Warrants For Arrest In Nc

Description

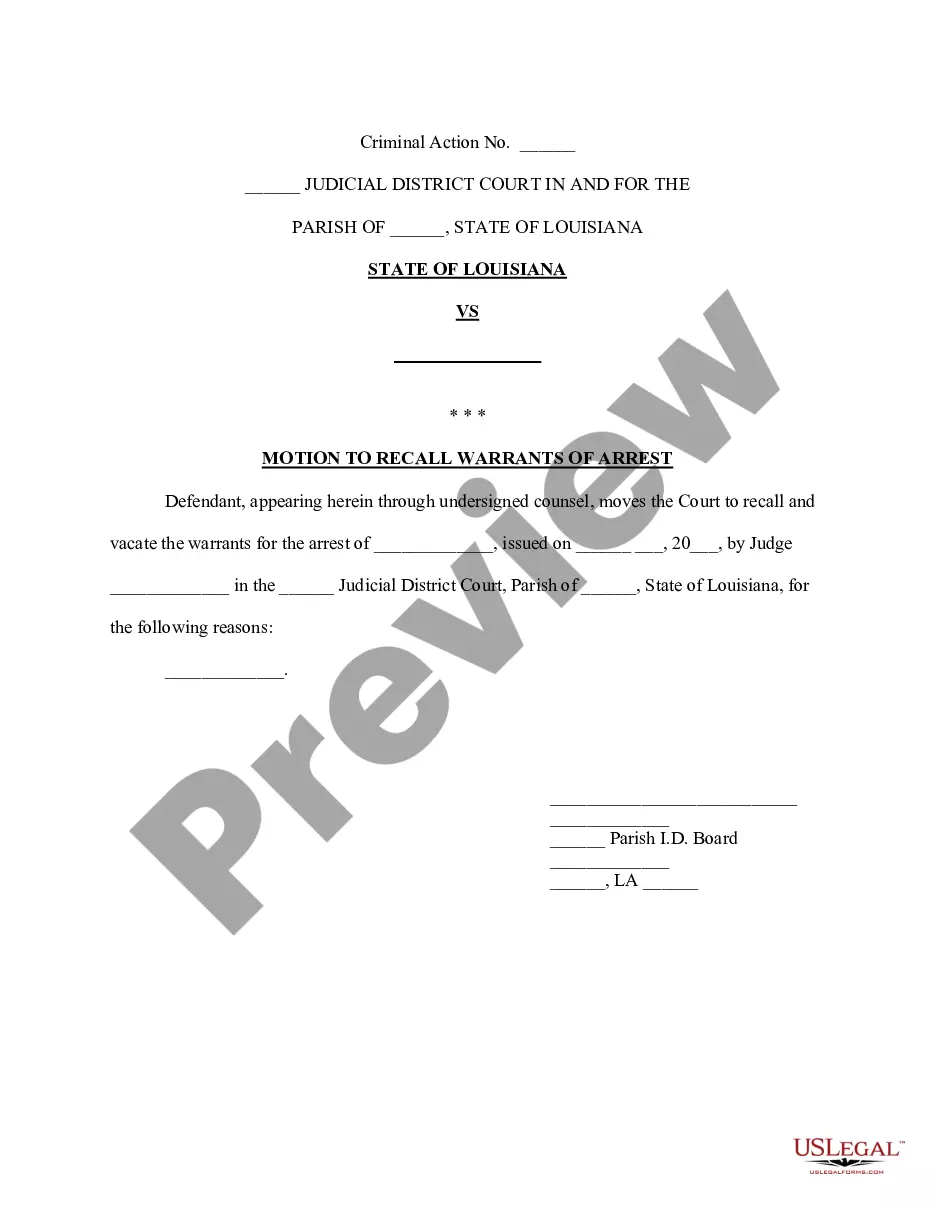

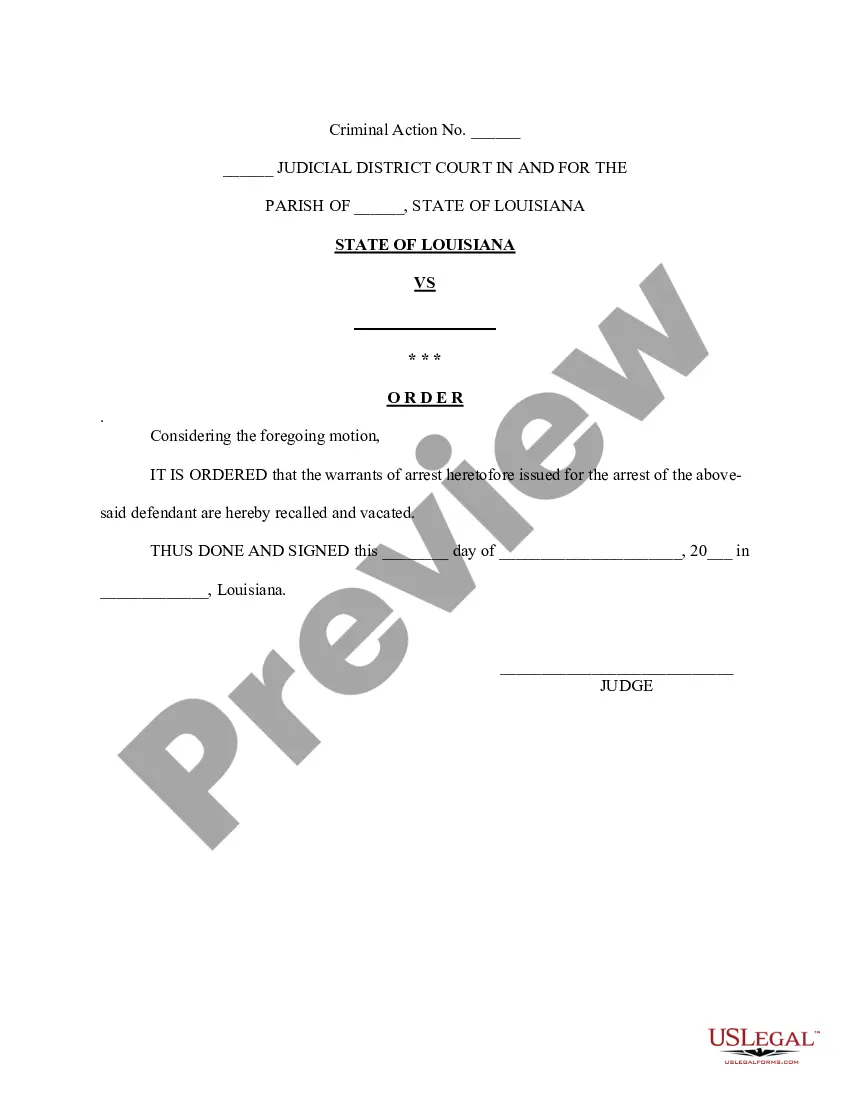

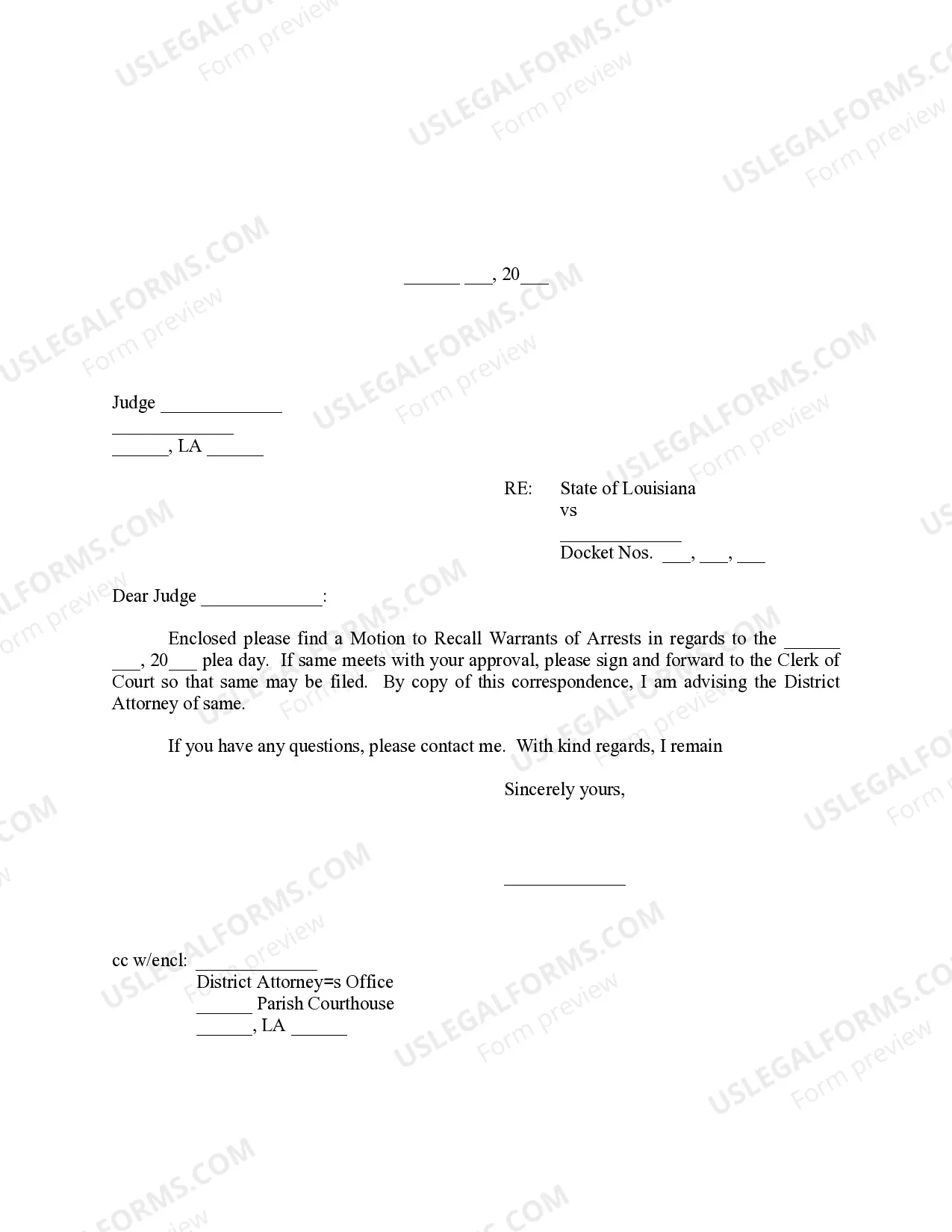

How to fill out Louisiana Motion To Recall Warrants Of Arrest?

Regardless of whether it's for corporate objectives or personal issues, everyone inevitably faces legal circumstances during their lifetime.

Completing legal documents requires meticulous care, starting with choosing the correct form template.

With a comprehensive collection of US Legal Forms available, you won't need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the appropriate form for any circumstance.

- Locate the template you need through the search bar or catalog browsing.

- Review the document’s details to ensure it corresponds to your circumstance, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Warrants For Arrest In Nc example you require.

- Obtain the template once it suits your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you have not yet created an account, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the desired file format and download the Warrants For Arrest In Nc.

- Once saved, you can either fill out the form using editing software or print it to complete it by hand.

Form popularity

FAQ

The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded. The Grantor and Grantee are jointly and severally liable for the payment of the tax.

A gift deed frames the ownership of the house as a gift the parent gives the child. Both parties must sign the deed, and there is no exchange of money or compensation. In this case, the child will be held liable for gift taxes and may be subject to capital gains if the property has increased in value.

Nevada also has no gift tax. There is a federal gift tax with an exemption of $16,000 per year for each gift recipient for 2022, increasing to $17,000 in 2023. If you gift one person more than $17,000 in a year, you must report that gift to the IRS.

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. A Declaration of Value form must accompany all real property documents.

A conveyance of Nevada real estate must be evidenced by a deed signed by a property owner of lawful age or by the owner's authorized agent or attorney. Nevada law assumes that a deed transfer's the owner's entire interest?including any water rights or after-acquired title?unless the deed expressly limits the transfer.