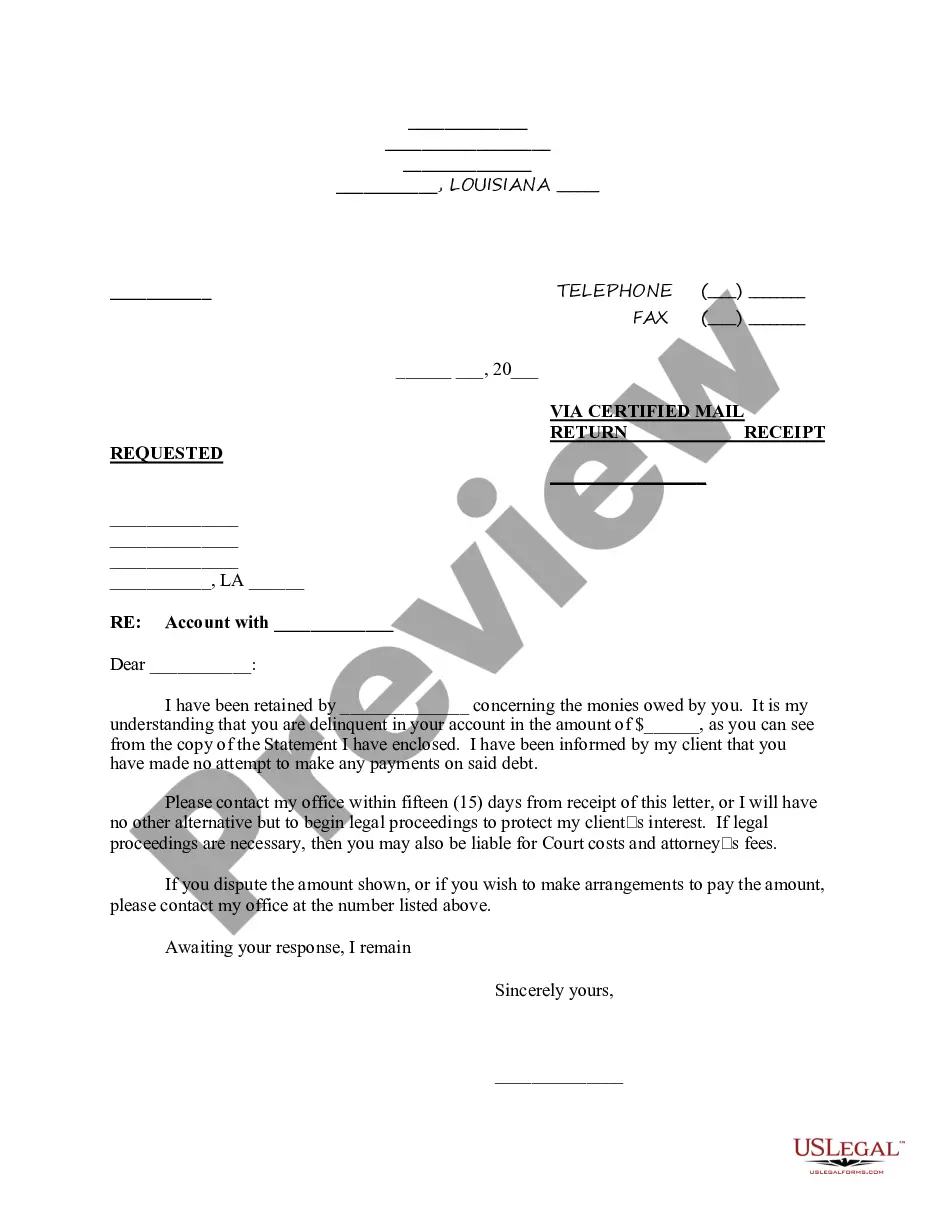

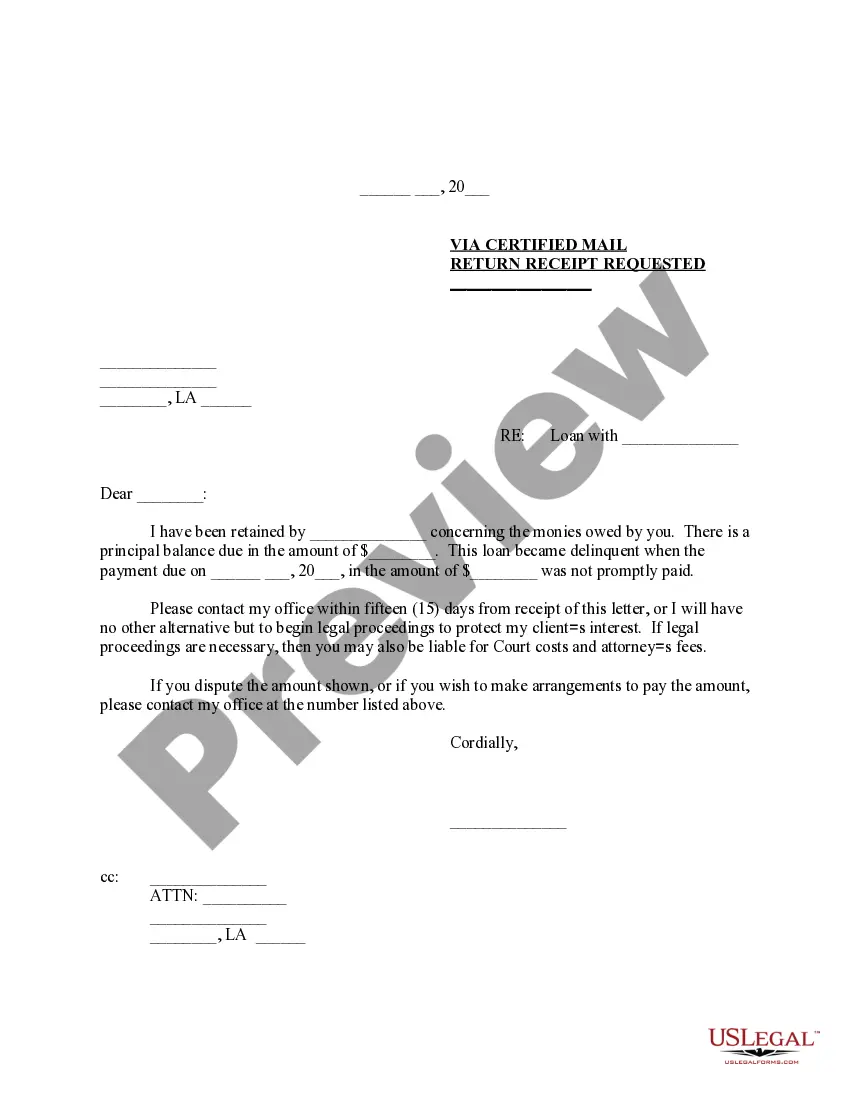

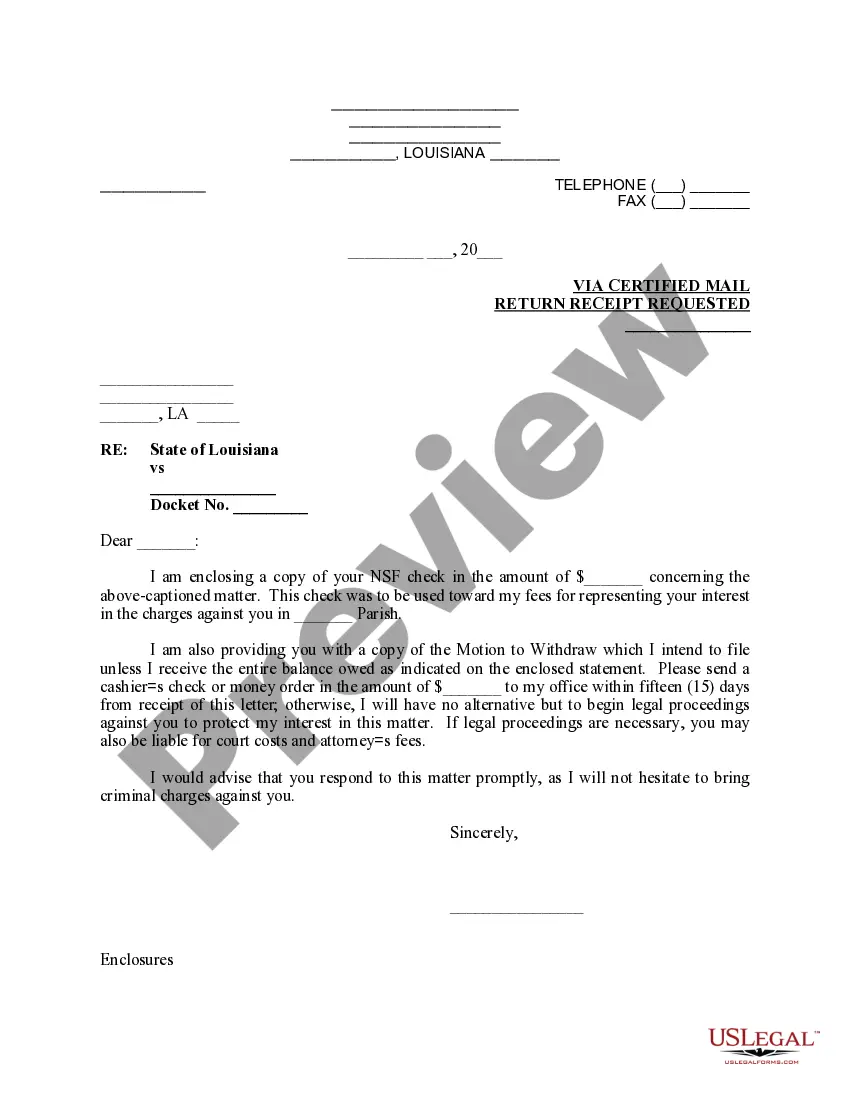

Letter Nsf Check With Bank Statement) (of Uncollectible)

Description

How to fill out Louisiana Demand Letter Regarding Payment For NSF Check?

There's no further necessity to squander time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our platform provides over 85,000 templates for various business and personal legal situations categorized by state and area of use.

Completing legal paperwork in accordance with federal and state regulations is quick and easy with our library. Experience US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and authenticated for legitimacy, so you can be confident in receiving an up-to-date Letter Nsf Check With Bank Statement (of Uncollectible).

- If you're acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever required by opening the My documents tab in your profile.

- If you haven't utilized our service before, the process will involve a few more steps to complete.

- Here's how new users can locate the Letter Nsf Check With Bank Statement (of Uncollectible) in our library.

