Kentucky Llc Operating Agreement With Multiple Members

Description

How to fill out Kentucky Limited Liability Company LLC Operating Agreement?

It’s obvious that you can’t become a law professional overnight, nor can you grasp how to quickly draft Kentucky Llc Operating Agreement With Multiple Members without having a specialized set of skills. Putting together legal forms is a long process requiring a specific education and skills. So why not leave the creation of the Kentucky Llc Operating Agreement With Multiple Members to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you need in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Kentucky Llc Operating Agreement With Multiple Members is what you’re looking for.

- Start your search again if you need a different template.

- Register for a free account and choose a subscription option to buy the template.

- Choose Buy now. As soon as the payment is through, you can get the Kentucky Llc Operating Agreement With Multiple Members, complete it, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Without the operating agreement, your state might not acknowledge you as an LLC, which means someone could sue you without there being any shield to protect your personal assets. You've already put in the time and effort to form your LLC to get liability protection.

The difference between Class A shares and Class B shares of a company's stock usually comes down to the number of voting rights assigned to the shareholder. Class A shareholders generally have more clout. Despite Class A shareholders almost always having more voting rights, this isn't actually a legal requirement.

Kentucky does not require LLCs to include member information with their Articles of Organization, so chances are you won't have to contact the Kentucky Division of Business Filings to change your filing with the state. Instead, you'll include your new LLC member information when you file your Kentucky Annual Report.

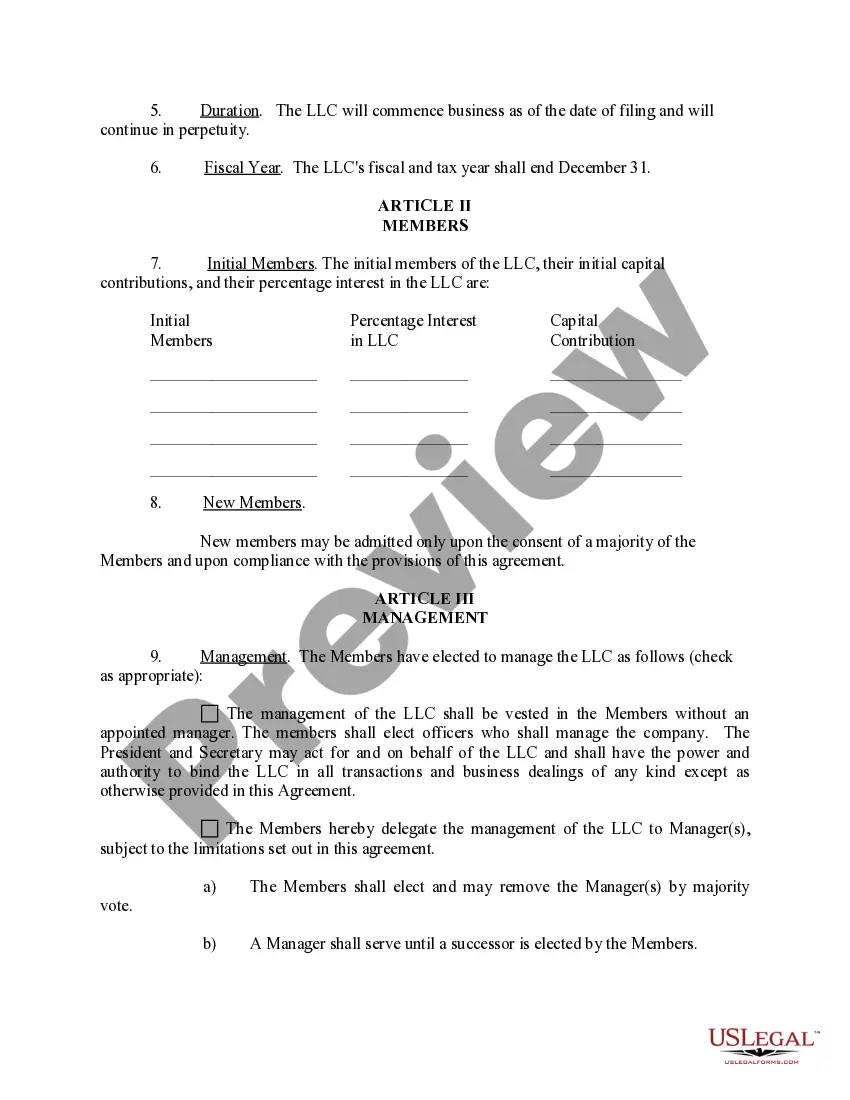

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

Here, Class A would be business-founding members with complete voting rights. Class B would also be founders, but perhaps they played a minor role and are thus given less voting power. Class C would be investors, which aren't given any voting power.