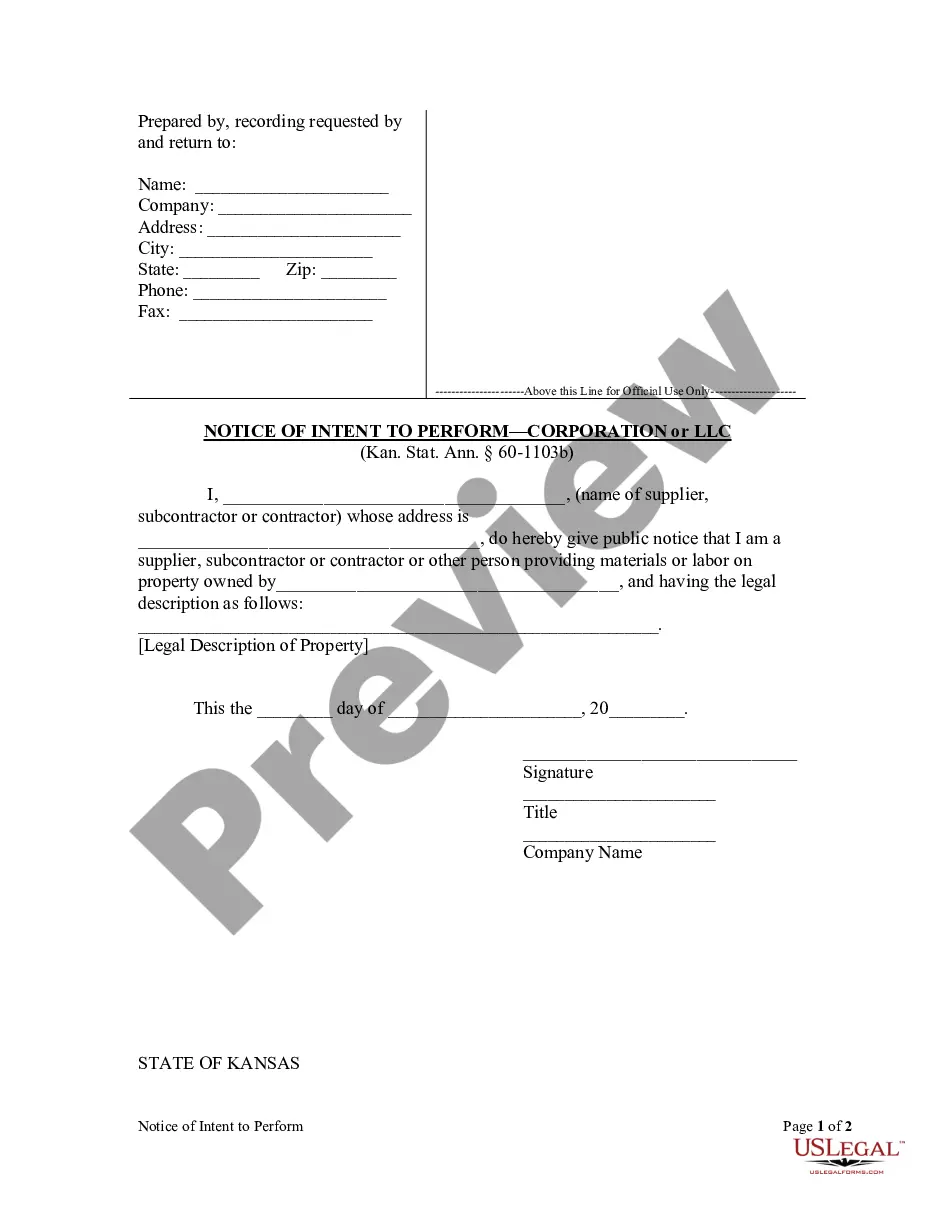

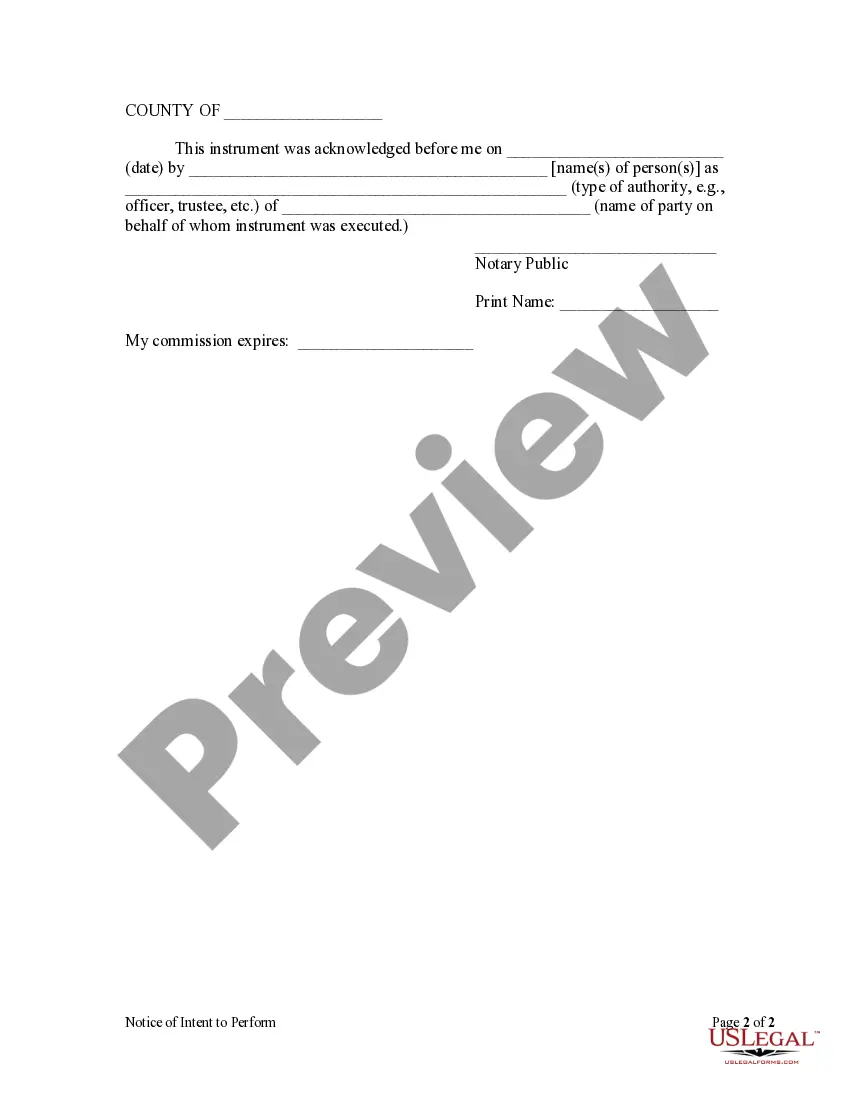

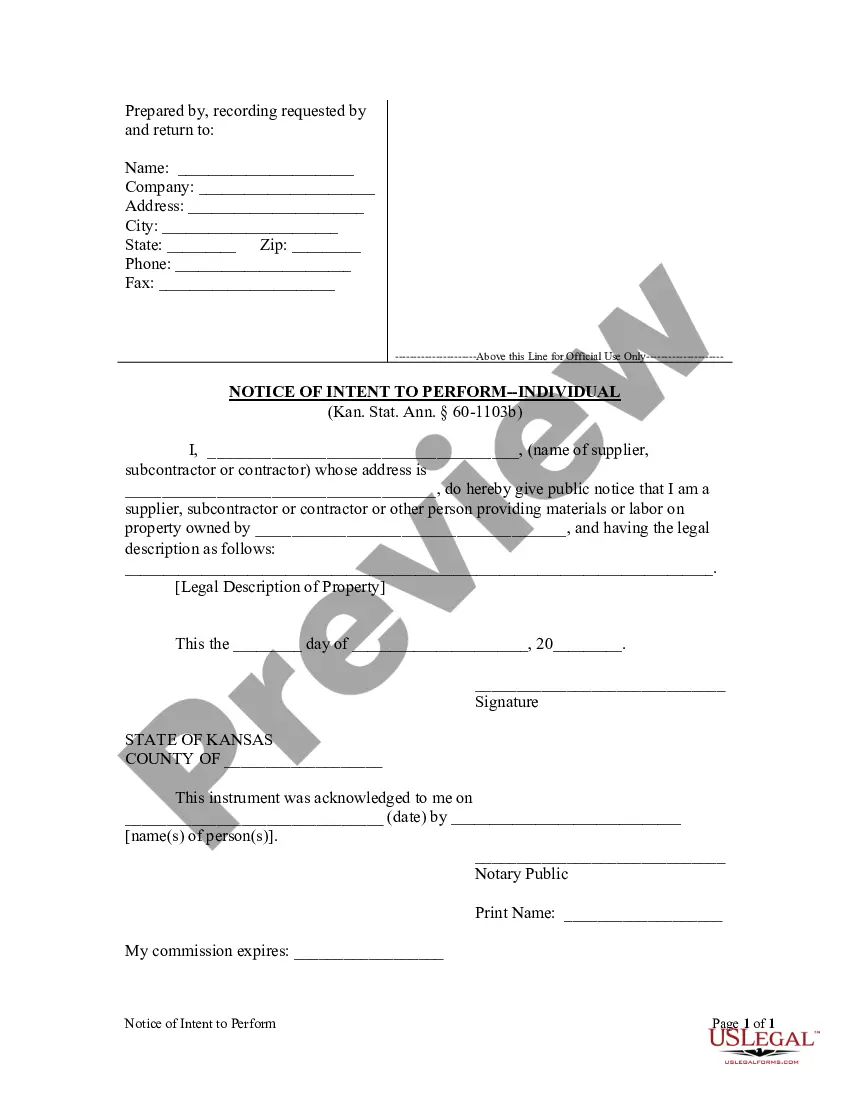

Kansas Notice Intent For Sale

Description

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

- Log in to your US Legal Forms account if you've used the service before. Ensure your subscription is active; renew if necessary.

- For first-time users, start by browsing the extensive online library. Preview the 'Kansas Notice Intent for Sale' form to confirm it meets your specific needs.

- Use the search bar to find alternative templates if the initial form doesn’t suit your requirements.

- Select the 'Buy Now' button for the document you need and choose an appropriate subscription plan. Remember, registration is required for full access.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Download the form to your device for completion, and access it anytime via the 'My Forms' section in your profile.

Successfully navigating legal document preparation has never been easier. By utilizing US Legal Forms' extensive library, you can quickly and confidently draft the necessary papers.

Get started today and take the first step towards your property sale with US Legal Forms!

Form popularity

FAQ

