Quitclaim Deed Kansas With Mortgage Owed

Description

How to fill out Kansas Quitclaim Deed By Two Individuals To Corporation?

Whether you deal with documentation frequently or occasionally need to submit a legal document, it is essential to have a reliable resource where all the examples are pertinent and current.

The first step you should take with a Quitclaim Deed Kansas With Mortgage Owed is to verify that it is the most recent version, as it determines its eligibility for submission.

If you wish to streamline your search for the newest document samples, look for them on US Legal Forms.

To acquire a form without an account, follow these instructions: Utilize the search menu to locate the desired form. Review the preview and description of the Quitclaim Deed Kansas With Mortgage Owed to ensure it is exactly what you need. After confirming the form, just click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card details or PayPal account to complete the transaction. Choose the file format for download and validate it. Eliminate confusion when handling legal documents. All your templates will be organized and authenticated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes almost any template you may seek.

- Search for the templates you need, assess their appropriateness immediately and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across various areas.

- Discover the Quitclaim Deed Kansas With Mortgage Owed samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account enables you to obtain all the samples you need with added convenience and less effort.

- Simply click Log In in the website header and navigate to the My documents section with all the forms at your fingertips; you won't need to waste time finding the appropriate template or confirming its accuracy.

Form popularity

FAQ

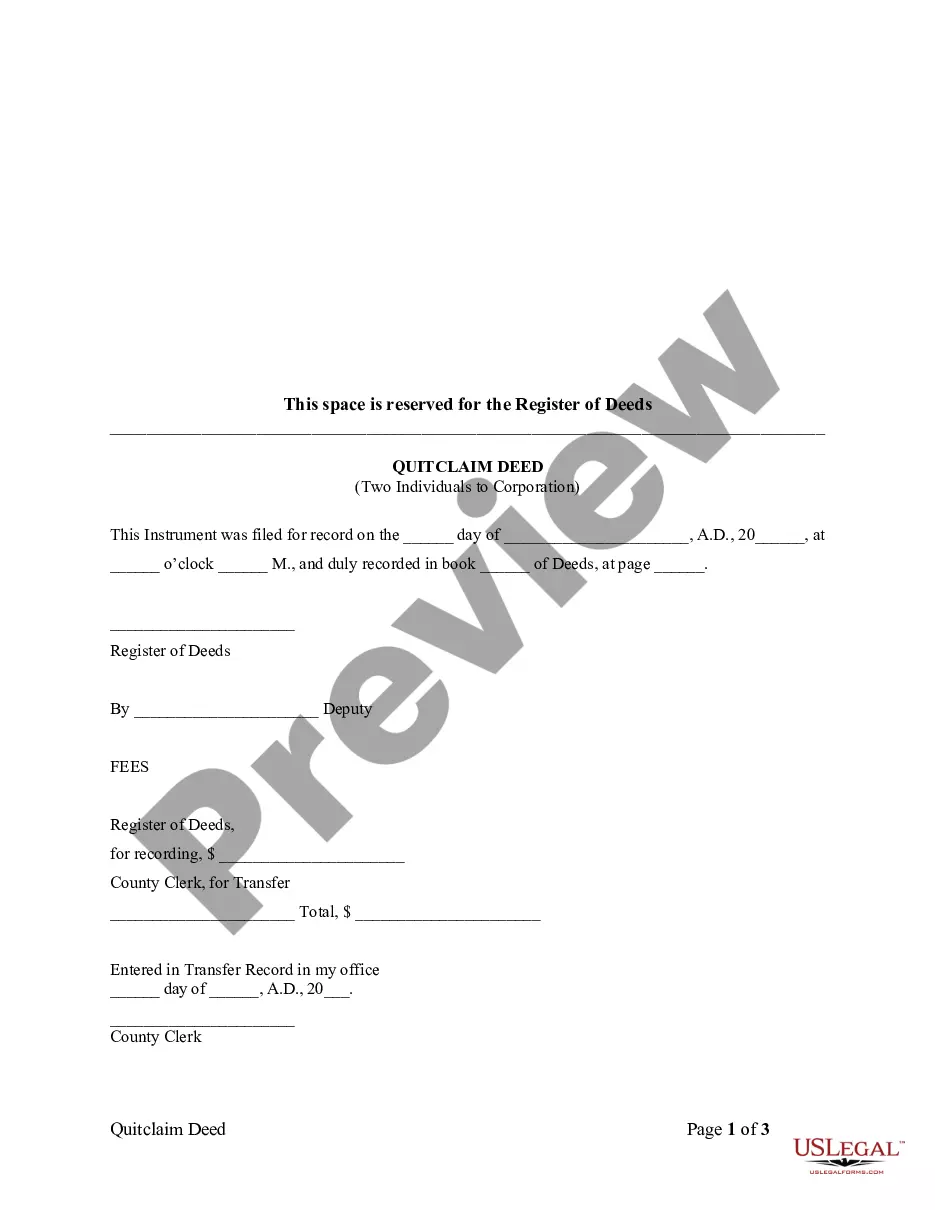

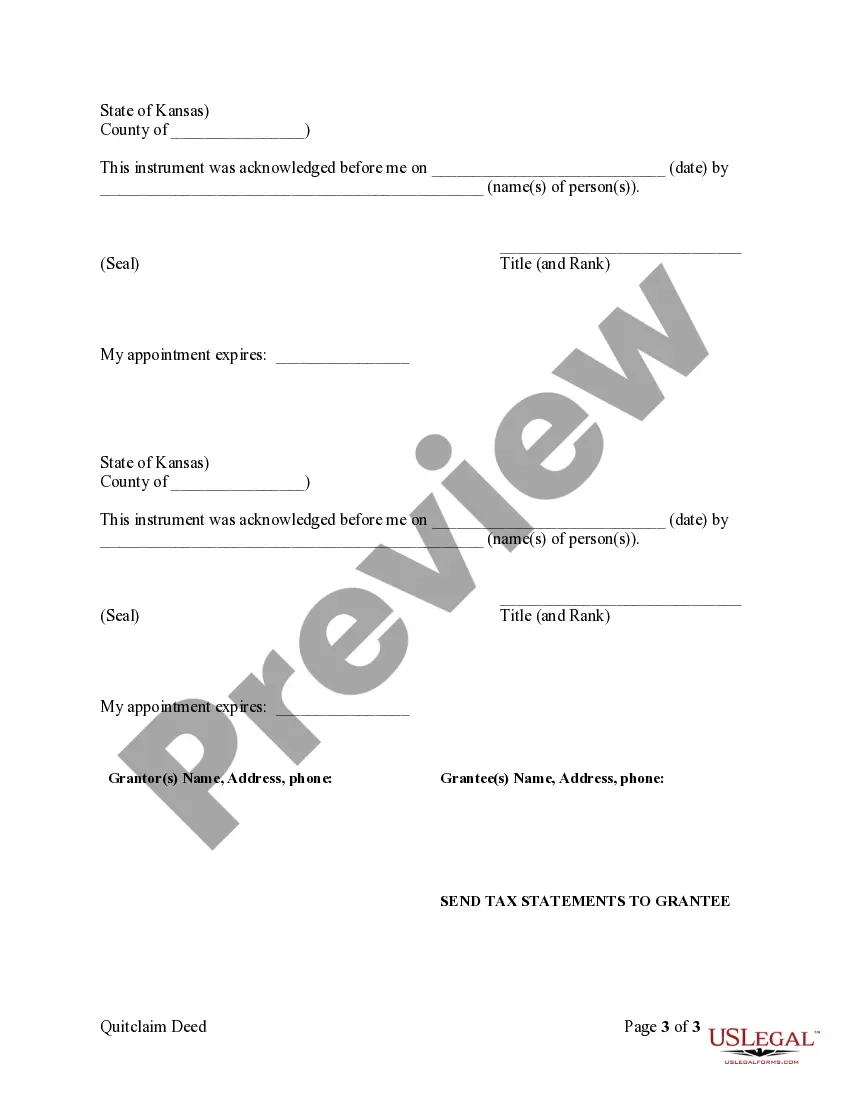

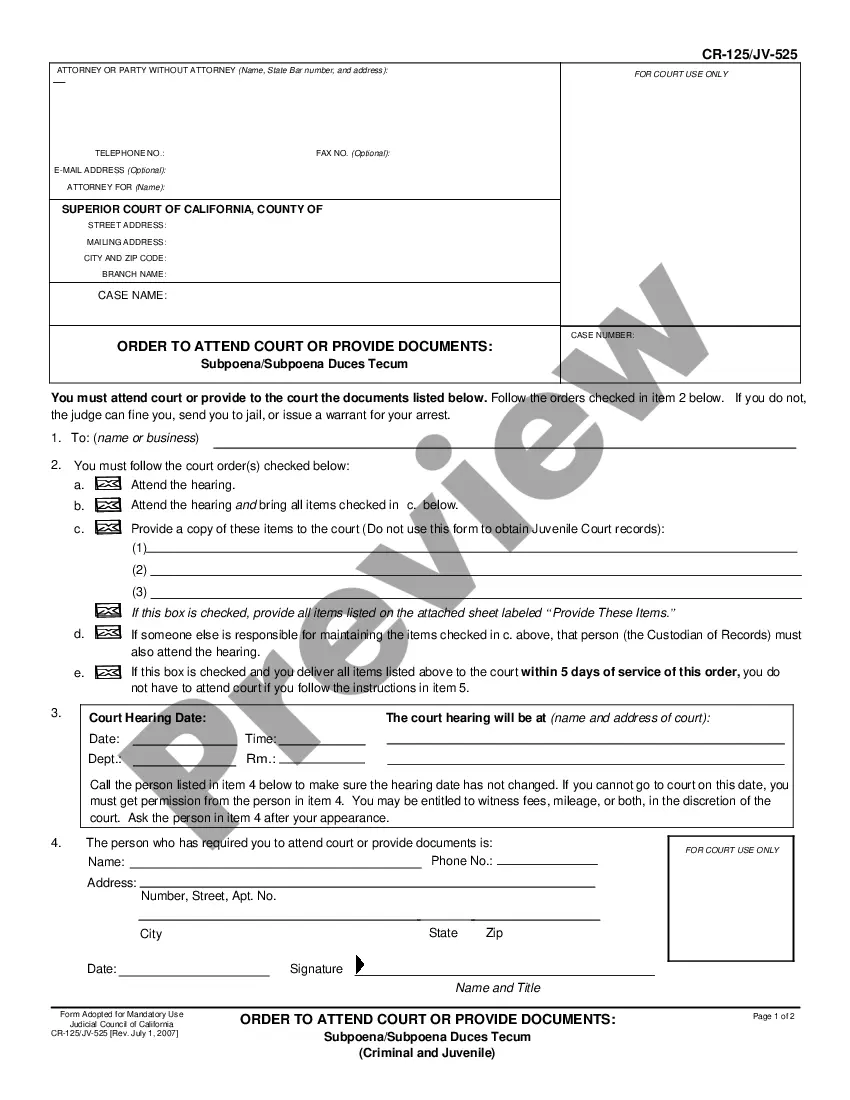

To obtain the deed to your house in Kansas, you will need to file the original deed with the Register of Deeds in your county. If you're using a quitclaim deed Kansas with mortgage owed, it's important to ensure that all required signatures are included. After filing, the Register of Deeds will stamp the document, making it official. Additionally, you may want to consult with a legal professional to ensure you meet all specific requirements.

