Limited Liability Formation For A Corporation

Description

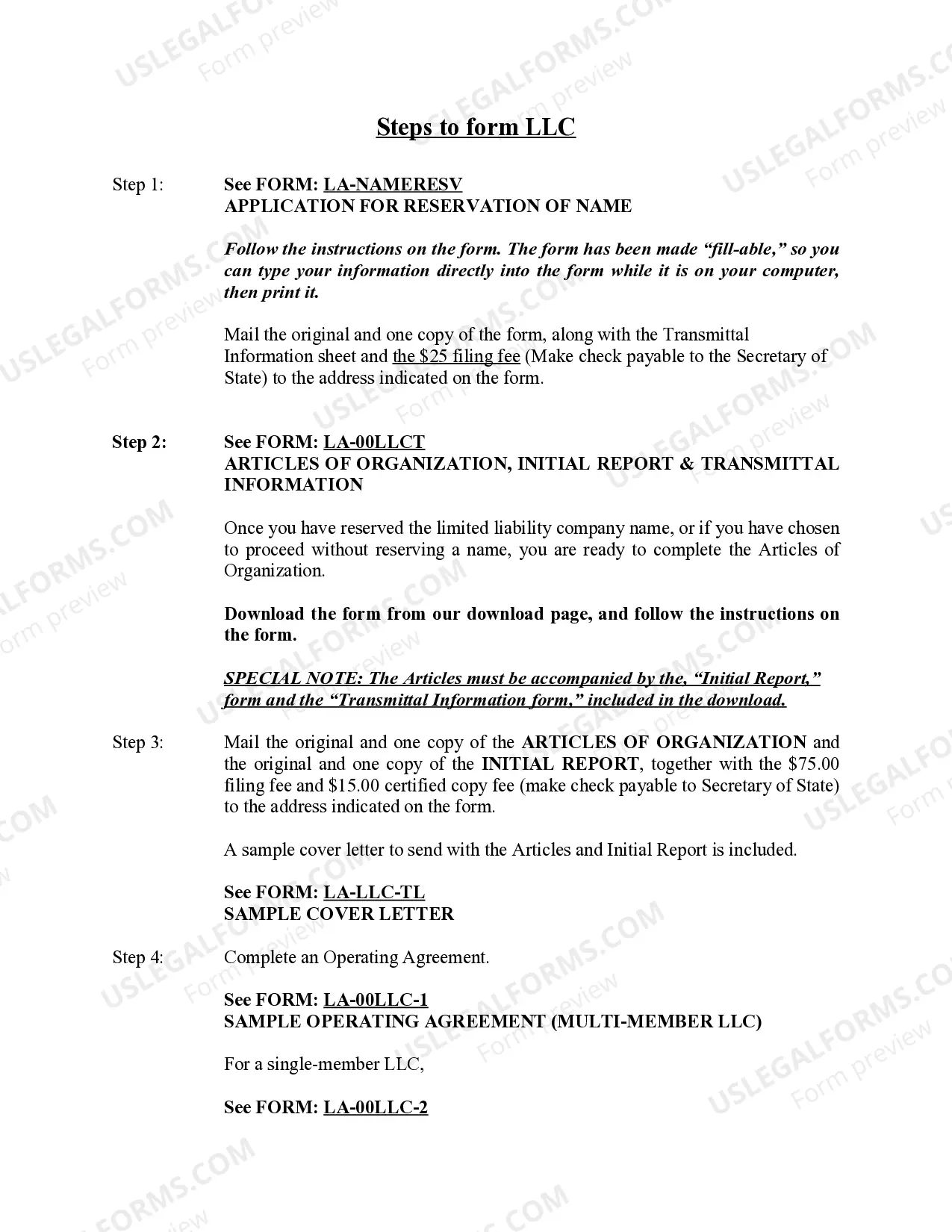

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- If you're a returning user, log in to your account and select the required template. Verify that your subscription remains active before downloading.

- For first-time users, browse the Preview mode to review the form and its specifics. Ensure it aligns with your jurisdiction's regulations.

- If adjustments are needed, utilize the Search tab to find the appropriate template. Confirm it meets your criteria, then continue.

- Purchase the document by clicking 'Buy Now' and opting for your preferred subscription plan. An account registration is necessary for accessing the full library.

- Complete your payment using a credit card or PayPal to confirm your subscription.

- Download the form to your device, enabling you to fill it out. You can also access it later in the My Forms section of your profile.

By following these steps, you simplify the process of legal form completion, backed by US Legal Forms' robust resources.

Take control of your business's legal needs today. Explore the benefits of US Legal Forms and start your limited liability formation for a corporation with confidence!

Form popularity

FAQ

Deciding between an LLC and an Inc. hinges on your business goals and needs. An LLC provides flexibility and ease in management, while a corporation offers a solid framework for growth and potential stock options. When you think about limited liability formation for a corporation, the choice between LLC and Inc. should consider aspects like funding, ownership structure, and your long-term vision. It's often helpful to consult with experts or platforms like uslegalforms to better understand your options.

Choosing a corporation over an LLC can be beneficial for those seeking to raise capital through the sale of stock or for certain tax advantages. Corporations often have an easier time attracting investors, as they can issue shares. Additionally, limited liability formation for a corporation can offer a more robust structure for governance and long-term growth. If you are considering these factors, exploring the benefits of both structures can help you make an informed decision.