A letter of intent to place a lien serves as a declaration that you plan to file a lien on a property due to non-payment. This letter outlines the details of the work you performed and the amount owed. Similar to the notice of intent, this letter can provoke payment discussions before taking further actions. With the support of USLegalForms, you can easily create and send this letter to the relevant parties.

A notice of intent to file a lien in Kansas is a preliminary document that expresses an underground intent to secure a lien if debts remain unpaid. This notice alerts the property owner and other interested parties about your claim for payment. It can increase the chance of receiving payment before you move forward with the legal process. The USLegalForms platform can provide you with templates and guidance in creating this important document.

A letter of intent to file a lien is a written communication notifying affected parties of the upcoming lien. Typically, it specifies the amount owed, the services rendered, and the timeline of dispute. This proactive measure can often lead to quicker resolutions and now generates more awareness about your claims. You can utilize USLegalForms to draft this letter efficiently.

A notice of intent to lien in Kansas serves as a formal alert that a lien may be filed against a property. This document notifies property owners and other interested parties of the contractor’s intention to secure a lien due to unpaid debts. While not mandatory, sending this notice can facilitate payment discussions and encourage resolution before actual filing. Using platforms like USLegalForms can simplify drafting and sending this notice.

Yes, a contractor can file a lien in Kansas without a formal contract, but certain conditions apply. Even in the absence of a written agreement, if the contractor can prove they provided labor or materials for a project, they may still pursue a lien. It’s important to understand the legal nuances surrounding this process to ensure your rights are protected. The USLegalForms platform offers resources to help navigate these situations effectively.

In Kansas, you generally have six months from the date of the last work or material supplied to file a lien. This timeline is crucial, as missing it may forfeit your right to file a lien. Hence, if you are involved in a construction project, be mindful of this deadline to ensure that you protect your interests effectively. Tools like the USLegalForms platform can help you prepare and file the necessary documentation in a timely manner.