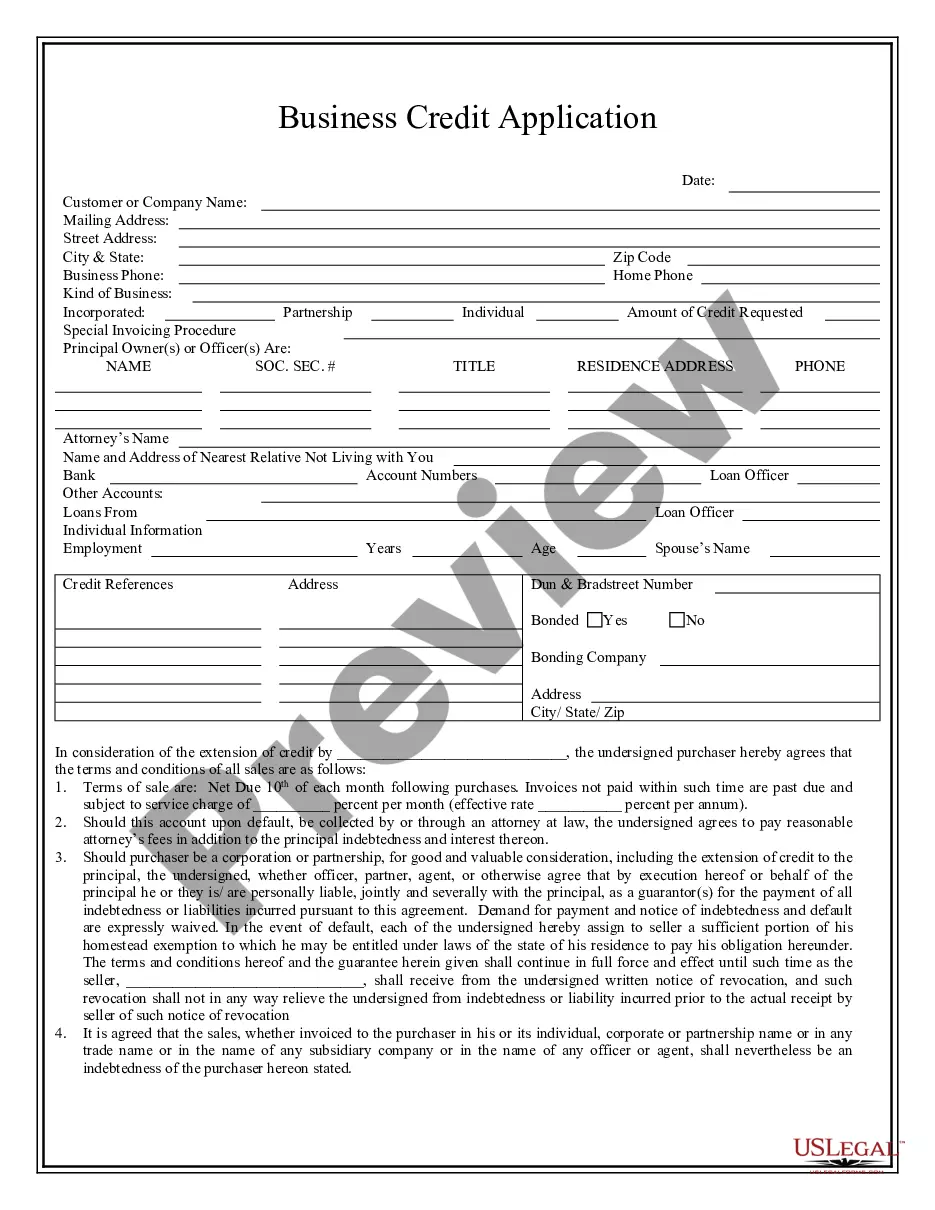

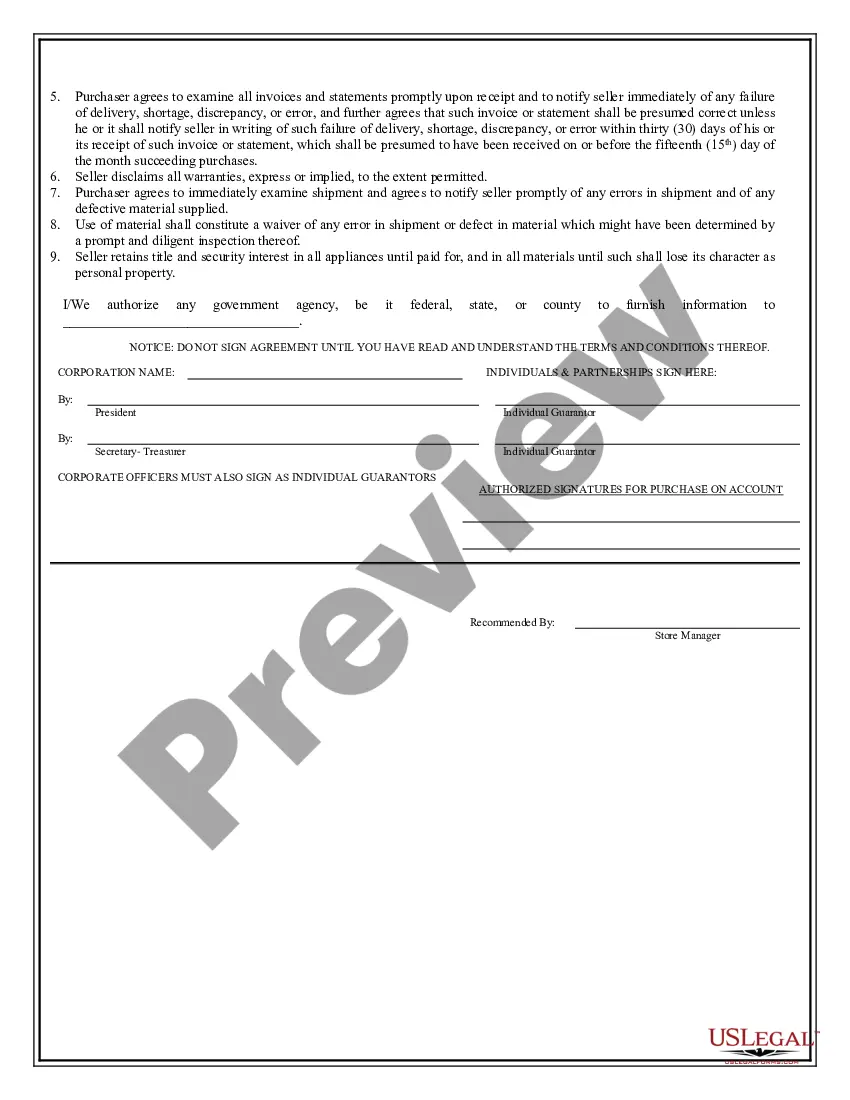

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Credit Applications For Small Business

Description

How to fill out Credit Applications For Small Business?

How to obtain professional legal forms that comply with your state legislation and create the Credit Applications For Small Business without consulting an attorney.

Numerous services online provide templates to address various legal matters and formalities. Nonetheless, it may require time to identify which available samples fulfill both usage context and legal obligations for you.

US Legal Forms is a reliable platform that assists you in finding formal documents crafted in accordance with the latest updates in state laws, enabling you to save on legal fees.

Should you not have an account with US Legal Forms, adhere to the steps provided below: Review the page you have opened and confirm whether the form meets your requirements. To do this, utilize the form description and preview options if accessible. Search for another template in the header that lists your state if necessary. Press the Buy Now button when you identify the right document. Select the most fitting pricing plan, then Log In or register for an account. Choose your preferred payment method (by credit card or through PayPal). Select the file format for your Credit Applications For Small Business and hit Download. The acquired forms remain yours: you can always revisit them in the My documents tab of your account. Join our platform and create legal documents independently like a seasoned legal expert!

- US Legal Forms is not just a standard online library.

- It is a compilation of over 85,000 validated templates for assorted business and personal situations.

- All documents are categorized by area and state to streamline your search process and minimize frustration.

- Moreover, it works with advanced solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to effortlessly complete their paperwork online.

- Acquiring the necessary documents requires minimal time and effort.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Credit Applications For Small Business using the appropriate button next to the file name.

Form popularity

FAQ

To get business credit with a new LLC, begin by ensuring your company is registered and compliant with state requirements. Applying for credit applications for small business helps you access various credit lines. Additionally, consider using platforms like US Legal Forms, which provide resources to assist businesses in building credit and understanding compliance guidelines.

Yes, a new LLC can get a business credit card, but the process may vary depending on the lender’s requirements. When applying for credit applications for small business, show proof of your business income, even if it’s limited. Establishing a good credit history significantly increases the chances of approval, so timely bill payments are crucial.

