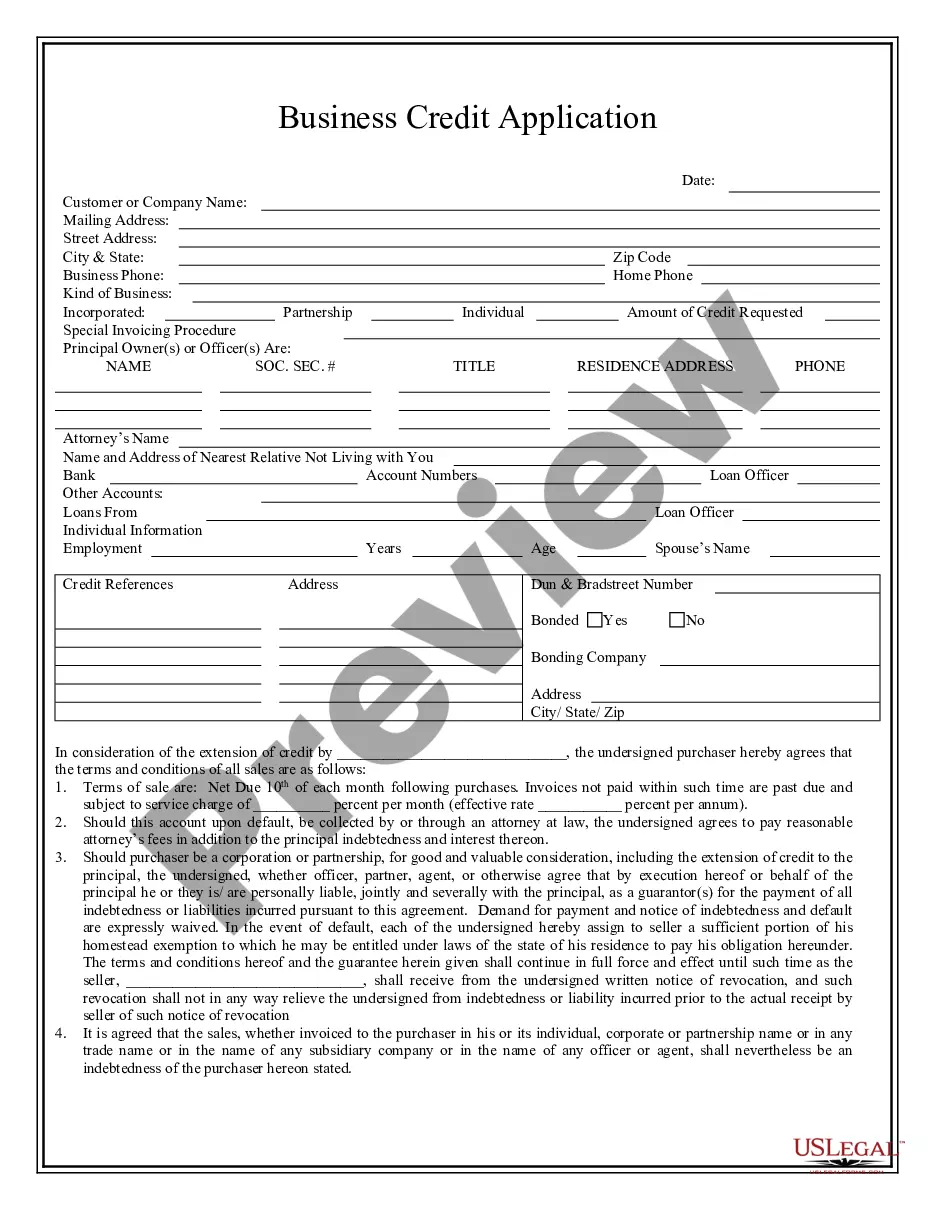

Credit Application Form For Business Pdf

Description

How to fill out Louisiana Business Credit Application?

There's no longer a need to spend countless hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in one place and simplified their availability.

Our website provides over 85,000 templates for various business and personal legal situations organized by state and area of use. All forms are expertly crafted and verified for accuracy, so you can be confident in acquiring an up-to-date Credit Application Form For Business Pdf.

