Louisiana Llc Annual Report Form

Description

Form popularity

FAQ

LLCs in Louisiana are generally taxed as pass-through entities, meaning profits and losses pass through to the individual members. Members report this income on their personal tax returns. However, if your LLC chooses to be taxed as a corporation, different tax rates will apply. Consider consulting with a tax professional for tailored advice, especially regarding the implications of filing the Louisiana LLC annual report form.

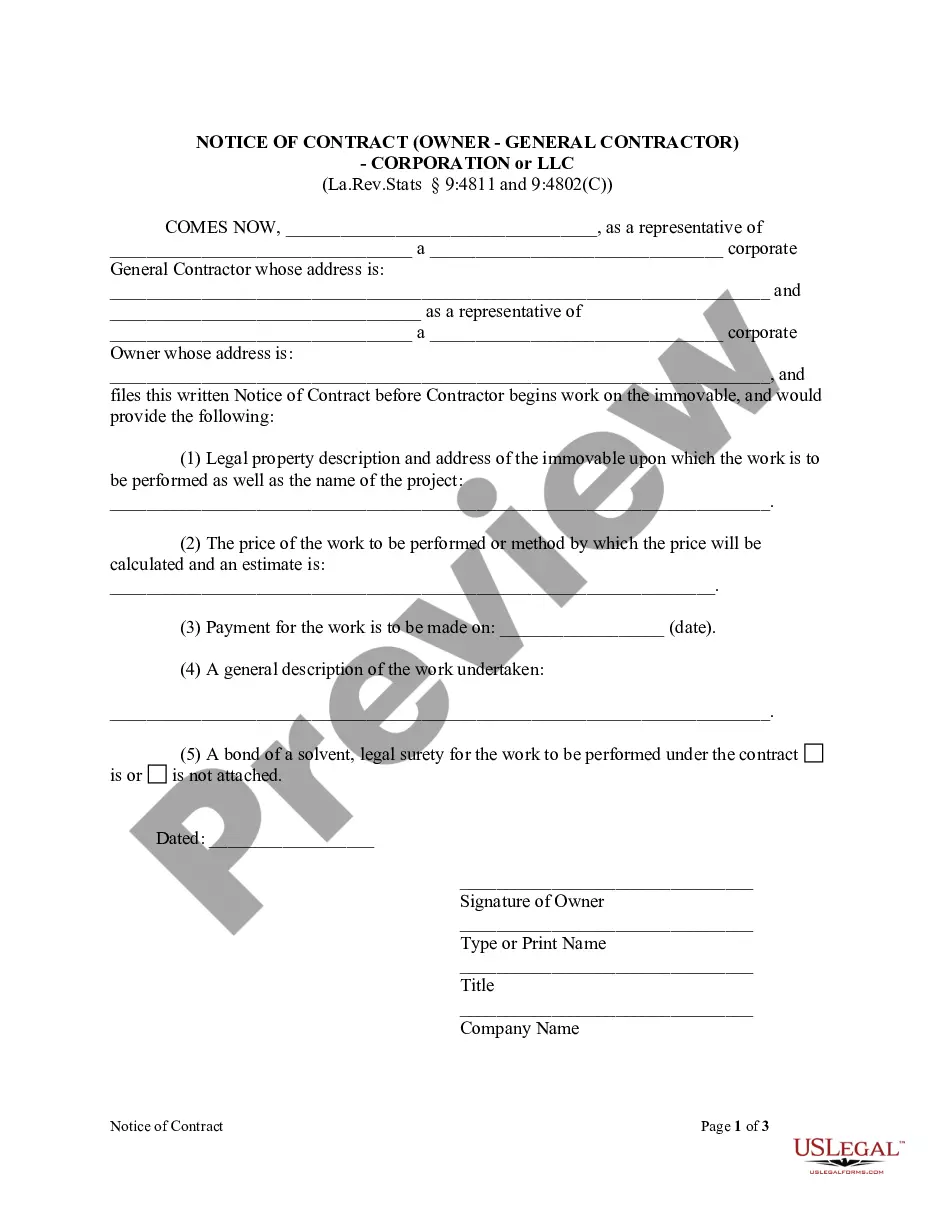

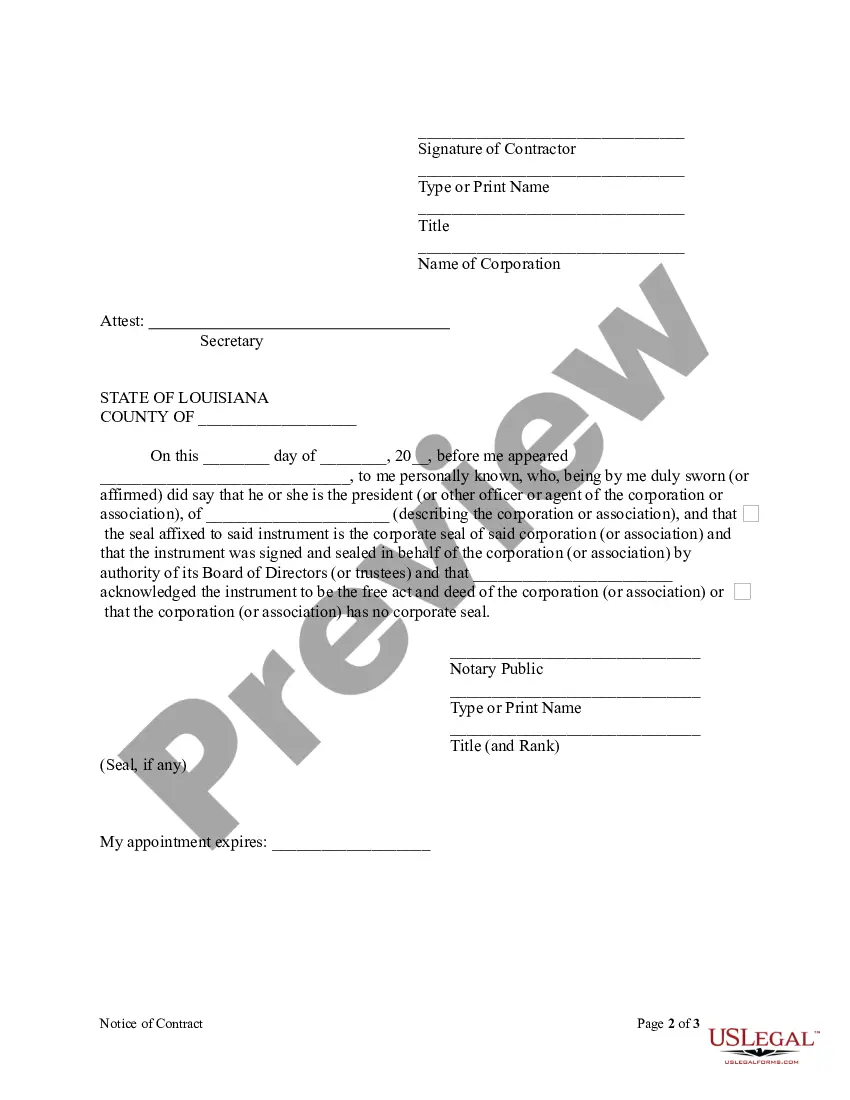

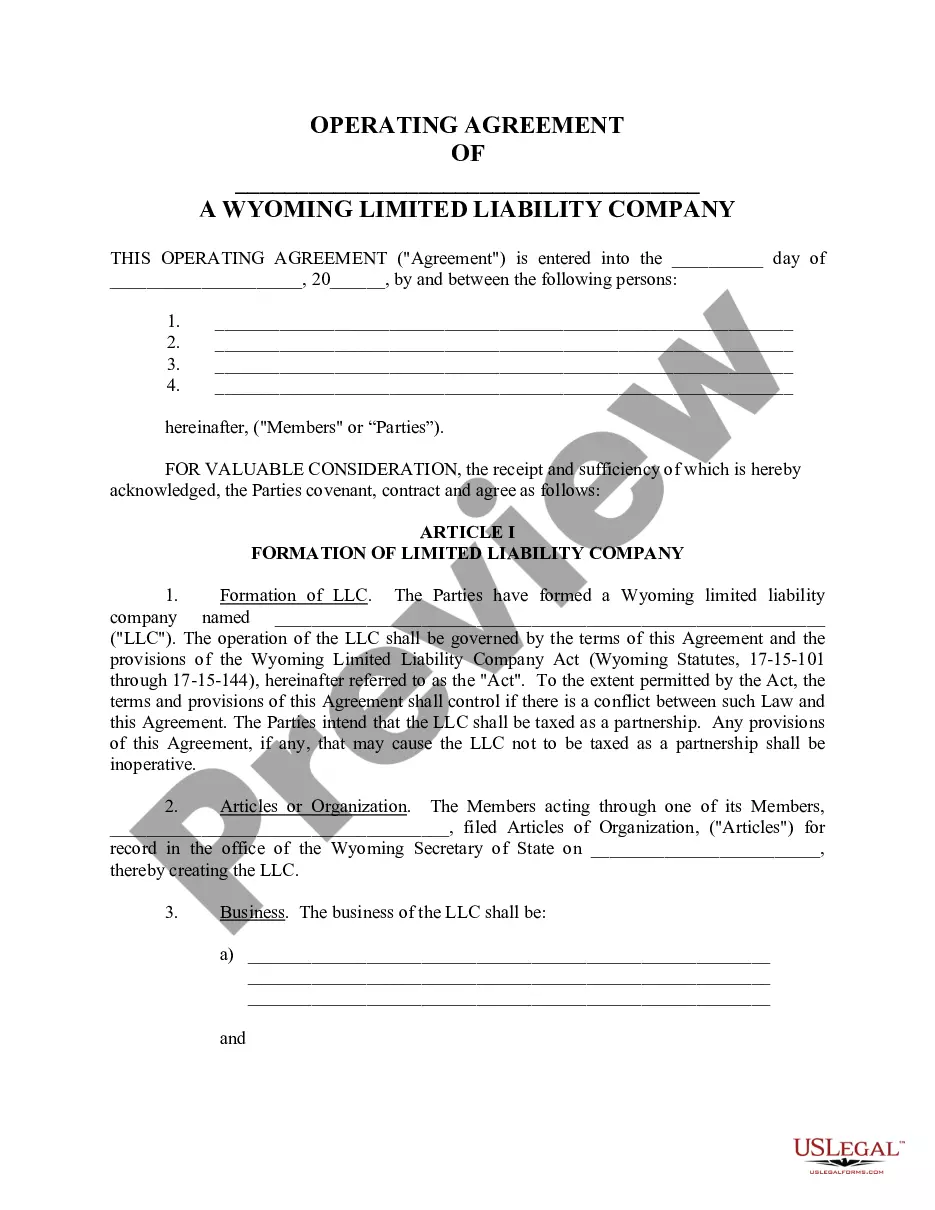

Setting up an annual report for your LLC involves gathering necessary information such as member names and business activities. You then need to complete the Louisiana LLC annual report form accurately and submit it by the due date. This process can be managed easily if you use a platform like US Legal Forms, which offers templates and guidance to ensure you comply with all state regulations. Staying organized will help prevent future complications.

