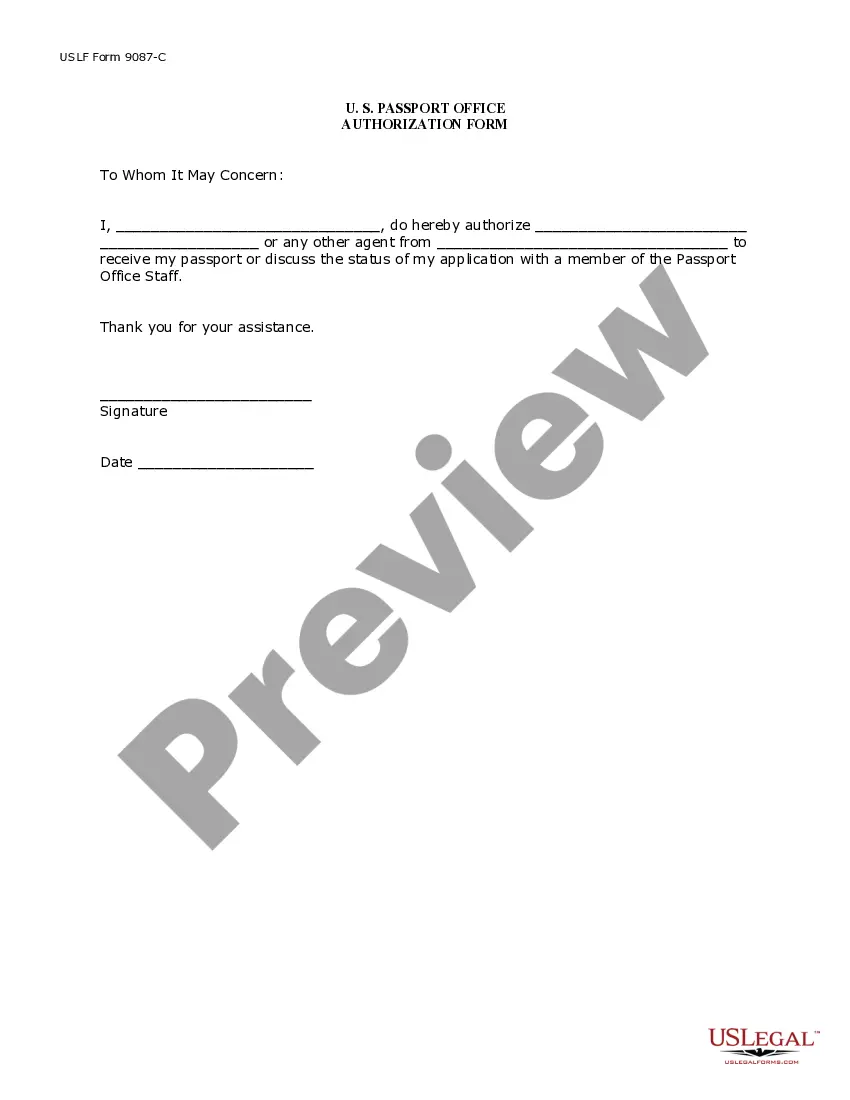

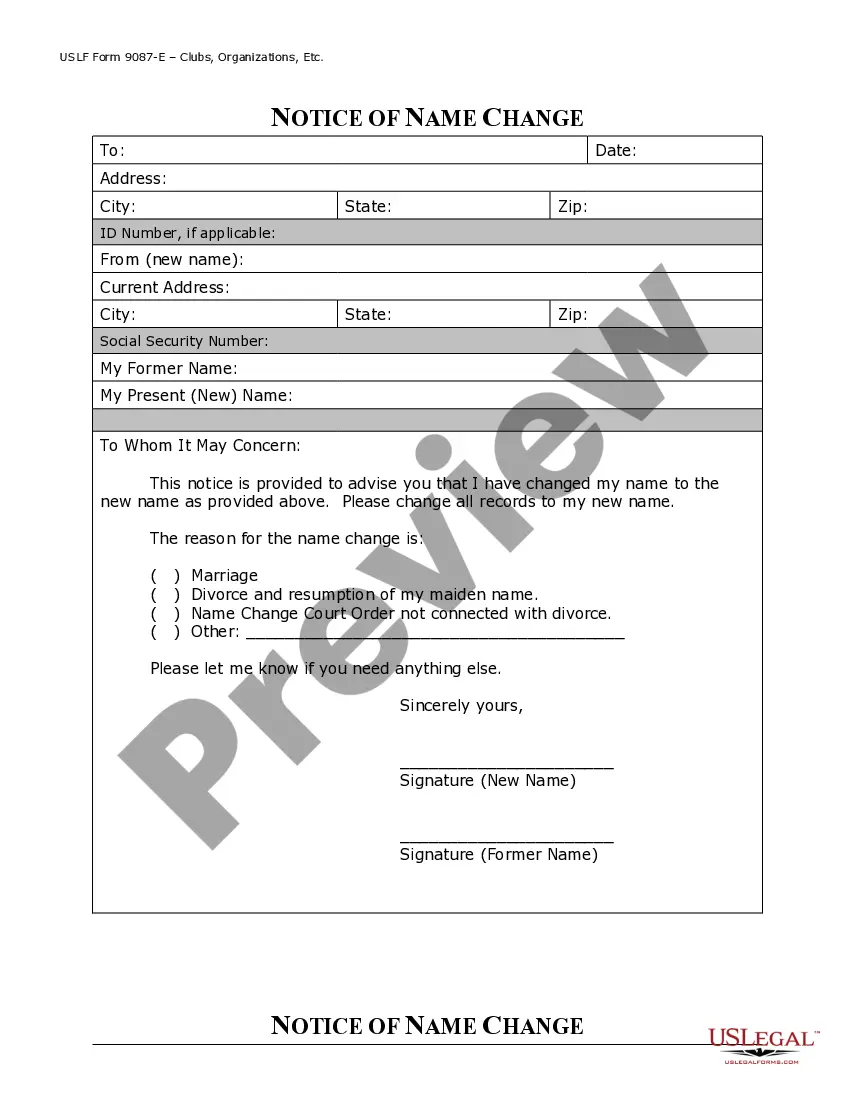

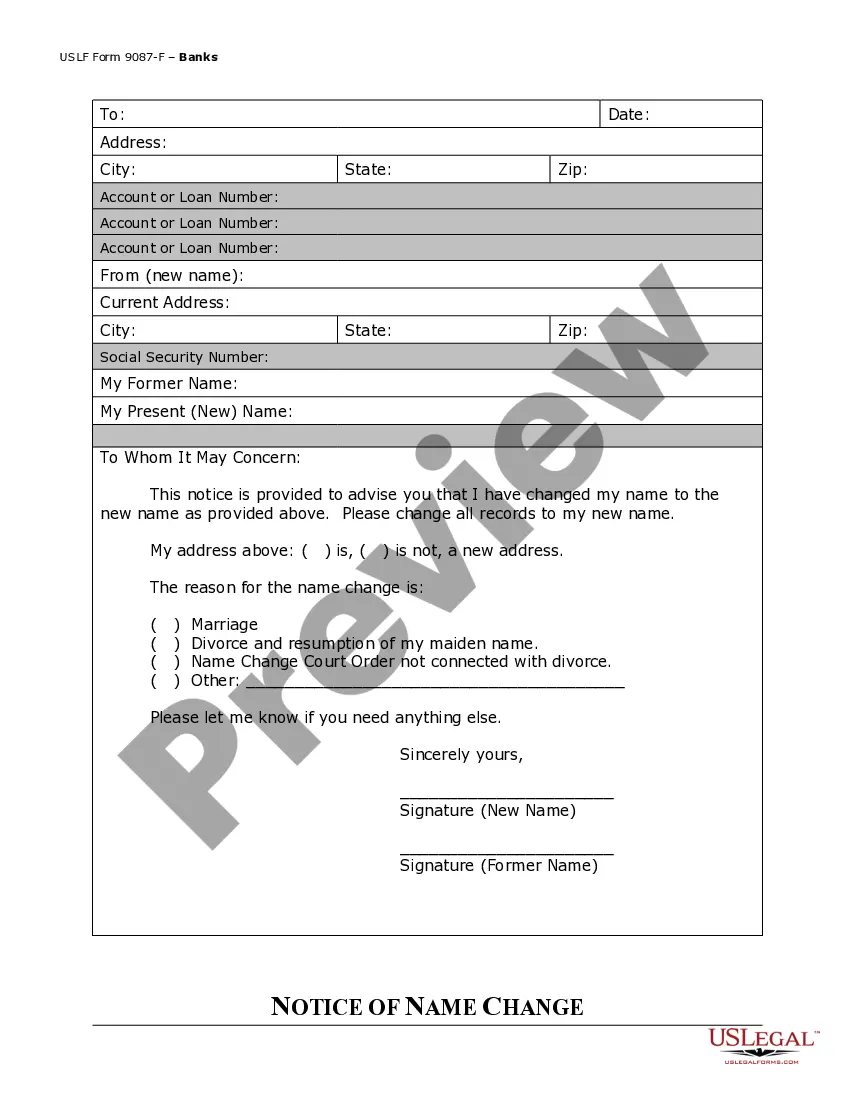

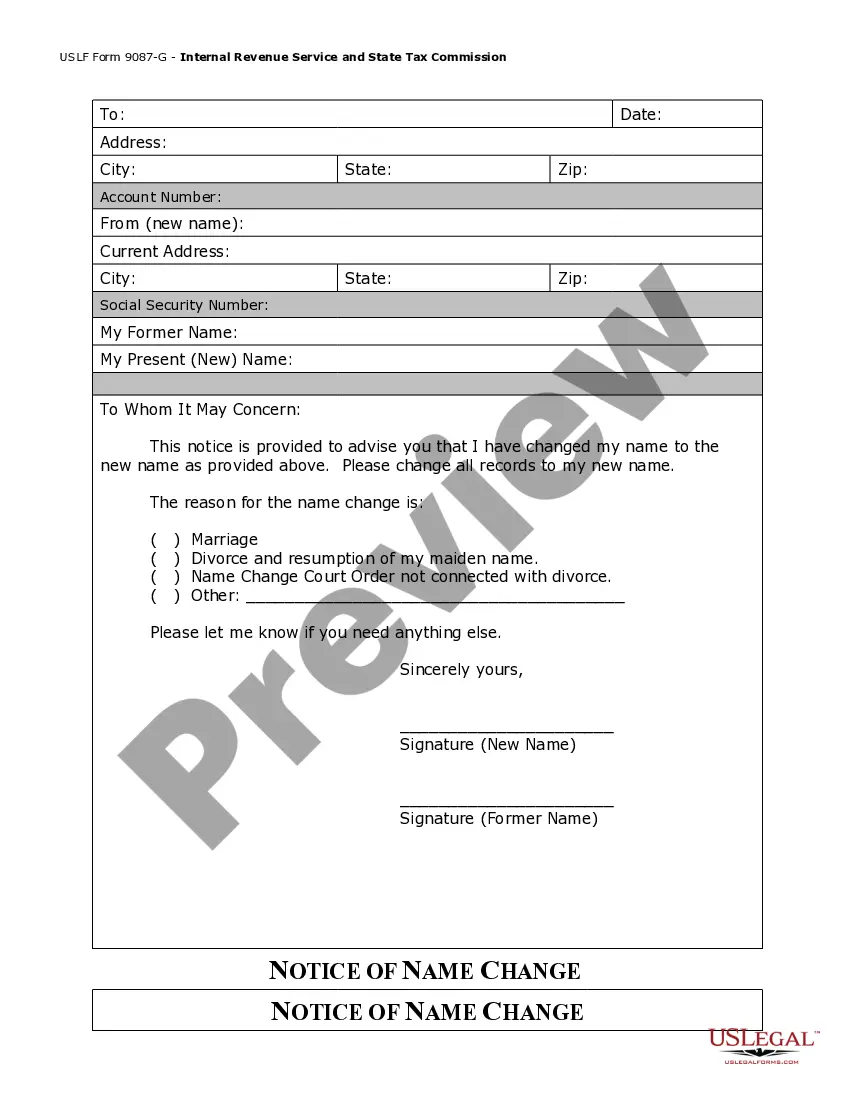

Kansas Name Change For Withholding Tax

Description

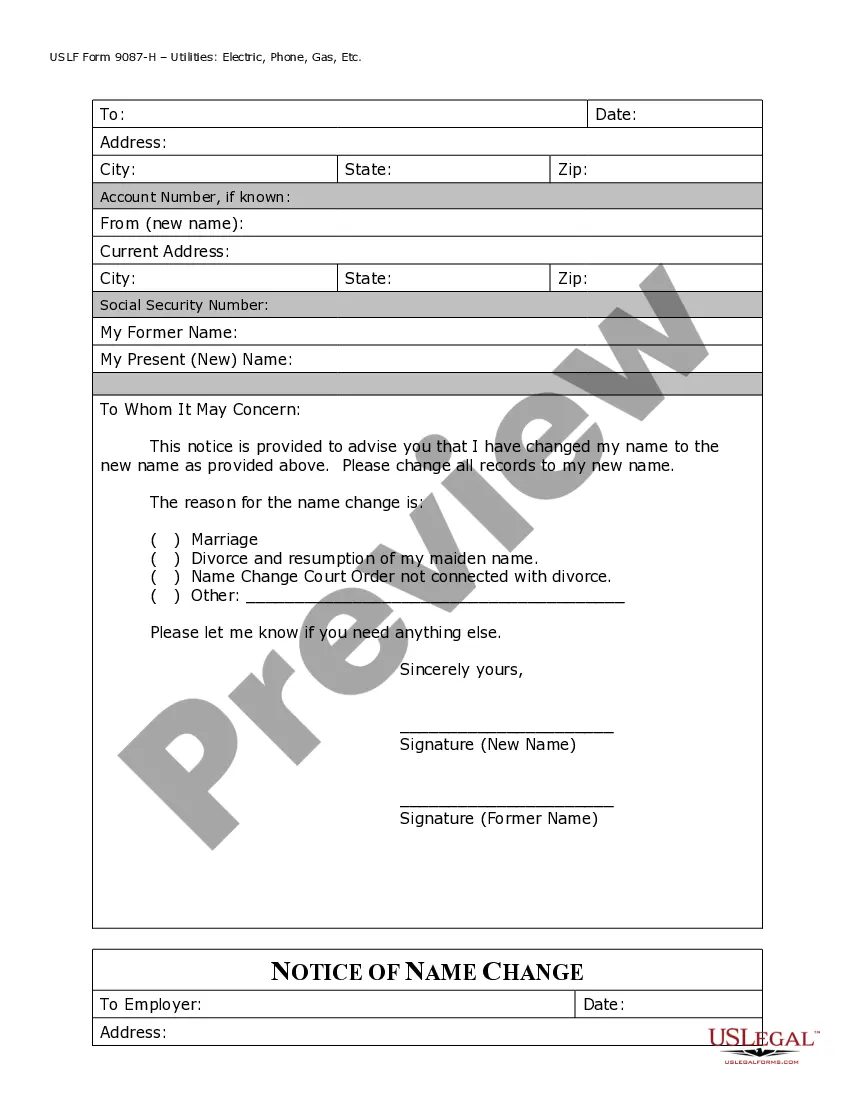

How to fill out Kansas Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

The Kansas Name Change For Withholding Tax you see on this page is a reusable formal template drafted by professional lawyers in line with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, easiest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Kansas Name Change For Withholding Tax will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or review the form description to verify it fits your needs. If it does not, utilize the search option to get the appropriate one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Kansas Name Change For Withholding Tax (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Utilize the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

