Act Of Donation For A Car In Louisiana

Description

How to fill out Louisiana Act Of Donation Real Estate From One Individual To One Individual?

The Document Of Gift For A Vehicle In Louisiana you observe on this site is a versatile legal template created by expert attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and lawyers with over 85,000 validated, state-specific forms for any professional and personal circumstances. It’s the fastest, easiest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data protection and malware safeguarding.

Pick the format you prefer for your Document Of Gift For A Vehicle In Louisiana (PDF, DOCX, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Scan through the sample you searched and preview it or review the form description to verify it meets your needs. If it doesn’t, use the search option to find the correct one. Click Buy Now when you have found the template you need.

- Choose and Log In.

- Select the pricing plan that works for you and create an account. Utilize PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Yes, donating a house to a family member in Louisiana is possible and follows similar procedures as donating a car. You will need to execute an act of donation that clearly outlines the details of the property and the relationship between the donor and recipient. Completing the necessary documentation is critical to protect both parties and ensure that the donation is legally binding. Platforms like USLegalForms provide the tools and forms you need for this process.

Yes, you can do an act of donation in Louisiana, specifically for items like a car. This type of donation is legally supported as long as it follows the state’s regulations and includes the proper documentation. It is important to draft a valid deed of donation that outlines the terms of the gift. If you need help navigating the process, consider using resources available on USLegalForms to ensure everything is done correctly.

An act of donation for a car in Louisiana involves a legal process where you transfer ownership of the vehicle from one person to another, typically without receiving any payment. The process requires a written agreement that specifies the details of the donation, including information about the car and the parties involved. It’s essential to complete this process properly to ensure that the donation is recognized by the state, which helps avoid potential legal issues later on. You can easily access the necessary forms and instructions on platforms like USLegalForms.

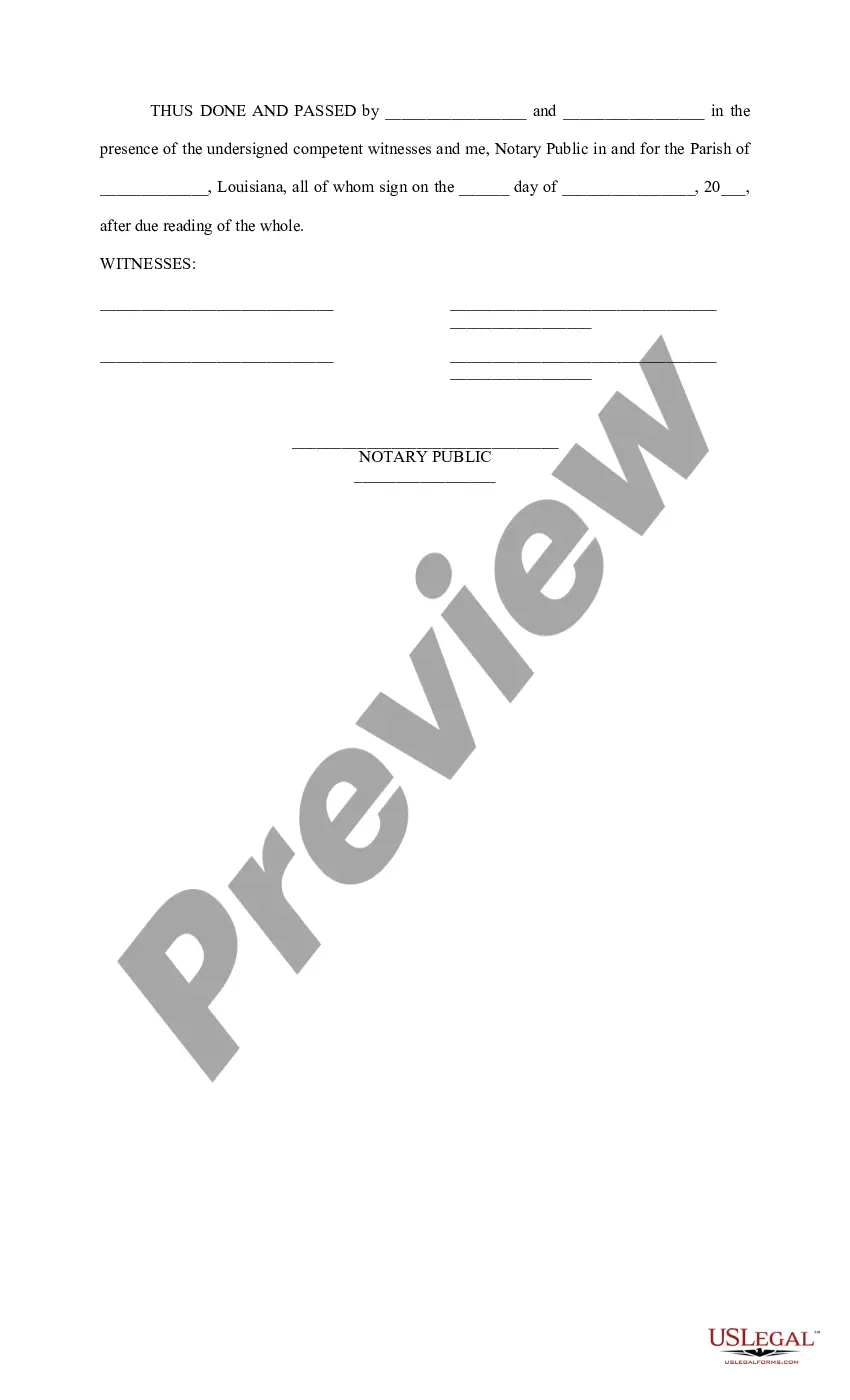

An act of donation for a car in Louisiana does not necessarily need to be notarized, but having it notarized adds a level of legal assurance. While it is not a requirement, notarization can provide additional proof of the authenticity of the document and the identities of those involved. Opting for notarization may help avoid potential disputes in the future.

You can obtain an act of donation form for a car in Louisiana through various sources, including legal websites like USLegalForms. This platform offers customizable templates that ensure your document meets Louisiana's legal requirements. Alternatively, you can visit local offices that deal with vehicle registrations or consult with a legal professional for assistance.

Yes, you can donate a car to a family member in Louisiana by completing an act of donation for a car in Louisiana. Family members often benefit from this process, as it allows for a smooth transfer of ownership without the complications of a sale. Ensure that the act of donation clearly states the relationship between the donor and the recipient, as well as any specific terms regarding the vehicle.

An act of donation for a vehicle in Louisiana is a legal document that transfers ownership of a car from one person to another without any payment involved. This process allows the donor to give the vehicle as a gift, with clear terms laid out in the document. It's important for both the donor and recipient to understand the terms of this act, as it can affect tax obligations and registration issues in the future.

To complete an act of donation for a car in Louisiana, you need to draft a formal document that outlines the details of the donation. This document should include the donor's and recipient's information, vehicle description, and any conditions associated with the donation. Once the act of donation is prepared, both parties should sign it. Lastly, you may want to record the act with the local DMV to update the vehicle title.

When you donate a car, the tax write-off amount is usually equal to the fair market value of the vehicle at the time of the donation. Under the Act of donation for a car in Louisiana, you must determine this value accurately to claim the correct deduction. Documenting all the details can help avoid any issues with the IRS.

Donating a car can serve as a beneficial tax write-off if you follow the guidelines correctly. The Act of donation for a car in Louisiana allows you to claim the fair market value, which can significantly reduce your taxable income. It's important to keep all documentation and consult with a tax advisor to ensure you maximize your benefits.