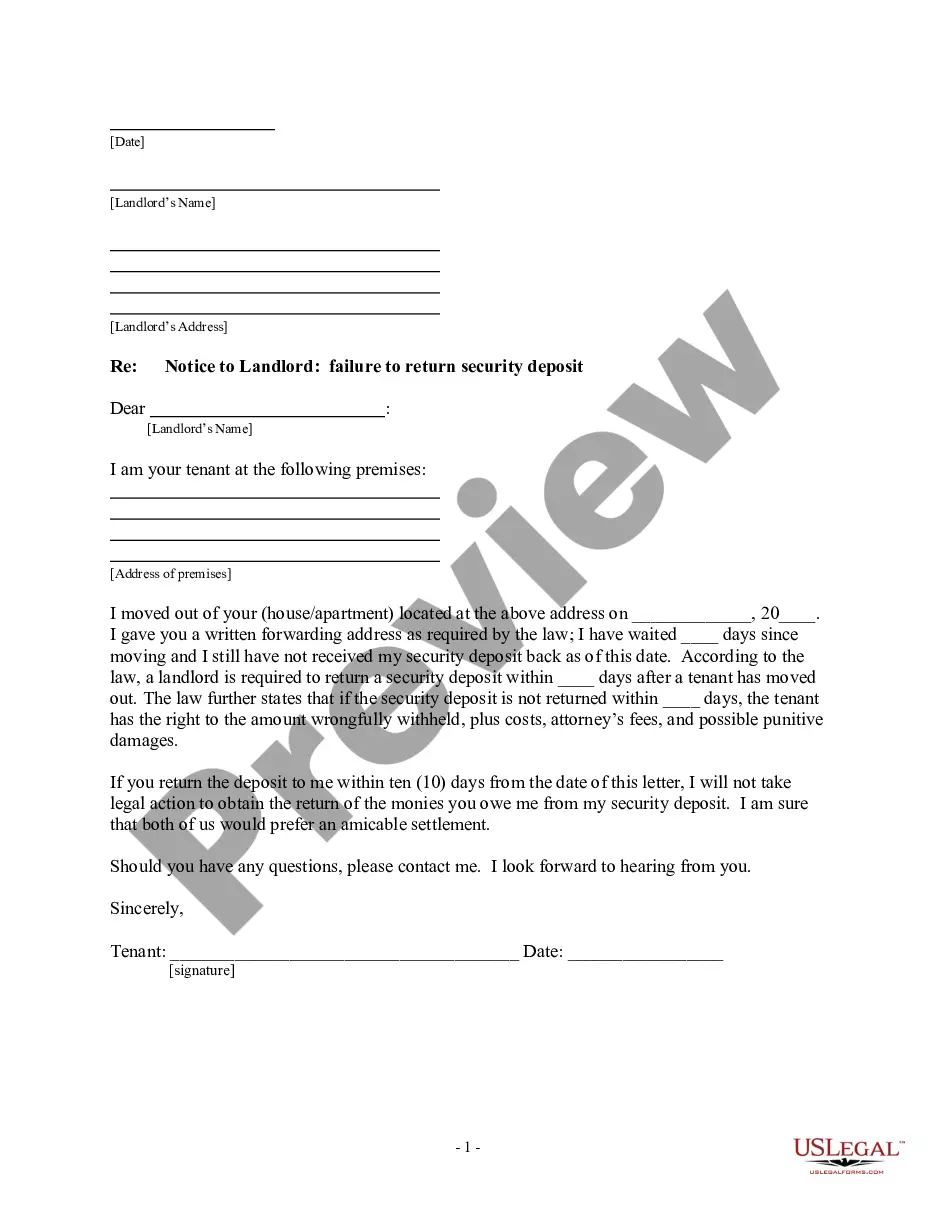

Notice Failure Form Withholding

Description

How to fill out Notice Failure Form Withholding?

How to obtain professional legal documents that conform to your state regulations and prepare the Notice Failure Form Withholding without consulting an attorney.

