Louisiana Judgment Withholding

Description

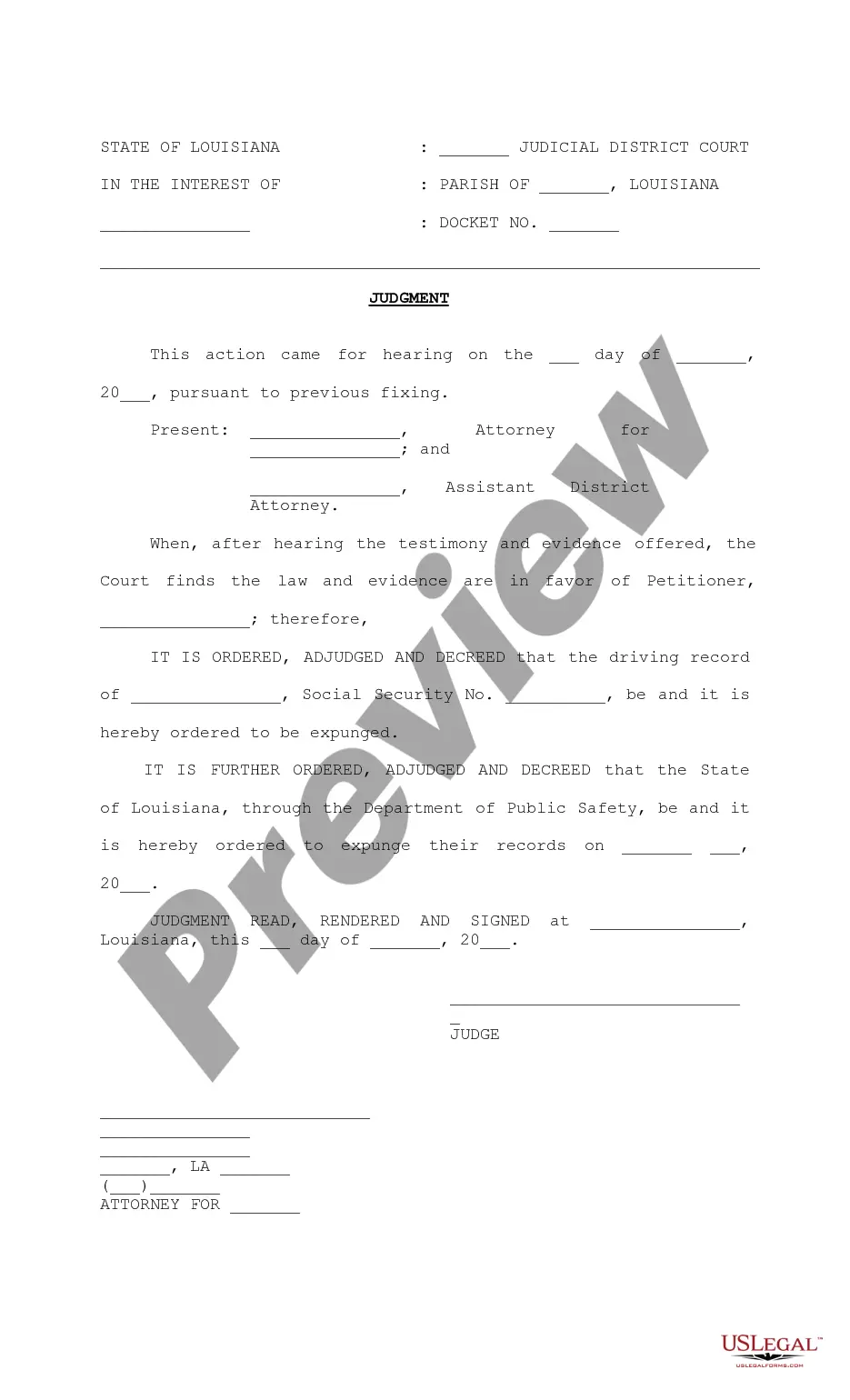

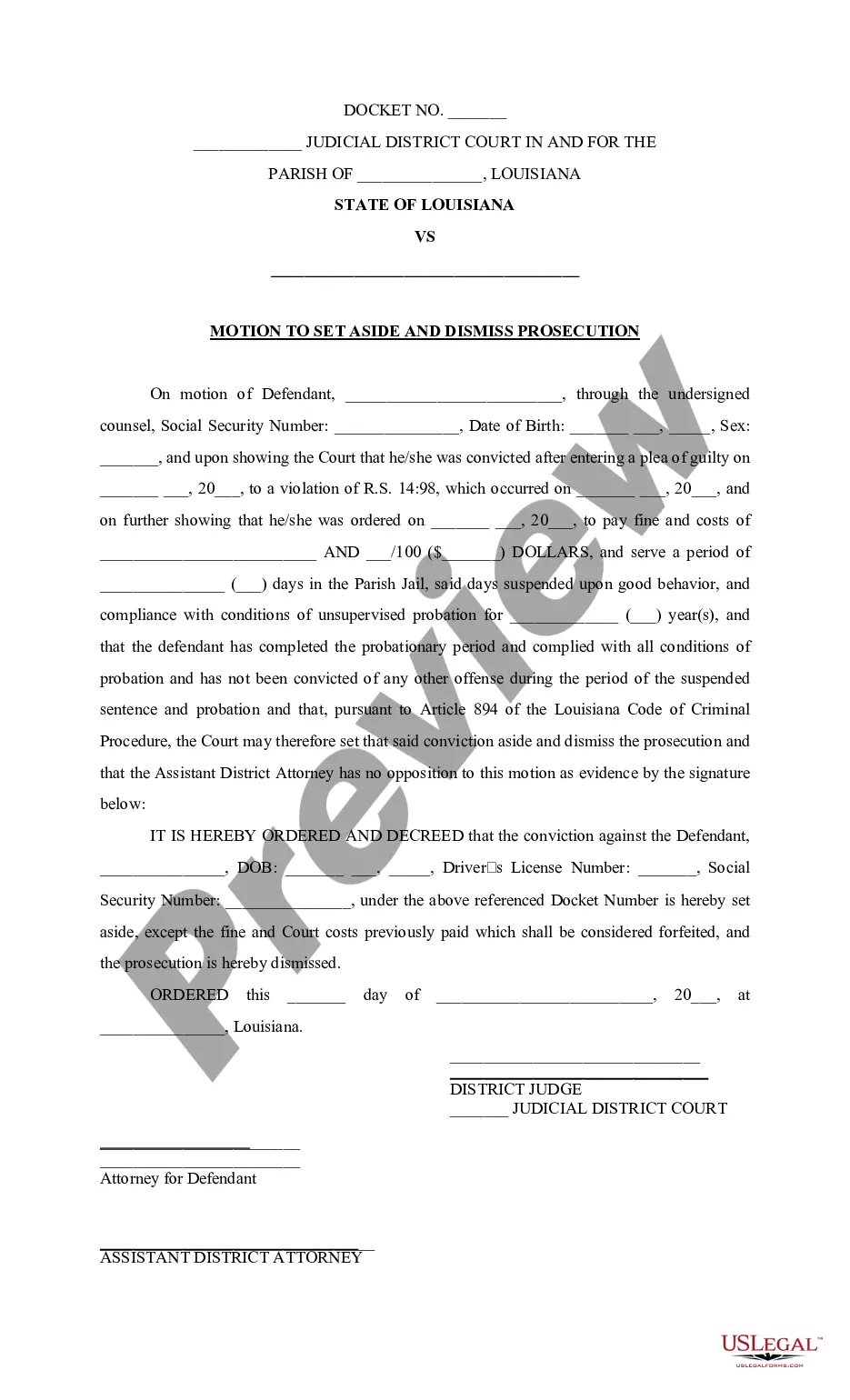

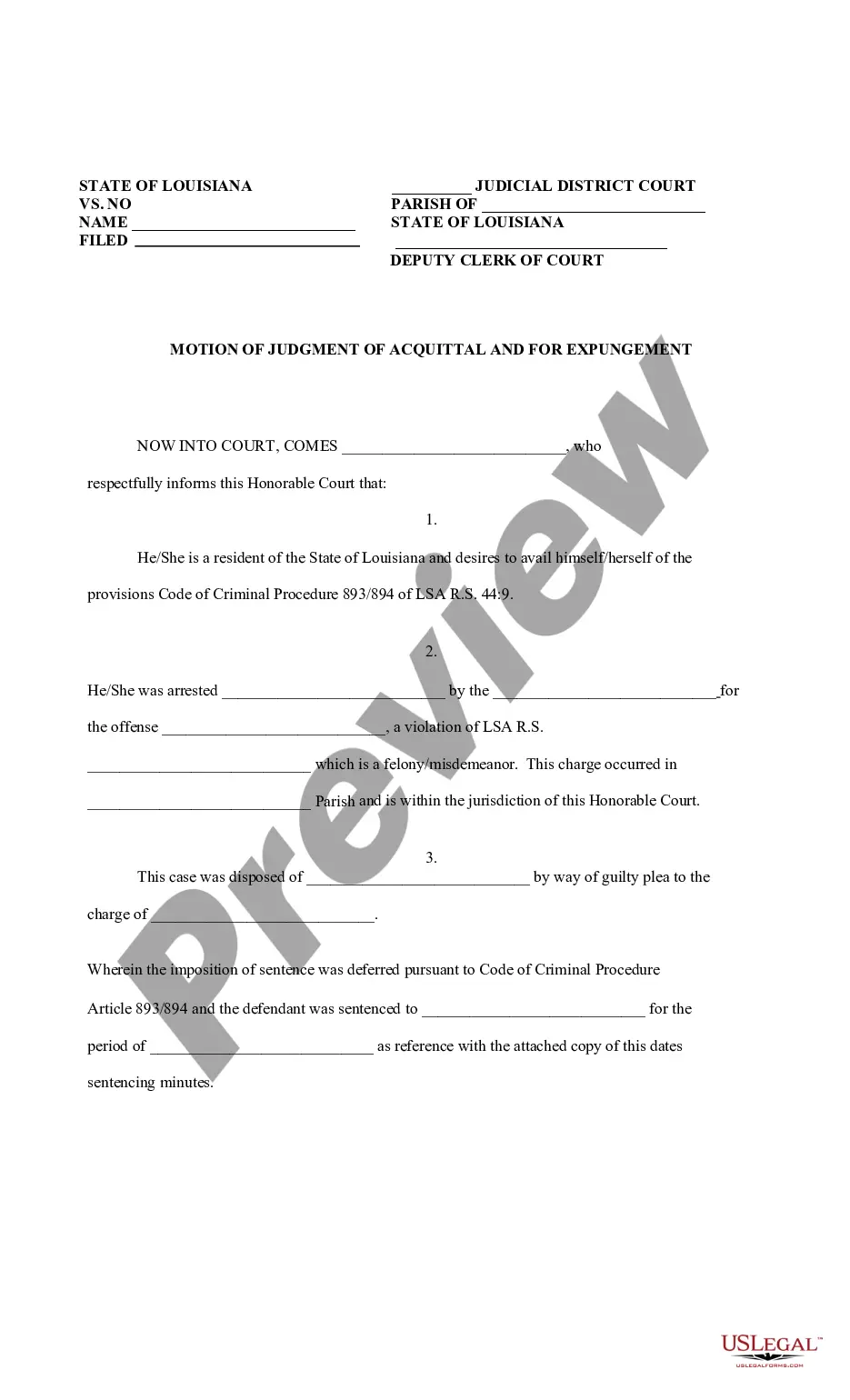

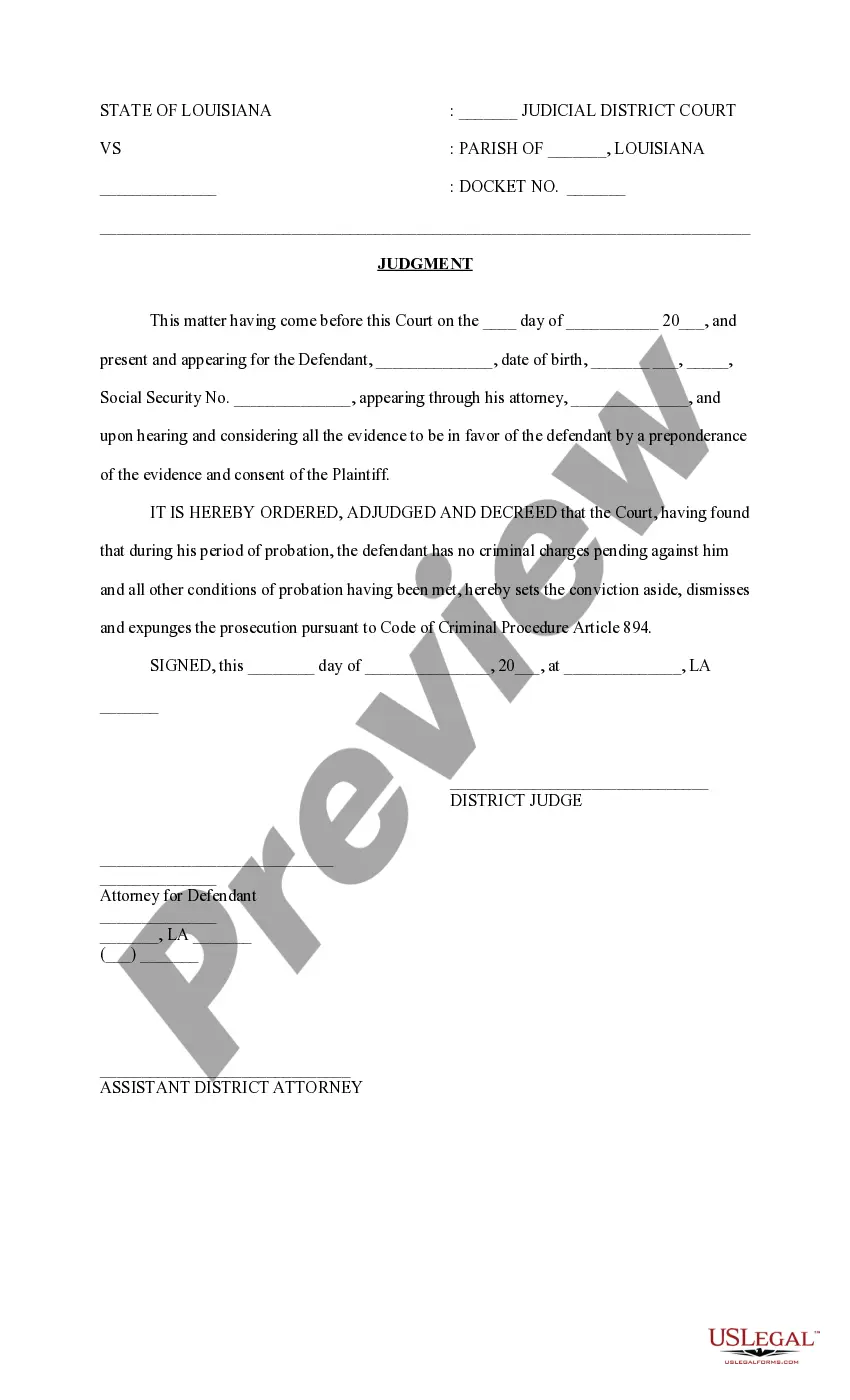

How to fill out Louisiana Judgment To Set Aside Conviction, Dismiss And Expunge Prosecution?

Whether for commercial reasons or personal affairs, everyone must deal with legal matters at some stage in their lives.

Completing legal paperwork requires meticulous consideration, beginning with selecting the appropriate form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you do not have to waste time searching for the suitable template online. Use the library’s straightforward navigation to locate the correct form for any occasion.

- Obtain the template needed through the search bar or catalog browsing.

- Review the form’s description to ensure it matches your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search function to find the Louisiana Judgment Withholding template you require.

- Download the file if it aligns with your needs.

- If you already possess a US Legal Forms account, click Log in to retrieve saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you prefer and download the Louisiana Judgment Withholding.

Form popularity

FAQ

If you are employed by more than one employer, you may claim the exemption from withholding with each employer, provided that the total of your anticipated income will not cause you to incur any liability for Louisiana income tax for the current year and you incurred no liability for Louisiana income tax for the ...

Every employer who withheld or was required to withhold income tax from wages must file the Employer's Quarterly Return of Louisiana Withholding Tax (Form L-1).

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Companies who pay employees in Louisiana must register with the LA Department of Revenue for a Revenue Account Number and the LA Workforce Commission for a State ID Number. Apply online at the DOR's Taxpayer Access Point portal to receive an Account Number immediately after registration or apply with this form.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000 25-Feb-2022