Affidavit Of Heirship Example

Description

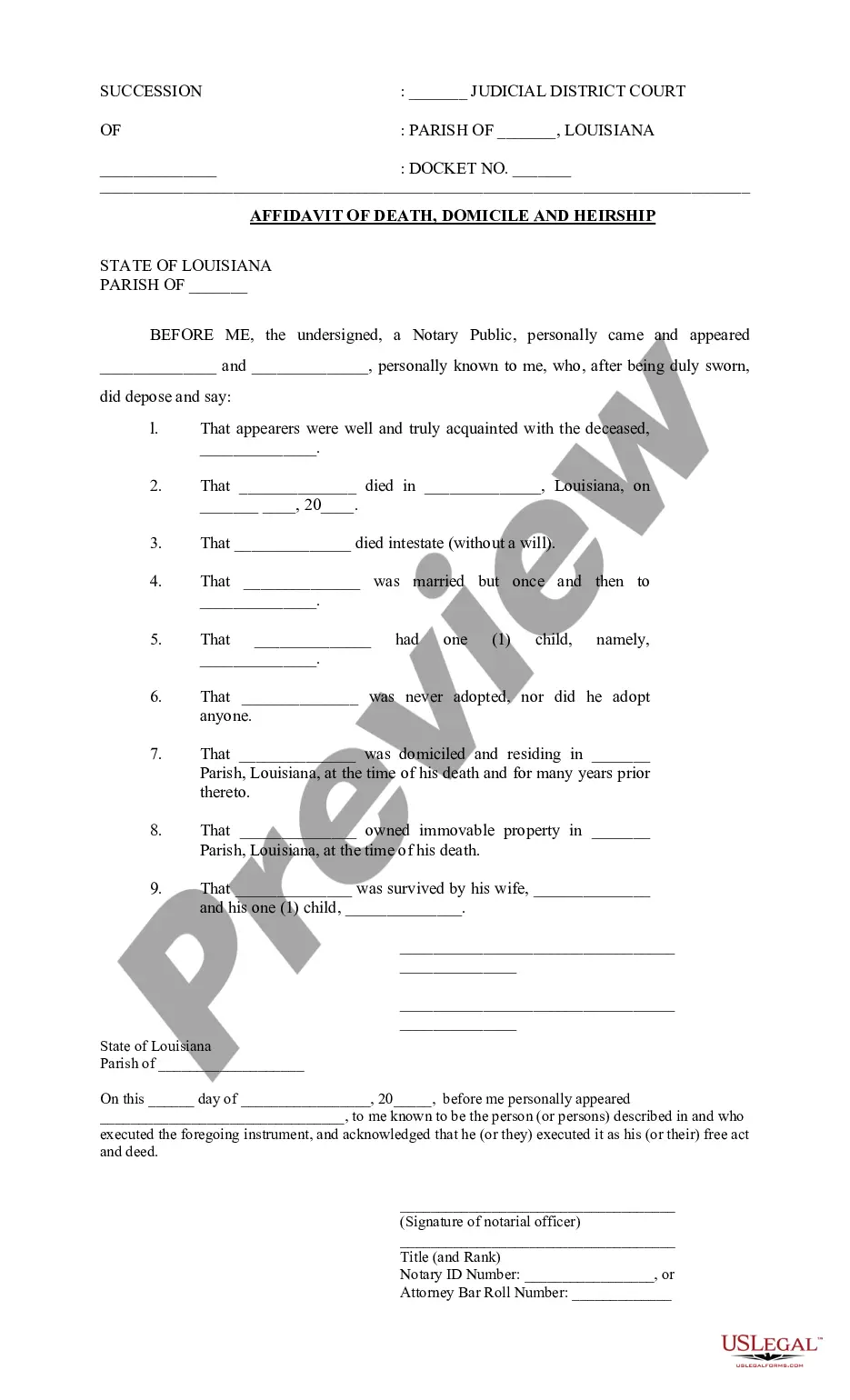

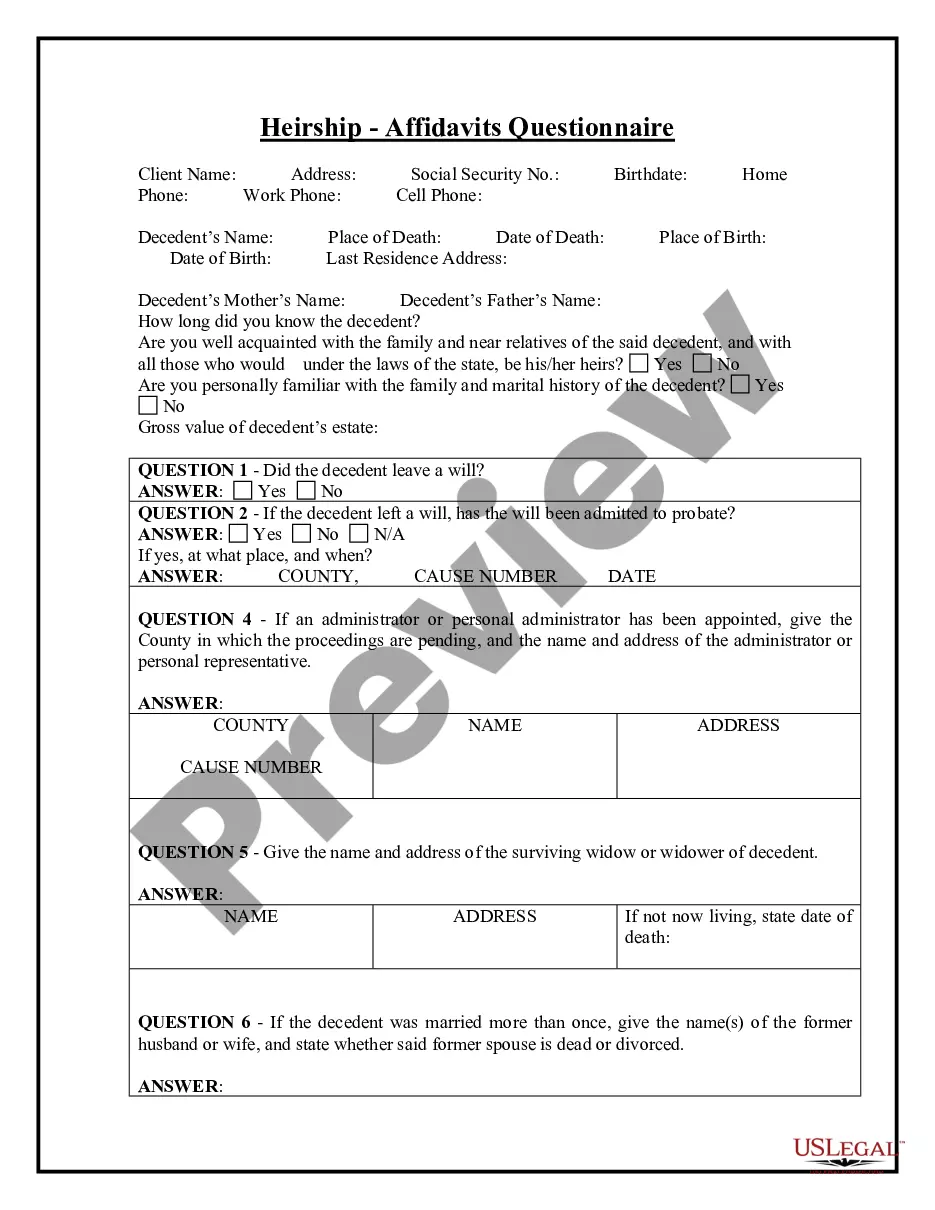

How to fill out Louisiana Affidavit Of Death, Domicile And Heirship Or Descent?

Managing legal paperwork and procedures can be an arduous addition to your schedule.

Affidavit Of Heirship Example and similar documents generally necessitate you to search for them and comprehend the most effective method to fill them out proficiently.

As a result, whether you are managing financial, legal, or personal issues, possessing a comprehensive and functional online directory of documents when needed will greatly benefit you.

US Legal Forms is the top online platform for legal templates, providing over 85,000 state-specific documents and various tools to assist you in completing your paperwork with ease.

Is it your first time using US Legal Forms? Create and set up a free account in just a few minutes, and you will gain access to the document library and Affidavit Of Heirship Example. Then, follow these steps to fill out your form: Ensure you have selected the correct document using the Preview feature and reviewing the document description. Click Buy Now when you're prepared, and select the monthly subscription plan that suits you best. Press Download then fill out, eSign, and print the document. US Legal Forms brings 25 years of experience assisting clients with their legal paperwork. Discover the document you need today and simplify any procedure effortlessly.

- Browse the library of relevant documents available at your fingertips with just one click.

- US Legal Forms provides state- and county-specific documents available for download at any time.

- Streamline your document management processes with high-quality support that enables you to prepare any form within minutes without extra or hidden fees.

- Simply Log In to your account, search for Affidavit Of Heirship Example, and obtain it instantly from the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

A Loan Agreement, also known as a Loan Contract or Personal Loan Agreement, is used to loan or borrow money with or without interest included. It typically covers the amount of the loan, the interest rate, the repayment terms, and other specific provisions and terms that will be explained in more detail below.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

However, using a lawyer is not necessary for the loan to be valid. Once you draft the promissory note, it's time for everyone to sign it: the lender, the borrower and the co-signer (if there is one). Again, seeking professional help such as notarizing the signatures is a good idea but not required.