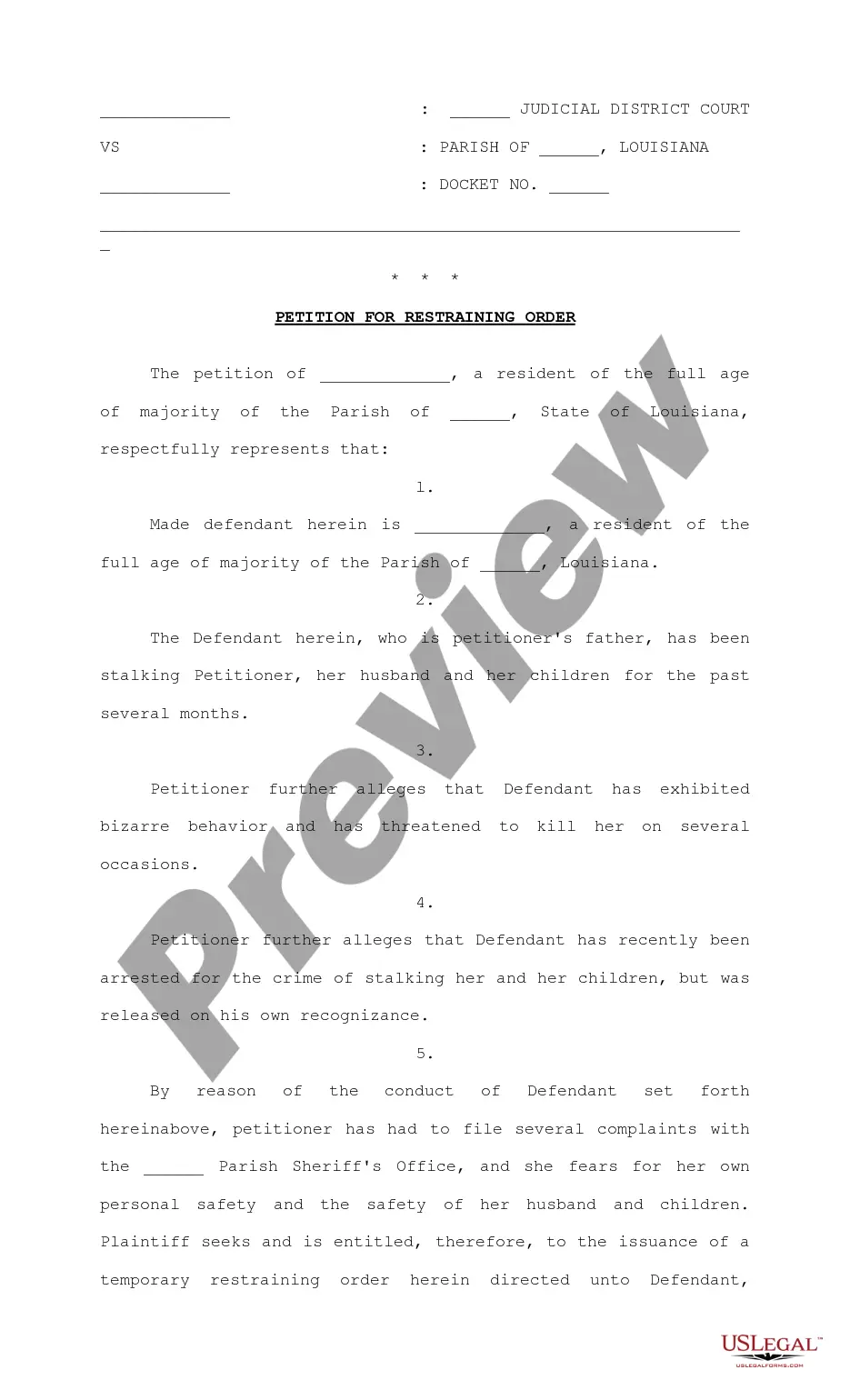

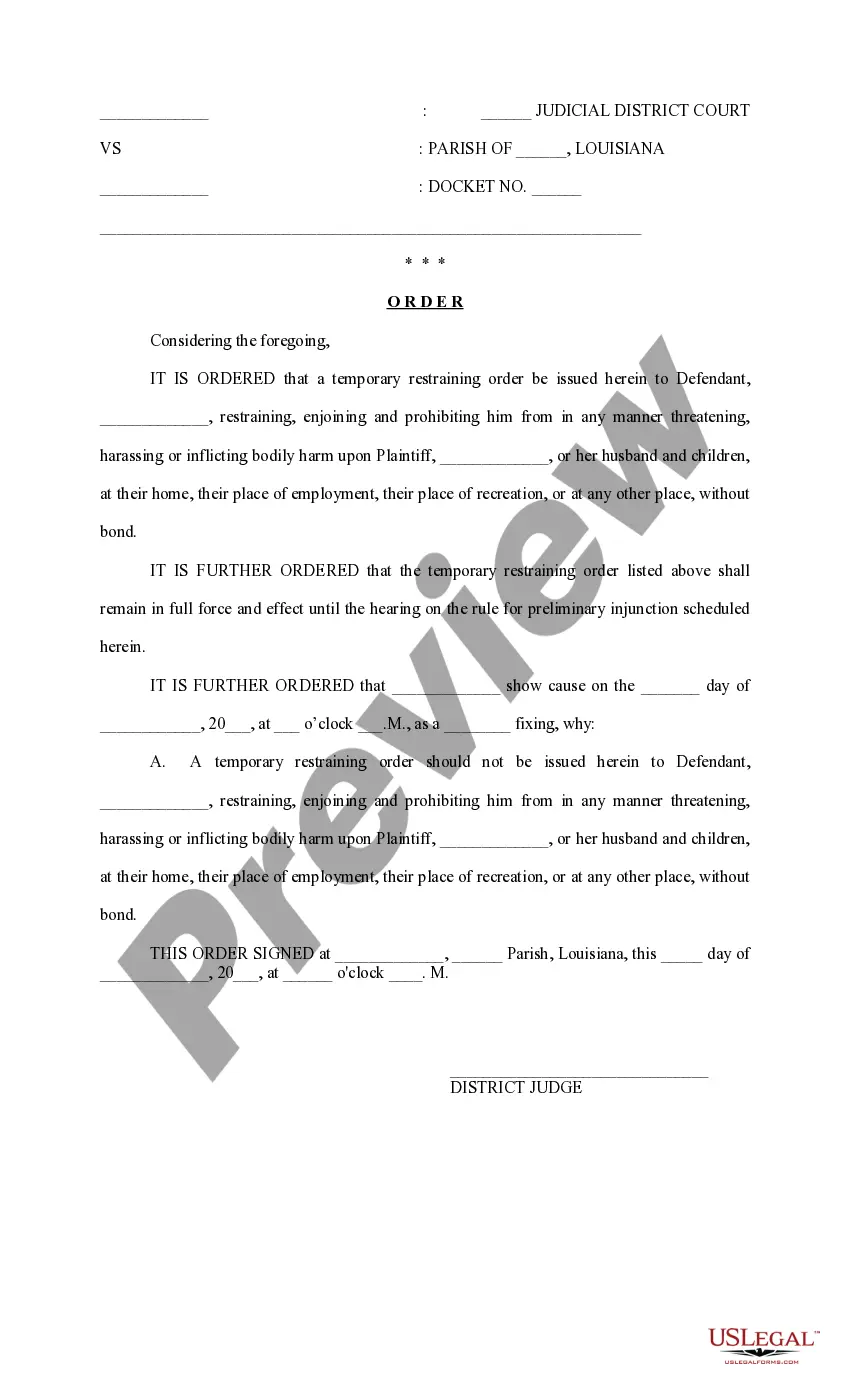

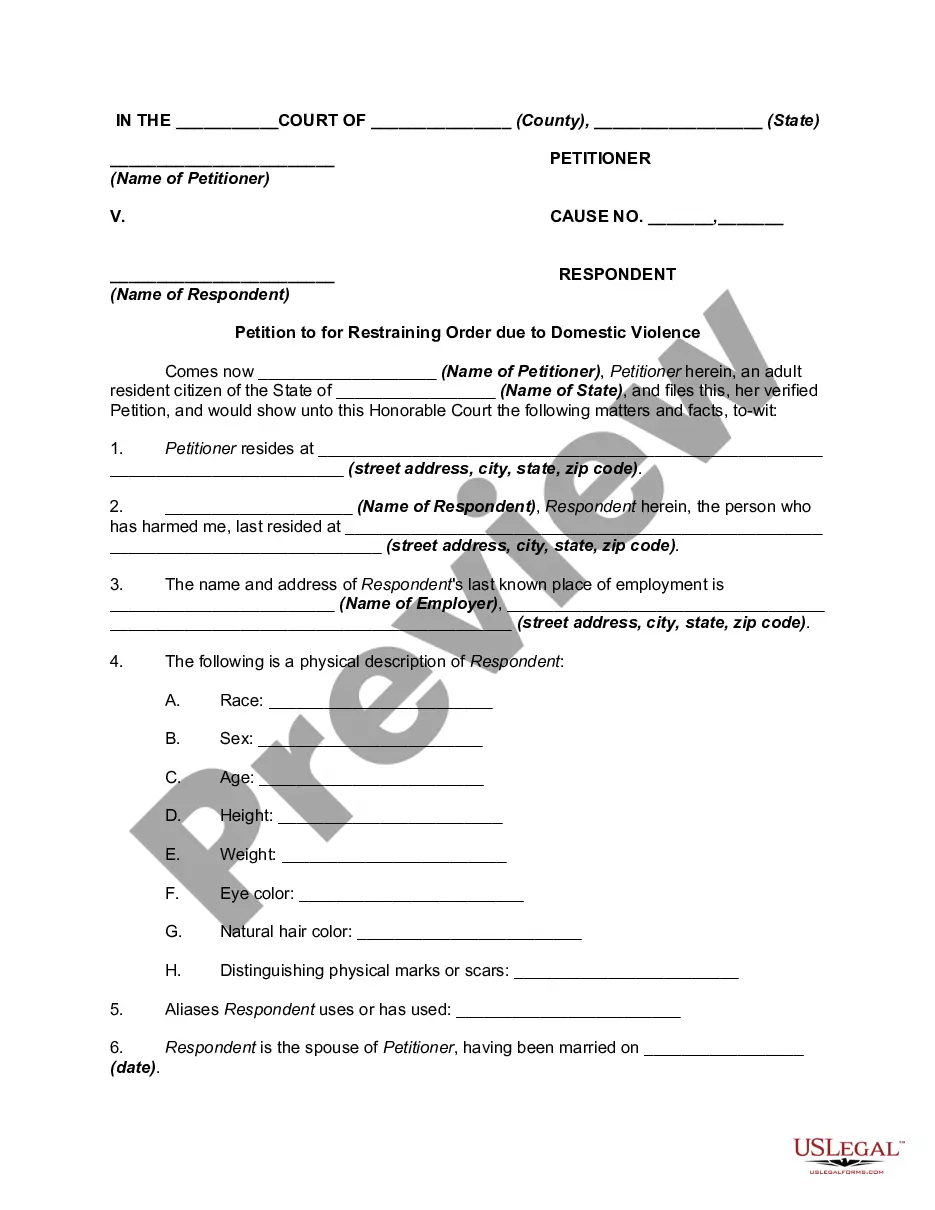

How to fill out Louisiana Petition For Restraining Order?

Creating legal documentation from the ground up can occasionally be overwhelming.

Specific situations may require extensive research and significant financial resources.

If you’re in search of a simpler and more economical method for preparing the Louisiana Restraining Order Form With Google Docs or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly all aspects of your financial, legal, and personal matters.

Before proceeding to download the Louisiana Restraining Order Form With Google Docs, consider these recommendations: Ensure the document preview and descriptions confirm that you have located the correct form. Verify if the selected form aligns with the standards of your state and county. Choose the most suitable subscription option to acquire the Louisiana Restraining Order Form With Google Docs. Download the file, then complete, sign, and print it. US Legal Forms boasts an impeccable track record and over 25 years of experience. Join us today and transform document completion into a straightforward and efficient process!