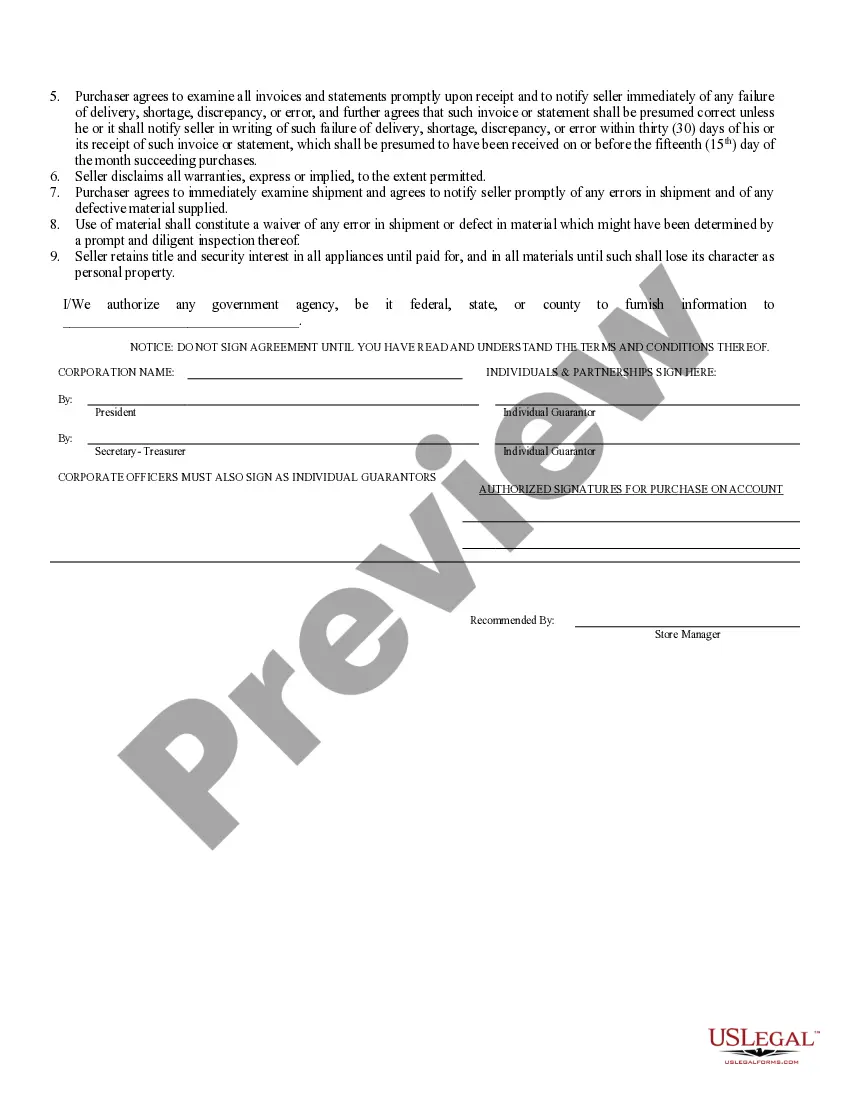

Click Buy Now next to the template name when you find the appropriate one. Select the desired subscription plan and create an account or Log In. Complete the payment for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Credit Application Form For Business Pdf and download it to your device. Print the form for manual completion or upload the sample if you would rather work with an online editor. Completing official paperwork under federal and state regulations is quick and easy with our platform. Try US Legal Forms today to keep your documents organized!

- If you are acquainted with our service and already possess an account, you should confirm that your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time by navigating to the My documents tab in your profile.

- If you are unfamiliar with our service, the process will involve a few additional steps to finish.

- Here’s how new users can locate the Credit Application Form For Business Pdf in our library.

- Review the page content meticulously to ensure it includes the sample you need.

- To do this, use the form description and preview options if available.

- Utilize the Search bar above to look for another sample if the previous one didn't meet your needs.

Form popularity

FAQ

To create a credit application form, start by determining the needed information, like business name, address, and financial details. Using US Legal, you can create a credit application form for business pdf that is both efficient and compliant with legal standards. The step-by-step process guides you through customization options, ensuring you capture all relevant details. This structured form helps you assess credit-worthiness effectively.

Creating a credit card form involves outlining essential fields for information collection, such as card number, expiration date, and CVV. With the US Legal platform, you can easily generate a credit application form for business pdf. This tool simplifies the process, ensuring you meet federal regulations and capture necessary data securely. Start by using a template, and customize it according to your business needs.

To get approved for a business credit card, you will need to provide a credit application form for business pdf that outlines your business details and financial situation. Lenders typically look for a strong credit score, stable revenue, and a well-established business. Additionally, having a clear business plan and a solid financial history can significantly enhance your chances of approval.

The credit approval process for a business involves several key tasks. First, you'll fill out a credit application form for business pdf, providing detailed information about your company. Lenders will analyze this information along with your credit history to determine your eligibility. This assessment will help them decide the terms of your credit, including the amount and interest rate offered.

The credit approval process typically begins when you submit a credit application form for business pdf. After your application is received, the lender reviews your business's financial history and credit score. They may request additional documentation to verify your business operations and revenue. Finally, the lender makes a decision, which can range from approval to denial, based on the assessed risk.

Creating a credit form involves outlining the required information an applicant needs to provide, such as business details, requested credit amount, and financial disclosures. For simplicity and professionalism, consider using a template like the Credit application form for business pdf from USLegalForms. This approach ensures you gather all necessary data efficiently.

To build credit for your LLC, start by establishing a separate business bank account and using it for all company transactions. Additionally, applying for credit and making timely payments will positively influence your credit score. You can utilize a Credit application form for business pdf to keep your records organized and provide a clear picture of your financial management.

To create a business credit file, start by registering your business with the necessary state and federal agencies. Next, open a business bank account and establish trade lines with suppliers. This action creates a credit footprint, which you can enhance by using a Credit application form for business pdf from USLegalForms to maintain accurate records.

A credit application for a business is a document that outlines a company's financial information, including its credit history, assets, and liabilities. This form helps lenders assess a business's creditworthiness before extending credit or loans. Using our Credit application form for business pdf can streamline this process, ensuring you present all necessary details professionally.

The three Cs of credit questions refer to Character, Capacity, and Capital. These aspects evaluate the reliability and repayment ability of the applicant. Incorporating these key elements into a credit application form for business pdf ensures that you gather the necessary information to make informed lending decisions.