Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Bankruptcy Form 13 Without Spouse

Description

How to fill out Bankruptcy Form 13 Without Spouse?

Bureaucracy necessitates precision and exactness.

Unless you manage filling out paperwork like Bankruptcy Form 13 Without Spouse regularly, it may lead to some bewilderment.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any inconveniences from having to re-submit a file or redo the entire process from scratch.

Discovering the correct and current samples for your documentation is a matter of mere minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your form management.

- Locate the template through the search bar.

- Verify that the Bankruptcy Form 13 Without Spouse you discovered is applicable for your state or region.

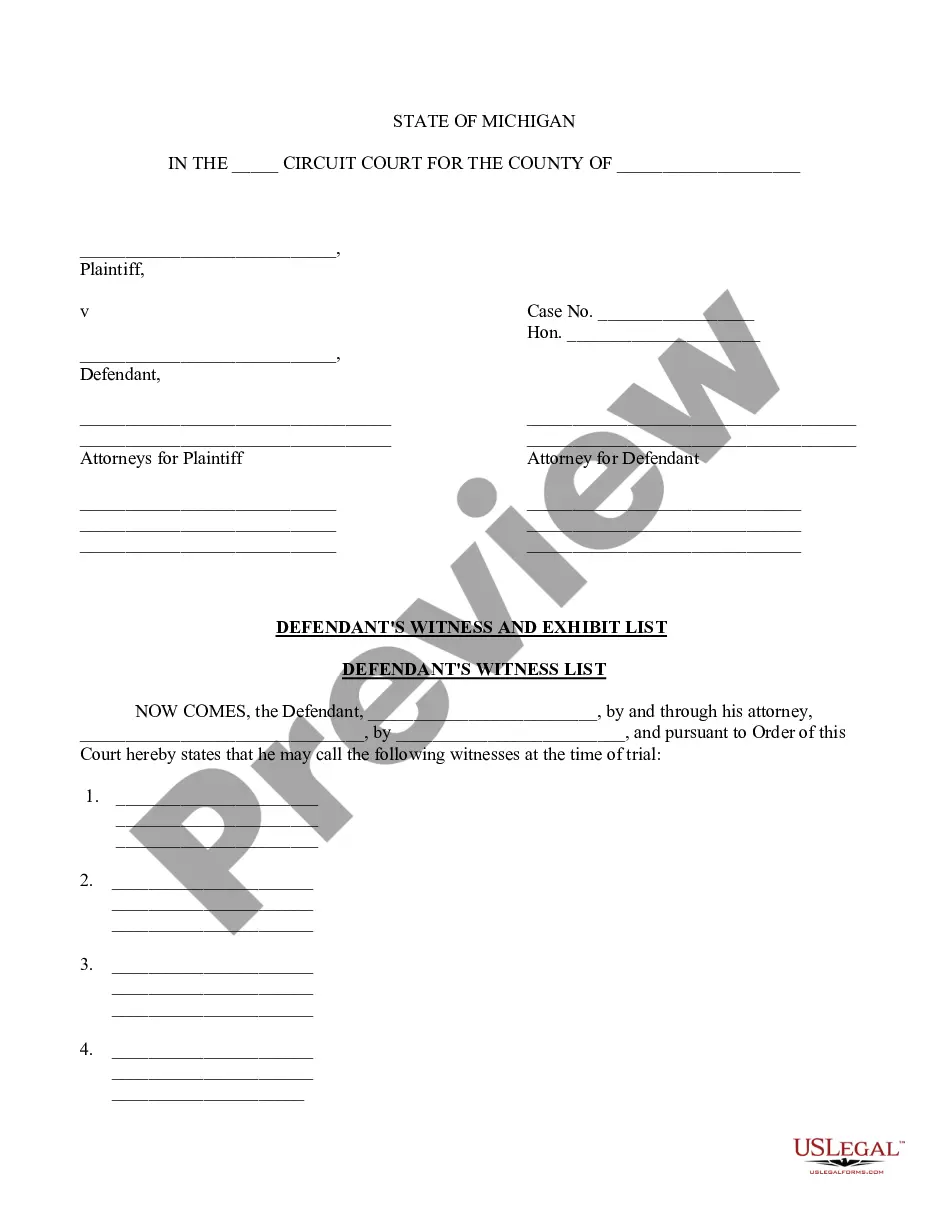

- Examine the preview or read the description that includes the details on using the sample.

