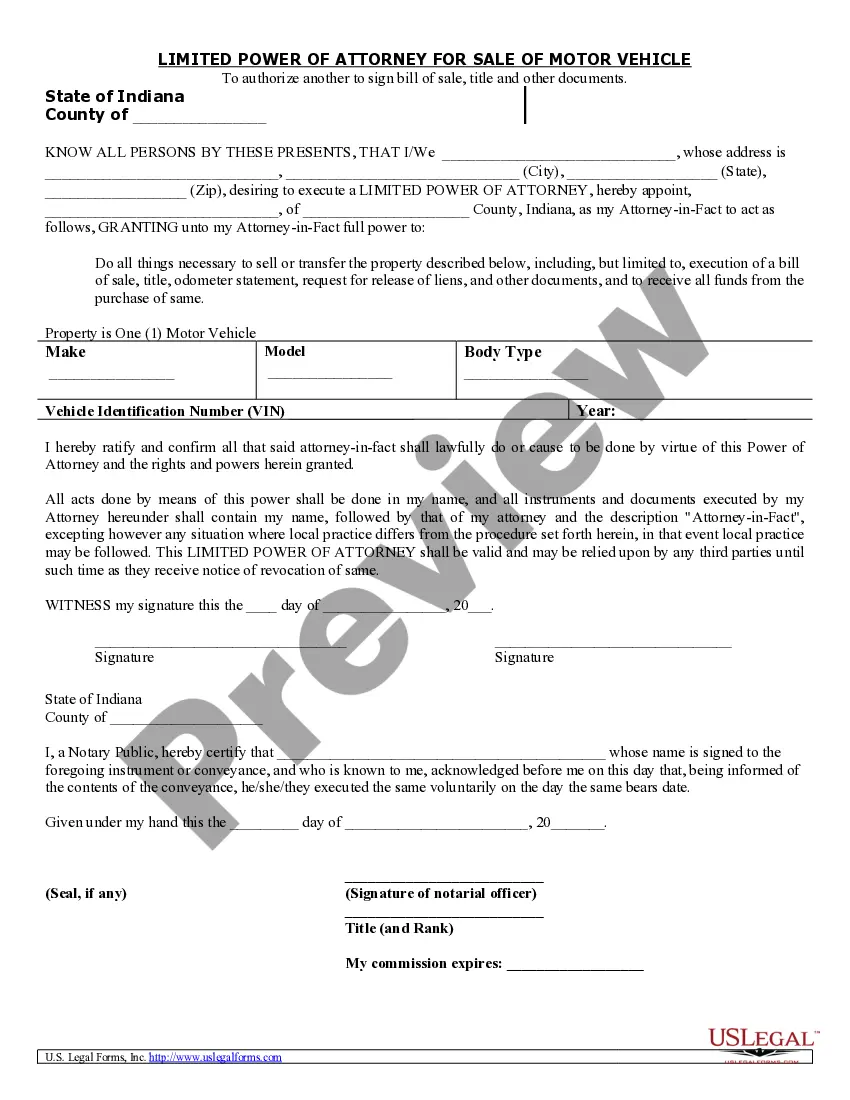

Indiana Power Of Attorney Requirements

Description

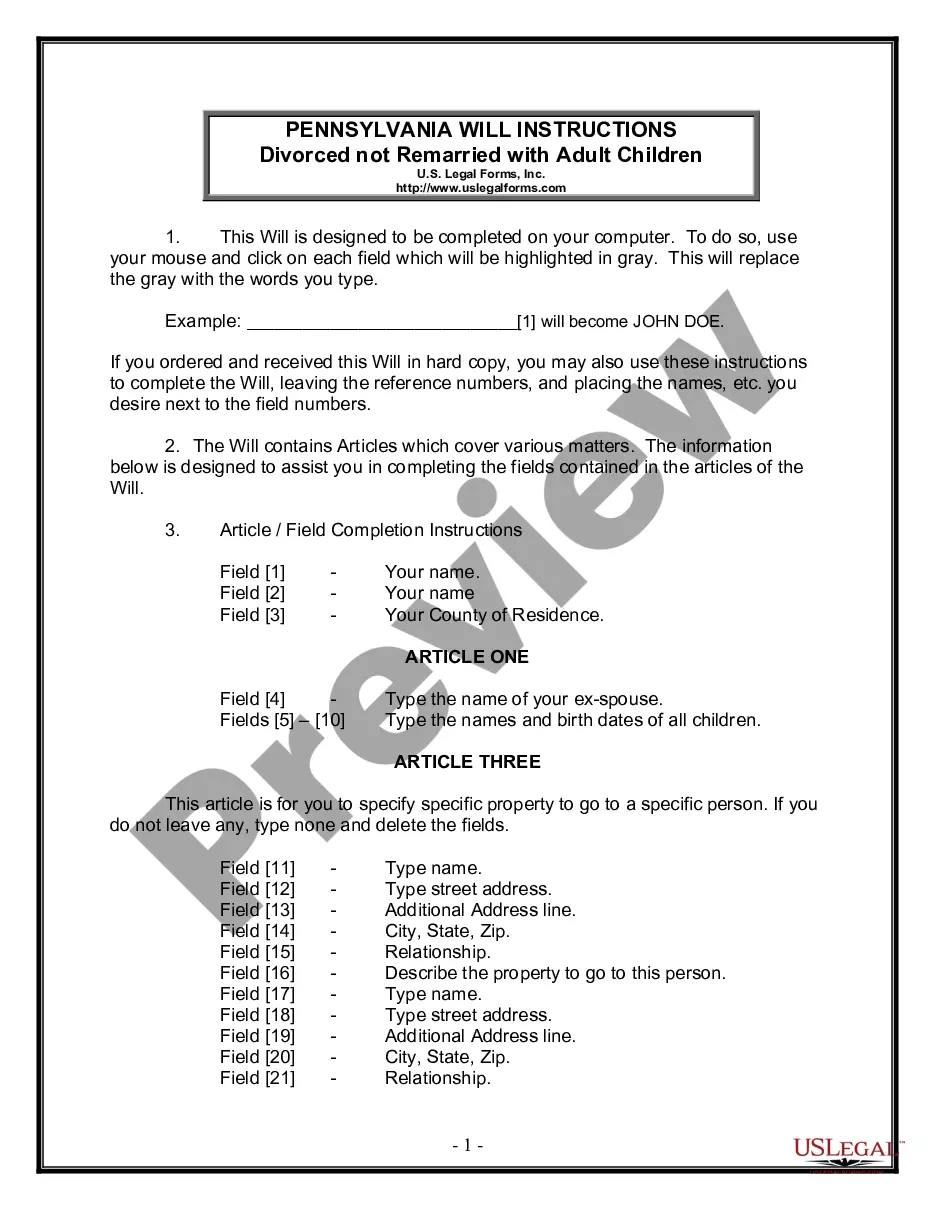

How to fill out Indiana Power Of Attorney For Sale Of Motor Vehicle?

The Indiana Power Of Attorney Requirements you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Indiana Power Of Attorney Requirements will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or review the form description to ensure it fits your requirements. If it does not, make use of the search option to find the right one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Indiana Power Of Attorney Requirements (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

The principal must be a mentally competent adult. The agent must be a mentally competent adult. You can name co-agents (this can be a good way to designate a successor agent in case the first agent becomes unavailable). The POA typically must be in writing and notarized ? or signed with two witnesses present.

What Are the Legal Requirements of a Financial POA in Indiana? Mental Capacity for Creating a POA. ... Notarization or Witnessing Requirement. ... Create the POA Using a DIY Option or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact.

(d) A document creating a power of attorney must comply with recording requirements, including notary and preparation statements, to be recorded under this section.

Instructions for Indiana Form POA-1 In lieu of a Power of Attorney, you can authorize the department to discuss your specific tax return information with someone else by filling out the Personal Representative Portion on that specific individual tax return.

Indiana power of attorney requirements The principal must be a mentally competent adult. The agent must be a mentally competent adult. ... The POA typically must be in writing and notarized ? or signed with two witnesses present.