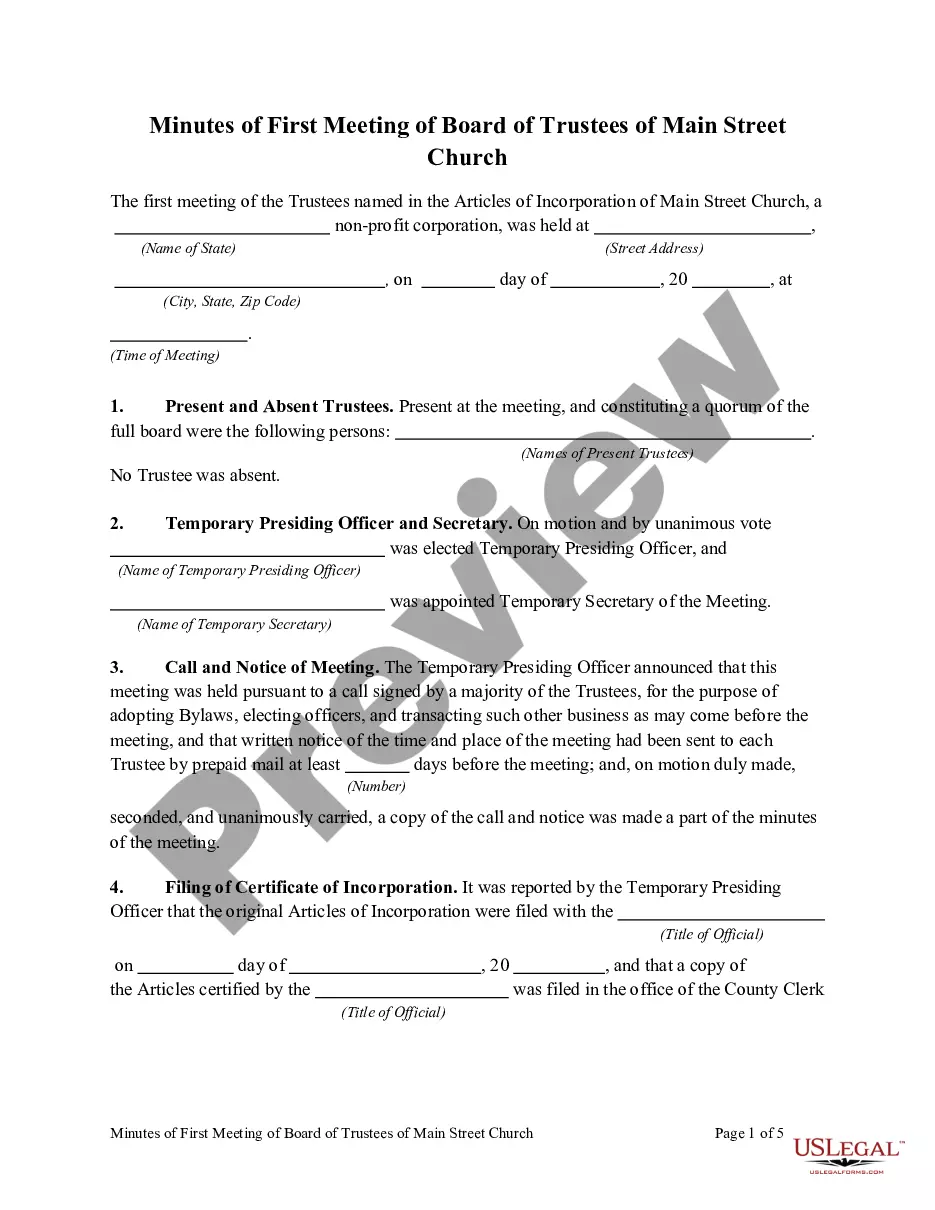

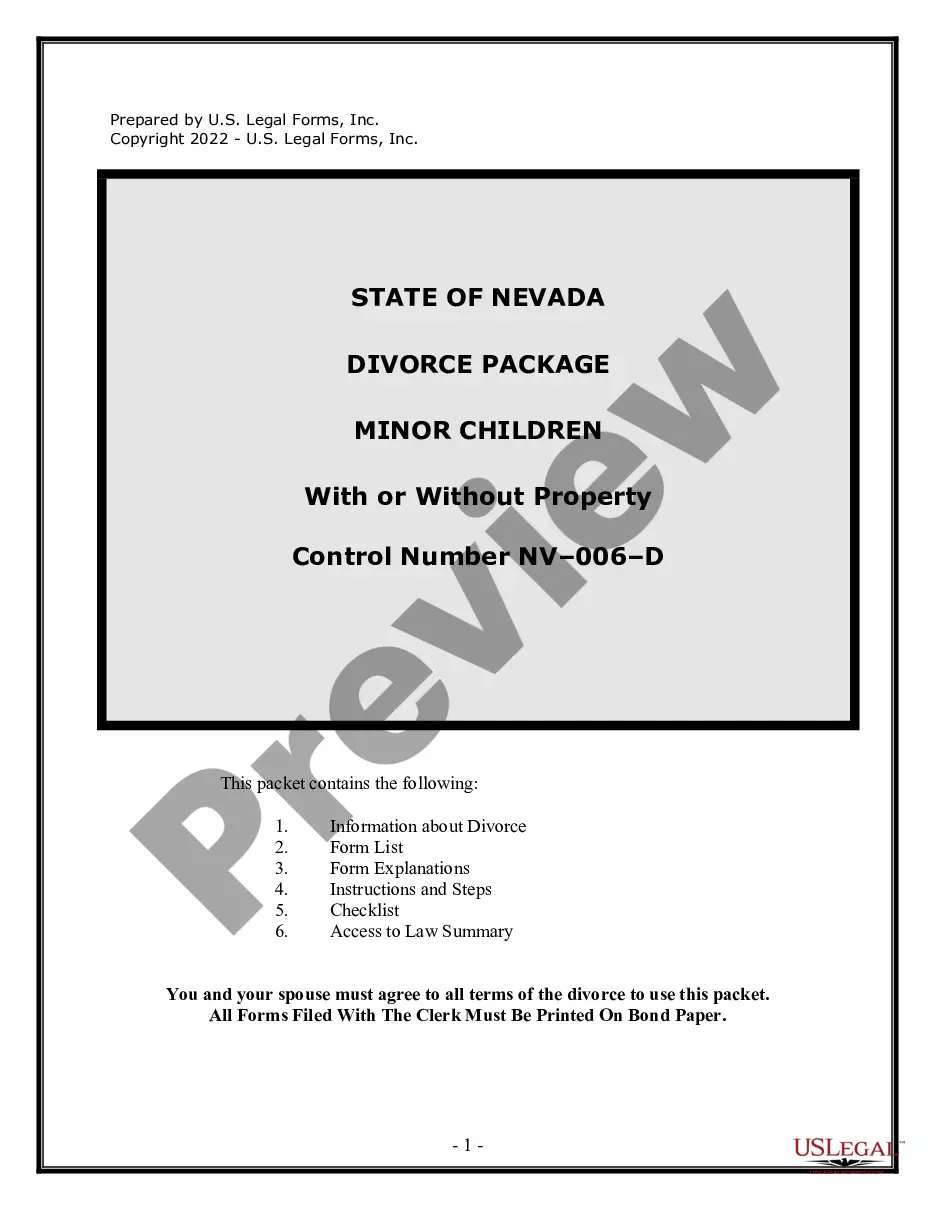

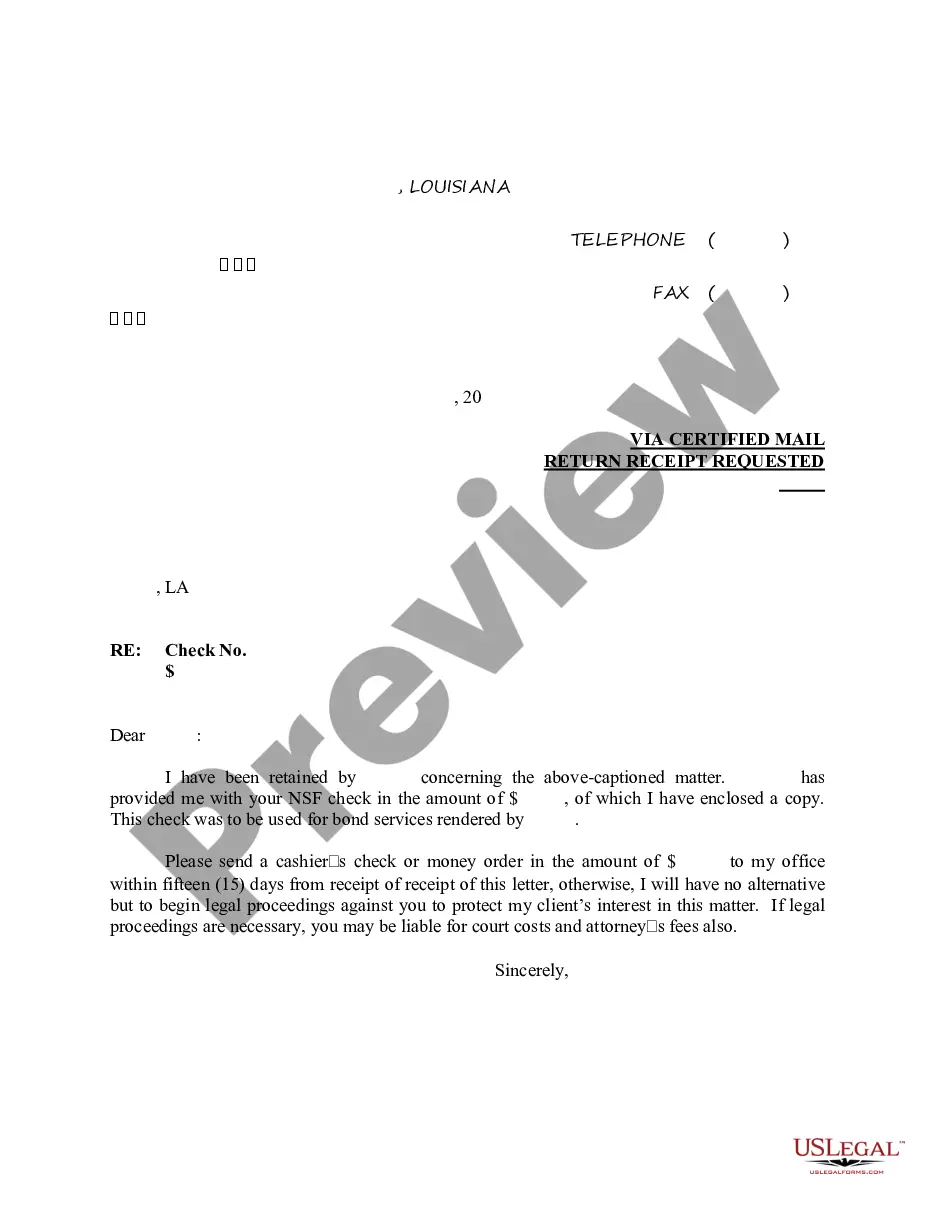

- Examine the page content thoroughly to ensure it contains the sample you need.

- To achieve this, employ the form description and preview options if available.

Form popularity

FAQ

To treat an NSF transaction in your bank statement, first verify the details of the transaction against your records. Next, record the NSF amount as a deduction from your available balance. It is also wise to document the incident using a letter concerning the NSF check with bank statement, ensuring that all aspects are covered clearly for future reference.

The proper treatment of an NSF check involves notifying the payee and requesting payment. It is advisable to record the transaction in your accounting system to reflect the reversal of funds. Using a document such as a letter discussing the NSF check with bank statement can help maintain transparency and assist in tracking funds due.

NSF stands for 'non-sufficient funds' on a bank statement. It indicates that a transaction cannot be completed because there are not enough funds in the account to cover it. This is critical information for account holders, as it may lead to fees and negative impacts on their financial status. Keeping track of NSF checks with bank statements helps maintain a clear financial overview.

