Cash For Deed

Description

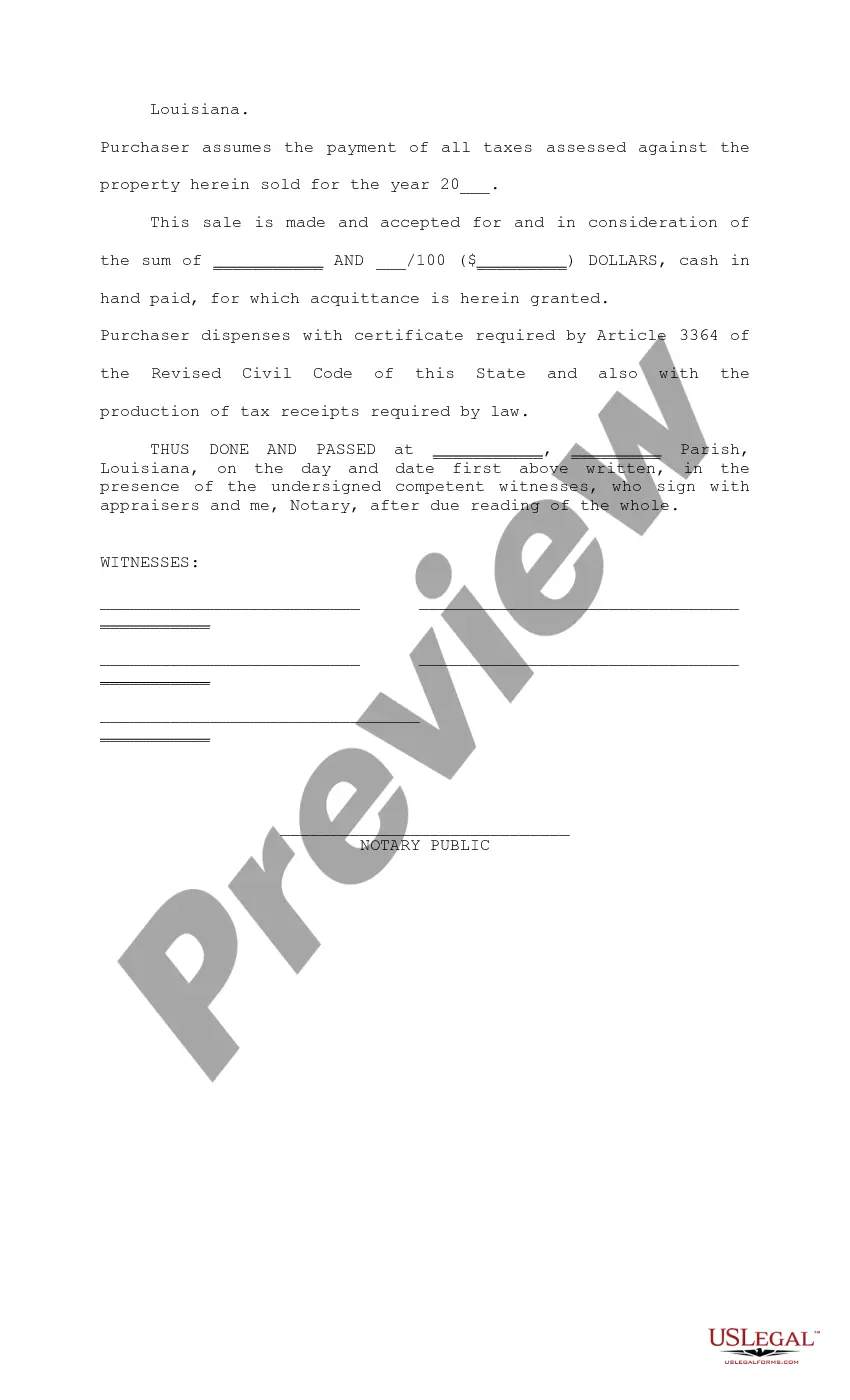

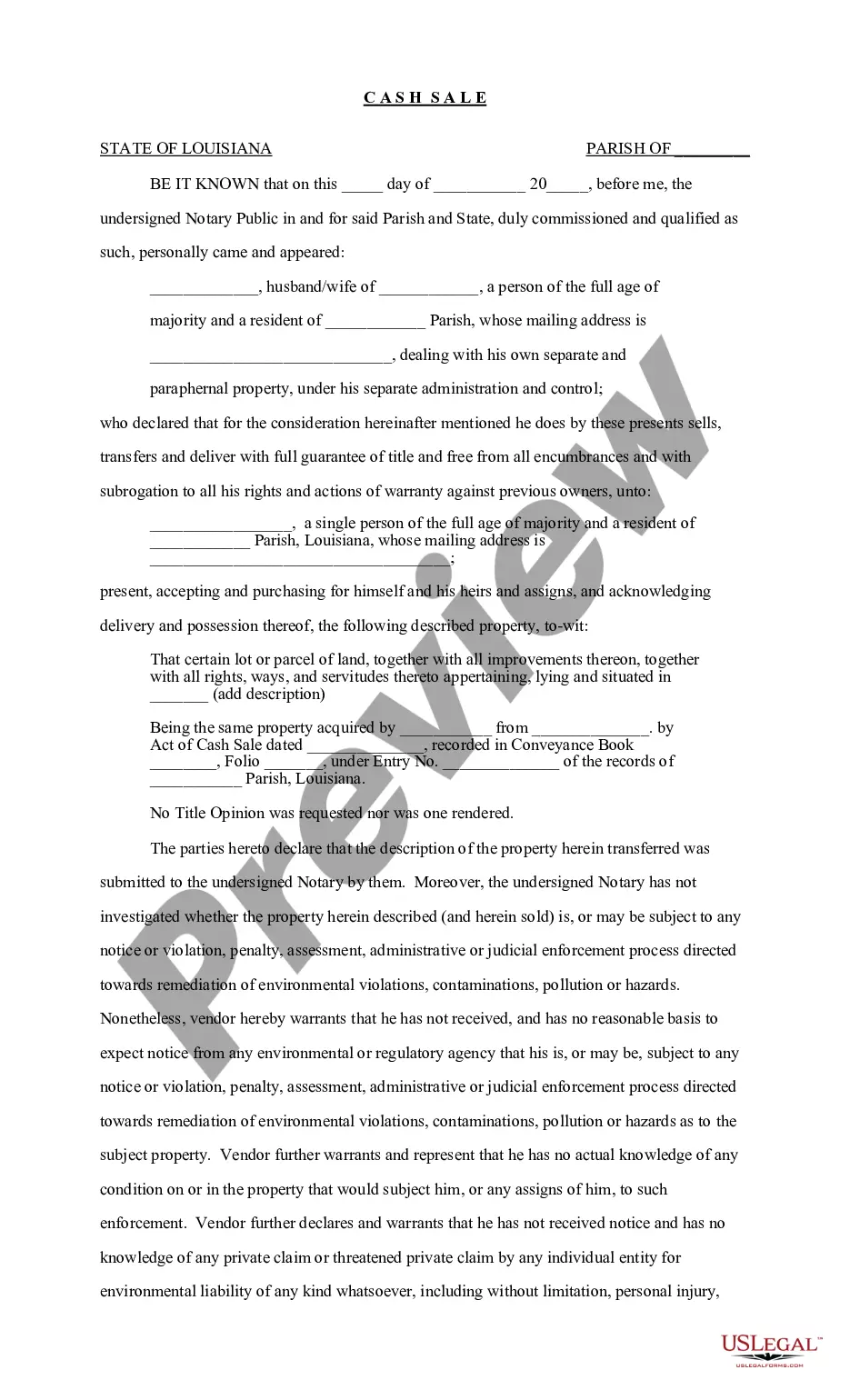

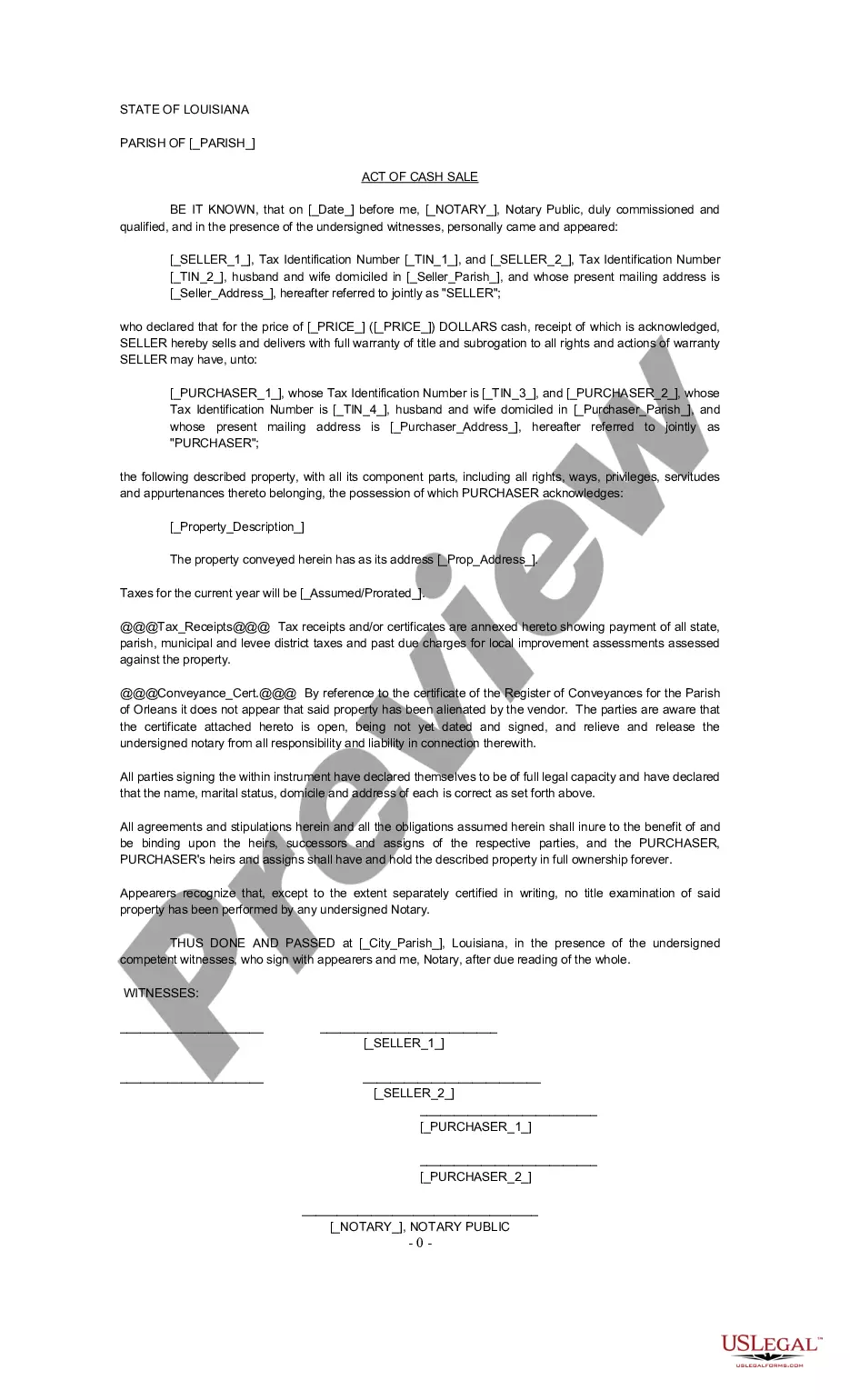

How to fill out Louisiana Cash Sale?

The Cash For Deed displayed on this website is a reusable formal template crafted by experienced attorneys in accordance with federal and local statutes and guidelines.

For over 25 years, US Legal Forms has delivered individuals, entities, and lawyers with over 85,000 authenticated, state-specific documents for any commercial and personal situation. It’s the fastest, simplest, and most trustworthy method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware safety.

Select your preferred format for your Cash For Deed (PDF, Word, RTF) and save the document on your device. Complete and sign the document. Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature. Download your documents again as needed. Access the My documents tab in your account profile to redownload any previously saved documents. Subscribe to US Legal Forms to access verified legal templates for every life situation at your fingertips.

- Explore the document you require and assess it.

- Browse the sample you searched and preview it or review the document description to ensure it meets your needs. If it doesn’t, use the search function to find the correct one. Click Buy Now when you have selected the template you want.

- Register and Log In.

- Select the subscription plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already have an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

