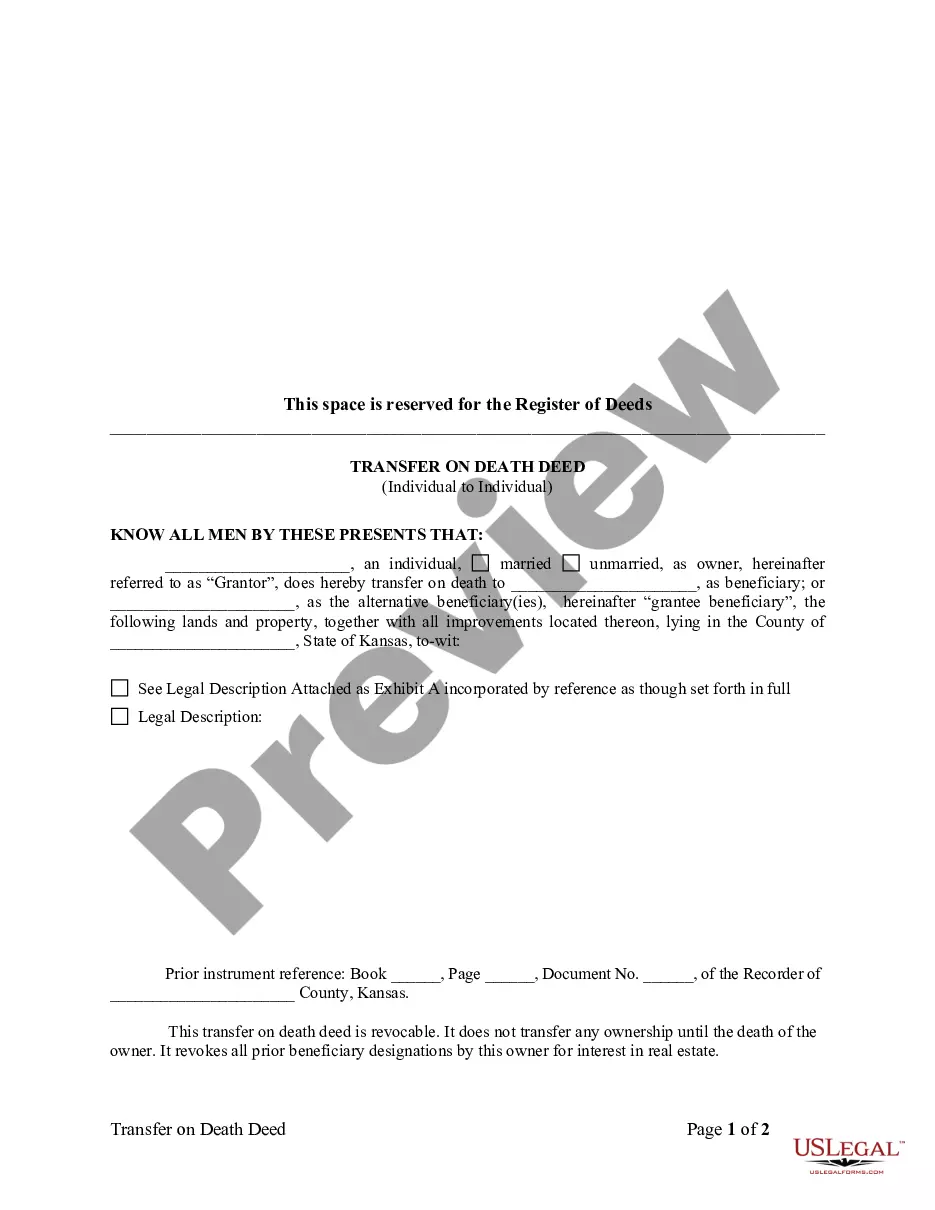

The Kansas transfer on death deed form with beneficiaries is a legal document that allows property owners to designate beneficiaries for their real estate holdings, ensuring a smooth transfer of ownership upon their death. This type of deed is often used as a probate avoidance tool, helping to bypass the lengthy, costly, and often complex probate process. The Kansas transfer on death deed form with beneficiaries, also known as a TOD beneficiary deed, provides individuals with the ability to transfer their property to designated beneficiaries without the need for a will or trust. With this form, the property owner can retain complete control and ownership of the property during their lifetime, while also providing a straightforward method of estate planning for their loved ones. There are two main types of Kansas transfer on death deed forms with beneficiaries, which include: 1. Individual Beneficiary Deed: This form allows property owners to designate one or more specific individuals as beneficiaries of their real estate. These individuals will inherit the property upon the owner's death, and they will become the legal owners without the need for probate. 2. Contingent Beneficiary Deed: This form allows property owners to designate primary and secondary beneficiaries. If the primary beneficiaries predecease the property owner, the contingent beneficiaries will then inherit the property. This type of deed ensures that the property will pass to alternate beneficiaries if the primary beneficiaries are no longer alive. Both types of Kansas transfer on death deed forms with beneficiaries offer flexibility and control for property owners in determining the future ownership of their real estate. It is important to consult with an attorney or legal professional to ensure that the deed form is properly executed and adheres to all applicable laws and regulations. In summary, the Kansas transfer on death deed form with beneficiaries serves as a valuable estate planning tool, enabling property owners to designate their preferred beneficiaries for their real estate, while simplifying the transfer of ownership process and avoiding probate.

Kansas Transfer On Death Deed Form With Beneficiaries

Description

How to fill out Kansas Transfer On Death Deed Form With Beneficiaries?

Using legal templates that comply with federal and state laws is essential, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Kansas Transfer On Death Deed Form With Beneficiaries sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal scenario. They are easy to browse with all documents collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Kansas Transfer On Death Deed Form With Beneficiaries from our website.

Obtaining a Kansas Transfer On Death Deed Form With Beneficiaries is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview option or through the text description to ensure it meets your needs.

- Look for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Kansas Transfer On Death Deed Form With Beneficiaries and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Steps to Obtaining a Child Care License Visit the Child Care Licensing Page and Complete the New Provider Training. ... Apply for the Child Care License. ... Submit Background Check Form and Fingerprints. ... Create a Utah ID. ... Log into Your Child Care Licensing Portal. ... Obtain and Complete the Following: ... Onsite Inspection with Licensor.

You need to be licensed as a licensed family child care provider in Utah if you provide care: In the home where you reside. In the absence of the child's parent. For five to 16 unrelated children.

Care in the home of the provider. A license or certificate is not required for care provided in the home of the provider for less than four hours per day, or for fewer than five children in the home at one time.

13 to 24 months: one staff for up to four children () ? 2 years: one staff for up to seven children () ? 3 years: one staff for up to 12 children () ? 4 years: one staff for up to 15 children () ? 5 to 13 years: one staff for up to 20 children () ? During naptime, higher ratios are permitted for ...

Utah Admin. Code 381-100-10 TABLE 1Age GroupCaregiver-to-Child ratioMaximum Group Size0-11 Months - Infant12-17 Months -- Younger Toddler18-23 Months -- Older Toddler04 more rows

Care for up to 8 children with 1 caregiver including no more than 2 children under age 2; OR care for up to 6 children with 1 caregiver including no more than 3 children under age 2; OR care for up to 16 children with 2 caregivers including no more than 4 children under age 2.