Louisiana Life Estate With Powers

Description

How to fill out Louisiana Warranty Deed To Child Reserving A Life Estate In The Parents?

What is the most reliable service to obtain the Louisiana Life Estate With Powers and other current iterations of legal documentation? US Legal Forms is the solution!

It offers the best assortment of legal forms for any occasion. Each template is professionally composed and confirmed for adherence to federal and local laws.

Template compliance confirmation. Before you acquire any template, ensure it satisfies your use case requirements and complies with your state or county regulations. Review the template description and utilize the Preview option if available.

- They are organized by category and state of application, making it easy to find the one you require.

- Experienced users of the site need only to Log In to the platform, verify their subscription, and click the Download button next to the Louisiana Life Estate With Powers to obtain it.

- Once saved, the template is accessible for future use within the My documents section of your account.

- If you do not yet have an account with us, here are the steps you need to follow to create one.

Form popularity

FAQ

Louisiana law currently does not allow transfer on death (TOD) registrations for brokerage accounts. Currently, forty-eight states and the District of Columbia have enacted TOD legislation to facilitate the transfer of investment securities.

Louisiana does not recognize joint tenancy with rights of survivorship (JTWROS). Louisiana is a community property state. Often, when people decide to co-own property together, it is because they are married to each other.

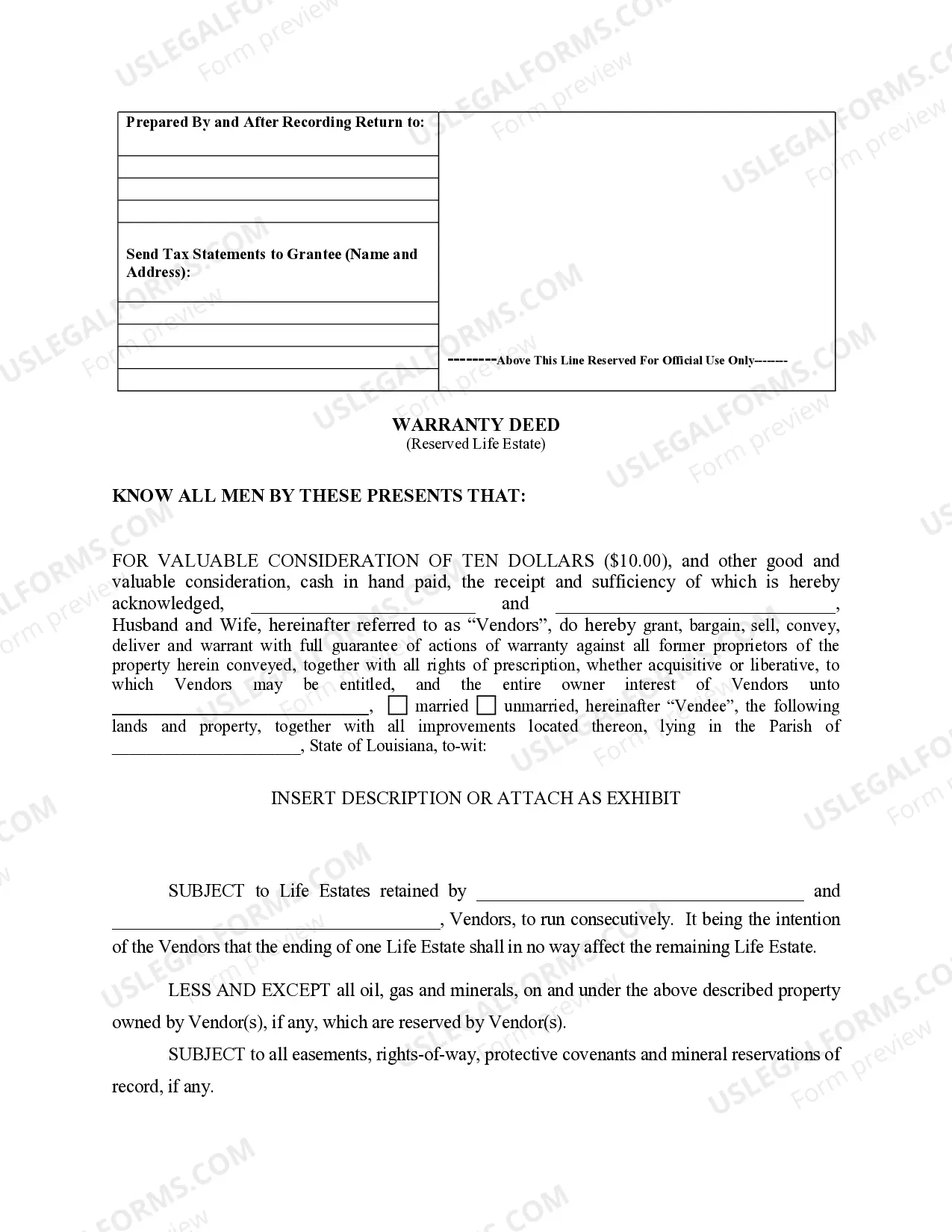

Description Life Estate Deed Louisiana This form is a Transfer on Death Deed where the Grantor/Vendor is an individual and the Grantees/Vendees are two individuals or husband and wife. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor.

Spouses in Louisiana Inheritance Law Whereas spousal inheritances will typically be dictated by the presence of a child or not, Louisiana throws the parents and siblings of a decedent into the mix as well. But if no parents, children or siblings survive him or her, the whole of the estate goes to the surviving spouse.

1) Louisiana does NOT recognize Transfer on Death (TOD) accounts. In Louisiana, the TOD designation is basically ignored and the asset must go through the deceased's Succession (Probate). Many times that is not the same person (or in the same amount) as the named TOD.