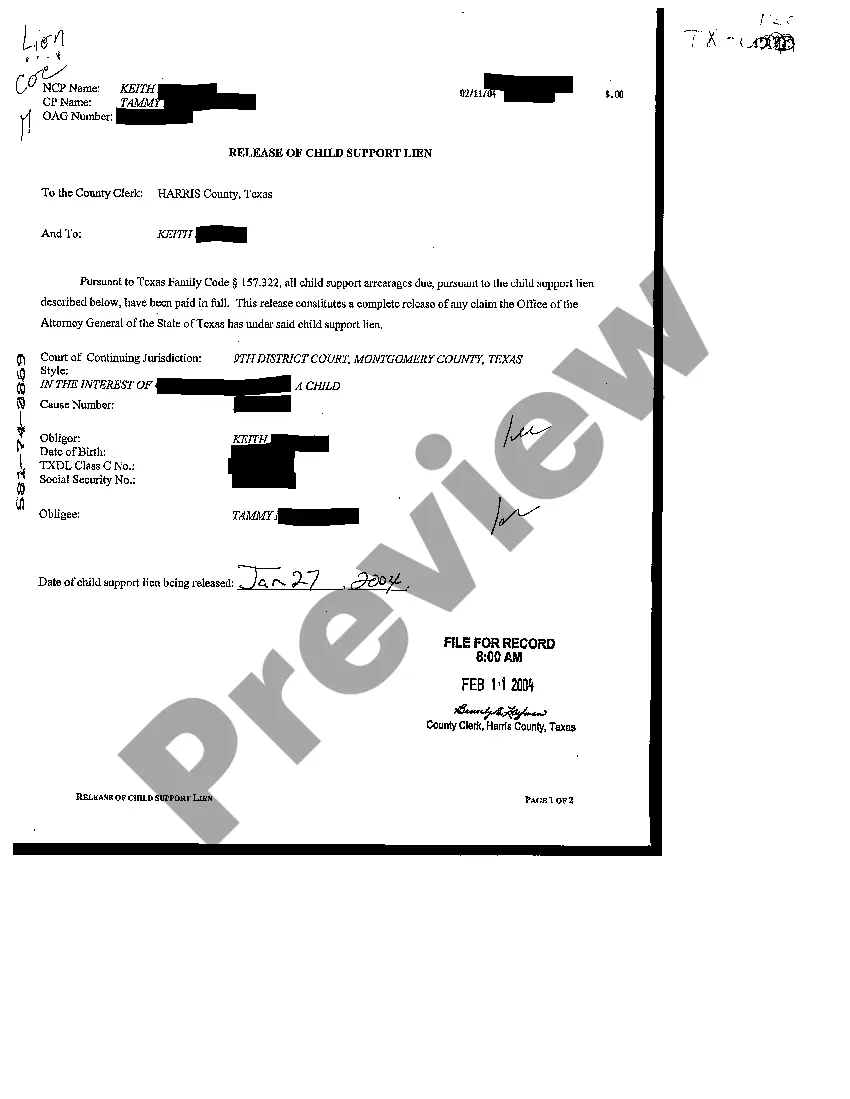

To protect yourself with a contract for deed, clearly outline terms and conditions in the agreement. Use legal resources, such as those available at US Legal Forms, to create a thorough contract that includes provisions for payment schedules, responsibilities, and property conditions.

The tax implications of a contract for deed can vary based on how payments are structured. Typically, you will recognize interest income and potentially report capital gains upon receiving the final payment, so staying informed is crucial.

Yes, you must report all income, regardless of whether it exceeds $20,000. If you receive a 1099-K from a cash for deed transaction, include this information in your tax filings to stay compliant.

To potentially avoid capital gains on a land contract sale, consider utilizing the installment sale method. This approach allows you to spread out gains over time, making it easier to manage tax implications associated with your cash for deed agreement.

To avoid 1099 penalties, ensure that you report all income accurately and on time. If you're involved in a cash for deed transaction, keep all records organized and consult a tax professional to confirm you're meeting reporting requirements.

You should report proceeds from real estate transactions on your federal tax return, typically using Schedule D for capital gains. If you engage in a cash for deed arrangement, be sure to track all income to comply with IRS regulations.

A contract for deed can be a useful option for buyers who lack traditional financing, but it also has its drawbacks. This arrangement allows for ownership without a mortgage, but it may involve higher total costs over time. Buyers should understand the terms fully and recognize that they could lose their investment if they fail to comply with the contract. Therefore, it's essential to consider all aspects before proceeding.

Making a cash offer can carry some risks, including the possibility of overpaying for the property. While cash for deed makes your offer more appealing to sellers, you still need to conduct thorough inspections to avoid costly surprises. Additionally, without proper contingencies, you might face challenges if an issue arises after the sale. Educating yourself can help mitigate these risks.

When someone pays cash for a house, the transaction typically moves forward without delays caused by lender approvals. This direct approach often benefits both parties by allowing for a straightforward negotiation process. The seller may receive their funds quickly, while the buyer can avoid many costs that come with financing. This arrangement is particularly beneficial in cash for deed scenarios, where clarity and speed are key.

While paying cash for a house, often seen in cash for deed deals, has its benefits, it does come with some downsides. The primary concern is the lack of liquidity; tying up a large sum in real estate can limit access to quick cash for emergencies or investments. Additionally, without a mortgage, homeowners may miss out on potential tax deductions. Weighing these factors is important before proceeding.