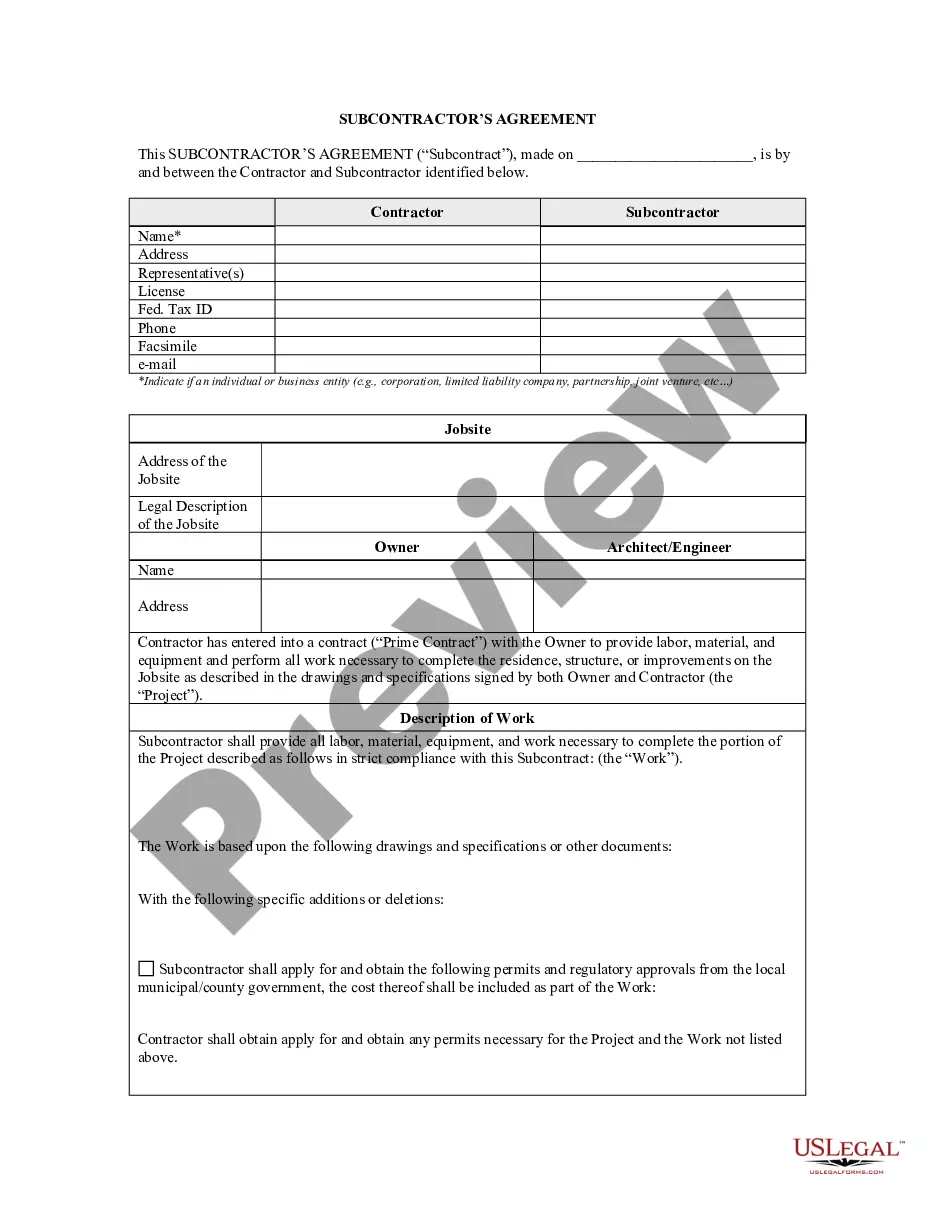

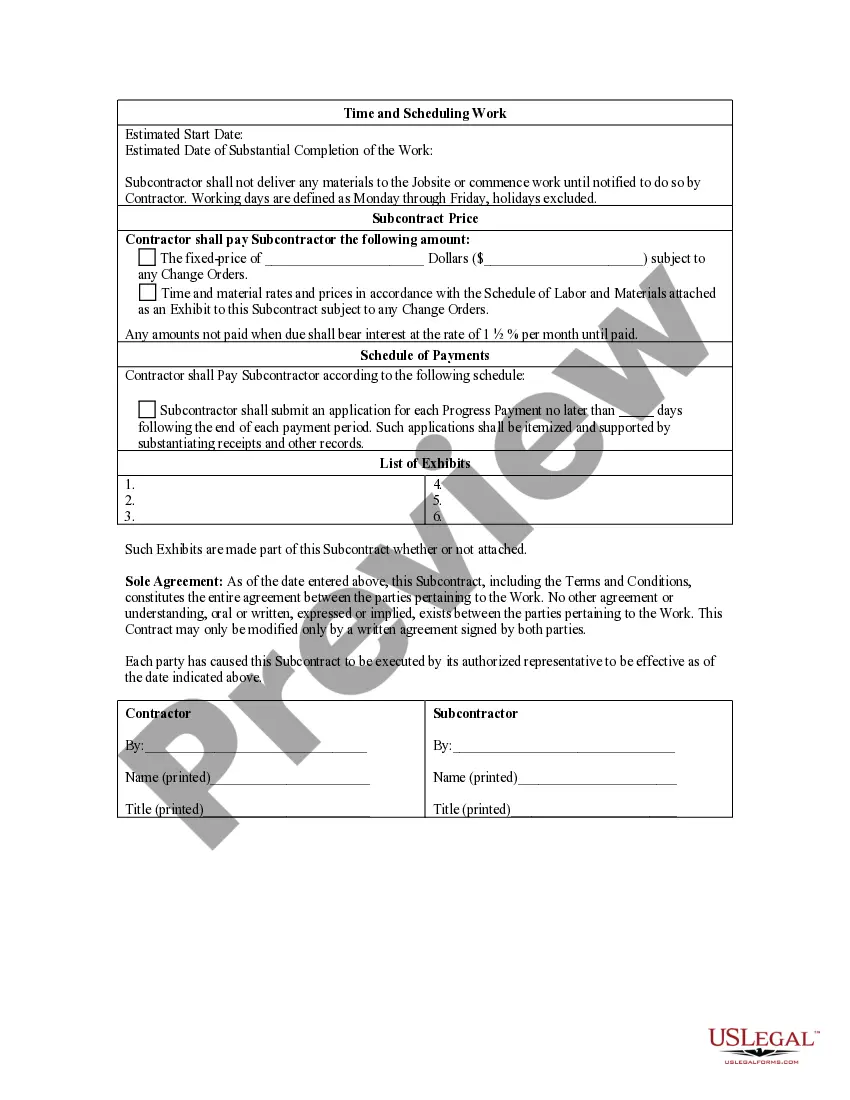

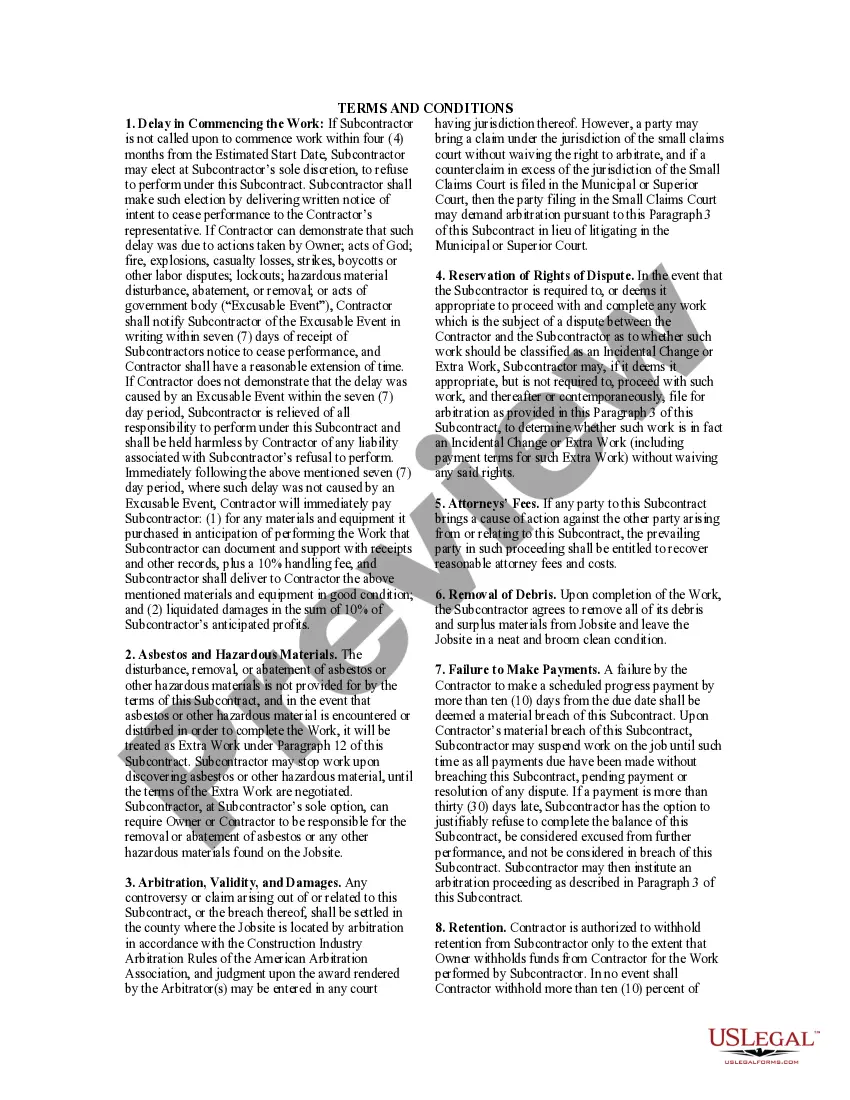

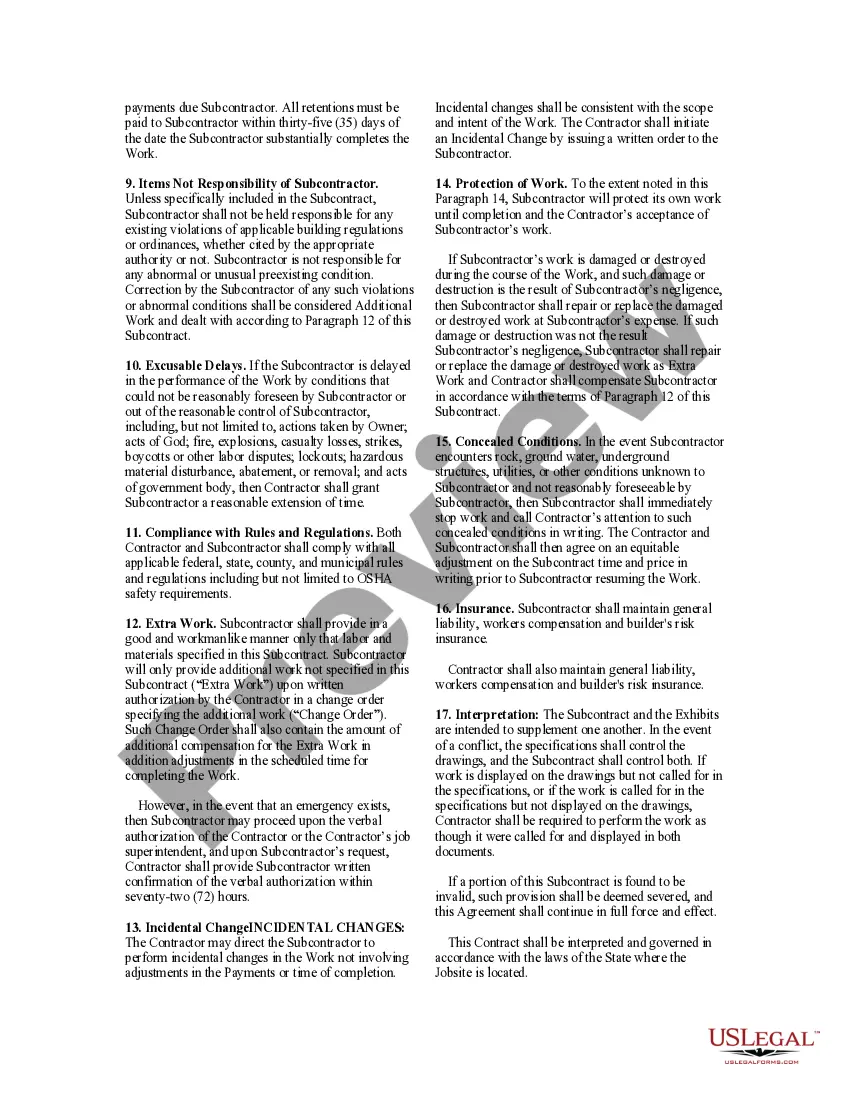

This state specific form addresses issues for subcontract work including: identifying the parties, identifying the jobsite, describing the work, scheduling the work, payment amount, payment schedule, change orders, contractor’s delay in commencing work, late payments, dispute resolution, excusable delay, concealed conditions, insurance, and contract interpretation.

Kentucky Agreement Form Withdrawal

Description

How to fill out Kentucky Subcontractor's Agreement?

What is the most reliable service to obtain the Kentucky Agreement Form Withdrawal and other current versions of legal documents.

US Legal Forms is the solution! It boasts the largest assortment of legal forms for any situation.

