Living Trust Property With Title Deed

Description

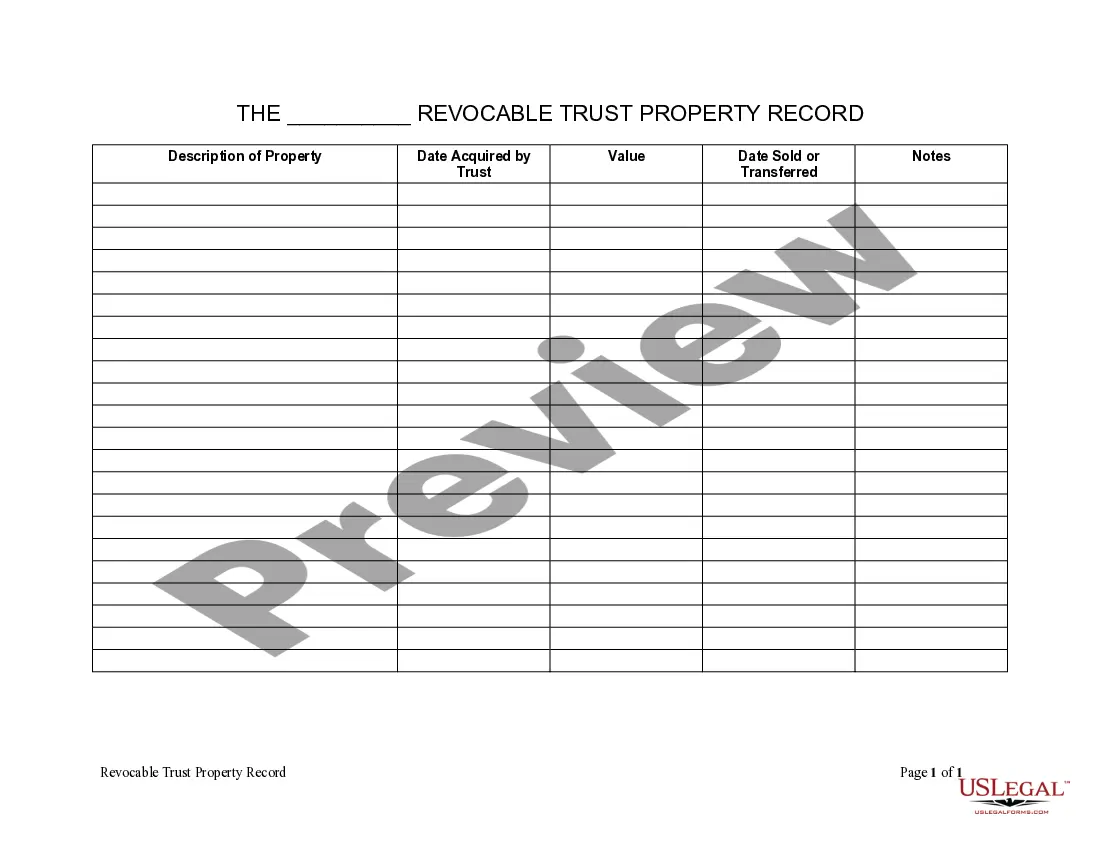

How to fill out Kentucky Living Trust Property Record?

- For returning users, simply log in to your account, verify your subscription status, and download the appropriate form template.

- If you're new to US Legal Forms, start by checking the Preview mode and reading the form description to confirm you've selected the right document that aligns with your jurisdiction requirements.

- Should you find any discrepancies, utilize the Search tab to locate the correct template.

- Once satisfied, proceed to purchase the document by clicking 'Buy Now' and choosing the appropriate subscription plan, which will require you to create an account.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download the completed form to your device and access it later in the My Forms section of your profile.

By using US Legal Forms, you're taking advantage of an extensive library with over 85,000 legal forms, empowering individuals and attorneys alike to draft precise documents effortlessly.

Start your journey in estate planning today. Visit US Legal Forms and secure your living trust property with title deed now!

Form popularity

FAQ

Yes, you may need to declare a trust deed depending on your state laws. It is important to properly disclose this information, especially if you engage in financial transactions involving the living trust property with title deed. Ensuring compliance can help you avoid legal complications and maintain transparency with all parties involved.

Yes, you can write your own trust deed, but it is advisable to seek professional assistance. Crafting a trust deed requires attention to legal details to ensure it meets all state laws and successfully outlines the intentions for your living trust property with title deed. Consulting a legal expert or using platforms like US Legal Forms can help you create a properly structured document.

One disadvantage of a trust deed is that it can complicate the process of selling your property. Since a trust deed often involves multiple parties, potential buyers may need to navigate legal complexities. Moreover, if not managed correctly, it may impact the transition of living trust property with title deed to the heirs.

When a title is held in a trust, it means that the legal ownership of the property is transferred to a trust. This trust is managed by a trustee who administers the assets for the benefit of the beneficiaries. This setup can provide clear advantages, such as avoiding probate and ensuring efficient management of living trust property with title deed.

The downside of putting assets in a trust includes the administrative burden that it may create, as a trustee must be appointed to manage the living trust property with title deed. This process can be quite involved and may require legal assistance. Moreover, certain tax implications may arise, which families should consider before taking this step.

One of the biggest mistakes parents make when establishing a trust fund is failing to fund the trust properly. This means they might neglect to transfer living trust property with title deed into the trust, which can defeat its purpose. To avoid this pitfall, parents should actively ensure that all intended assets are formally included in the trust.

Filling a living trust involves accurately listing all living trust property with title deed, including real estate and other valuable assets. It's essential to follow the specific guidelines provided in the trust document. A professional service, such as UsLegalForms, can guide you through the process to ensure everything is completed correctly and comprehensively.

Putting assets into a trust can be beneficial for your parents, especially to ensure a smooth transfer of their living trust property with title deed. This approach helps avoid probate and can safeguard their assets for future generations. However, they should consult with a legal expert to thoroughly understand the implications and benefits specific to their situation.

One significant downfall of having a trust is that it can create a false sense of security regarding asset protection. People might mistakenly believe that establishing living trust property with title deed eliminates all risks. Moreover, managing the trust properly requires ongoing attention, which can be burdensome for some individuals.

A family trust may lead to complications in managing living trust property with title deed. One major downside is the potential for misunderstandings among family members about how the trust operates. Additionally, there can be costs associated with setting up and maintaining the trust, which some families may not anticipate.