- With a few clicks, you can swiftly obtain state- and county-compliant forms carefully assembled for you by our legal experts.

- Utilize our website whenever you require dependable and trustworthy services through which you can promptly discover and download the Louisiana Restraining Order Form With Google Docs.

- If you’re already familiar with our website and have set up an account, simply Log In to your account, find the form, and download it or re-download it at any time from the My documents section.

- Haven’t registered yet? No problem. Setting it up and browsing the catalog takes mere minutes.

Form popularity

FAQ

Partnerships conducting business within Indiana must file an annual return (Form IT-65) and information returns (Schedule IN K-1) with DOR. These forms must disclose each partner's distributive share of the partnership income distributed or undistributed.

Who Must File. A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of ?doing business? in General Information A, Important Information.

The composite return must include each nonresident partner regardless of whether or not the nonresident partner has other Indiana source income. (j) If a partnership does not include all nonresident partners in the composite return, the partnership is subject to the penalty imposed under IC 6-8.1-10-2.1(j).

Other (Current Year Conformity) Add-Back 120 Therefore, the IRC used to figure Indiana income may not be the same as the IRC used to figure federal income. This add-back is specific to these annual current year conformity is- sues.

Any partnership doing business in Indiana or deriving gross income from sources within Indiana is required to file a return. The following activities occurring in Indiana constitute doing business or deriving income from Indiana sources: 1.

General Tax Information An Indiana individual income tax return may need to be filed if you lived in Indiana and received income greater than your exemptions or you lived outside Indiana and received income from Indiana.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Meal Deduction Add-Back (3-digit code: 149) 1, 2021, add back the amount deducted for federal purposes in excess of 50% of the food or beverage expenses. Do not add back any amount for which an exception to the 50% limitation was in effect for amounts paid before Jan. 1, 2021.