If you do not yet have an account with our repository, here are the steps you need to follow to create one: Form compliance review. Prior to acquiring any template, you must verify that it meets your use case requirements and complies with your state or county's regulations. Review the form description and utilize the Preview feature if available.

- Each template is professionally crafted and verified for compliance with federal and local laws.

- They are categorized by field and state of application, making it easy to locate the one you need.

- Experienced users of the website simply need to Log In to the system, confirm the validity of their subscription, and click the Download button next to the Kentucky Agreement Form Withdrawal to obtain it.

- Once saved, the template remains accessible for future use within the My documents section of your account.

Form popularity

FAQ

In order to cancel your sales tax permit in Kentucky, you need to close your account by completing Section F of the Update or Cancellation of Kentucky Tax Accounts form 10A104-1.

Form K-4 is only required to document that an employee has requested an exemption from withholding OR to document that an employee has requested additional withholding in excess of the amounts calculated using the formula or tables. If neither situation applies, then an employer is not required to maintain Form K-4.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

You may be exempt from withholding if you work in Kentucky but reside in one of the following reciprocal states: Illi- nois, Indiana, Michigan, West Virginia, Wisconsin, Virginia and you commute daily or Ohio and you are not a sharehold- eremployee who is a twenty (20) percent or greater direct or indirect equity

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.