Yes, filing an annual report is a requirement for all LLCs in Louisiana. This report ensures that your business information is current with the state and helps maintain your LLC's good standing. The Louisiana LLC annual report form must be submitted every year, which typically includes details like your business address and management structure. Neglecting to file could result in penalties, so it’s wise to stay on top of this obligation.

To complete the annual report for your LLC, begin by gathering your business information for the Louisiana LLC annual report form. This includes your LLC's name, address, and details about your registered agent. You can easily file online, which streamlines the process and reduces paperwork. For assistance, consider using the USLegalForms platform, where you can find resources and tools that simplify this requirement.

An LLC in Louisiana may need to file a tax return depending on its tax classification. If your LLC is treated as a partnership or corporation for tax purposes, you will generally need to file an annual tax return. Keep in mind that filing the Louisiana LLC annual report form does not replace your obligation to file a tax return; both are necessary to stay compliant.

Yes, in Louisiana, you must file an annual report for your LLC every year to keep it active. This report serves as a renewal of your LLC's legal status. The Louisiana LLC annual report form must be submitted annually to ensure compliance with state regulations. Neglecting this requirement can lead to unwanted consequences, so stay on top of it.

If you fail to file the annual report for your LLC in Louisiana, your business may face penalties, including late fees. Additionally, your LLC could be administratively dissolved, meaning it loses its legal status. It's important to prioritize submitting the Louisiana LLC annual report form to keep your business in good standing and avoid disruption.

To file an annual report for your LLC in Louisiana, you need to complete the Louisiana LLC annual report form. You can submit this form online through the Louisiana Secretary of State's website. Make sure to provide accurate information about your business, including any updates on your address or management. Filing is crucial for maintaining your LLC's compliance and avoiding potential penalties.