- If the result aligns with your search, click the Buy Now button.

- Select the appropriate option from the available subscription plans.

- Log In to your account or create a new one.

- Complete the purchase using a credit card or PayPal payment method.

- Receive the form in the file format you prefer.

Form popularity

FAQ

To file Chapter 13, you must have a regular income and your secured and unsecured debts must fall below certain thresholds. As of now, the secured debt limit is approximately $1,257,850, and the unsecured limit is about $419,275. It's best to review your financial situation to ensure you meet these requirements. Utilizing a Bankruptcy form 13 without spouse can provide clarity in your financial journey.

Yes, you can file Chapter 13 without your spouse. This option is particularly useful for individuals who want to keep their finances separate or face debt issues individually. By using a Bankruptcy form 13 without spouse, you can manage your debts on your own terms. If you choose this route, it’s essential to understand that your spouse's income and debts may still impact your overall case.

Several factors could disqualify you from filing Chapter 13. For instance, if your secured and unsecured debts exceed the limits set by the bankruptcy law, you will not qualify. Additionally, individuals who have had a previous bankruptcy dismissed for willful failure to follow court orders may also find themselves disqualified. It's important to check your eligibility using Bankruptcy form 13 without spouse.

When you file Chapter 13, you may lose certain assets, but this largely depends on your individual situation. Generally, if you fail to meet the payment plan, you risk losing non-exempt property. However, many individuals find that they can keep their property by following the repayment plan. Using a Bankruptcy form 13 without spouse can simplify the process and help protect your assets.

Yes, you can file Chapter 13 without your spouse's knowledge, provided that you have separate debts and income. In such cases, using the Bankruptcy form 13 without spouse is essential to ensure your filing accurately reflects your financial situation. However, it is wise to consider the implications of filing alone, as it can impact your overall family finances. Consulting with a legal expert can help you navigate this decision more effectively.

The average monthly payment for Chapter 13 can vary depending on your income, debts, and expenses. Typically, payments range from $300 to $600 or more, aiming to be affordable yet effective in repaying creditors. You can use the Bankruptcy form 13 without spouse to calculate your monthly obligation, helping you budget accordingly. Always consider consulting a professional for personalized guidance.

Yes, you can file for Chapter 13 without your spouse. This option allows you to address your individual debts separately through the Bankruptcy form 13 without spouse. Keep in mind that your spouse's debts will not be included in your filing, so careful consideration of your financial situation is important. Using a reliable platform like uslegalforms can guide you through this process smoothly.

Yes, you can file Chapter 13 bankruptcy on your own, though navigating the process can be challenging. It requires careful attention to detail when completing the necessary forms, such as the Bankruptcy form 13 without spouse. Many individuals choose to consult with a lawyer or use services like uslegalforms to simplify the paperwork and improve the chances of approval.

To start a Chapter 13 bankruptcy, begin by collecting your financial documents and listing your debts. Next, you will need to complete the Bankruptcy form 13 without spouse, if filing individually. After filling out the forms, file them with the bankruptcy court and attend a required hearing. It may be beneficial to use uslegalforms to streamline this process and ensure accuracy.

Yes, you can file bankruptcy separately from your wife. When you choose to file individually, you will complete your own Bankruptcy form 13 without spouse. This approach allows you to deal with your debts independently while keeping your spouse's finances separate. It’s often a strategic choice for individuals facing financial challenges.