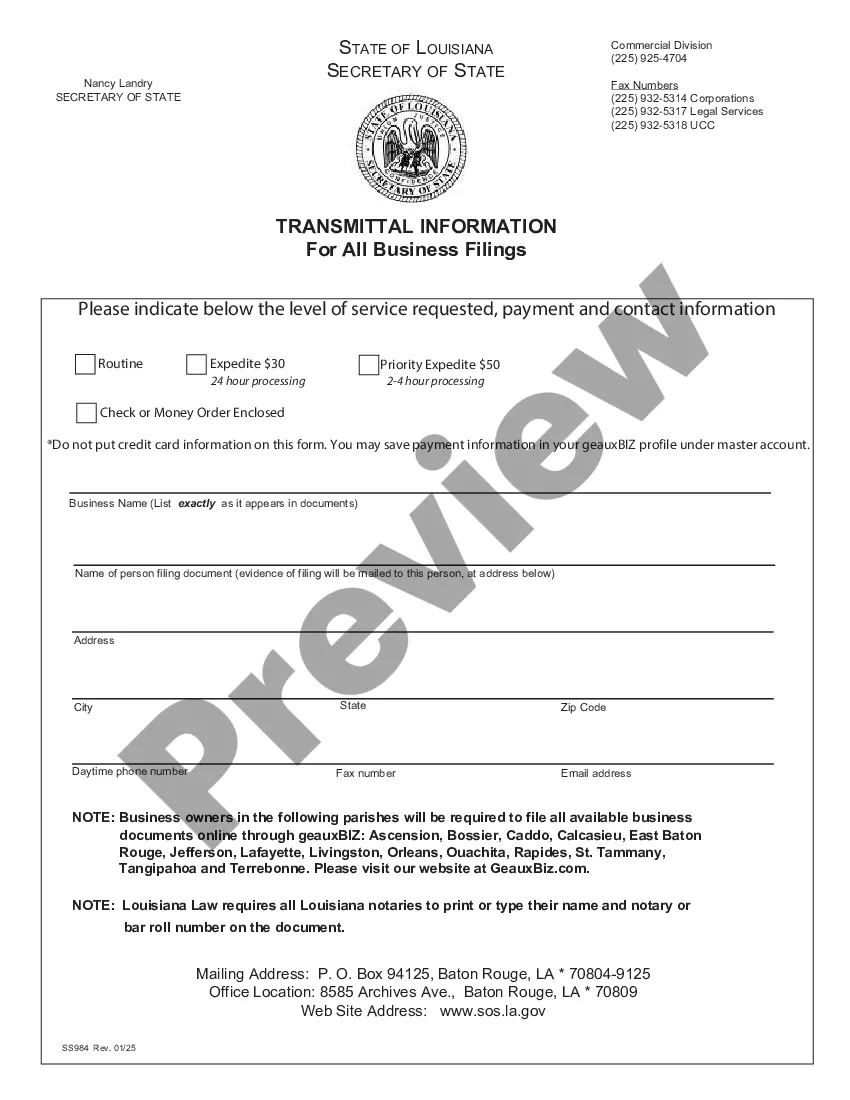

To obtain a limited liability corporation, you need to register your business with your state government by filing the appropriate forms and paying the required fees. This process usually involves preparing an operating agreement that outlines the management and ownership structure of your corporation. By choosing limited liability formation for a corporation, you gain essential legal protections, allowing you to operate your business confidently. Platforms like uslegalforms can help simplify this process and guide you through the necessary steps.

Consider moving your LLC to a corporation when your business starts to expand significantly or when you need to raise capital. If you're looking to offer shares to investors or you plan for future growth, the corporate structure can facilitate these processes. Additionally, the limited liability formation for a corporation can offer you greater legal protection and enhance your business credibility. Assess your growth trajectory and make the switch at the right moment.

Deciding whether to convert your LLC into a corporation depends on your business goals and growth plans. If you seek to attract investors or plan to offer stock, transitioning to a corporation can offer significant advantages. Additionally, limited liability formation for a corporation may provide a stronger legal foundation for raising capital and facilitating expansion. Evaluate your specific needs and consult with a professional to make the best choice.

A corporation provides limited liability protection to its owners, meaning they are not personally responsible for the debts and liabilities of the business. This structure safeguards your personal assets against claims made against the corporation. Essentially, if the corporation faces financial issues, your personal belongings remain secure. By opting for limited liability formation for a corporation, you can focus on growing your business with peace of mind.

An example of a limited liability partnership (LLP) is a law firm where partners work together while protecting their personal assets from business debts. In an LLP, each partner typically enjoys limited liability, meaning they are not personally responsible for the negligence of other partners. This structure emphasizes collaboration and security, making it ideal for professional services. Considering limited liability formation for a corporation through this model can provide unique advantages in competitive markets.

An example of a limited liability company is a local boutique that operates under an LLC designation. This structure allows the owners to separate their personal finances from the business, shielding their assets from potential business liabilities. The benefits of limited liability formation for a corporation make it an appealing choice for small business owners. By adopting this structure, they can confidently manage risks while focusing on growth.

To file an LLC as an S Corp, first, ensure your LLC meets the eligibility requirements by having fewer than 100 shareholders and being a domestic entity. Next, you need to file Form 2553 with the IRS, indicating your choice to be taxed as an S Corp. This strategic choice can enhance the tax benefits of limited liability formation for a corporation. Seek guidance from uslegalforms for assistance in completing the necessary paperwork.

A corporation limited liability company, or LLC, is a business structure that combines the benefits of a corporation's limited liability protection with the tax flexibility of a partnership. This structure allows owners, known as members, to protect their personal assets while enjoying pass-through taxation. Choosing this form for limited liability formation for a corporation can provide both security and simplicity for new businesses. It is an effective way to manage risk while maximizing benefits.