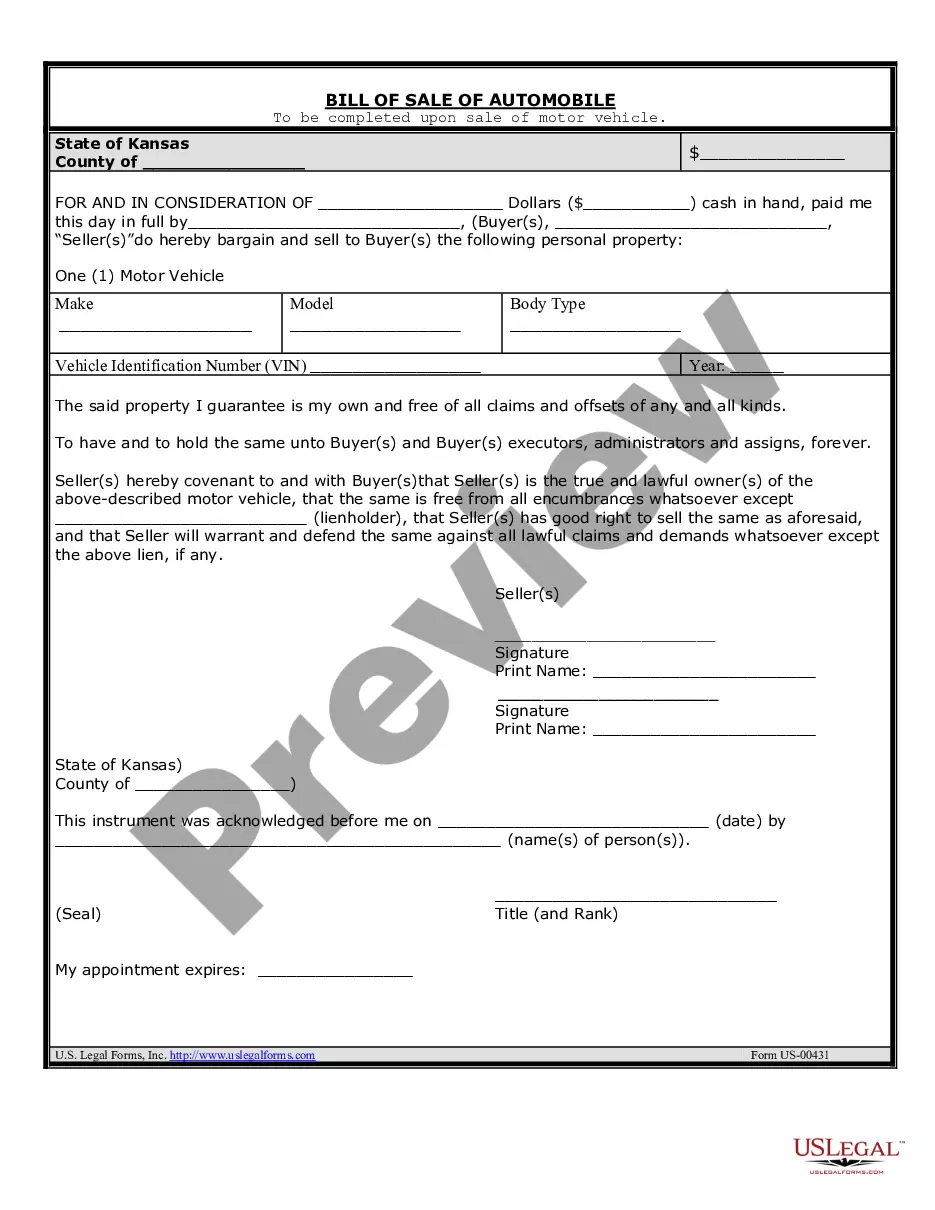

Kansas Bill Of Sale Without Address

Description

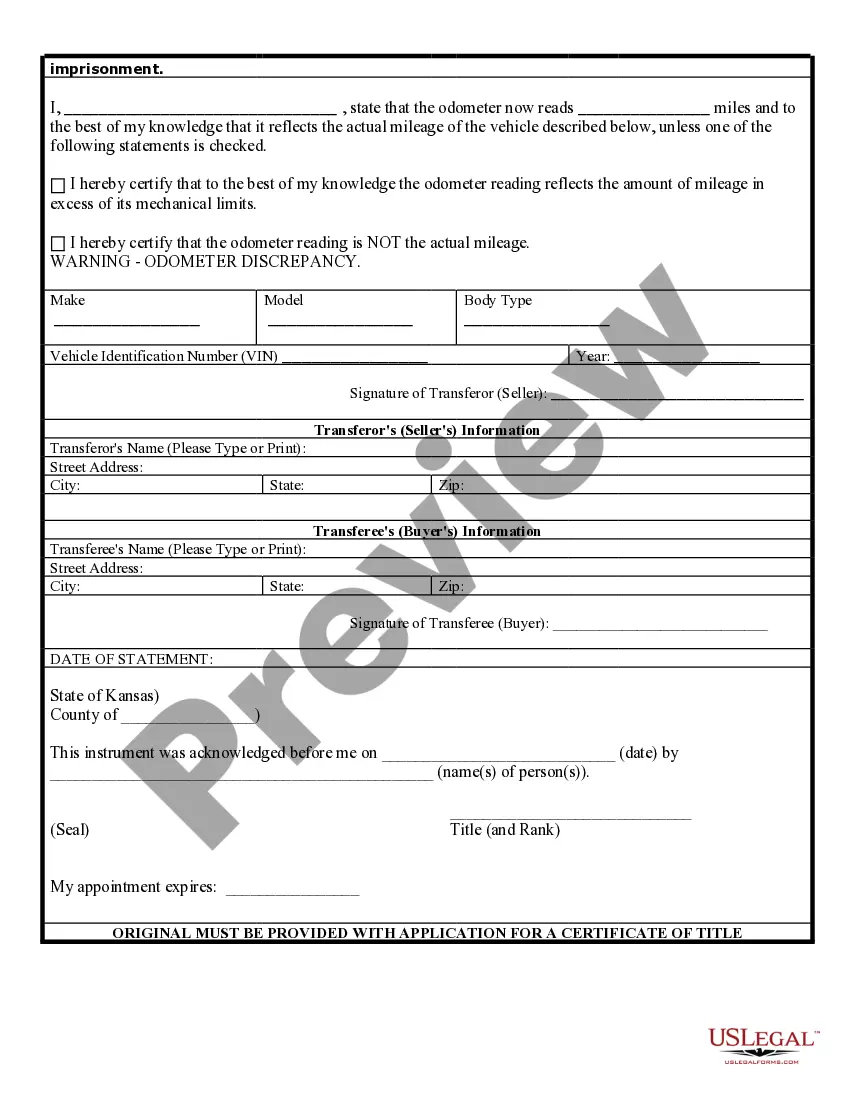

How to fill out Kansas Bill Of Sale Of Automobile And Odometer Statement?

When you have to complete the Kansas Bill Of Sale Without Address according to your local state's statutes and guidelines, there are numerous choices available to select from.

There’s no requirement to review every document to confirm it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable platform that can assist you in obtaining a reusable and current template on any topic.

Browse the recommended page and verify it aligns with your needs.

- US Legal Forms has the largest online repository with a collection of over 85,000 ready-to-use documents for commercial and personal legal matters.

- All templates are verified for compliance with each state's regulations.

- Consequently, when downloading the Kansas Bill Of Sale Without Address from our site, you can be assured that you possess a legitimate and current document.

- Obtaining the required template from our service is remarkably straightforward.

- If you already have an account, just Log In to the platform, ensure your subscription is active, and download the chosen file.

- In the future, you can access the My documents section in your account and retrieve the Kansas Bill Of Sale Without Address at any time.

- If this is your first time using our library, please follow the instructions below.

Form popularity

FAQ

The items you should include on a vehicle bill of sale are the following:Seller's information: name, address, phone number.Buyer's information: name, address, phone number.Vehicle information: year, make, model, VIN.Purchase price.Date of sale.Seller's signature and date.Buyer's signature and date.

3) What papers will I need to title my vehicle? Title or MSO signed over to the buyer, sales tax receipt or bill of sale, current mileage, proof of insurance. When transferring tag you need: current owner's registration or tag number and name and address of whom the vehicle was sold to.

Is a Bill of Sale Required in Kansas? In most cases, no. You only need a bill of sale in Kansas if the vehicle being registered is an antique at least 35 years old without a title or the title you have doesn't have a figure listed for the sale amount.

Details to Include in a Bill of SaleThe vehicle's make, model, year, and VIN (Vehicle Identification Number) Purchase price of the vehicle. Date of the sale. Signatures of both the buyer and seller and the date the document was signed.

How to Get a Kansas Title With Only a Bill of SaleBring the bill of sale to your local county treasurer's motor vehicle office if the antique vehicle is model year 1949 or earlier.Take your antique car to a local Kansas Highway Patrol office to get a VIN inspection done if the vehicle is model year 1950 or later.