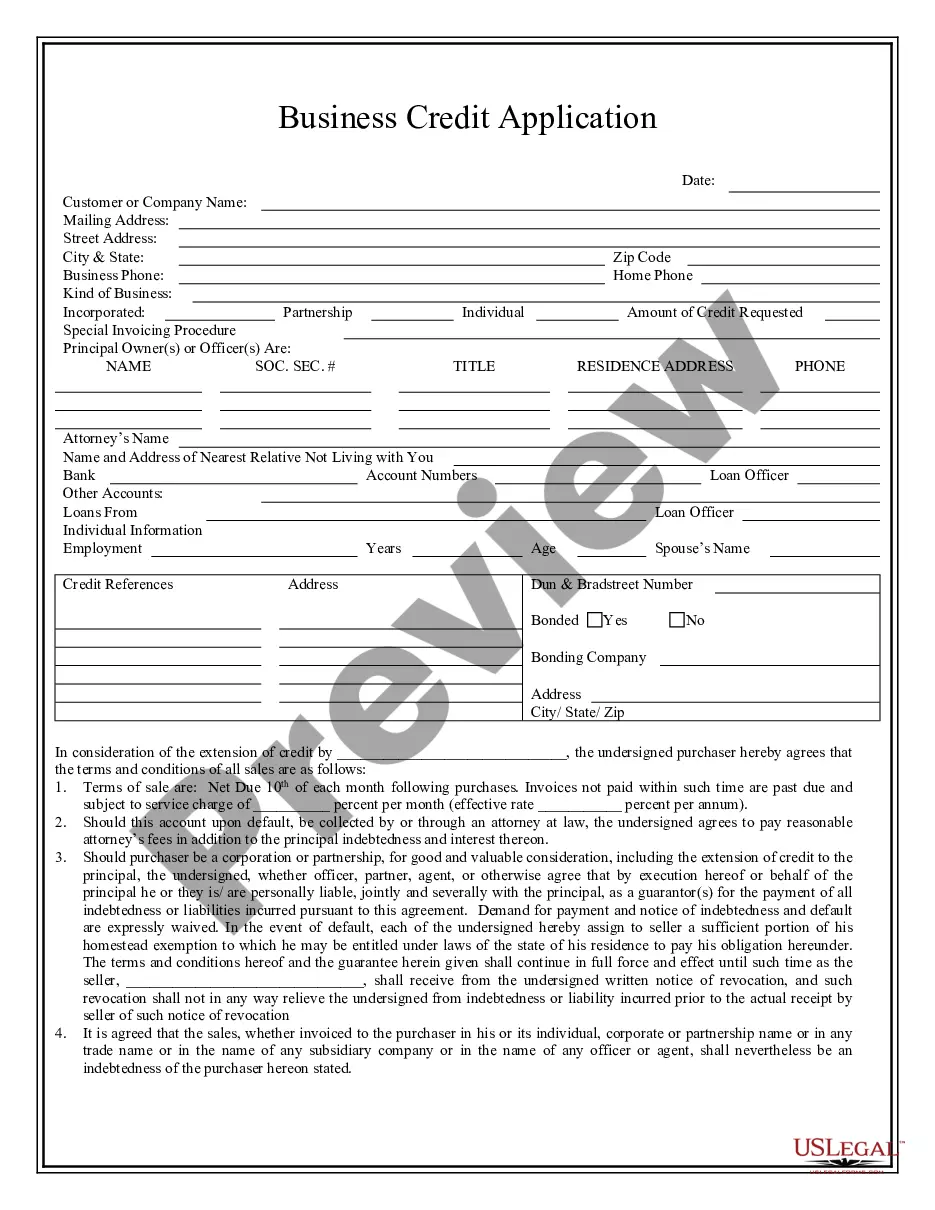

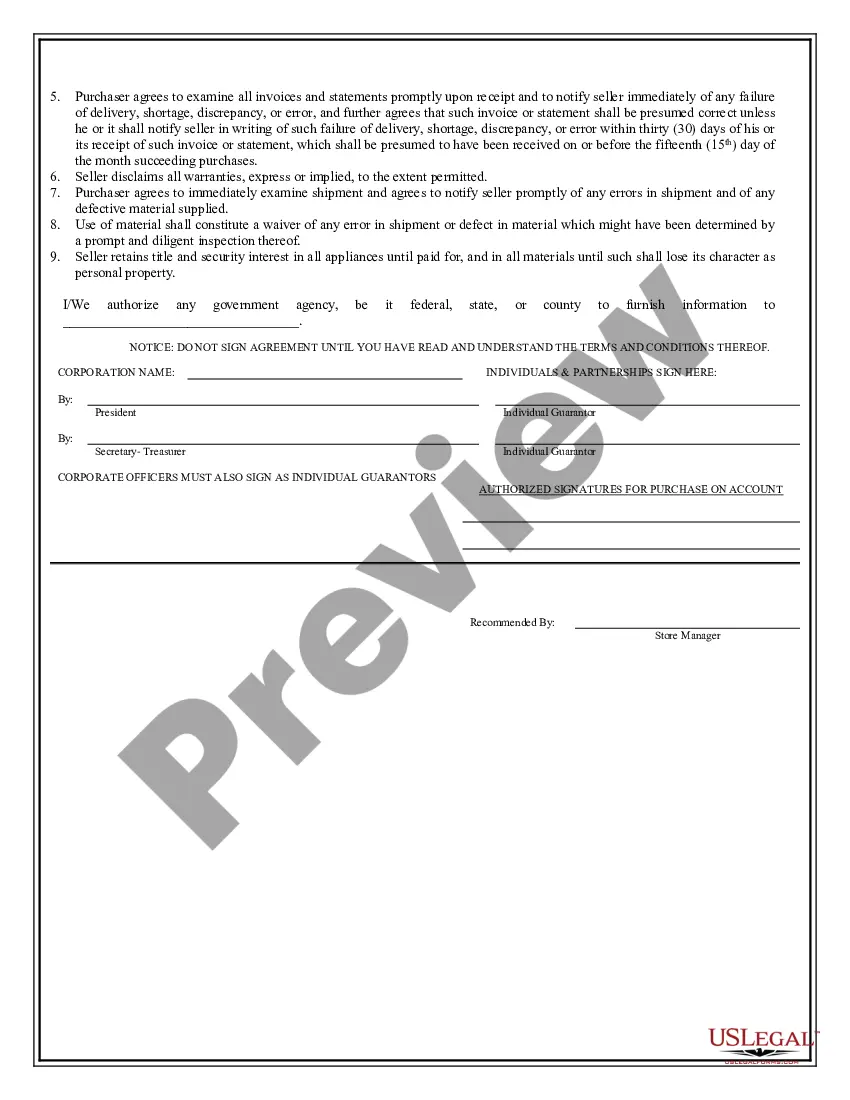

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Applications Forms

Description

How to fill out Business Credit Applications Forms?

Individuals often connect legal documentation with something intricate that only an expert can manage.

In a certain sense, this is accurate, as creating Business Credit Applications Forms requires considerable knowledge of subject criteria, including regional and local laws.

However, with US Legal Forms, the situation has improved: pre-made legal templates for any personal and business events specific to state legislation are gathered in a single online directory and are now accessible to all.

All templates in our collection are reusable: once purchased, they remain stored in your profile. You can access them anytime needed through the My documents section. Explore all advantages of using the US Legal Forms platform. Subscribe now!

- Review the page details thoroughly to ensure it meets your requirements.

- Examine the form overview or view it through the Preview feature.

- Search for an alternative sample using the Search bar in the header if the previous option is not appropriate.

- Click Purchase Now when you identify the right Business Credit Applications Forms.

- Choose a subscription option that aligns with your needs and financial plan.

- Create an account or sign in to advance to the payment section.

- Complete your subscription payment using PayPal or a credit card.

- Select the file format and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

To complete an LC (Letter of Credit) application form, begin by entering fundamental details about the buyer and seller, including addresses and account numbers. It's crucial to include all terms agreed upon, like shipment dates and amounts. Take time to review each section, as accurate entries are essential for processing. Using organized business credit applications forms can guide you in ensuring all necessary details are included and correct.

To write a credit application letter, begin by clearly stating your purpose for requesting credit. Include essential information such as your business name, financial status, and the type of credit you seek. Make sure to convey why you are a reliable applicant. By completing business credit applications forms accurately, you improve your chances of approval while providing lenders with the right information.

Creating a business credit application form requires a clear understanding of the necessary information needed by lenders. Include sections for business name, address, contact details, and financial data. It's essential to keep the form straightforward and easy to fill out, ensuring you capture all critical information. Using resources like uslegalforms can provide templates and guidance to help you create a professional-looking business credit application form.

