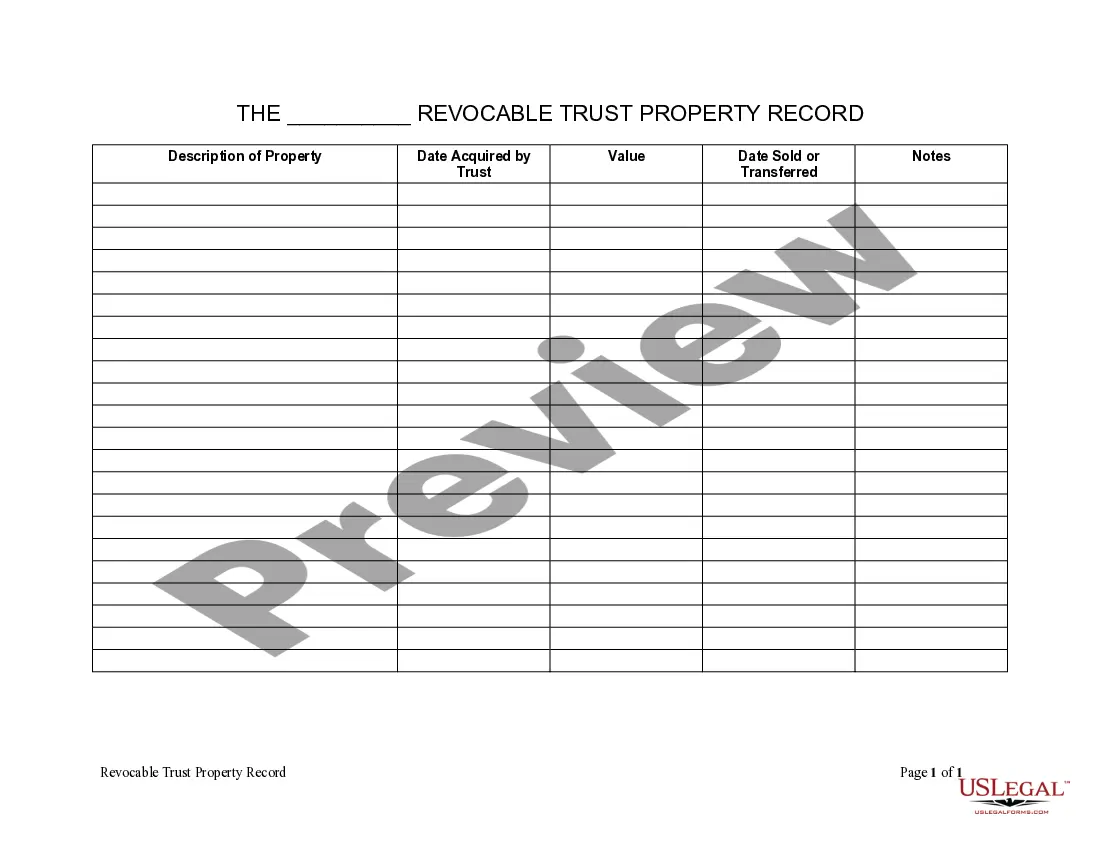

Living Trust For Property

Description

How to fill out Kentucky Living Trust Property Record?

- If you're a returning user, log into your account and select the living trust template you need. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by previewing the living trust form to verify it meets your needs and complies with local regulations.

- If necessary, utilize the search functionality to find more templates that fit your requirements.

- Choose the correct document and click the Buy Now button, selecting your preferred subscription plan and creating an account for library access.

- Submit your payment via credit card or PayPal to complete your purchase.

- Download your living trust form and store it on your device. You can easily find it later in the My Forms section of your profile.

By following these steps, you can easily create a comprehensive living trust for your property. US Legal Forms not only provides an extensive collection of over 85,000 legal forms but also ensures the accuracy of your documents with expert assistance.

Start your journey to secure your assets today by visiting US Legal Forms and exploring your options!

Form popularity

FAQ

Owning property through a trust can offer multiple advantages, including asset protection and privacy. A trust helps to manage and distribute your property according to your wishes, particularly in your absence. This approach can safeguard your assets from creditors and simplify the transfer process to your heirs. Exploring a living trust for property may align well with your estate planning goals, making it a worthy consideration.

One drawback of placing your house in a living trust is the potential complexity it introduces. Managing the trust incurs additional responsibilities, and if not properly funded, the trust may not effectively serve its purpose. There may also be implications for tax reporting and benefits that you need to consider. It's wise to consult with professionals familiar with living trusts for property to avoid common pitfalls.

Putting your house in a living trust can alleviate probate hassles, providing a straightforward transfer of property upon your passing. However, it may limit certain benefits, such as tax deductions or protections available through traditional ownership. Understanding both sides is crucial, so consider discussing your options with an expert on living trusts for property to gain more insight into what suits your needs best.

While a living trust has many benefits, it is not without drawbacks. First, setting up a living trust can require more upfront costs compared to a will. Moreover, you must actively manage and fund the trust; otherwise, unintended consequences may occur. It's important to weigh the pros and cons to determine if a living trust for property suits your financial situation.

People choose to place their property in a living trust for various reasons, primarily to streamline the transfer of assets after death. A living trust allows for quick and direct distribution of your property to beneficiaries, avoiding the probate process. Additionally, it offers privacy, as your assets do not become public records. Overall, a living trust for property can provide peace of mind and control over asset management.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly outline the terms of distribution for their children. Without specific guidelines, beneficiaries may misuse funds, leading to conflicts or mismanagement. Additionally, parents should regularly review and adjust the trust to align with their changing circumstances. Using a platform like US Legal Forms can guide you through the trust setup process, ensuring that your wishes are accurately reflected.

One potential downside to a living trust for property is that it does not cover all assets automatically. You must actively transfer assets into the trust to ensure they are protected. If not done correctly, certain assets may still go through probate, contradicting the primary purpose of the trust. It is crucial to assess how your assets are structured before establishing a living trust.

A living trust for property may not provide the same level of asset protection as a will. Additionally, it can involve higher initial costs and ongoing management responsibilities. It's essential to consider these factors when deciding on the best estate planning method. Understanding these downsides can help you make an informed choice.

Whether your parents should put their assets in a trust depends on their financial situation and estate planning goals. A living trust for property can help them avoid probate and provide more control over asset distribution after their passing. However, it is important to evaluate their specific needs and consult professionals for the best advice on setting up a trust. Tools like US Legal Forms can assist in navigating this process.

The downside of putting assets in a trust can include the loss of direct control over those assets. Once assets are transferred to the trust, you may need to follow the terms defined in the trust document. This arrangement can also entail some costs related to setup and ongoing administration. Therefore, carefully weighing the benefits of a living trust for property against these downsides is crucial.