Llc With With Us

Description

How to fill out Louisiana Member Managed Operating Agreement Of LLC With Managing Member To Have Certain Specific Authority?

- If you're already a member, log in to your account. Ensure your subscription is active, or renew it as needed.

- For first-time users, start by exploring the Preview mode and checking the form description. Confirm that it aligns with your specific needs and jurisdiction.

- If the chosen template doesn't meet your requirements, utilize the Search tab to find the appropriate form.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Registration will be necessary to access our library.

- Complete your payment using your credit card or PayPal account.

- Download your document and save it on your device. You can always access it later from the My documents section of your profile.

US Legal Forms empowers you to navigate legal processes efficiently. With an extensive collection of over 85,000 forms, you have more options than with many competitors.

Let us assist you in creating precise and legally valid documents quickly. Start your journey with us today!

Form popularity

FAQ

An LLC example typically includes the business name, purpose, member information, and operating structure. You can create a practical example by using our templates which simplify each element. Writing your LLC example with us ensures that you cover all relevant aspects to set a solid groundwork for your business.

Filing for an LLC generally requires you to submit specific forms to your state’s business office. Using our platform makes this process straightforward, as we provide personalized guidance every step of the way. By filing your LLC with us, you secure your business’s legal foundation efficiently.

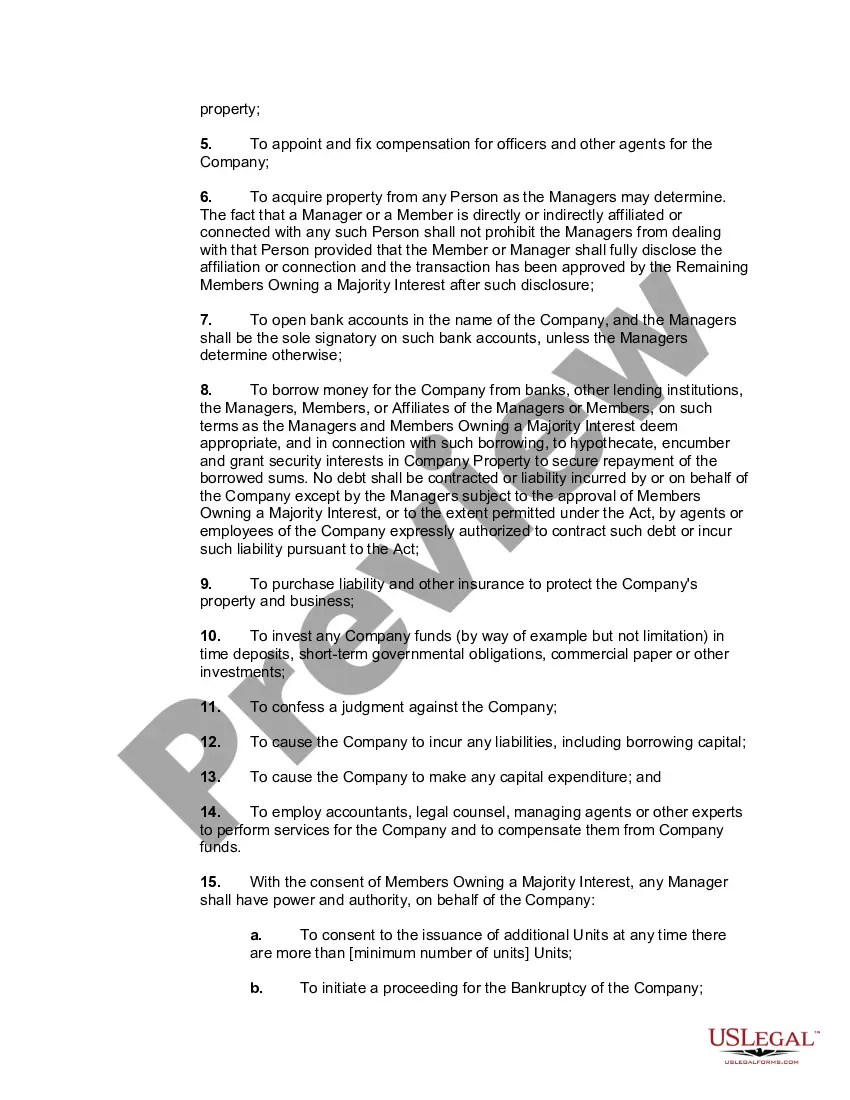

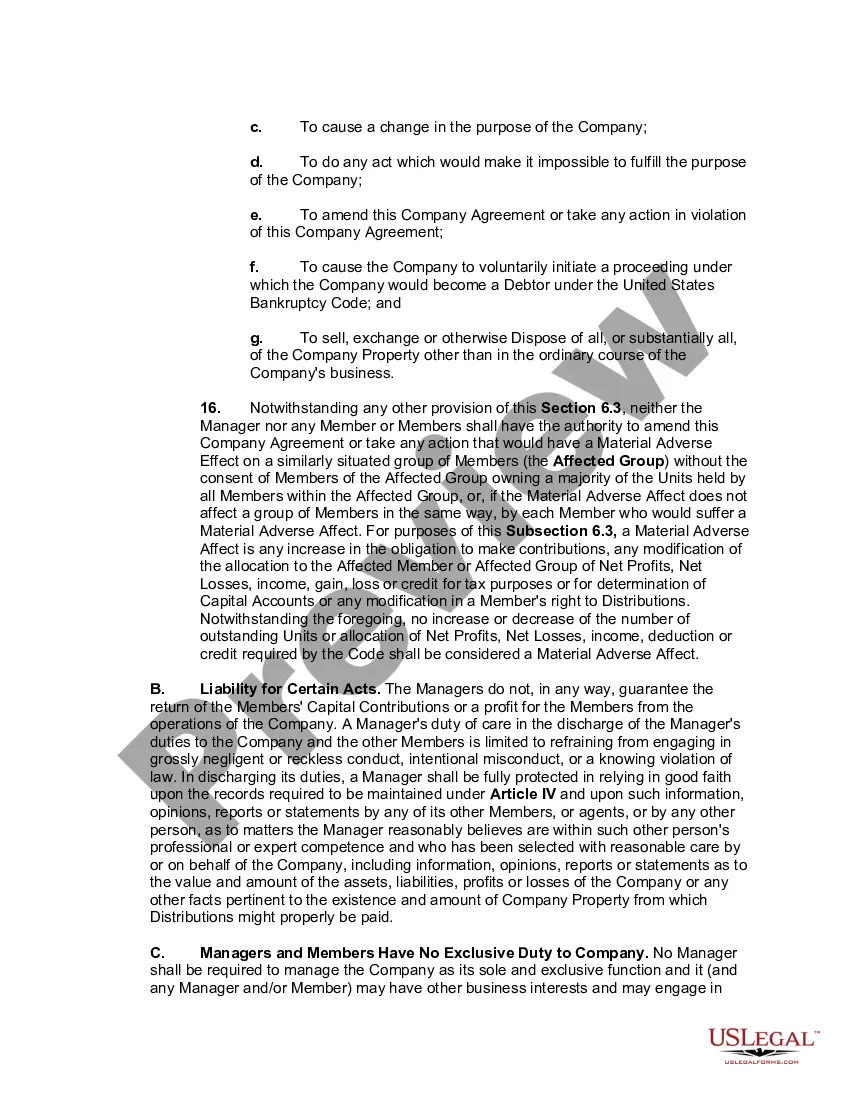

To fill out an LLC operating agreement, begin by defining the roles of members, management structure, and procedures for adding new members. You can find templates on our website that guide you in creating a comprehensive agreement. This crucial document ensures your LLC operates smoothly and you can trust us to assist you throughout the process.

