Kansas 60 Lien With Installment Agreement

Description

How to fill out Kansas Assignment Of Lien - Individual?

- If you're a returning user, log in to your account and access the template directly. Ensure your subscription is active, and renew it if necessary.

- For first-time users, begin by reviewing the document's preview and description. Confirm it's the right one for your needs and complies with local regulations.

- If you need to further refine your search, use the Search tab to find a more suitable template.

- After selecting the correct form, click on the 'Buy Now' button to choose your preferred subscription plan. You'll need to create an account if you haven't already.

- Complete the purchase by entering your payment details through credit card or PayPal.

- Finally, download your completed template and save it to your device. You can access it anytime from the My Forms section of your profile.

In conclusion, utilizing US Legal Forms not only saves you time but also guarantees access to premium resources for all your legal document needs. Ensure you follow these steps to streamline your form acquisition process.

Ready to get started? Visit US Legal Forms today and simplify your legal documentation!

Form popularity

FAQ

If you need to mail your Franchise Tax Board (FTB) installment agreement, be sure to check the FTB website for the specific mailing address based on your type of agreement. Generally, the address differs depending on whether you owe personal taxes or business taxes. To ensure accuracy and efficiency, platforms like USLegalForms can help you identify the right mailing procedures for your Kansas 60 lien with installment agreement.

Typically, the IRS may take about 30 days to review and approve your installment agreement after submission. The timing can depend on various factors, including the complexity of your financial situation. During this waiting period, staying informed about your Kansas 60 lien with installment agreement can help ease your worries, and using services like USLegalForms can often expedite the process.

To create a payment agreement with the IRS, you will need to fill out Form 9465, indicating your total tax liability and proposed monthly payments. Once your form is submitted, the IRS will review your financial situation and confirm your installment agreement. Utilizing services from USLegalForms can help you draft a clear and effective payment plan tailored to your Kansas 60 lien with installment agreement.

To file an installment agreement with the IRS, you typically need to submit Form 9465, which you can do online through the IRS website. Alternatively, you can mail the form to the address where you file your tax return. Using services like USLegalForms can simplify the process, ensuring you're submitting correct and complete documentation consistent with your Kansas 60 lien with installment agreement.

Yes, the IRS can file a Kansas 60 lien even if you have an installment agreement in place. This lien serves as a legal claim against your property due to unpaid taxes. However, having an installment agreement does indicate that you are working towards resolving your tax debt. It's essential to stay compliant with your agreement to minimize potential complications.

Yes, you can file a lien without a written contract if the debt is established. In the context of a Kansas 60 lien with an installment agreement, the IRS can place a lien based on your tax liabilities even without a formalized written acknowledgment. However, having documentation can make the process clearer and help you resolve disputes more effectively. It's advisable to keep detailed records and consult with professionals if you have concerns.

If the IRS rejects your payment, they will notify you with the reasons for the rejection. This situation can complicate your standing with a Kansas 60 lien and an installment agreement, as continued non-payment can lead to severe penalties. To minimize complications, address payment issues swiftly, and consider setting up alternate payment methods. Understanding your obligations is vital to maintaining a good standing with the IRS.

If the IRS rejects your installment agreement, you will receive a notice explaining the reasons for rejection. You typically have the option to appeal or adjust your request, especially when dealing with a Kansas 60 lien with an installment agreement. It’s wise to carefully review the notice and address any listed issues. You can also seek professional assistance to ensure your revised agreement meets IRS standards.

The IRS may terminate an installment agreement if you fail to make payments, do not file your tax returns, or if you do not keep them informed of your financial situation. If you find yourself in this situation concerning a Kansas 60 lien with an installment agreement, it's crucial to communicate with the IRS immediately. Often, reinstating the agreement is possible if you address the issues promptly. Keep in mind that documented communication can be helpful.

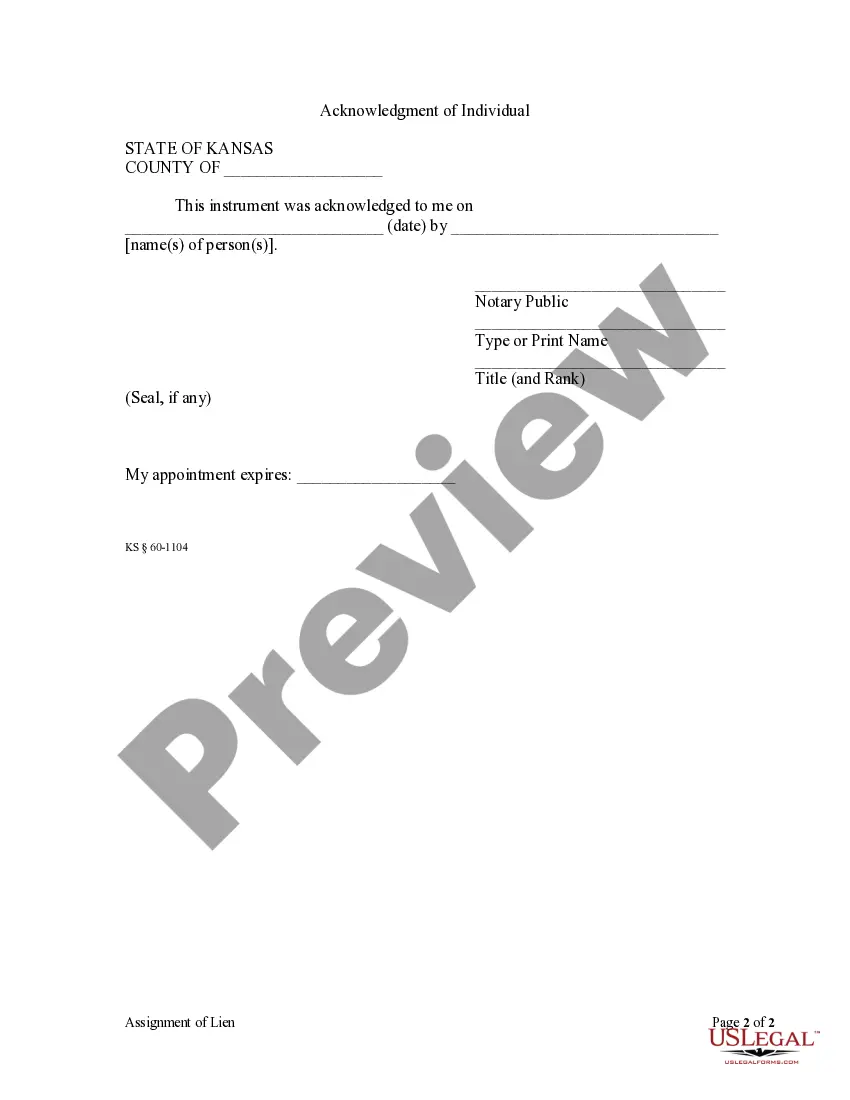

Statute 60-1101 in Kansas relates to the creation and enforcement of liens for certain types of property. This law outlines the procedures for filing liens and the rights of parties involved. A good understanding of this statute is vital when dealing with a Kansas 60 lien with installment agreement. Utilizing resources like UsLegalForms can provide you with necessary documentation and guidance.