Yes, in Louisiana, you are required to renew your LLC by filing an annual report each year. This involves submitting the Louisiana LLC annual report form, which ensures that your business information remains current. Failing to complete this renewal may lead to penalties or the loss of your LLC status. US Legal Forms provides the resources to help you stay on track with your annual reporting and maintain your LLC compliance.

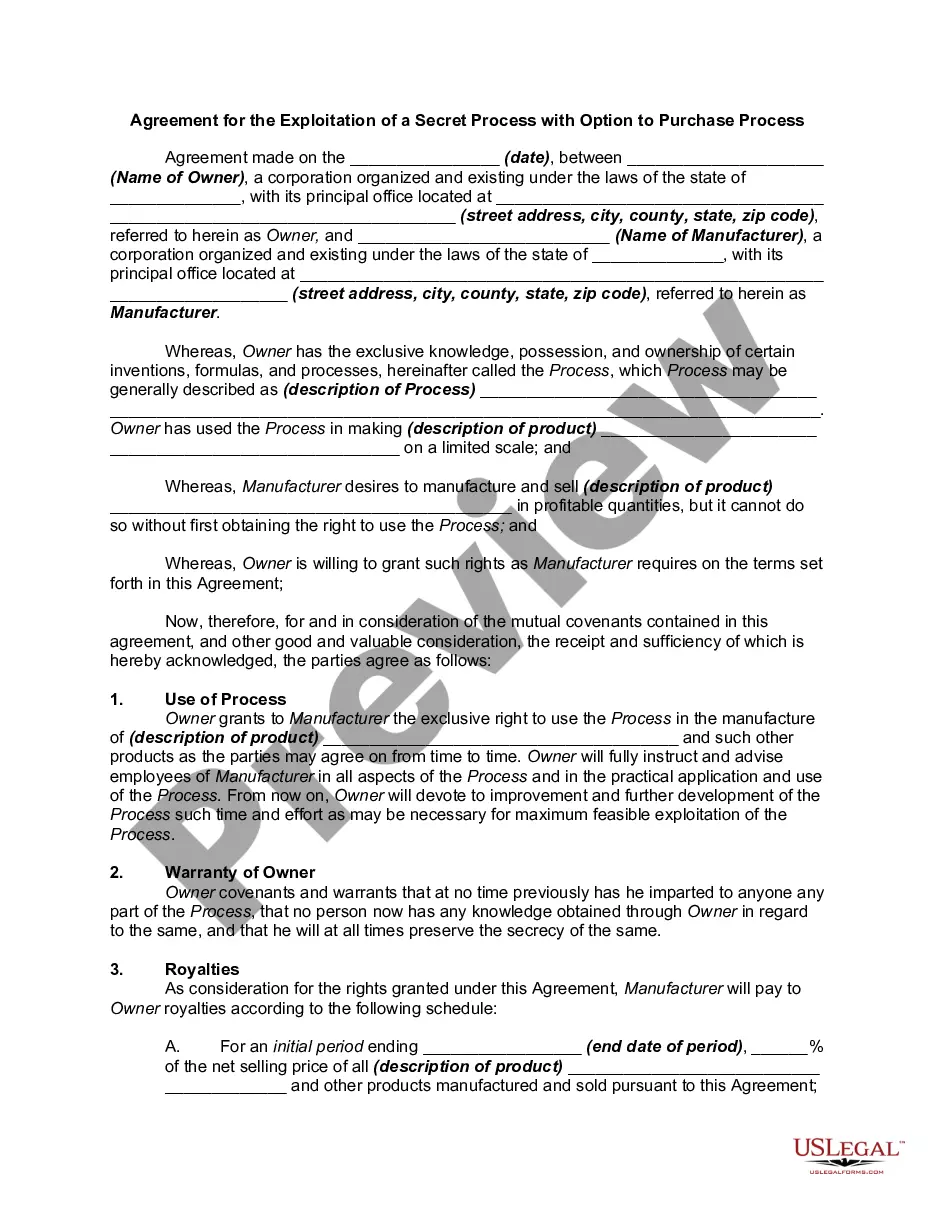

To form an LLC in Louisiana, you need to choose a unique name for your business, designate a registered agent, and file the Articles of Organization with the state. Additionally, you should prepare the Louisiana LLC annual report form, which provides updates on your business status. This annual report is an essential part of keeping your LLC compliant and maintaining good standing with the state. Simplifying this process is easy with US Legal Forms, where you can find all necessary forms and guidance.