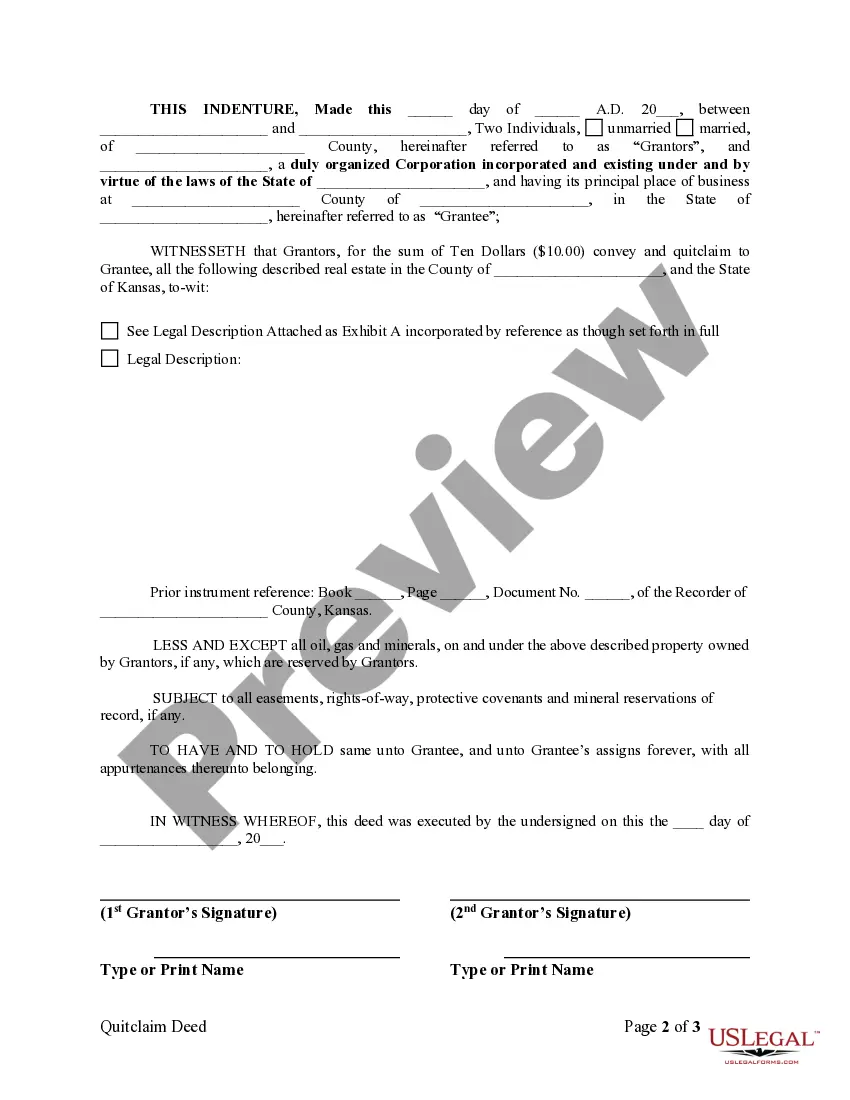

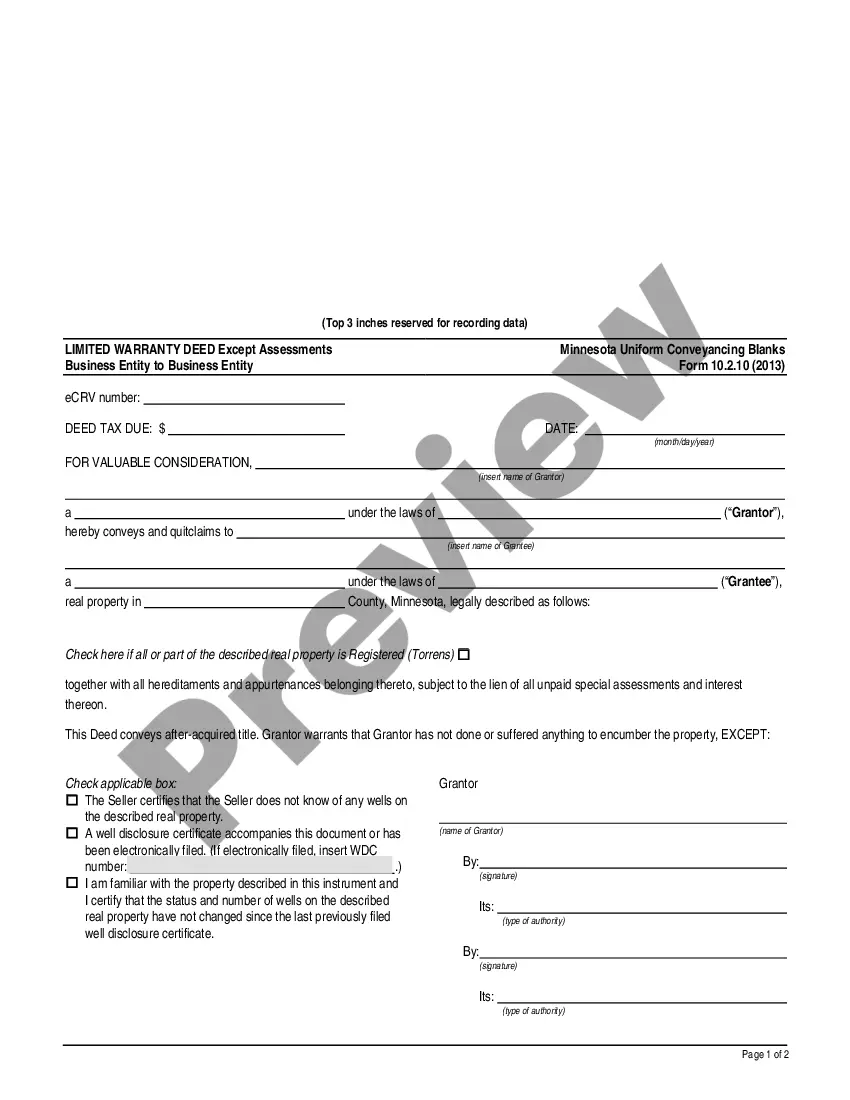

A quitclaim deed Kansas with mortgage owed allows a property owner to transfer their interest in the property to another person, even if there is an existing mortgage. This type of deed does not change the financial obligations tied to the mortgage; instead, the new owner assumes responsibility for the mortgage payments. It is essential to communicate with the lender beforehand to understand any implications of the transfer. Using platforms like US Legal Forms can help streamline the process of drafting and recording your quitclaim deed while ensuring you comply with legal requirements.

Quitclaim deeds are most often used for transferring property between family members or during divorce settlements. They are popular because they are simple and do not require a lengthy process. When a mortgage is owed, it's crucial to understand that the quitclaim deed will not remove the financial responsibility associated with the property.

A warranty deed provides the greatest protection because it guarantees that the seller holds clear title and has the right to convey it. This deed protects the buyer against any future claims on the property. Conversely, a quitclaim deed in Kansas with mortgage owed offers no such guarantees, making it less protective.

The best deed to transfer property often depends on the specific circumstances of the transaction. For a comprehensive assurance of clear title, a warranty deed is preferred. However, if transferring property among family or friends, a quitclaim deed may suffice, even when there is a mortgage owed on the property.

The individual who receives the property title usually benefits the most from a quitclaim deed. This is particularly true when there is a family or personal relationship between the parties involved. For those dealing with a quitclaim deed in Kansas with a mortgage owed, it's important for the recipient to understand the financial responsibilities associated with the property.

To transfer a property title to a family member in Kansas, you can utilize a quitclaim deed. This legal document allows you to convey your interest in the property directly to your relative. If there is a mortgage owed, make sure to review how this transfer may affect the debt responsibility.

In Kansas, a quitclaim deed must include specific information such as the names of the grantor and grantee, a legal description of the property, and acknowledgment of the parties involved. If there is a mortgage owed, it is also essential to note the details of the mortgage to clarify any remaining obligations. This full disclosure helps protect both parties in matters concerning property transfer. For optimal handling of such transactions, consider utilizing the US Legal Forms platform, which simplifies the process by providing comprehensive forms and guidance for quitclaim deed Kansas with mortgage owed.