Kansas Reserving Life For Life

Description

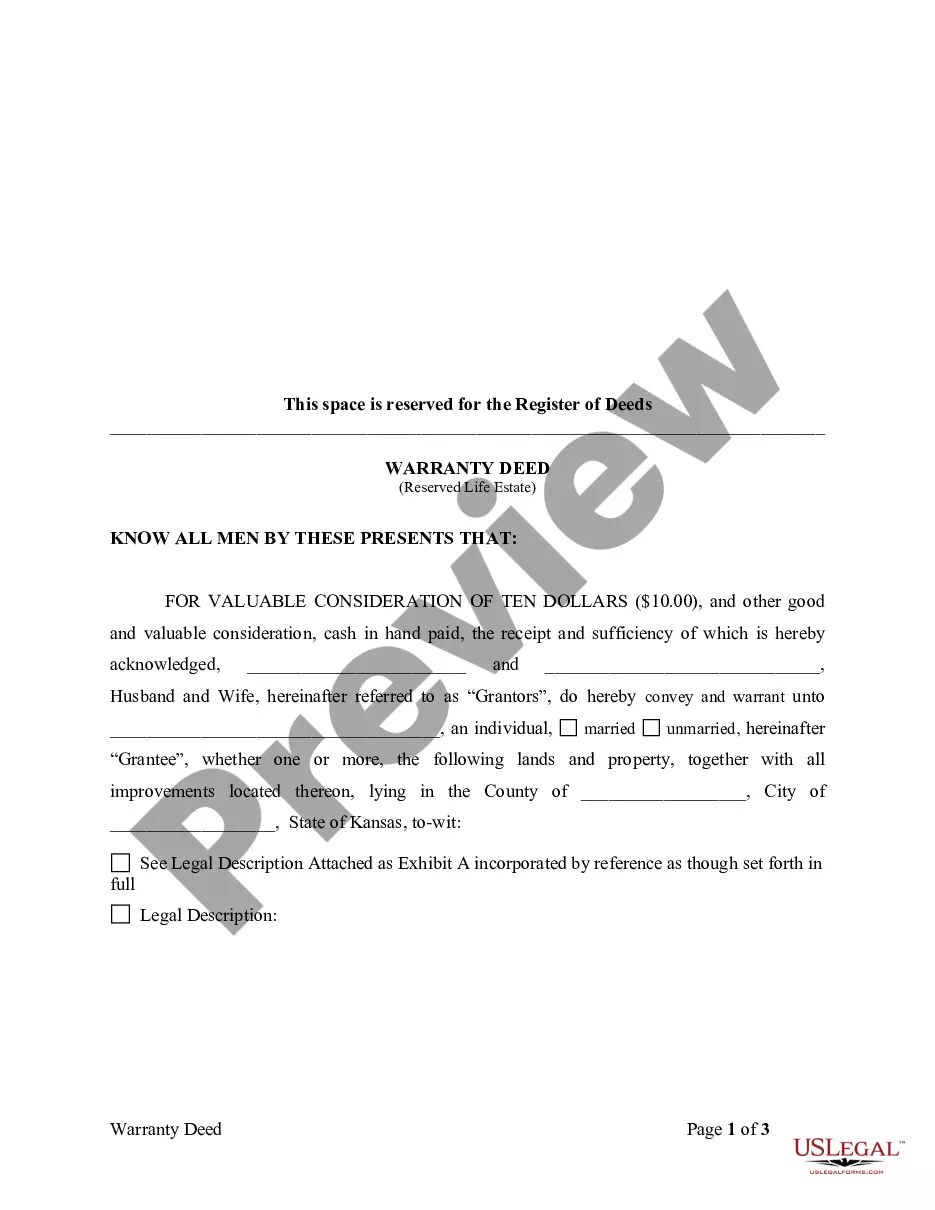

How to fill out Kansas Warranty Deed To Child Reserving A Life Estate In The Parents?

- If you're a returning user, log in to your account and download the required form by clicking the Download button. Ensure your subscription remains active and renew it if necessary.

- For first-time users, begin by examining the Preview mode and description of the form. Confirm it aligns with your needs and local jurisdiction requirements.

- If you need a different template, use the Search tab to find the correct one. Once confirmed, proceed to the next step.