To write a demand letter for a bad check, start with a professional greeting and include specific details about the check, such as the check number and amount. Clearly outline the reasons for the letter and request payment, providing a deadline for response. Including a reference to the NSF check with bank statement can create a stronger case, emphasizing the seriousness of the situation.

When writing a letter of insufficient funds, your aim is to inform the recipient about the non-payment due to a lack of available funds. Begin with the date, followed by the recipient's name and address. Clearly state the reason for the insufficient funds, and request that they resolve the matter promptly, ideally including a mention of the NSF check with bank statement for clarity and reference.

To write a letter for a bounced check, start by stating the date and addressing it to the check issuer. Clearly mention the details of the bounced check, including the amount and check number. It is important to express your intent for the issuer to rectify the situation, perhaps by providing an alternative method of payment. Consider using a template that incorporates a specific mention of the NSF check with bank statement, which helps in maintaining documented proof.

A legal letter for a bounced check typically outlines the specific details of the transaction and demands payment within a set timeframe. This letter serves as documentation for both parties and may include a request for additional fees associated with the NSF check. Using a template from uslegalforms can simplify this process, ensuring a professional and legally sound approach to resolving bounced check issues.

Writing a letter for a bad check involves clearly stating the details of the transaction and the reason for the non-collection. Include the original check number, amount, and date, as well as a request for payment or resolution. You can implement a letter for NSF check with bank statement as a formal way to document your request and maintain a clear record of your communications.

When informing someone their check bounced, it's important to approach the situation delicately. Begin by expressing your understanding, and mention that their check did not clear due to non sufficient funds. You can offer a solution by suggesting they send a replacement payment and mention a letter for NSF check with bank statement can help clarify the matter.

Writing a bad check typically occurs when you write a check without having sufficient funds in your bank account to cover the amount. This could be unintentional or due to a misunderstanding of your account balance. However, if you need to address the situation, you may consider sending a letter for NSF check with bank statement to clarify the issue and prevent further misunderstandings.