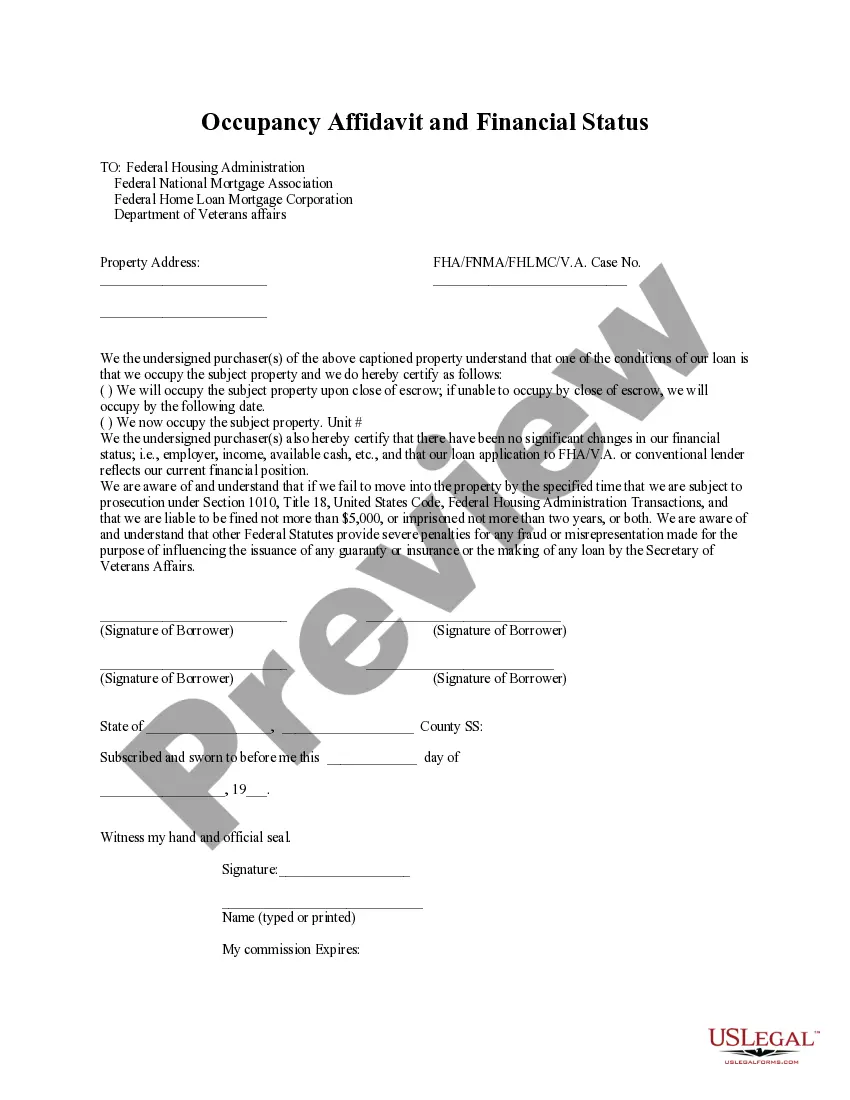

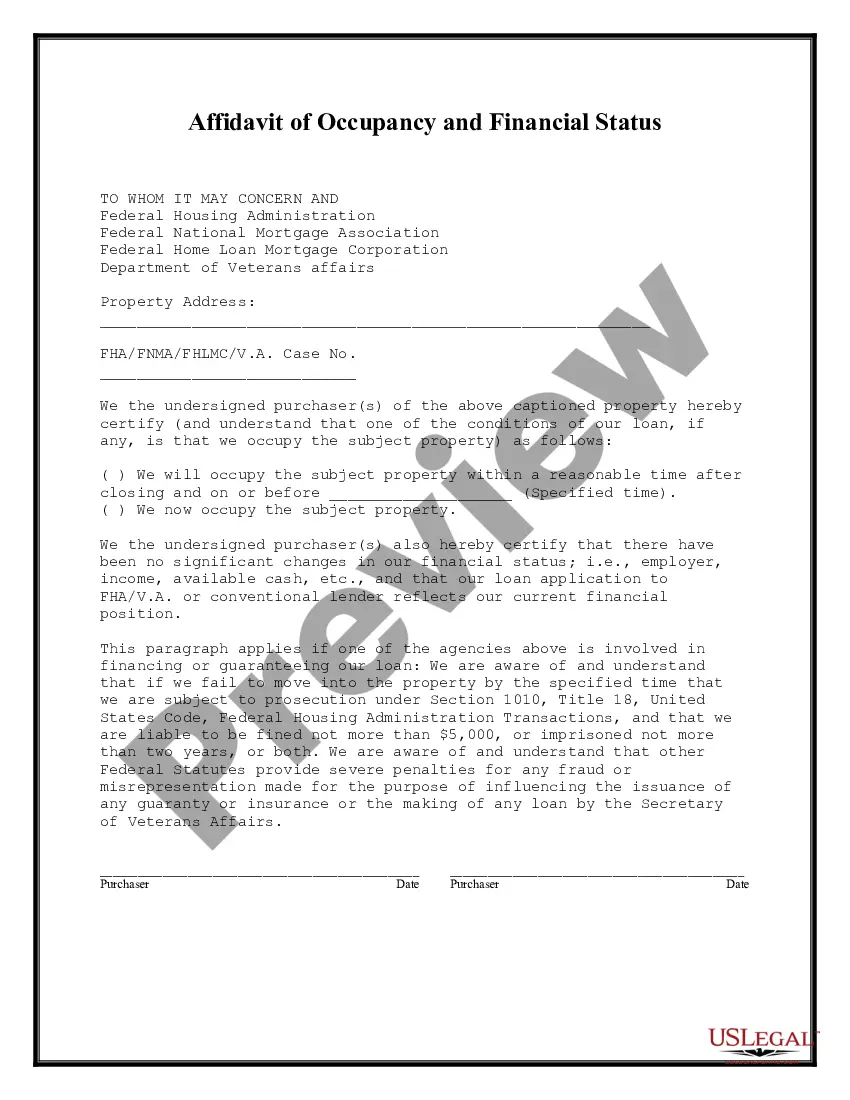

Freddie Mac Affidavit Of Owner-occupancy Form

Description

How to fill out Kansas Affidavit Of Occupancy And Financial Status?

When you are required to submit the Freddie Mac Affidavit Of Owner-occupancy Form in line with your local state's statutes and guidelines, there may be numerous choices available.

There's no need to scrutinize each document to verify that it satisfies all the legal prerequisites if you are a subscriber of US Legal Forms.

It is a reliable source that can assist you in obtaining a reusable and current template on any topic.

Navigate the suggested page and verify it aligns with your needs.

- US Legal Forms is the most extensive online database with a collection of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are confirmed to comply with the regulations of each state.

- Thus, when downloading the Freddie Mac Affidavit Of Owner-occupancy Form from our platform, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary template from our platform is exceptionally straightforward.

- If you already have an account, just Log In to the system, check to ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents section in your profile to retrieve the Freddie Mac Affidavit Of Owner-occupancy Form at any time.

- If it's your first visit to our website, please follow the instructions below.

Form popularity

FAQ

Lending companies cannot force a homeowner to live in a home when they have legitimate reasons or even desires to move. However, to get out of the owner-occupancy clause on a primary residence home loan, the owner should be able to prove that they had every intention of occupying the home at the time of purchase.

Fannie Mae has owner occupancy requirements in place for some of the homes it sells to encourage homeowners to buy the properties before investors. Occupancy rules usually apply to homes during at least the first two weeks of the initial listing, before non-occupant investors can have their bids considered.

An owner-occupied property is a piece of real estate in which the person who holds the title (or owns the property) also uses the home as their primary residence. The term owner-occupied is commonly associated with real estate investors who live in a property and rent out separate spaces to tenants.

Lenders usually stipulate that homeowners have 30 days after closing to occupy a primary residence. To verify the person moving in is actually the owner, the lender may call the house and ask to speak to the homeowner. A tenant is likely to respond that the owner lives elsewhere.

Fannie Mae's HomePath program includes guidelines and special offers for owner occupants. Owner-occupant buyers must sign an affidavit that certifies they will occupy the home as their principal residence within 60 days of closing and for a minimum one year after purchase.