Louisiana Community Property Partition Form Withholding Tax

Description

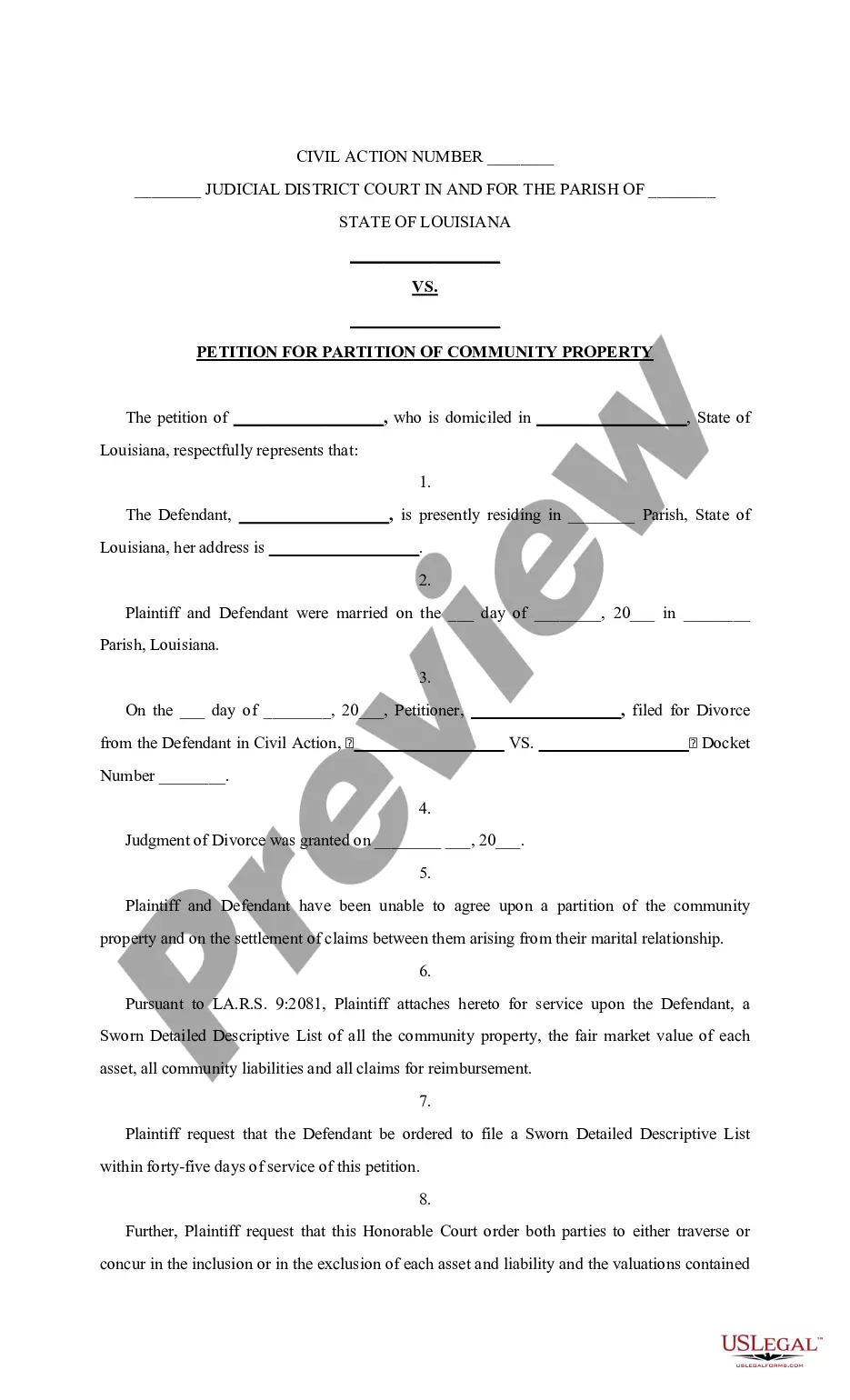

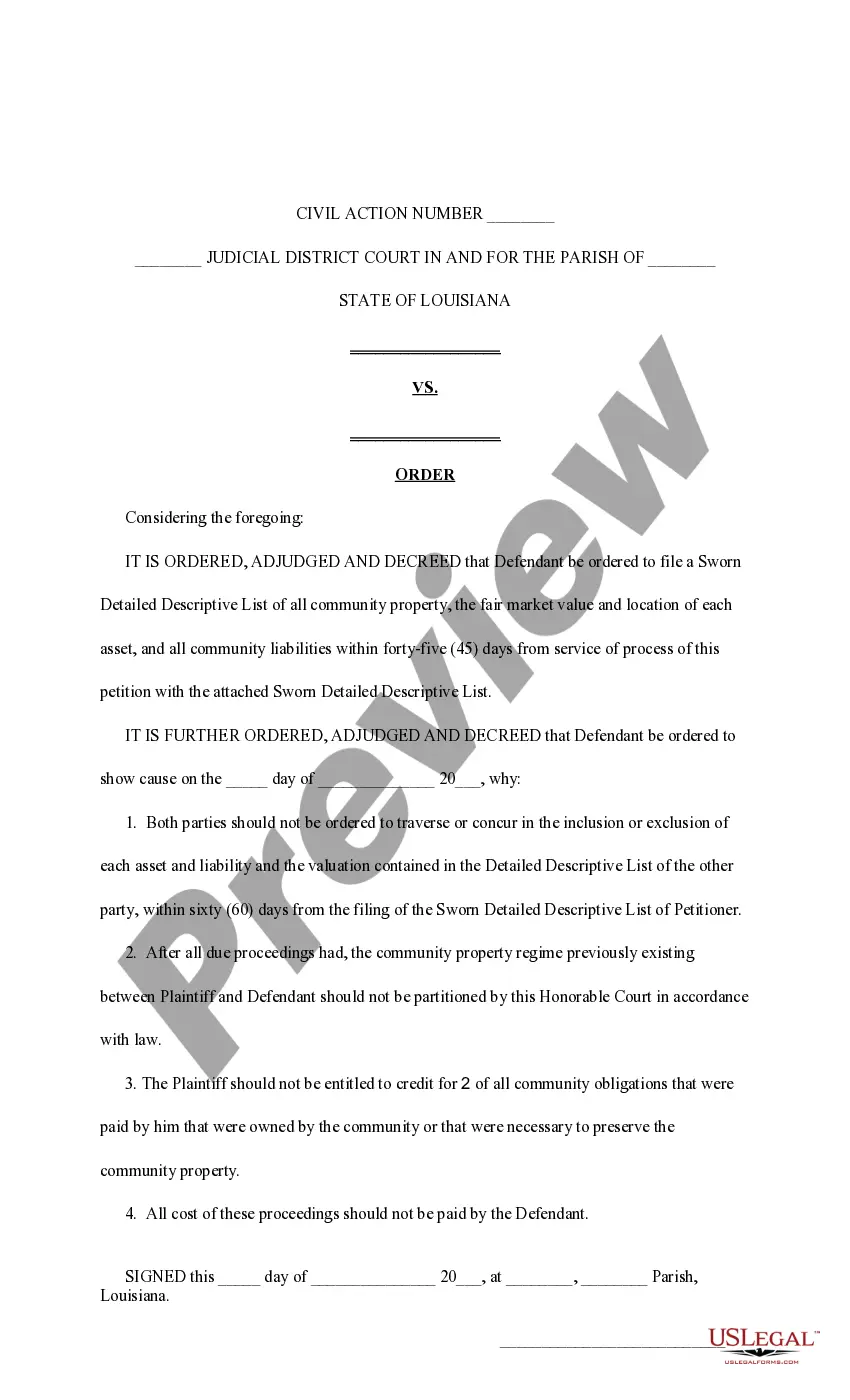

How to fill out Louisiana Petition For Partition Of Community Property With List Of Commercial Property?

Whether for business purposes or for personal affairs, everyone has to handle legal situations at some point in their life. Completing legal documents requires careful attention, beginning from choosing the appropriate form sample. For example, if you pick a wrong version of the Louisiana Community Property Partition Form Withholding Tax, it will be turned down when you submit it. It is therefore essential to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a Louisiana Community Property Partition Form Withholding Tax sample, follow these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it suits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to find the Louisiana Community Property Partition Form Withholding Tax sample you require.

