There is no longer a necessity to waste time hunting for legal documents to adhere to your local state regulations. US Legal Forms has gathered all of them in one location and enhanced their availability.

Our site offers over 85,000 templates for any business and personal legal matters categorized by state and usage area. All forms are expertly drafted and validated for authenticity, so you can trust in obtaining an up-to-date Addendum To Lease Kansas Withholding.

If you are acquainted with our service and already possess an account, you must ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. Additionally, you can revisit all previously obtained documents anytime by accessing the My documents tab in your profile.

Select the file format for your Addendum To Lease Kansas Withholding and download it to your device. Print your document to fill it out manually or upload the sample if you prefer using an online editor. Preparing official paperwork under federal and state guidelines is quick and easy with our platform. Give US Legal Forms a try now to keep your documentation organized!

- If you haven't used our service before, the process will involve a few more steps to finish.

- Here's how new users can find the Addendum To Lease Kansas Withholding in our collection.

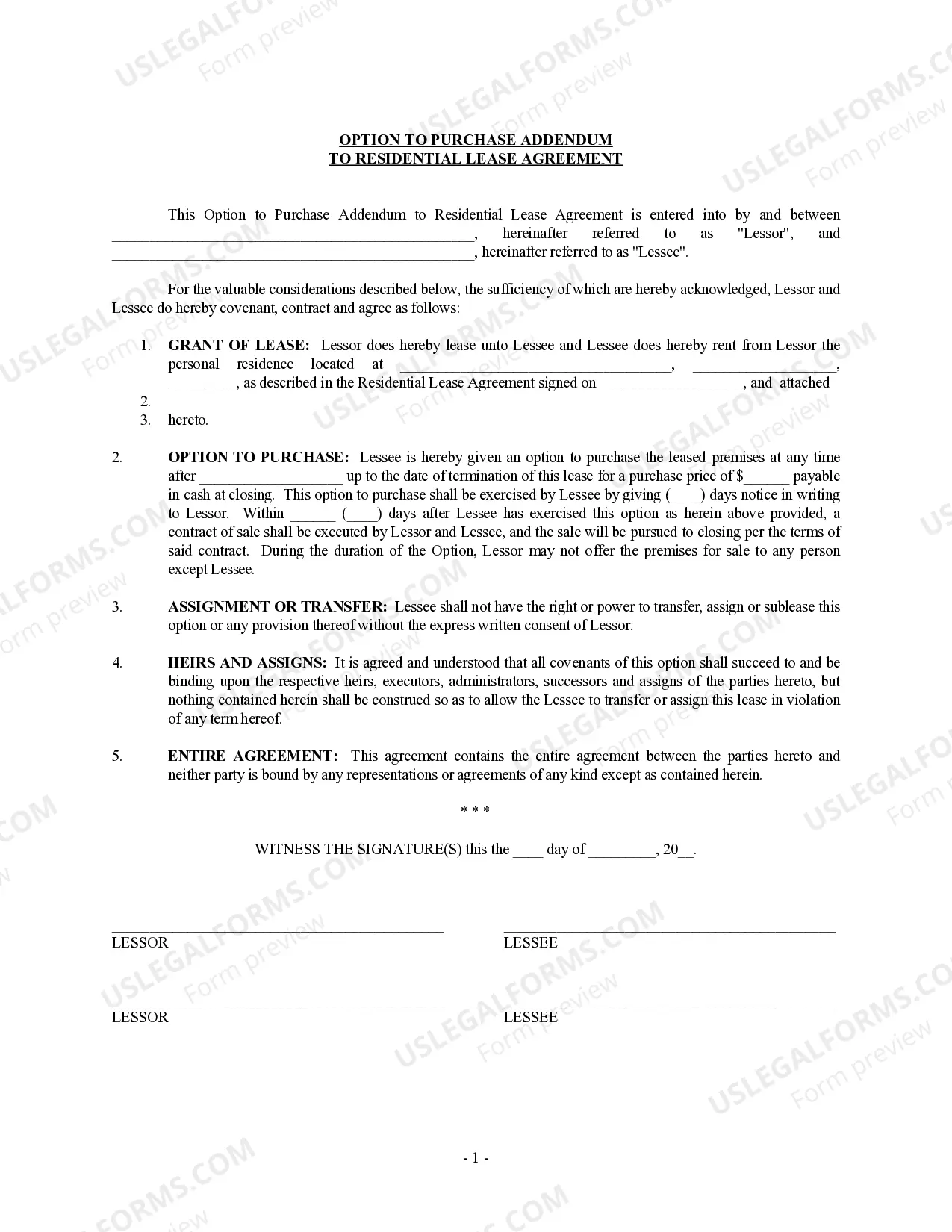

- Carefully review the page content to ensure it includes the sample you require.

- Use the form description and preview options if available.

- Utilize the Search bar above to find another sample if the previous one was unsuitable.

- Click Buy Now beside the template title once you identify the right one.

- Choose the most appropriate pricing plan and sign up for an account or Log In.

- Make your payment for the subscription using a credit card or PayPal to proceed.

4th Edition 6th Revision of our Kansas Tenants Handbook. If you are currently in a lease, check your lease before you get a pet.Concern laws that are subject to amendment and interpretation. KANSAS APARTMENT LEASE CONTRACT filed on July 3rd, 2012. Do not apply to commercial real estate leases in Kansas. Described in Paragraph 2 and in any addendum to this agreement. Tax Clearance: WSU strongly supports the State of Kansas Tax Clearance Process.