Kentucky House

Description

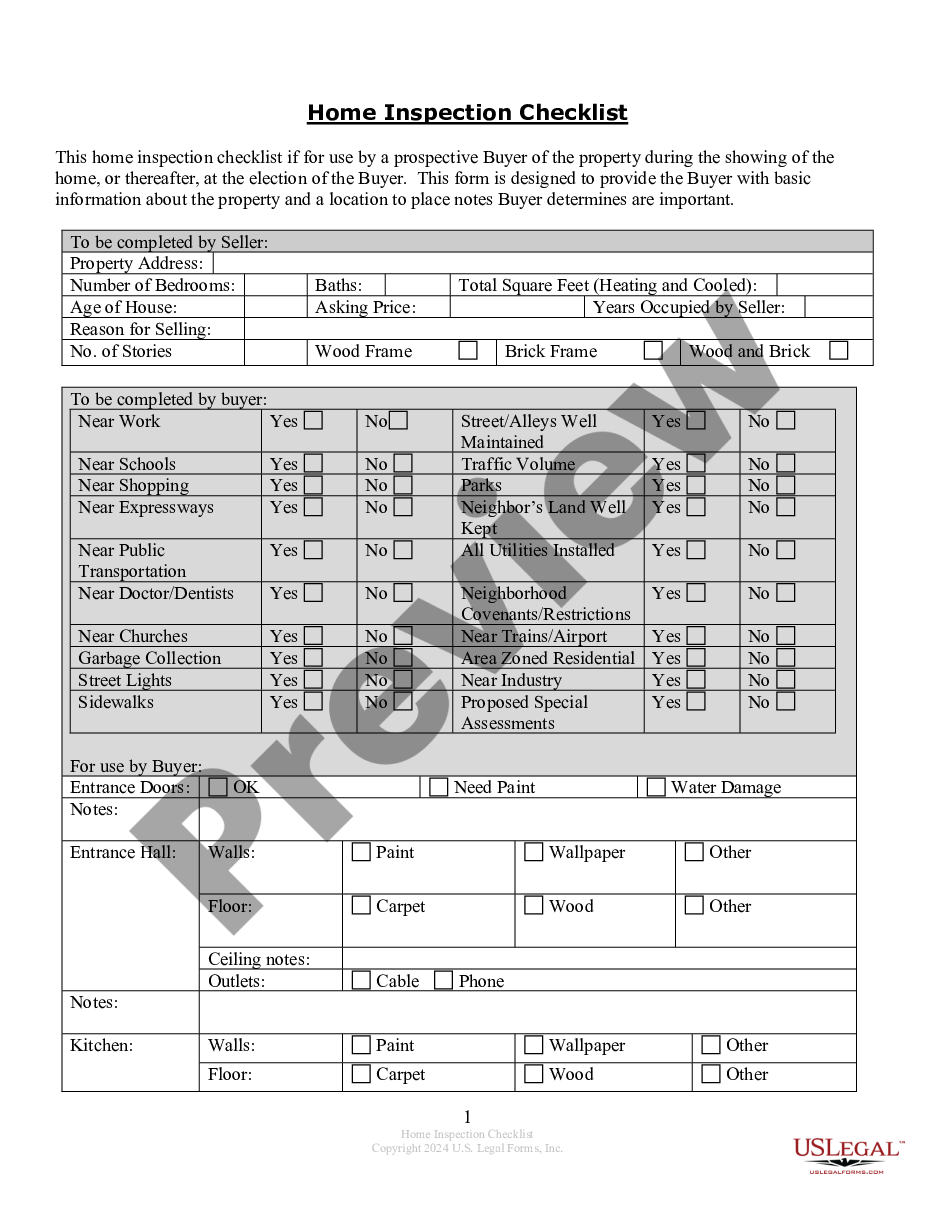

How to fill out Kentucky Buyer's Home Inspection Checklist?

- If you're a returning user, log in to your account to access your purchased forms. Ensure your subscription is active; renew if necessary.

- First-time users should check the Preview mode and form description to confirm you have the right document that complies with Kentucky legal requirements.

- If adjustments are needed, use the Search tab to find an appropriate form that fits your specific situation.

- Purchase your document by clicking the 'Buy Now' button and select a suitable subscription plan. You will need to create an account for full access.

- Finish your transaction by entering your payment details, either through credit card or PayPal.

- Download your Kentucky house form to your device and keep it handy. You can always return to the My Forms section of your profile for future reference.

US Legal Forms gives you the advantage of a comprehensive selection with over 85,000 editable legal documents. By utilizing their service, you not only save time but also ensure accuracy in your legal paperwork.

Ready to get started? Follow these steps to secure your Kentucky house form and experience the ease of managing your legal needs with US Legal Forms today!

Form popularity

FAQ

Kentucky home rule allows local governments to create ordinances and govern themselves more freely. This means that cities and counties can set their own rules concerning zoning, building codes, and local taxes related to properties, including Kentucky houses. Knowing about home rule aids prospective homeowners in understanding local real estate regulations. For customized forms and information, you can turn to US Legal Forms.

Kentucky has a total of 100 representatives in its House of Representatives. These representatives serve two-year terms, focusing on the needs of their constituents. Understanding this structure can be beneficial when looking to buy a Kentucky house, as local governance affects real estate regulations. Engage with your local representatives for insights on housing policies.

To buy a Kentucky house, you must be at least 18 years old and have a valid ID. Generally, lenders require a decent credit score, proof of income, and a down payment. Familiarity with Kentucky’s real estate laws helps, so consider using platforms like US Legal Forms to access necessary documents and guidelines. Additionally, ensure you have adequate funds for closing costs.

While it's not mandatory for an attorney to prepare a deed in Kentucky, it may be beneficial. An attorney can help ensure that the deed is correctly drafted and compliant with all local laws. If you're unsure, consider using services like uslegalforms, where you can find templates and guidance tailored to Kentucky house transactions.

Transferring a deed to a family member in Kentucky requires drafting a new deed that identifies both the current owner and the recipient. Ensure both parties sign the deed, and then file it with the local county clerk's office for it to take legal effect. You might find resources on uslegalforms helpful for completing this process seamlessly.

In Kentucky, certain individuals may qualify for income tax exemptions. Generally, this includes low-income individuals, some seniors, and specific disabled persons. Always consult a tax professional or the Kentucky Department of Revenue to understand your eligibility for possible exemptions associated with your Kentucky house.

Claiming abandoned property, including a Kentucky house, involves several steps. First, you must check the local records to establish ownership history and determine if the property is truly abandoned. Next, you may need to file a claim with the appropriate county office, possibly seeking legal advice to navigate the process.

To transfer a house deed to a family member in Kentucky, you should prepare a new deed that indicates the transfer. This should include both the current owner's and the family member's details. After completing the deed, file it with your local county clerk's office to finalize the transfer of the Kentucky house.

Transferring a property title for a Kentucky house between family members can be straightforward. It generally requires a properly executed deed, signed by the current owner, to effectively transfer ownership. Additionally, consider documenting the transfer formally to avoid potential disputes in the future.

To file your Kentucky house, you need to gather essential documents like the property's deed, proof of ownership, and tax identification number. You may also need to provide identification and possibly proof of residence. Ensure you check with your local county clerk’s office for any additional requirements specific to your area.