- Get the template if it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the profile registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Louisiana Community Property Partition Form Withholding Tax.

- After it is saved, you can fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time seeking for the right template across the web. Use the library’s easy navigation to get the correct template for any occasion.

Form popularity

FAQ

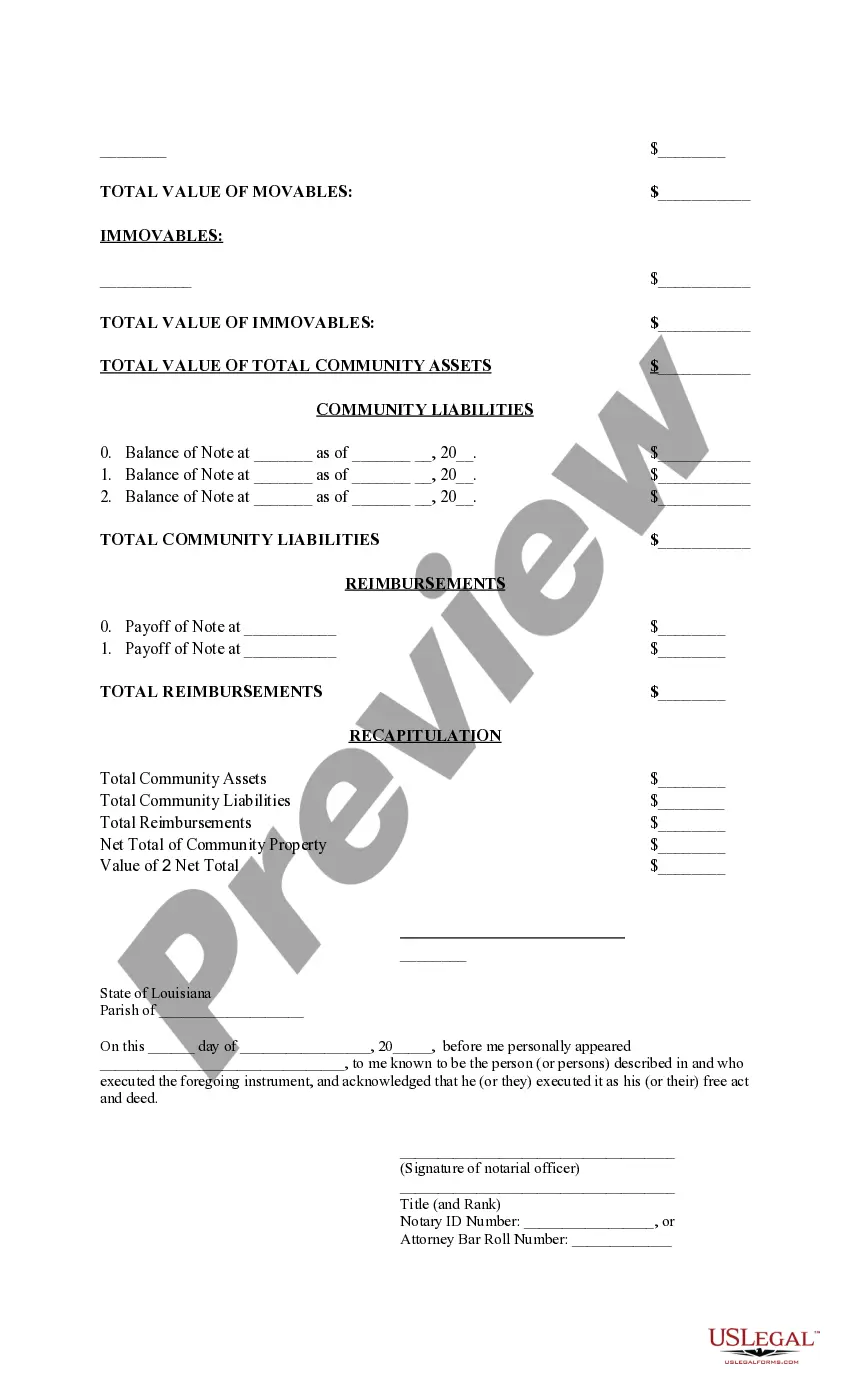

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000

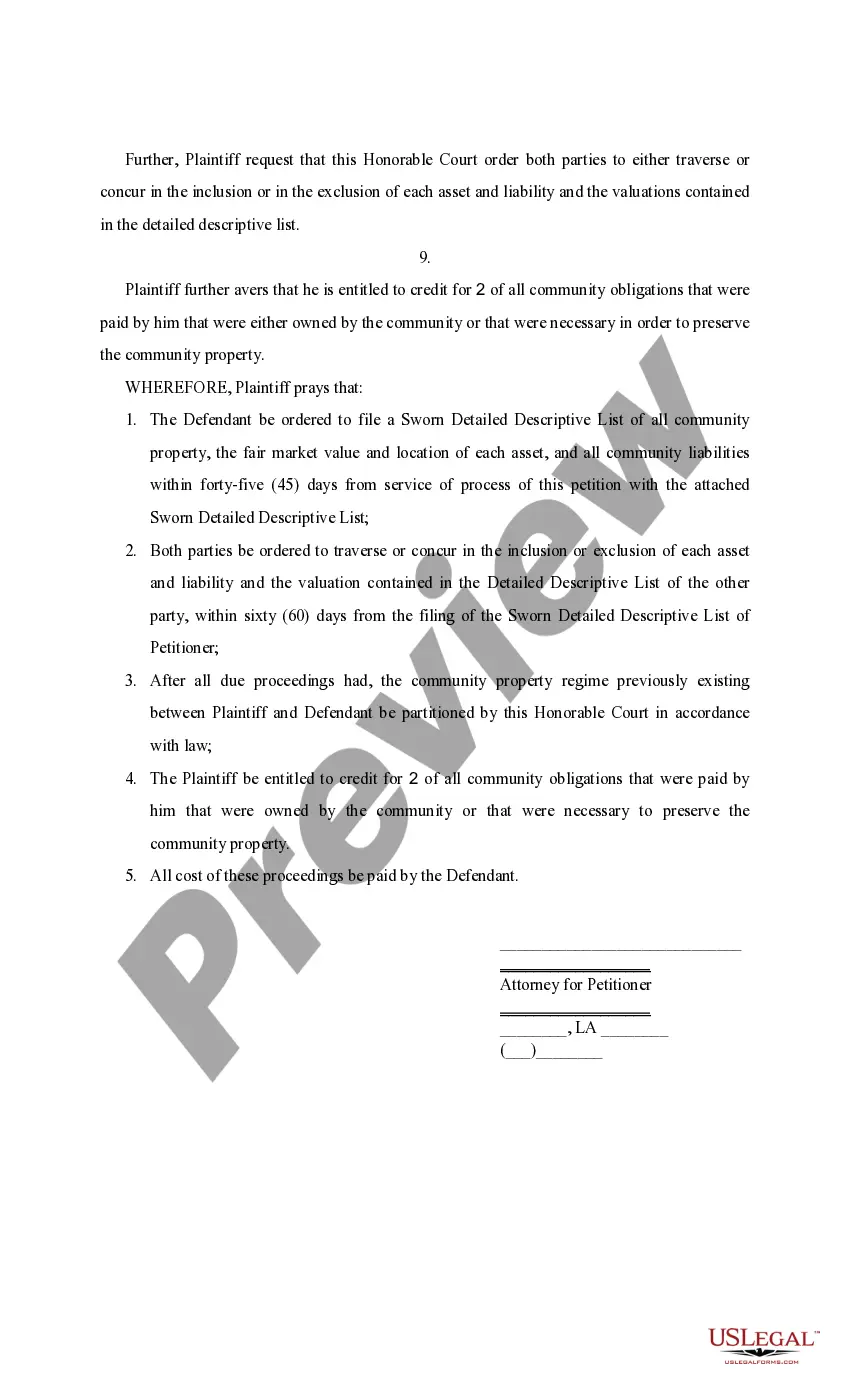

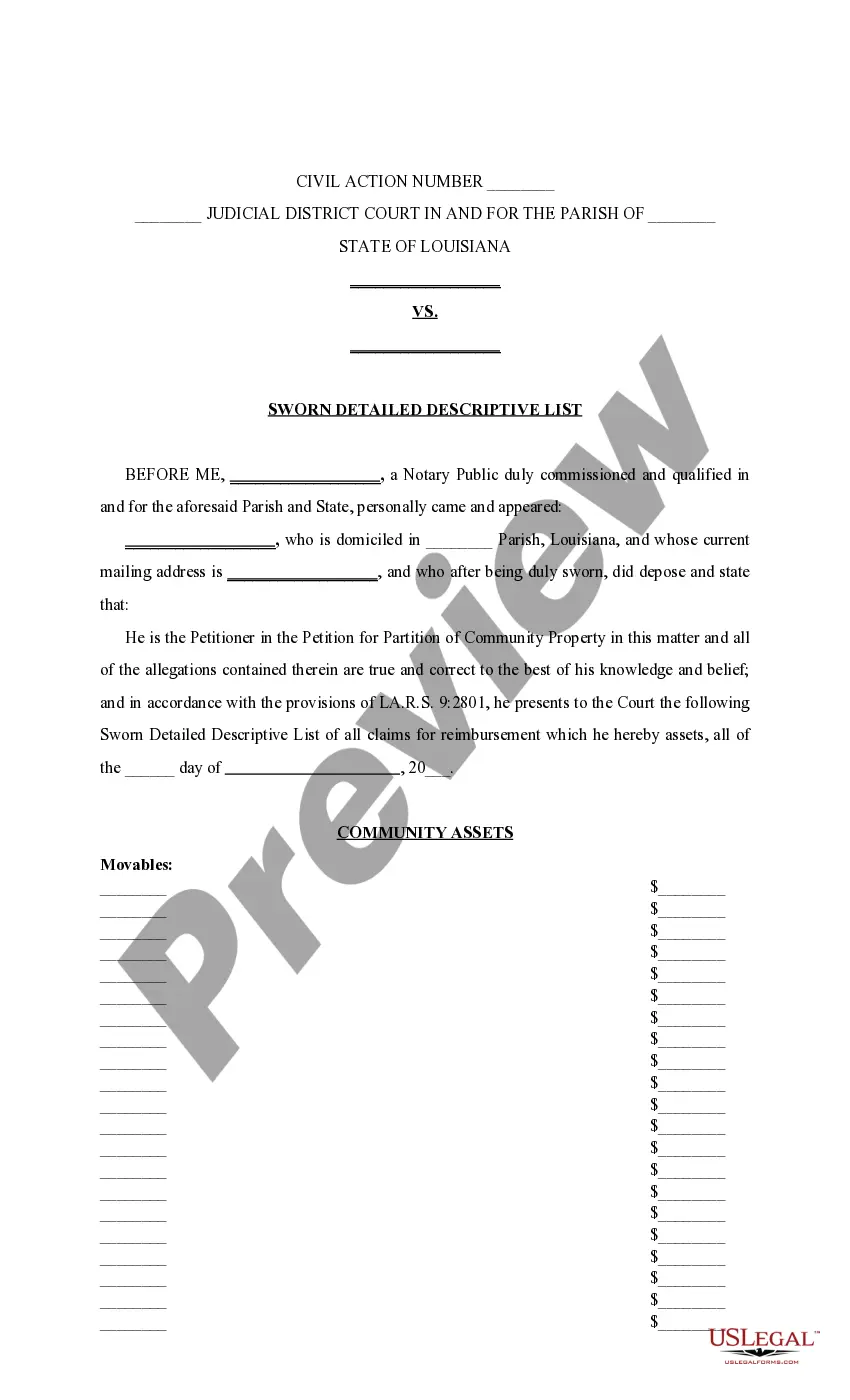

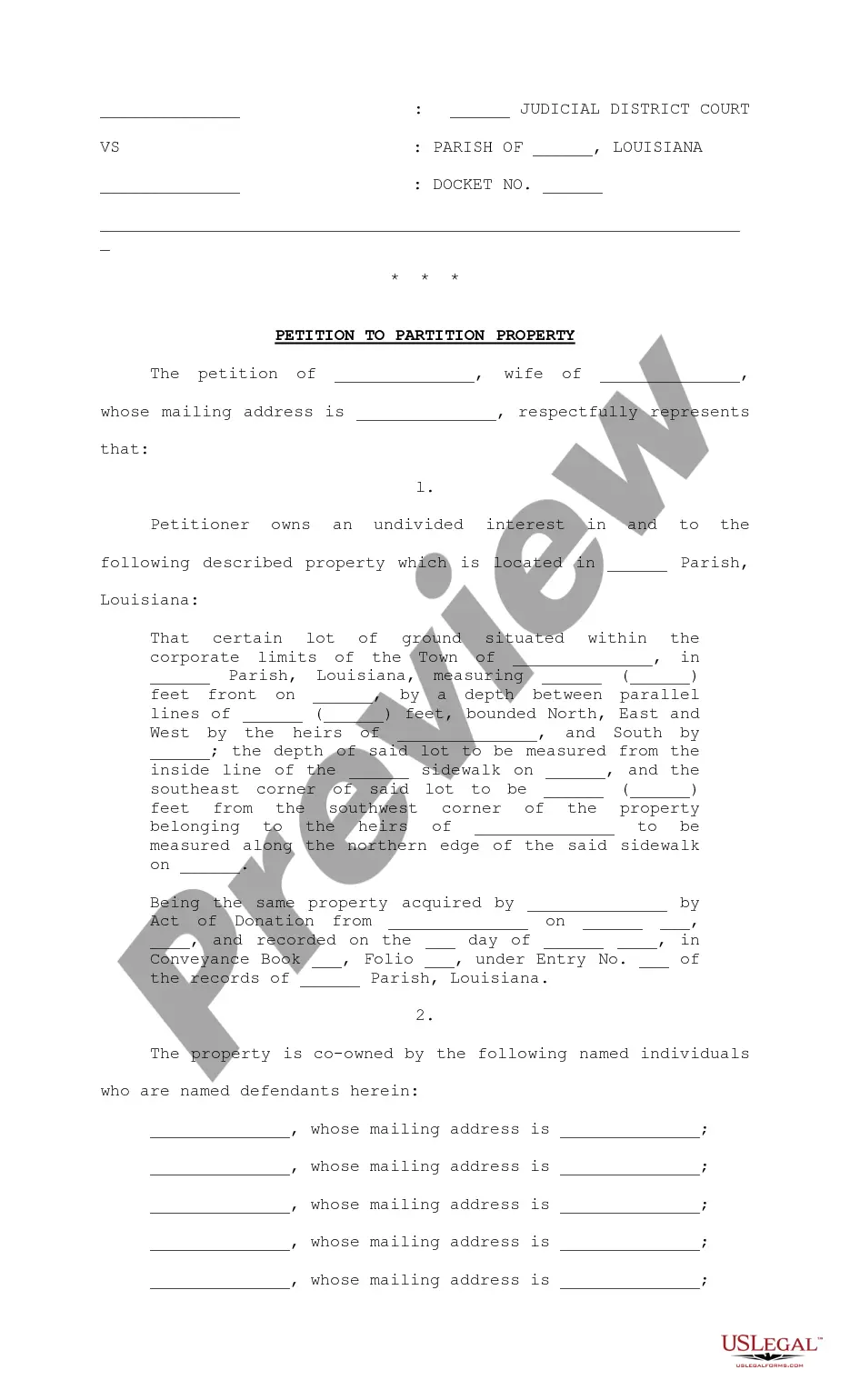

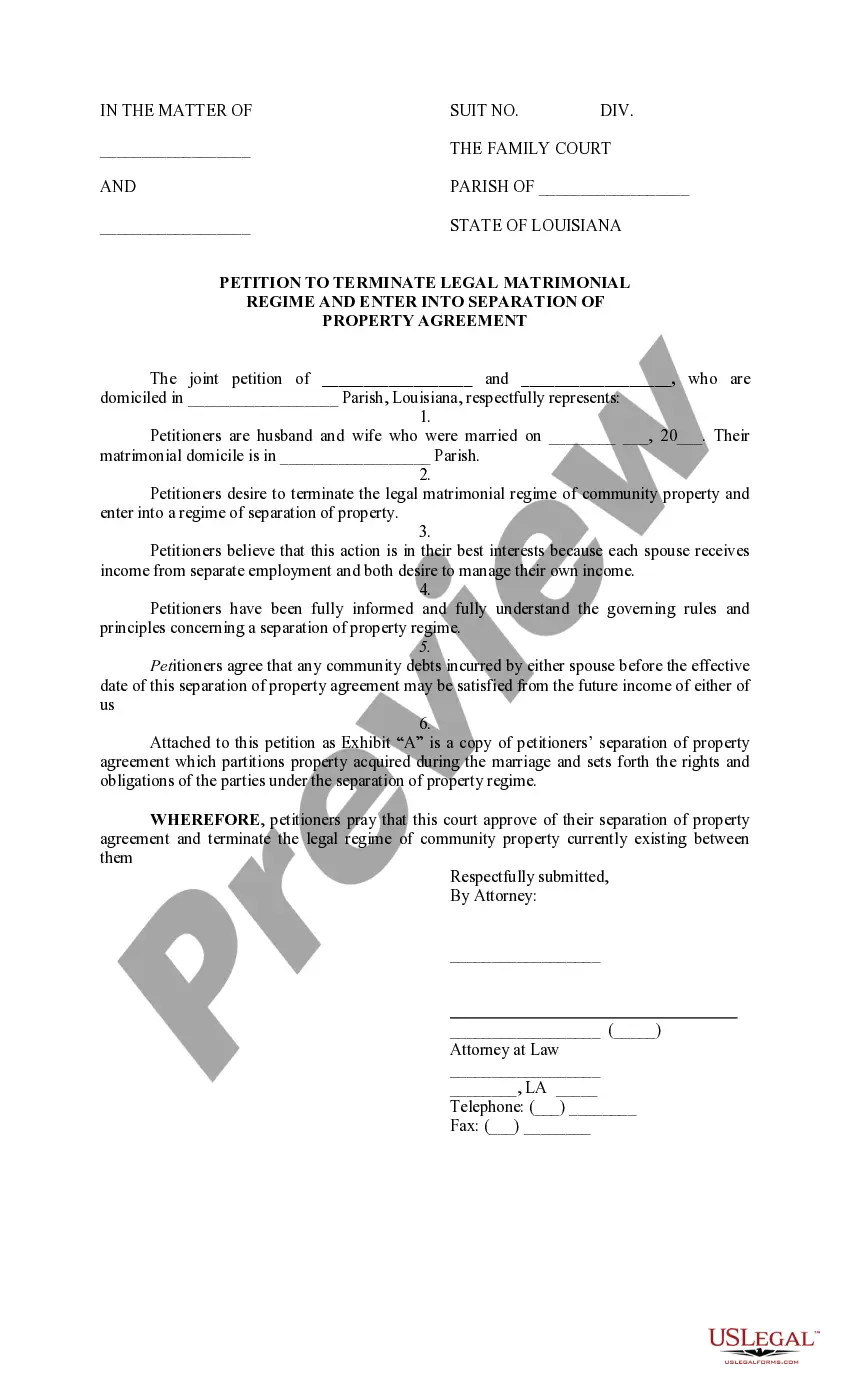

With few exceptions, the court will first value all of a couple's community property and assets. Those assets are then divided so that each spouse receives one-half of all their community property. In some cases, the court may order that certain assets be sold and the proceeds be split equally between the two spouses.

Employers are required to withhold income tax on all wages that are subject to Louisiana income tax as follows: Employers located in Louisiana?income tax must be withheld on all employee wages earned in Louisiana regardless of whether the employee is a resident or not.

This means in a divorce a Louisiana court will attempt to divide property and debts as equally as possible, rather than using equitable distribution rules. Because community property rules can be very complicated, it's vital to seek experienced legal counsel from a Lake Charles community property partition lawyer.

In Louisiana, property partition can be either voluntary or involuntary. Voluntary partition occurs when co-owners agree to divide the property through a written agreement or a court order. Involuntary partition, on the other hand, occurs when one co-owner sues the other co-owners to divide the property.