A commercial credit application form is a document that businesses complete when seeking credit from suppliers or lenders. This form typically requests information about the company's financial history, ownership, and credit needs. Effectively using commercial credit application forms helps businesses present their case for credit clearly, which can facilitate quicker approvals.

Establishing credit for an LLC can typically take between three to six months, depending on your efforts and financial activities. Initially, your credit profile relies on the activities listed in business credit application forms. Regularly using credit and making timely payments will help accelerate your credit building process. Moreover, monitoring your credit periodically will keep you informed of your progress.

To obtain business credit for your LLC, begin by forming a legal entity and obtaining an Employer Identification Number (EIN). Then, apply for credit using structured business credit application forms that highlight your business's financial stability. Establish relationships with vendors and suppliers who report to credit bureaus, as this will further improve your credit standing.

Building credit for an LLC quickly involves several key steps. Start by establishing a business bank account and obtaining a business credit card. Use these accounts responsibly and make timely payments to enhance your credit profile. Additionally, consider using business credit application forms effectively to manage and track your credit progress.

Credit application forms are documents that businesses use to apply for credit. These forms collect essential information about your business, including its financial history and credit needs. By completing these forms, lenders can evaluate your business's creditworthiness. Utilizing well-structured business credit application forms can streamline this process.

When completing business credit applications forms, it’s crucial to provide accurate and comprehensive information. Include your business name, address, Employer Identification Number (EIN), and the nature of your business. You should also detail your estimated annual revenue and business expenses, as this information helps lenders assess your creditworthiness. Additionally, having your financial documents ready can streamline the application process.

Your business card should effectively represent your business and include essential information. Clearly display your business name, your name, title, contact number, and email address. Including your website and social media links can provide potential clients with more ways to connect with you. Well-organized information enhances your professionalism and makes a lasting impression.