Kentucky Deed Recording Fees

Description

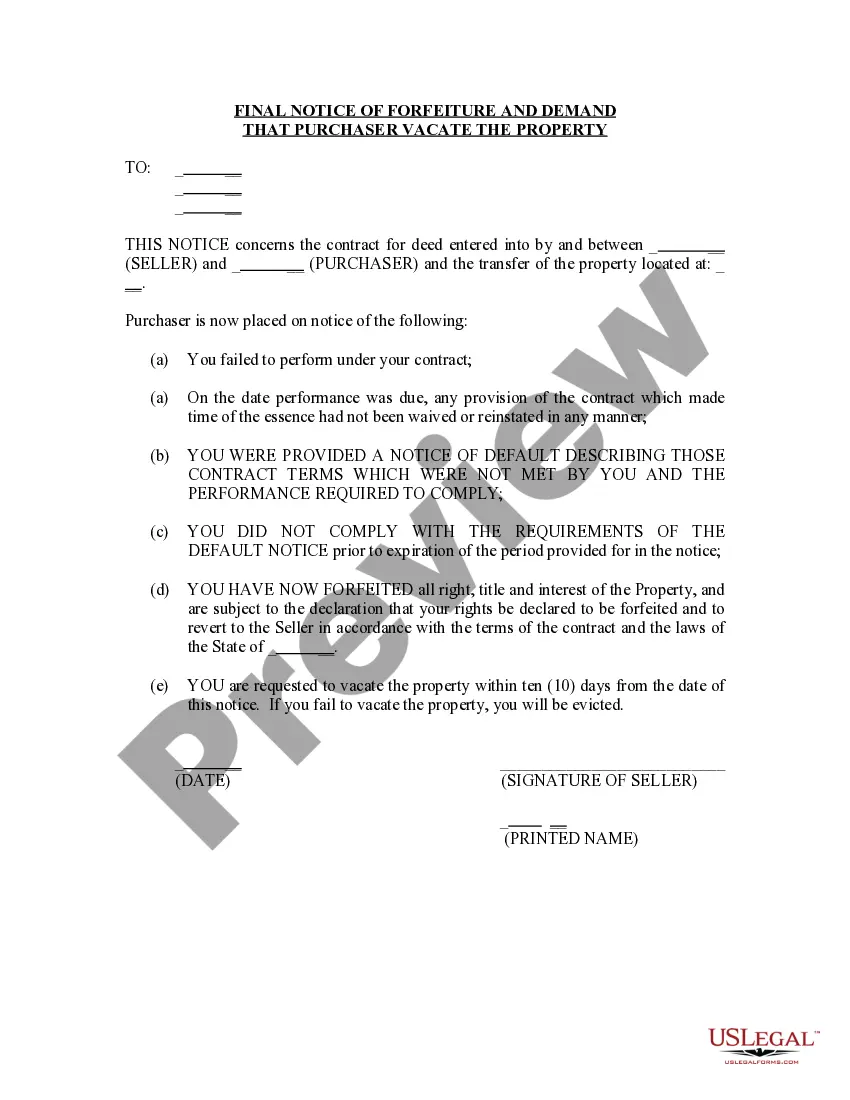

How to fill out Kentucky Final Notice Of Forfeiture And Request To Vacate Property Under Contract For Deed?

Legal administration can be daunting, even for the most proficient professionals.

When you are concerned about Kentucky Deed Recording Fees and cannot allocate time for searching the proper and updated version, the process may become stressful.

Obtain a collection of articles, guides, handbooks, and resources related to your issue and needs.

Conserve time and energy while looking for the documents you require, and utilize US Legal Forms’ advanced search and Review feature to find Kentucky Deed Recording Fees and download it.

Utilize the formatting you desire, and Download, complete, sign, print, and send your document. Benefit from the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to access the documents you previously downloaded and manage your folders as you prefer.

- If it is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- Here are the steps to follow after downloading the form you seek.

- Confirm it is the right form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms fulfills any requirements you may possess, ranging from personal to corporate paperwork, all in one place.

- Employ cutting-edge tools to complete and manage your Kentucky Deed Recording Fees.

Form popularity

FAQ

Recording Fees The tax will be imposed upon the grantor at the rate of 50 cents per $500 of value or fraction thereof.

Legal Recording Fees Type of Legal RecordingFeeCondo - Deed$50.00 ($3.00/page after 5 pages)Contract - Land$50.00 ($3.00/page after 5 pages)Deed of Correction$46.00 ($3.00/page after 5 pages)Deed of Release$46.00 ($3.00/page after 5 pages)57 more rows

The grantor (or agent) and grantee (or agent) must sign a sworn consideration statement and the signatures must be notarized. (KRS 382.135 and KRS 382.130) The document must be filed in the county clerk's office of the county where the property is located (or the greater part). KRS 382.110.

(1) All deeds, mortgages and other instruments required by law to be recorded to be effectual against purchasers without notice, or creditors, shall be recorded in the county clerk's office of the county in which the property conveyed, or the greater part thereof, is located.