Living Trust Property With A Will

Description

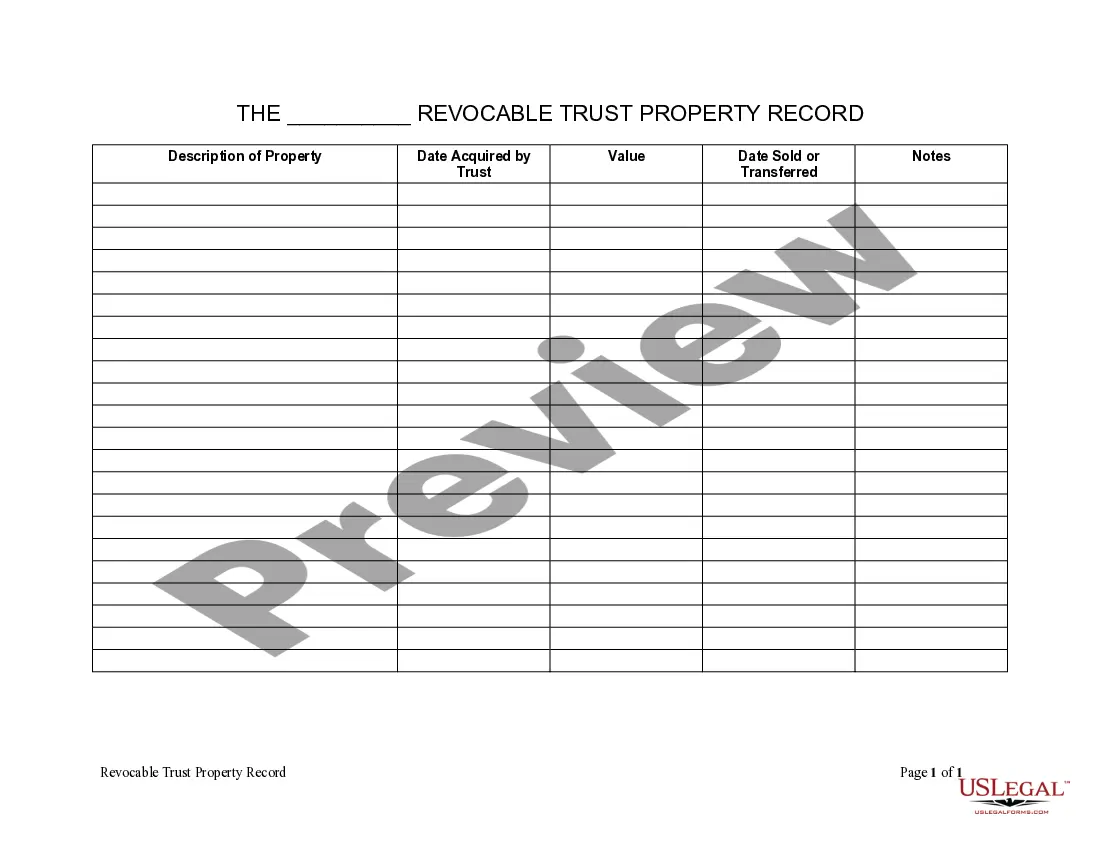

How to fill out Kentucky Living Trust Property Record?

- If you’re a returning user, log in to access your account and locate the necessary form template. Ensure your subscription is active; if it’s not, renew it based on your chosen plan.

- If you’re a new user, begin by browsing the Preview mode and form descriptions to select the appropriate template that aligns with your needs and local jurisdiction.

- In case you find any discrepancies, utilize the Search tab above to discover templates. Once you find one that fits, you can proceed.

- Purchase the document by clicking on the Buy Now button and selecting your subscription plan. You’ll need to create an account to unlock the full range of resources.

- Complete your purchase by entering your credit card details or through your PayPal account for the subscription.

- Finally, download your form and save it to your device. You can revisit it anytime from the My Forms menu.

US Legal Forms is dedicated to empowering users with a vast collection of over 85,000 legal forms, ensuring access to the right documents when you need them.

Take control of your legal documentation today! Start your journey with US Legal Forms to ensure your estate plans are secure and hassle-free.

Form popularity

FAQ

When you place your house in a living trust property with a will, you may face potential disadvantages. For example, you might encounter upfront costs, such as legal fees to establish the trust. Additionally, transferring your property into the trust could be time-consuming, requiring paperwork and possible delays. Finally, certain tax implications may arise that could affect your estate, so it's essential to consider these factors before making a decision.

Writing a living trust will involves several steps to ensure it aligns with your living trust property with a will. Start by determining which assets you will place in the trust and name a trustee to manage them. You should clearly outline your wishes regarding asset distribution to your beneficiaries. Additionally, using resources like US Legal Forms can simplify the process by providing templates and guidance tailored to your specific needs.

While a living trust has many benefits, it also has some downsides to consider regarding living trust property with a will. Establishing a living trust can involve higher initial costs and requires ongoing management, especially if you acquire new assets. Additionally, some people may find the legal complexities of funding a living trust challenging. Evaluating your unique situation can help you make a more informed decision.

When considering living trust property with a will, many find that a living trust offers distinct advantages. A living trust typically allows for quicker asset distribution after death and helps avoid probate, which can be a lengthy process. However, a will is simpler to create and may be suitable for those with straightforward estates. Ultimately, the best choice depends on your individual circumstances and goals.

Certain assets cannot be placed in a living trust, which is important to consider. For example, retirement accounts such as IRAs often have designated beneficiaries, making them unsuitable for a living trust property with a will. Additionally, some personal items, like certain collectibles or joint assets, may also require different planning strategies. It's wise to consult a qualified professional to explore the best options for your unique situation.

Some pitfalls of a living trust include potential misunderstanding of how it works and what it covers. If you don't fund your living trust property with a will properly, it won't effectively avoid probate. Additionally, some individuals may forget to include specific assets in the trust, which can lead to conflict among heirs. It's essential to understand the terms and responsibilities to maximize the trust's benefits.

While a living trust offers many benefits, there are some downsides. Establishing a living trust property with a will can require initial setup costs, which may be higher than simply drafting a will. Additionally, assets not transferred into the trust may still go through probate, potentially leading to complications. You may also find that maintaining the trust requires ongoing management and updates over time.

A will generally does not override a living trust regarding assets held in the trust. When you designate property as part of a living trust, it typically takes precedence over the provisions in a will. Understanding this relationship between living trust property with a will can help clarify your estate plan while reducing potential conflicts.

In many cases, a living trust does override a will when it comes to distributing assets. If your assets are in a living trust, they are typically not subject to the terms of a will. Therefore, careful planning ensures that your living trust property with a will works harmoniously to achieve your desired outcomes.

Certain documents can take precedence over a will, including beneficiary designations on accounts and living trusts. For instance, if you have living trust property with a will, the living trust often dictates how assets are handled first. Thus, it’s vital to understand how your documents work together.