- To purchase the document, click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the library.

- Finalize your purchase by entering your payment details or using a PayPal account for the subscription.

- Finally, download your form and save it on your device. Access it later through the My Forms section of your profile.

Utilizing US Legal Forms ensures you have access to an extensive library of over 85,000 editable legal documents, providing you with a robust collection suited to your needs.

Start your journey towards hassle-free legal documentation today! Explore US Legal Forms for precise and legally sound documents tailored just for you.

Form popularity

FAQ

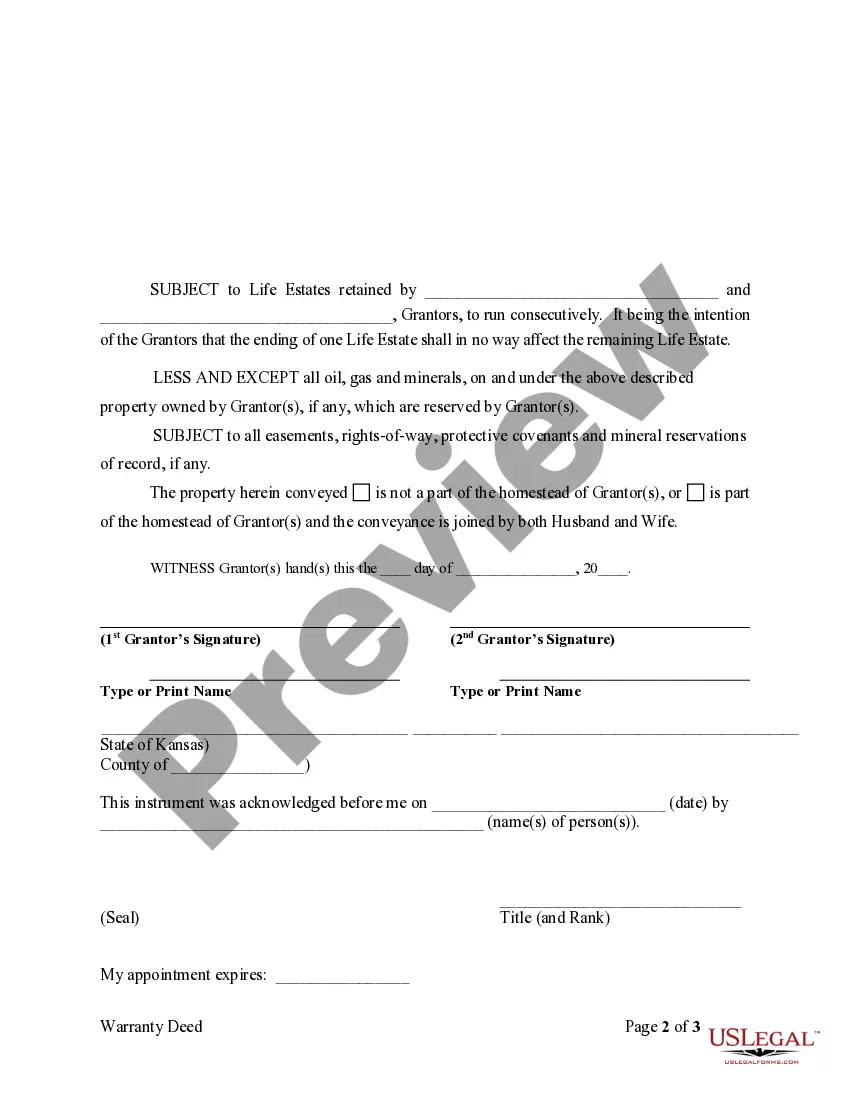

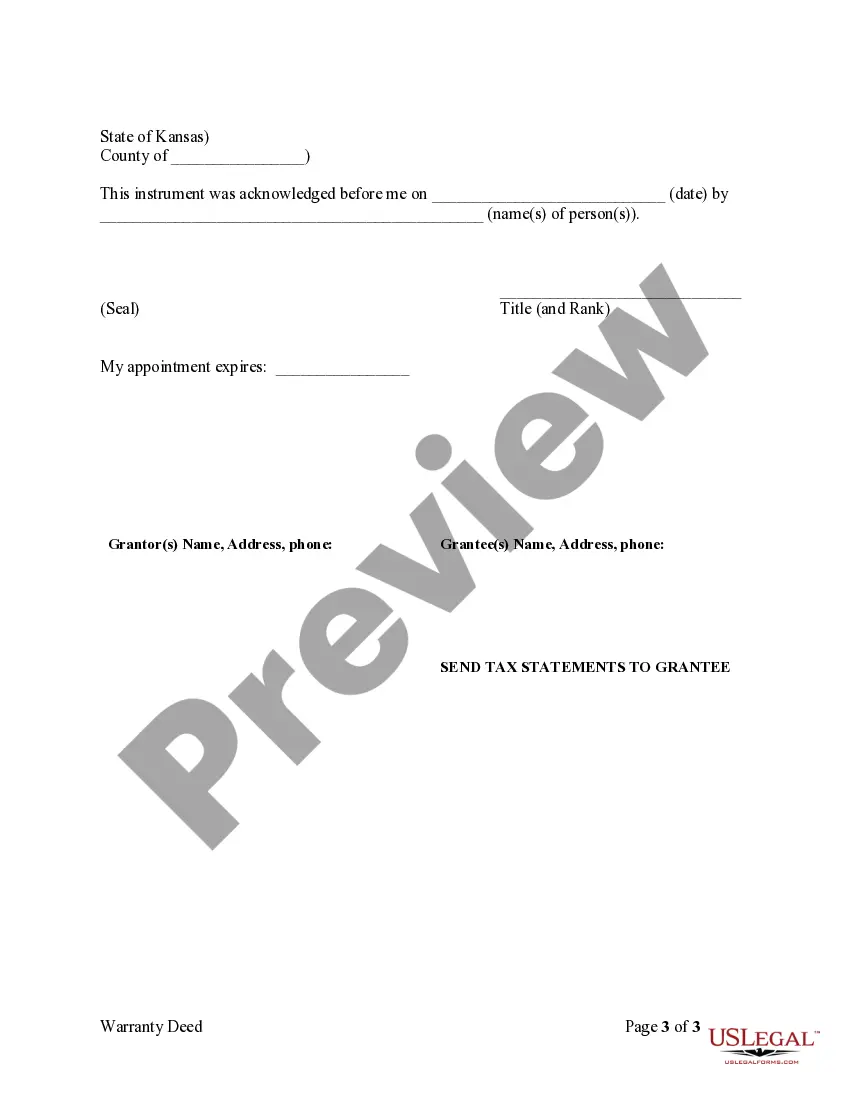

To release a life estate, the life tenant must execute a legal document known as a deed. This deed formally relinquishes their rights to the property and should include clear language about the intentions of the transfer. Seeking assistance from Uslegalforms can simplify this process and ensure that all necessary legal requirements are met within Kansas reserving life for life.

The primary purpose of a life estate is to provide a right of use and enjoyment during an individual's lifetime while determining clear future ownership. This arrangement is beneficial for estate planning, as it ensures that specific individuals receive property after the life tenant's death. In Kansas reserving life for life, this can be an effective tool to manage assets and plan for generational wealth transfer.

Releasing a life estate involves a legal process where the life tenant relinquishes their rights to the property. This can typically be done by executing a formal deed that transfers the property back to the original owner or remainderman. For assistance with this process, consider using Uslegalforms, which provides resources for creating necessary documents and ensuring compliance with Kansas laws.

Only the individual holding the life estate, known as the life tenant, can sell the property while they are alive. However, selling a life estate property can complicate matters, as the buyer will only acquire the property interest limited to the life tenant's remaining life. It is advisable to consult with Uslegalforms for guidance on the process of selling a life estate in Kansas reserving life for life.

Generally, a will cannot override a life estate because the life estate establishes clear rights for both the life tenant and the remainderman. The property in a life estate is not part of the life tenant's estate at death, as ownership is predetermined. However, you can take specific actions related to your estate planning using resources like Uslegalforms to navigate these complexities.

