Limited Liability Company With One Member

Description

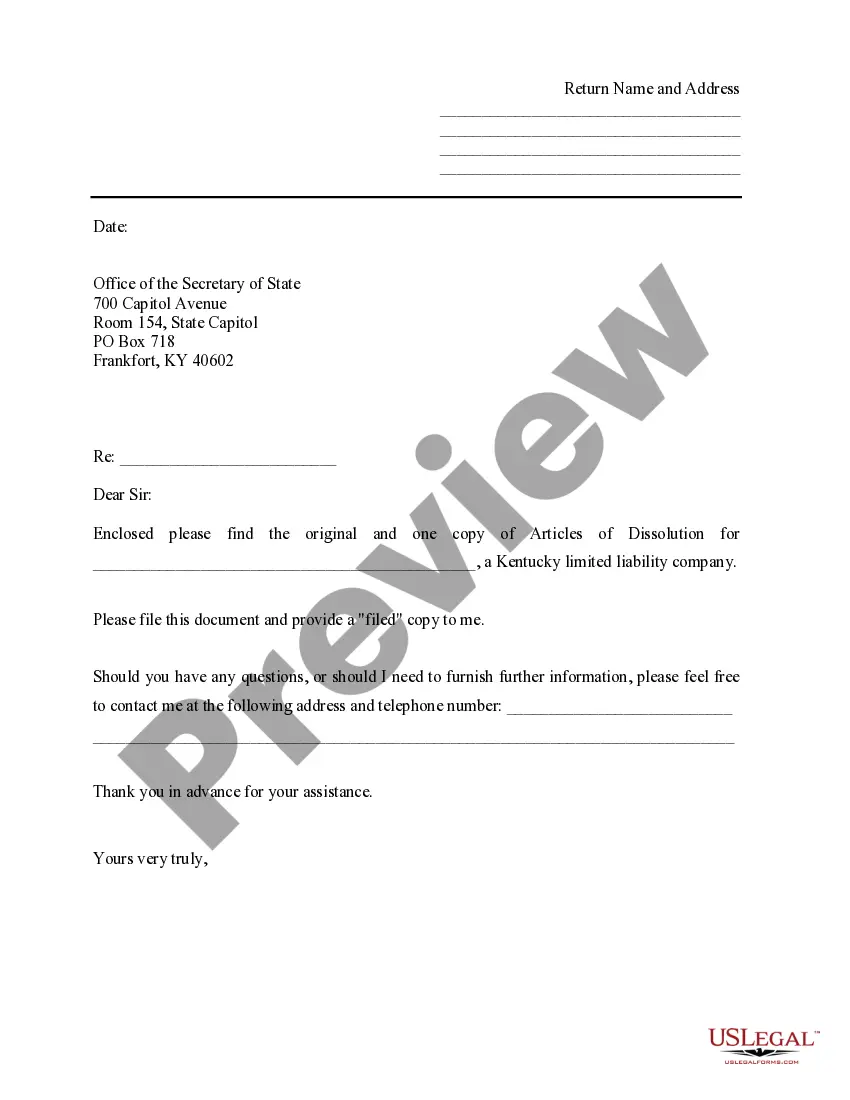

How to fill out Kentucky Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log in to your account and navigate to the library to find your desired LLC form.

- Preview the selected document to ensure it aligns with your state regulations and business needs.

- If the form isn't suitable, utilize the Search feature to locate the correct template that meets your requirements.

- Choose the desired subscription plan by clicking the Buy Now button, and create an account for full access to the legal library.

- Complete your payment using your credit card or PayPal to finalize the subscription.

- Download your completed form and save it on your device; you can also access it anytime from the My Forms section in your profile.

By using US Legal Forms, you gain access to a unique library of over 85,000 legal resources, ensuring your documentation is both comprehensive and compliant.

Take control of your business setup today! Visit US Legal Forms and streamline your LLC creation.

Form popularity

FAQ

To fill out a W-9 for a limited liability company with one member, start by entering your name on the first line. In the next section, write the name of your limited liability company as it appears on the formation documents. In the federal tax classification section, check the box for 'Individual/sole proprietor or single-member LLC.' Finally, provide your taxpayer identification number, which can be your social security number or the LLC's employer identification number. Using USLegalForms can simplify this process by providing templates tailored for single-member LLCs.

member LLC can use either an SSN or an EIN on a W9 form. If your LLC has opted for EIN, it is advisable to use this for tax reporting purposes. Otherwise, you can use your SSN, especially if you have not applied for an EIN yet, but opting for an EIN offers additional benefits, such as identity protection.

Yes, a single member LLC owner typically enjoys liability protection. This means that personal assets are generally shielded from business debts and legal claims against the business. However, it is crucial to maintain proper separation between personal and business finances to uphold this protection.

When filling out a W-9 as a single-member LLC, start by entering your name in the first box and the LLC name in the next if applicable. Then, select the option for 'Individual/sole proprietor or single-member LLC' in Part I. Make sure to provide either your SSN or EIN in the appropriate fields to ensure correct reporting.

An LLC with one person is often referred to as a single-member LLC. This structure offers similar benefits to a standard limited liability company while simplifying tax and operational requirements. In essence, it combines the liability protection of an LLC with the flexibility of single ownership.

A single person should fill out a W-9 by writing their legal name in the first box and leaving the business name box empty if they operate under their own name. Be sure to select 'Individual/sole proprietor or single-member LLC' to indicate your status correctly. Additionally, input your SSN or EIN in the required fields for accurate identification.

To fill out a W-9 form for your limited liability company with one member, start by entering your name as the single member in the appropriate section. Next, provide your LLC's official name if different from yours. Then, select 'Individual/sole proprietor or single-member LLC' in Part I, and be sure to include your Social Security Number (SSN) or Employer Identification Number (EIN) in the designated spaces.

Yes, as the owner of a limited liability company with one member, you can hire employees or independent contractors to help manage your business. This flexibility allows you to scale your operations based on your business needs. When hiring, it is essential to understand the implications for taxes and liabilities. US Legal Forms provides the necessary tools and paperwork to navigate this process smoothly.

Yes, a limited liability company with one member can be owned by another business entity, such as a corporation or another LLC. This structure provides flexibility, allowing business owners to limit their personal liability while enjoying tax benefits. By establishing a single-member LLC owned by a company, entrepreneurs can streamline operations and protect personal assets. For assistance in forming a limited liability company with one member, consider using US Legal Forms.

member LLC can write off a wide range of business expenses. You'll typically be able to deduct costs for supplies, travel, home office expenses, and other necessary expenditures directly related to your business operations. Remember, a limited liability company with one member allows for these writeoffs, helping you retain more of your earnings. Keeping accurate records of your expenses is key to maximizing your deductions.