A new LLC can establish credit by first obtaining an Employer Identification Number (EIN) and opening a business bank account. Next, it's essential to apply for credit applications for small business and build relationships with suppliers or vendors who report payment histories to credit bureaus. Consistently paying bills on time will improve your credit score, making your LLC more attractive to lenders.

When completing a business credit card application, include your business's legal name, EIN, and contact details. Accurate financial information, such as your annual revenue and years in operation, is also crucial. Most importantly, ensure consistency with the details on your other credit applications for small businesses. This thorough approach helps lenders gauge your business’s reliability and improves your chances of approval.

Your business card should contain essential information that reflects your brand and facilitates networking effectively. Include your business name, contact information, website, and a brief description of your services or products. This approach not only promotes your business but also establishes credibility. A well-crafted business card can enhance your prospects when pursuing credit applications for small businesses.

When filling out credit applications for small businesses, your business name must align with your legal operating name. If your business operates under a trade name or 'doing business as' (DBA) name, make sure to include that name. Consistency is essential, as lenders reference your business's official registration. Presenting your name accurately increases your chances of approval.

Yes, you can use your Employer Identification Number (EIN) to build business credit. Your EIN plays a vital role in credit applications for small businesses, helping lenders identify your business. When you apply for credit, using your EIN can enhance your credibility and streamline the application process. This approach sets a solid foundation for establishing a robust business credit profile.

To get credit for a small business, begin by assessing your business needs and financial situation. Gather necessary documents, such as business plans and financial statements, to support your credit applications for small business. Then, consider exploring different lenders, including banks and online providers, to find the best options. Platforms like uslegalforms can assist you in managing your applications and ensuring you present your business preferences accurately.

To build credit on your LLC, start by opening a business checking account and ensuring it is separate from personal finances. Next, secure a business credit card and make small, manageable purchases while paying off the balance every month. Use services offered by US Legal Forms to guide you through compliance and documentation, which strengthens your credibility—key when submitting credit applications for small business.

Building credit for an LLC can take anywhere from three months to several years, depending on various factors such as financial activities and payment history. Engaging in responsible credit usage and establishing strong relationships with lenders can expedite this process. Consistent, timely payments are crucial, as they help in crafting a solid credit history, which is vital when applying through credit applications for small business.