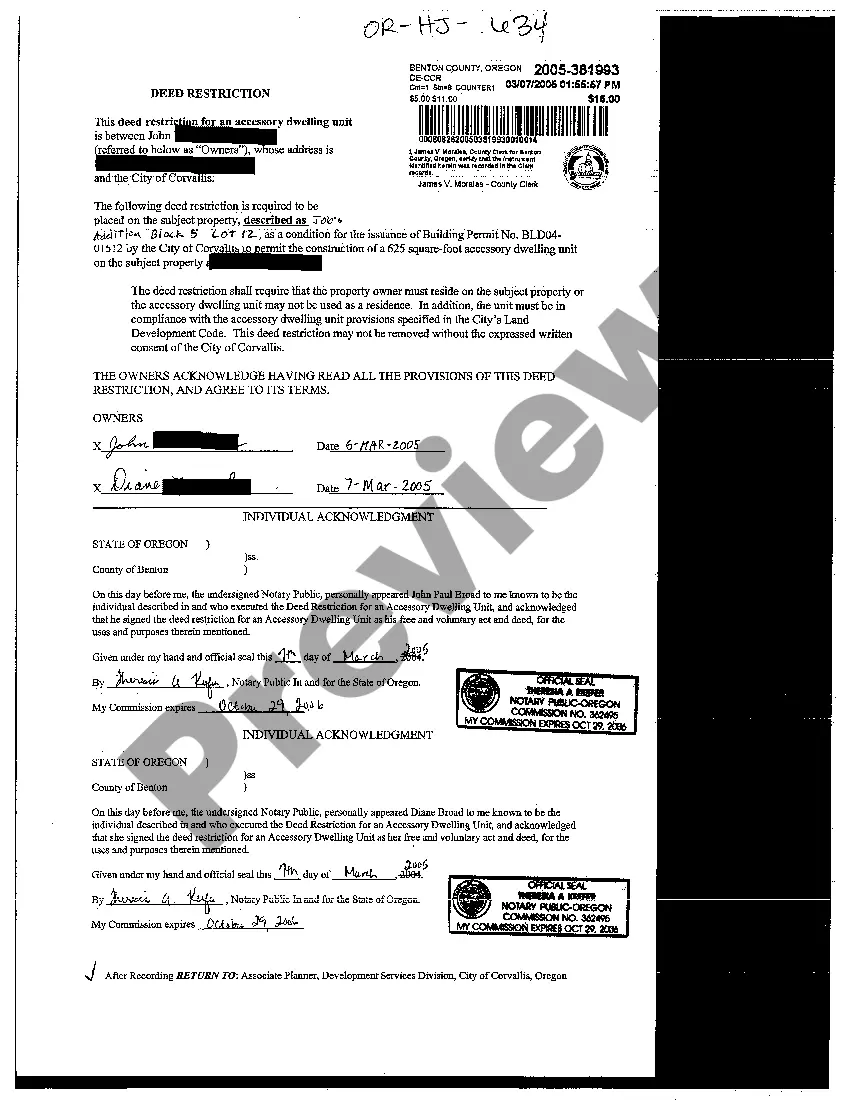

A life estate reserve is a legal arrangement that grants an individual the right to occupy or use a property during their lifetime. After the person's death, the property transfers to beneficiaries, as specified in the arrangement. In the context of Kansas reserving life for life, this setup allows individuals to maintain enjoyment of their property while ensuring it passes to designated heirs.

A deed reserving life estate is a legal document that transfers property ownership to another party while allowing the original owner to retain the right to live in or use the property for the rest of their life. This type of deed is an essential tool for estate planning, which ensures that property transitions smoothly after the owner passes away. In Kansas reserving life for life, this tool streamlines the planning process and protects both parties’ interests.

Generally, you cannot simply take back a life estate once it has been granted to someone else. However, you can have a legal agreement or instrument that modifies the original life estate terms. To navigate these complexities effectively, consider the value of resources from platforms like uslegalforms, focusing on Kansas reserving life for life.

Life estate reserved refers to a situation where the original owner reserves the right to live in or use the property for their lifetime while transferring ownership to another party after their death. This arrangement helps ensure that the original owner's interests remain protected during their lifetime while allowing for a smooth transition of ownership afterward. In Kansas reserving life for life, it's a common method for estate planning.

One downside of a life estate is that it can limit your ability to sell or mortgage the property without the consent of the remainder beneficiaries. Additionally, the property may still be subject to taxes and upkeep responsibilities. Consider these factors while exploring Kansas reserving life for life, as they can impact your overall estate strategy.