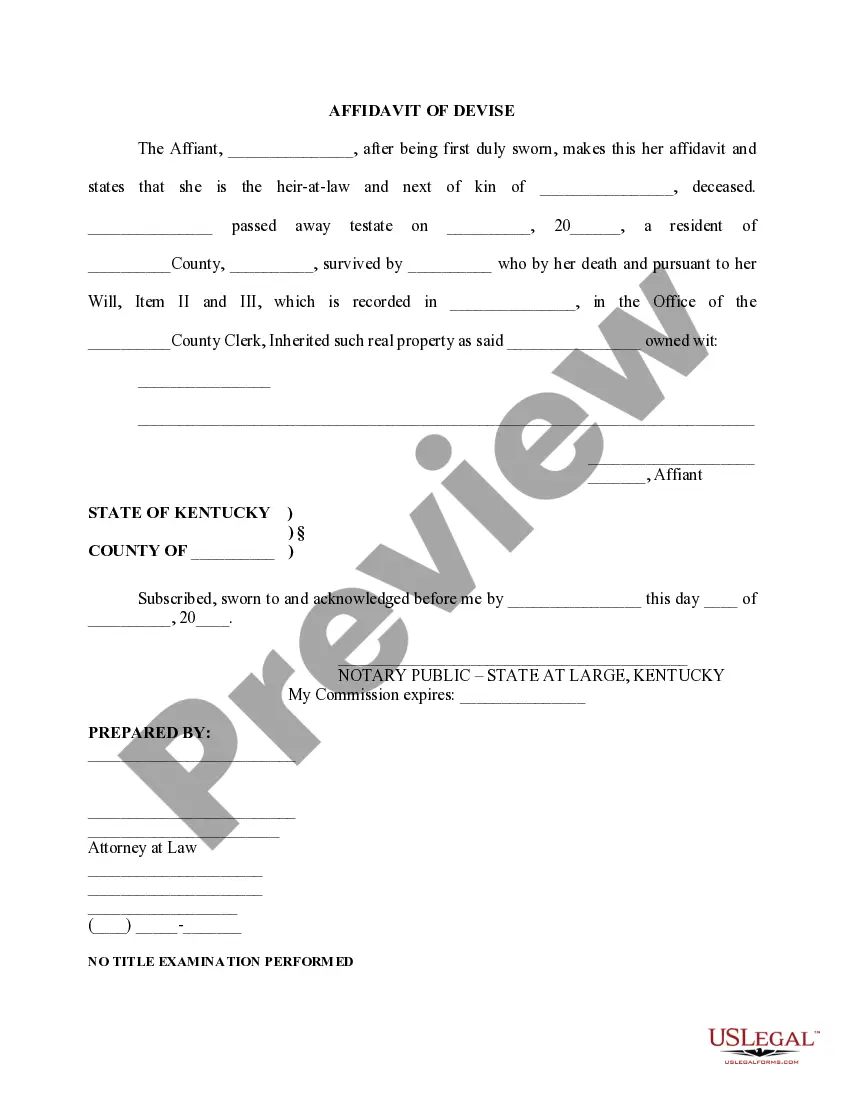

This Informal Final Settlement Affidavit Motion and Order is an official form used by the Commonwealth of Kentucky, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Probate Informal Settlement With The Irs

Description

Form popularity

FAQ

To file a petition to dispense with administration in Kentucky, you need to gather relevant documents and submit them to the local probate court. This petition must clearly outline why administration is unnecessary, particularly referencing a Kentucky probate informal settlement with the IRS if applicable. Once filed, be prepared to attend a hearing where a judge will review your request. For assistance in navigating this process, consider using US Legal Forms to ensure you meet all necessary requirements.

Filling out a petition to dispense with administration in Kentucky involves specific steps. You must provide details about the deceased, the estate's value, and any heirs, specifically highlighting any matters related to a Kentucky probate informal settlement with the IRS. It’s essential to complete the form accurately to prevent delays. Utilizing resources like US Legal Forms can help simplify this process.

Yes, Kentucky does issue letters of administration. These documents grant the appointed administrator the authority to manage the deceased's estate, including handling taxes related to a Kentucky probate informal settlement with the IRS. You will need to file the appropriate petitions and provide necessary documentation to the court. Receiving these letters is a crucial step to begin settling the estate.

Yes, an administrator of an estate can sell property in Kentucky. They may need to obtain court approval, especially if the estate involves a Kentucky probate informal settlement with the IRS. This ensures transparency and protects the interests of all beneficiaries. It's vital for the administrator to understand the legal requirements involved in the sale process.

Creditors in Kentucky generally have six months from the appointment of the executor to collect a debt from the estate. If the creditor fails to act within this timeframe, they may lose their right to collect. Engaging in a Kentucky probate informal settlement with the IRS can enhance coordination among creditors and the estate, promoting a smoother settlement process.

Examples of claims against an estate in Kentucky can include unpaid debts, medical expenses, and funeral costs. Additionally, disputes over the distribution of property may arise. Understanding these claims is essential, and a Kentucky probate informal settlement with the IRS can provide clarity and support in addressing these financial responsibilities efficiently.

The statute of limitations to contest an estate in Kentucky is typically one year from the time the will was admitted to probate. This timeline is vital for ensuring that any disputes are resolved promptly. Utilizing solutions like a Kentucky probate informal settlement with the IRS can also serve to minimize conflicts and expedite resolutions.

In Kentucky, a creditor has six months from the date of the appointment of the executor to file a claim against the estate. It's crucial to act within this period to ensure your claim is considered. A Kentucky probate informal settlement with the IRS can help clarify claims and obligations, making it easier for all parties involved.

In Kentucky, an executor typically has a year to settle the estate after the person has passed. This timeframe can vary based on the complexity of the estate and any ongoing probate matters. However, engaging in a Kentucky probate informal settlement with the IRS can help streamline the process and ensure all financial obligations are addressed efficiently.

In Kentucky, estates must generally be settled within a reasonable period, often within a year, though complexities can extend that time. This includes resolving debts, including those associated with a Kentucky probate informal settlement with the IRS. Staying organized and well-informed will help you expedite the settlement process. Utilizing platforms like USLegalForms can also simplify the necessary paperwork, ensuring you're on track with legal obligations.