Yes, you can file your LLC by yourself without the need for a lawyer. Our platform provides the essential forms and guidance to help you through the process with ease. Filing your LLC with us not only saves you time but also allows you to take control of your business formation.

To fill out an LLC, start by gathering the necessary information including your business name, address, and details of the members. You can find forms on our website, which simplifies this process. Just follow the step-by-step guide provided, and you'll be on your way to forming your LLC with us.

member LLC can write off various business expenses, including operational costs, equipment, and travel expenses directly related to the business. This helps reduce overall taxable income, leading to potential savings. When you establish your LLC with us, we provide guidance on maximizing these writeoffs effectively.

LLC owners can minimize their tax burden legally through deductions and tax strategizing. By properly structuring their business and utilizing available deductions, they can reduce their taxable income. Partnering with us can provide valuable resources and guidance on navigating these tax strategies.

An LLC with one member can enjoy various tax benefits, such as pass-through taxation. This means the LLC's profits are taxed only at the individual level, avoiding double taxation. Additionally, using our services can help streamline the filing process, ensuring you maximize your tax advantages.

member LLC can be advantageous for taxes, especially if you want simplicity in your tax filing. With us, you can choose to be taxed as a sole proprietorship, which often results in fewer tax obligations. However, it is vital to consult a tax professional to understand the implications for your specific situation.

An LLC is neither inherently good nor bad; it depends on your business goals and structure. Forming an LLC with us offers liability protection and flexibility, making it suitable for many entrepreneurs. However, it also comes with responsibilities and potential tax implications that should be considered.