Trust Account With Interest

Description

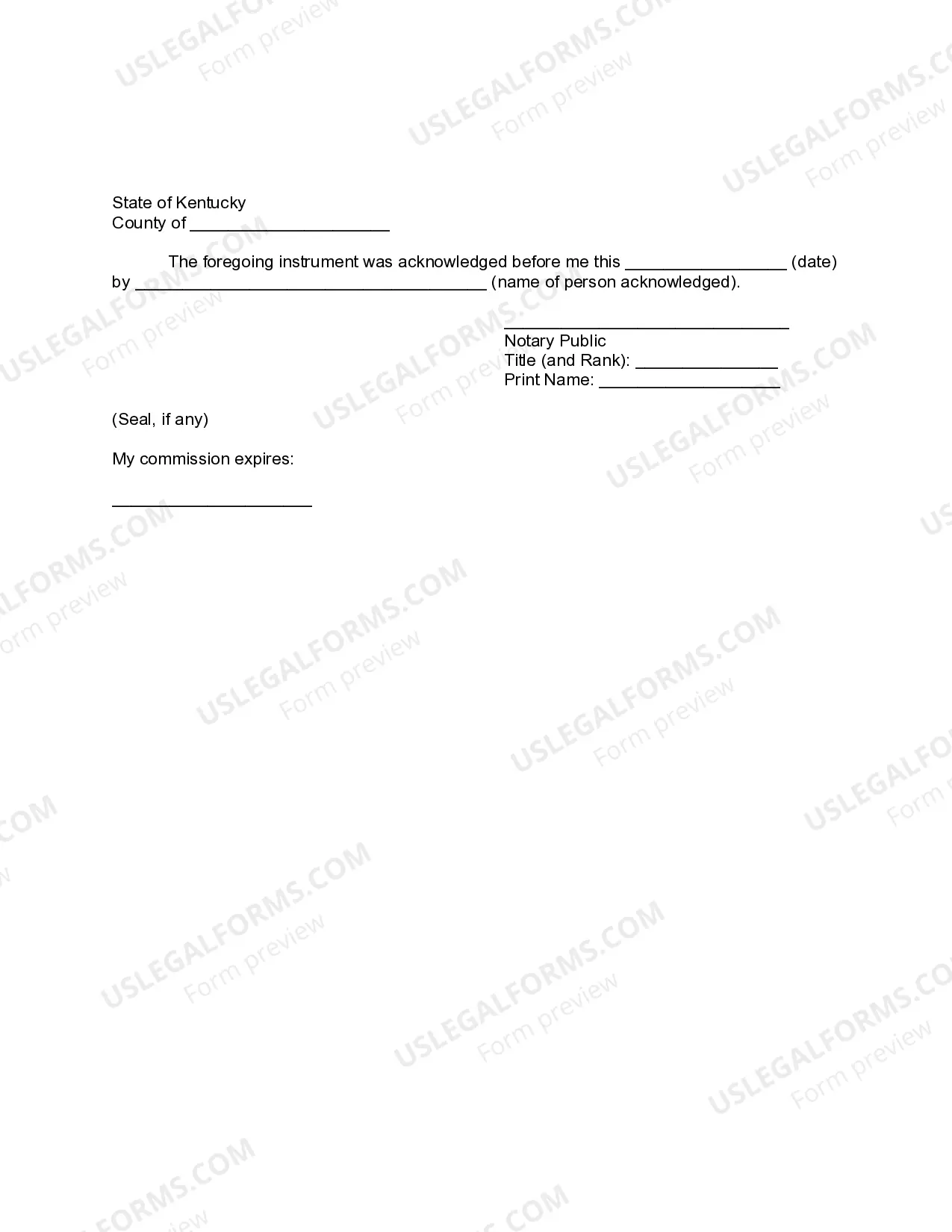

How to fill out Kentucky Financial Account Transfer To Living Trust?

- If you have used US Legal Forms previously, log into your account to access existing templates. Confirm your subscription is active; renew if needed.

- For first-time users, begin by exploring the Preview mode to find forms that meet your requirements while ensuring compliance with your local jurisdiction.

- Utilize the Search feature if necessary to locate alternative templates that may better fit your needs.

- Once you identify the correct document, click the Buy Now button and select your preferred subscription plan. Registration is required for accessing the full library.

- Complete your purchase by entering your payment details through a credit card or PayPal.

- Finally, download your form to your device. You can also retrieve it anytime from the My Forms section in your profile.

In conclusion, utilizing US Legal Forms for a trust account with interest ensures you have access to a comprehensive selection of legal documents designed to meet your specific needs. Take advantage of their resources and premium expert assistance for a seamless experience.

Start simplifying your legal form process today by visiting US Legal Forms!

Form popularity

FAQ

A trust fund can make varying amounts per year, depending on the size of the fund and the interest rates in effect. For a trust account with interest, annual earnings can range from a few hundred to thousands of dollars, contingent on investment strategies and market performance. It's essential to monitor the account and make adjustments to the investment strategy as needed. Using resources like US Legal Forms can provide valuable insights and templates to manage your trust effectively.

The amount of interest earned on a trust fund depends on several factors, including the account balance and the interest rates offered by the financial institution. Generally, the more substantial the deposits, the more significant the interest accumulation. With a trust account that generates interest, you can expect earnings that compound over time, enhancing the growth of the trust's assets. Always track your account's performance to ensure it's meeting your financial goals.

The trust fund interest rate varies depending on the financial institution and the type of account selected. Typically, trust accounts with interest may offer rates similar to high-yield savings accounts or may be slightly lower than other investment vehicles. It is important to shop around and examine current offers from various banks to secure the best rates. Understanding these rates will help you optimize your trust's financial performance.

Yes, a trust account can earn interest, making it a valuable tool for managing and growing assets. The interest generated can help provide income for beneficiaries, further assisting in the fulfillment of the trust's goals. When setting up a trust account with interest, it's crucial to evaluate the investment choices available and select one that aligns with your financial strategy. With the right guidance, you can ensure your trust grows effectively.

The best bank for a trust account with interest usually offers favorable interest rates, low fees, and excellent customer service. Look for banks that specialize in trust services, as they will have the expertise to help you manage your trust effectively. Additionally, consider online banks that often provide higher interest rates due to lower operating costs. Ensure that you read reviews and compare options to find the best fit for your financial needs.

The interest of a trust refers to the income generated from the assets held within the trust account with interest. This income can come from various sources, such as investments or savings accounts. The trustee manages these investments to ensure they align with the trust's purpose, ultimately benefiting the beneficiaries. Understanding how trust accounts generate interest can help you make informed decisions regarding asset management.

Deciding whether your parents should put their assets in a trust depends on their financial goals and estate planning needs. A trust can provide benefits like asset protection and simplified transfer upon death. It is wise to assess their situation comprehensively. Utilizing platforms like uslegalforms can aid in making these important decisions.

The interest earned on a trust account with interest generally benefits the beneficiaries of the trust. Depending on the trust's terms, the interest can either be reinvested or distributed. It's important to keep track of how interest accumulation impacts the overall trust value. Planning for this can ensure all parties understand their potential benefits.

The biggest mistake parents often make is not clearly defining the trust's terms and purpose. Without clarity, misunderstandings may arise among beneficiaries, leading to conflict. Additionally, failing to communicate the trust's structure to family members can create confusion. Using a well-organized service like uslegalforms can prevent these issues.

A significant downfall of having a trust is the possibility of limited control over assets. Once assets are transferred into a trust, the trust terms dictate how they are managed. This can be a challenge if your needs or circumstances change unexpectedly. It's vital to plan your trust wisely to mitigate these risks.