Limited Liability Company Llc Example

Description

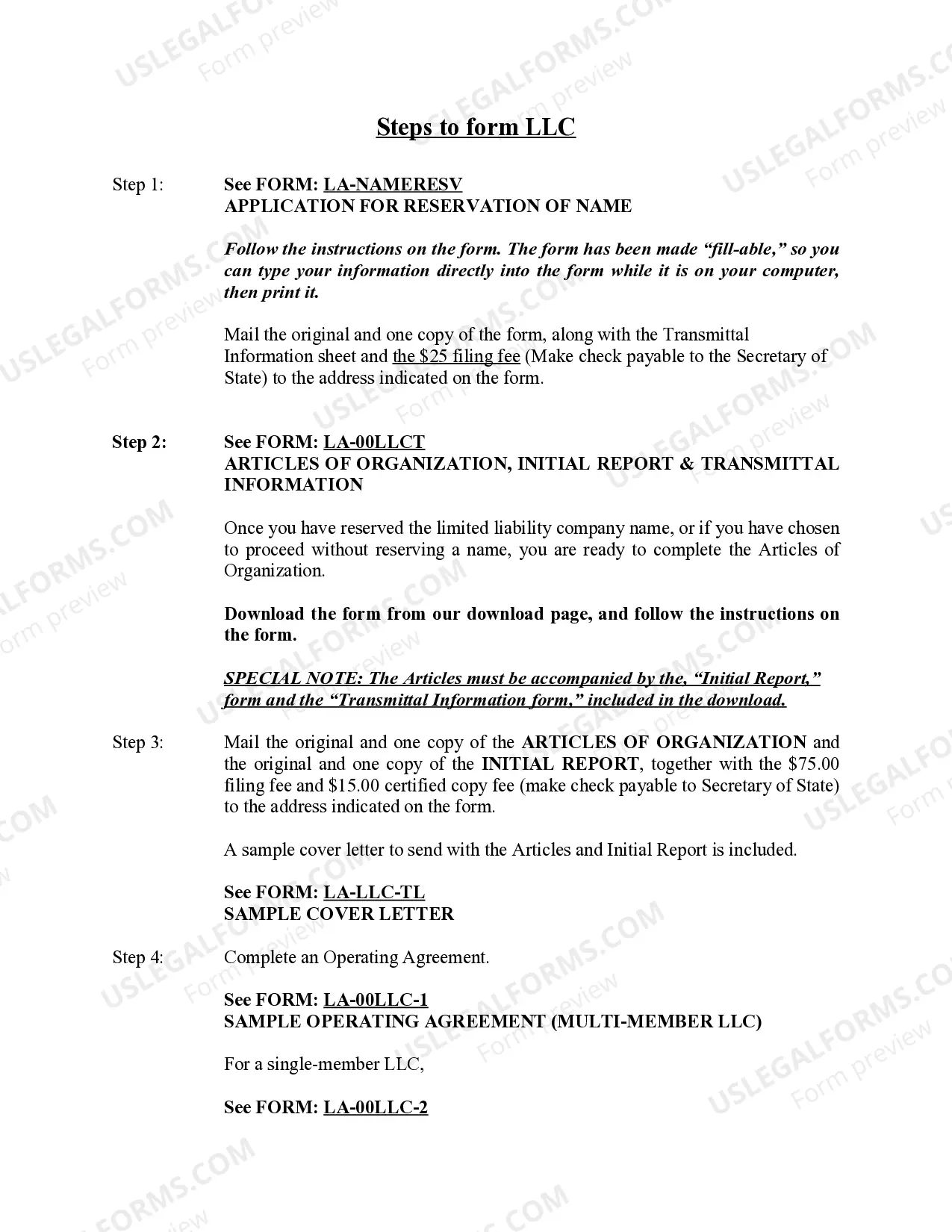

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- Log in to your US Legal Forms account if you're an existing user and click the Download button to retrieve your forms. Always verify that your subscription is active and renew if necessary.