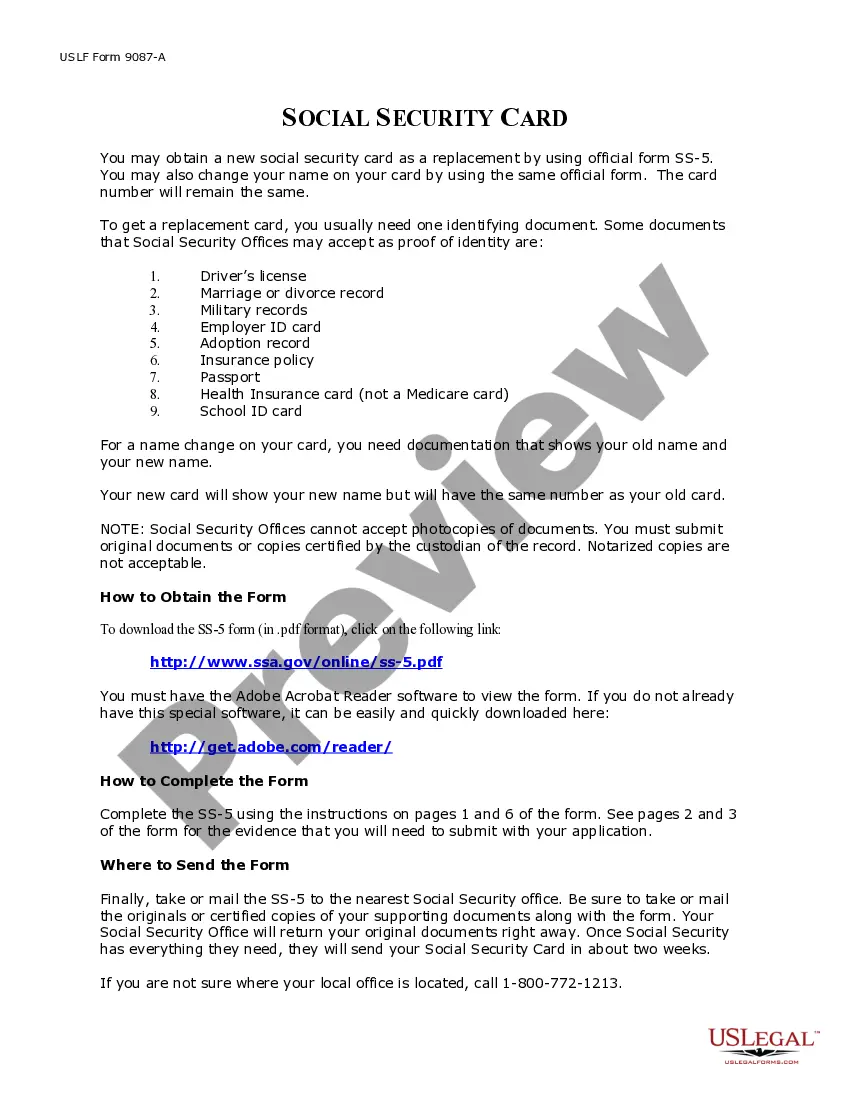

Similar to the W-4 form for federal withholding, employees must complete a K-4 form for state withholding. The state K-4 cannot be completed online. It must be printed and submitted to the KU Payroll Office.

Kansas law requires withholding on wages. If your cafeteria, 401K, profit sharing, or other employee plan is considered to be wages by the federal government and federal income tax withholding is required, Kansas withholding is also required.

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

Kansas law requires withholding on wages. If your cafeteria, 401K, profit sharing, or other employee plan is considered to be wages by the federal government and federal income tax withholding is required, Kansas withholding is also required.