Numerous online services offer templates for a variety of legal needs and formalities. However, it might require some time to determine which available examples align with both your specific situation and legal standards.

US Legal Forms is a trustworthy platform that aids in finding official documents crafted in alignment with the most recent updates to state law, helping you save on legal fees.

If you do not have an account with US Legal Forms, please follow the steps below: Review the webpage you've opened and ascertain if the form meets your desires. Utilize the form description and preview options if accessible. Search for an alternative sample in the header for your state if necessary. When you discover the correct document, click the Buy Now button. Select the most suitable pricing plan, and then either Log In or create an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Notice Failure Form Withholding and click Download. The acquired templates are yours: you can always revisit them in the My documents section of your profile. Subscribe to our platform and draft legal documents by yourself like a seasoned legal expert!

- US Legal Forms is not just another online directory.

- It is a compilation of over 85,000 verified templates for different business and personal scenarios.

- All documents are categorized by state and area, streamlining your search process.

- It also comes with advanced tools for PDF editing and electronic signatures, allowing users with a premium subscription to effortlessly finalize their documents online.

- Acquiring the necessary paperwork requires minimal effort and time.

- If you already possess an account, Log In and confirm your subscription is active.

- Download the Notice Failure Form Withholding using the appropriate button next to the file name.

Form popularity

FAQ

Claiming 0 does not guarantee that you will avoid owing taxes. Various factors contribute, including additional income sources, changes in tax laws, or unexpected financial situations. If your withholding does not accurately reflect your tax responsibility, you might find yourself facing a tax bill when you file your return. Regularly reviewing your withholding can help you manage your tax liabilities more effectively.

To correct a payroll withholding error, notify your employer or payroll department as soon as possible. Provide them with the correct information and any necessary documentation to support your request. It's important to act quickly to ensure future paychecks reflect the correct withholding. Additionally, consider revisiting your withholding form to prevent similar issues in the future.

Filling out an IRS withholding form is straightforward. Start by visiting the IRS website to download the appropriate form, such as the W-4. Carefully fill in your personal details and input your claimed allowances based on your financial situation. If you're unsure about specific entries, tools available on the US Legal Forms platform can offer valuable assistance.

Generally, claiming 0 on your tax withholding results in a larger potential refund. This is because more taxes are withheld from each paycheck compared to claiming 1. However, it is essential to evaluate your overall financial position to decide what works best for you. Consider adjustments if your tax situation changes throughout the year, and remember that proper planning is key.

To fill out a withholding exemption form, first gather all necessary personal information, such as your name, address, and Social Security number. Also, estimate your expected annual income to determine how many allowances to claim. Complete the form accurately, ensuring that you understand the impact of withholding on your potential tax return. If you have any uncertainties, using the US Legal Forms platform can guide you through the process.

The W-2 form is a statement of earnings provided by the employer at year-end, outlining how much was earned and withheld for taxes. In contrast, the W-4 form is filled out by the employee at the start to determine how much tax should be withheld from each paycheck. Understanding the differences can help you ensure accurate tax calculations and avoid notice failure form withholding issues.

The AW-4 form is similar to the W-4 but is used in some states to determine state-level withholding amounts. Like the W-4, it helps ensure the right taxes are withheld from your paycheck. Filling it out accurately is essential to prevent notice failure form withholding and manage your tax obligations effectively.

A CP2100 B notice is a document sent by the IRS when there is a mismatch between the name and Social Security number on forms submitted by an employer. This notice indicates issues that could affect tax filings and may require corrective action. It is essential to address any discrepancies promptly to avoid complications related to notice failure form withholding.

If an employer fails to withhold the appropriate amount of taxes, it may lead to tax liabilities for the employee. The employee could face unexpected tax bills when filing their return, as well as potential penalties. It's crucial to address any withholding discrepancies promptly to avoid notice failure form withholding scenarios.

The W-4 form is used by employees to inform their employer how much federal income tax should be withheld from their paychecks. This form helps you manage your tax liabilities effectively. Properly completing the W-4 can help you avoid tax debts and any related notice failure form withholding concerns at the end of the year.