- If you're new to the service, start by checking out the Preview mode and form descriptions. Ensure your choice meets your specific needs and complies with local jurisdiction requirements.

- If you need a different template, use the Search feature to locate the correct document and proceed if it aligns with your requirements.

- Select your desired template by clicking the Buy Now button and choosing a suitable subscription plan. You’ll need to create an account to access their full library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account for the subscription.

- Once your transaction is successful, download the document onto your device for future access. You can also find it in the My Forms section of your profile.

In conclusion, US Legal Forms offers an extensive range of legal documents designed to simplify the process of setting up your LLC. With a vast form collection and expert support, you ensure compliance and accuracy.

Don't miss out on the convenience—start using US Legal Forms today to effortlessly create your legal documents!

Form popularity

FAQ

member LLC is classified as a disregarded entity by default and not as a C corporation unless you elect to be taxed that way. If you do not file as a C Corp, your business profits will pass through to your personal tax return. This structure can provide simplicity and flexibility for solo entrepreneurs. Understanding these distinctions offers clarity in your business choice, showcasing a useful limited liability company LLC example.

member LLC is not automatically an S corporation; however, it can elect to be taxed as such. By filing the necessary paperwork with the IRS, you can enjoy the tax advantages of S corporation status while maintaining the benefits of an LLC. This choice can be strategic for your business's growth. Explore options that align with your goals using a limited liability company LLC example.

To determine if your LLC is taxed as an S or C corporation, check the IRS election you've made. If you've filed Form 2553 to elect S corporation status, you are classified as an S Corp. If you haven't made an election, a single-member LLC typically defaults to C corporation taxation. Knowing this distinction empowers you to leverage the benefits of your limited liability company LLC example effectively.

member LLC can choose to be taxed as an S corporation or a C corporation, but it is not automatically classified as either. Instead, it's initially treated as a disregarded entity for tax purposes. You may need to file specific forms with the IRS to make the tax classification choice that best suits your business. By understanding this classification, you can see a clear limited liability company LLC example in your financial strategy.

A limited liability partnership (LLP) is commonly used by professional services, such as law firms or accounting firms. In this structure, partners share profits but have limited personal liability for the business's debts. An example often cited is a group of lawyers forming an LLP to provide legal services while protecting their individual assets. Understanding the differences can enhance your choice between an LLC and LLP, giving you a better limited liability company LLC example to consider.

A classic example of a limited liability company (LLC) is a local bakery owned by an individual or a small group. This business structure limits personal liability while offering tax benefits. Allowing for easier management than corporations, an LLC provides a practical choice for small business owners. By forming a limited liability company LLC example like this, entrepreneurs can safeguard their personal assets.

The most common types of limited liability companies (LLCs) include single-member LLCs and multi-member LLCs. Single-member LLCs are typically owned by one individual, while multi-member LLCs involve multiple owners. These structures provide flexibility and protect personal assets from business liabilities. A limited liability company LLC example allows for a simple foundation for entrepreneurs to start their ventures.

No, Amazon is not a limited liability company (LLC). Instead, it operates as a corporation, specifically a publicly traded company. While many businesses benefit from the structure of a limited liability company, Amazon showcases an example of a larger corporate entity. If you're interested in forming your own LLC, platforms like USLegalForms can help guide you through the process.

The proper Limited Liability Company (LLC) format ensures that your business is legally compliant. Typically, this involves including 'LLC' or 'Limited Liability Company' in your business name. Additionally, you need to file necessary documents with your state, such as the Articles of Organization. For a seamless experience, you can utilize US Legal Forms to guide you through the process with their variety of templates and resources tailored for a Limited Liability Company LLC example.

To establish a limited liability corporation, begin by selecting a unique business name that complies with your state's regulations. Next, file the necessary formation documents with your state's business office, ensuring you include 'LLC' in the name. Using services from USLegalForms can simplify this process by providing templates and guidance tailored for aspiring business owners.