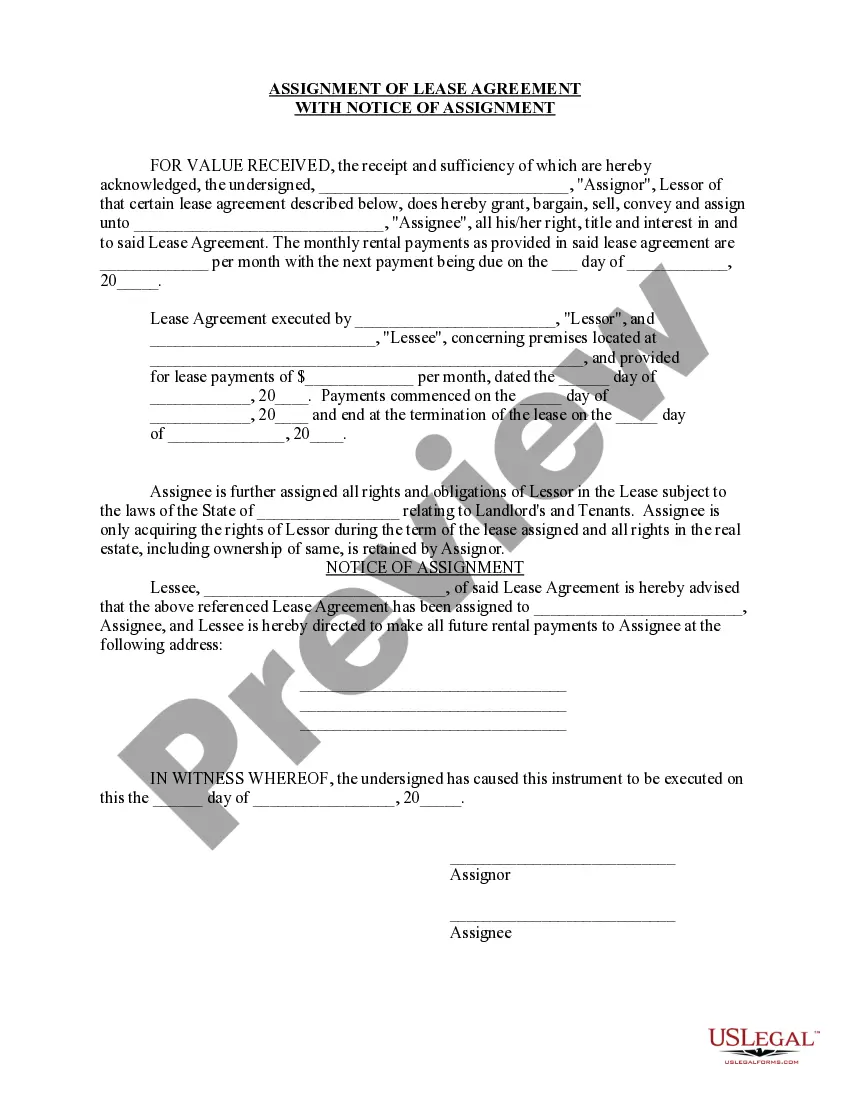

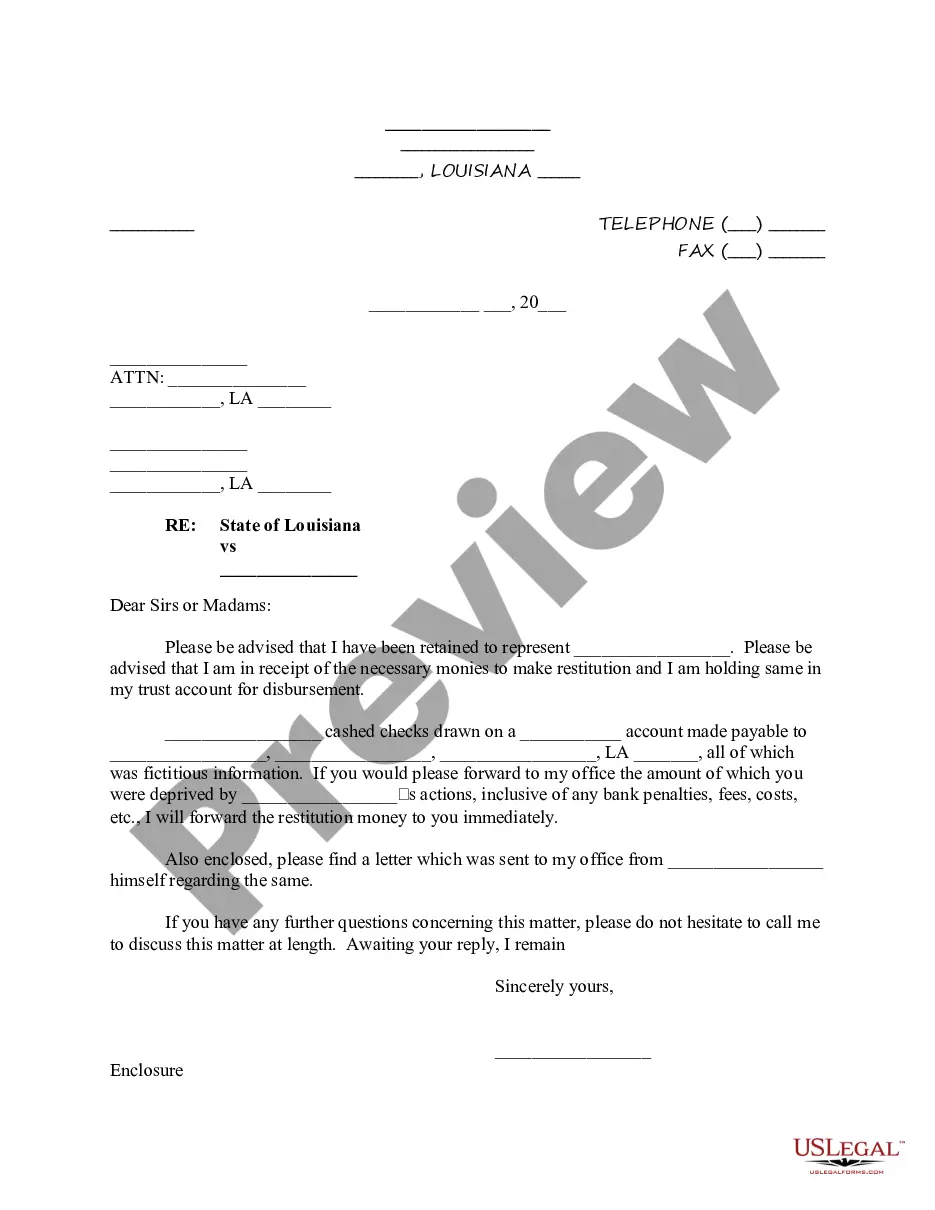

Restitution Letter Sample With Attached Resume

Description

How to fill out Louisiana Follow-up Letter To Bank Regarding Restitution Offer In Bank Fraud Case?

The Reimbursement Letter Example Accompanied by Resume that you observe on this page is a reusable official template crafted by expert attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal professionals with more than 85,000 authenticated, state-specific forms for any business and personal needs. It is the quickest, easiest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data protection and anti-virus security.

Choose the format you prefer for your Reimbursement Letter Example Accompanied by Resume (PDF, Word, RTF) and download the example onto your device.

- Search for the document you require and examine it.

- Review the file you searched and view it or check the form description to confirm it meets your requirements. If it does not, utilize the search bar to locate the appropriate one. Click Buy Now once you have located your desired template.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Utilize PayPal or a credit card to process a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Access the editable template.

Form popularity

FAQ

Form 2210AL is designed to calculate underpayment of estimated tax penalty as prescribed in Section 40-2A-11 and 40-18-80 of the Code of Alabama 1975. 2. 100% of your 2021 tax. (Your 2021 tax return must cover a 12-month period.)

Use this form to record when and why the return was not e-filed. Do not mail this form to the Franchise Tax Board (FTB). Please keep it for your records. For married/registered domestic partners (RDPs) filing jointly, only one spouse/RDP needs to sign.

Form 8453 is a simple document that is used to include any additional paperwork needed for certain portions of your tax return that were e-Filed. In this case, you need additional documentation for your 8949, so the final box will be checked on 8453.

Yes, a partnership, or other entity classified as a Subchapter K entity, is required to file a composite return and make composite payments on behalf of its nonresident owners or members if there are one or more nonresident owners or members at any time during the taxable year.

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

Corporations file this form to request that the IRS deposit a corporate income tax refund directly into an account at any U.S. bank or other financial institution that accepts direct deposits.

Form FTB 8453-FID, California e-file Return Authorization for Fiduciaries, is the signature document for fiduciary e-file returns.

FORM 20C-C Alabama Consolidated Corporate Income Tax Return. The Form 20C-C must be filed by or on behalf of the members of the Alabama affiliated group in ance with Alabama Code Section 40-18-39, when a Consolidated Filing elec- tion has been made pursuant to Code Section 40-18-39(c).