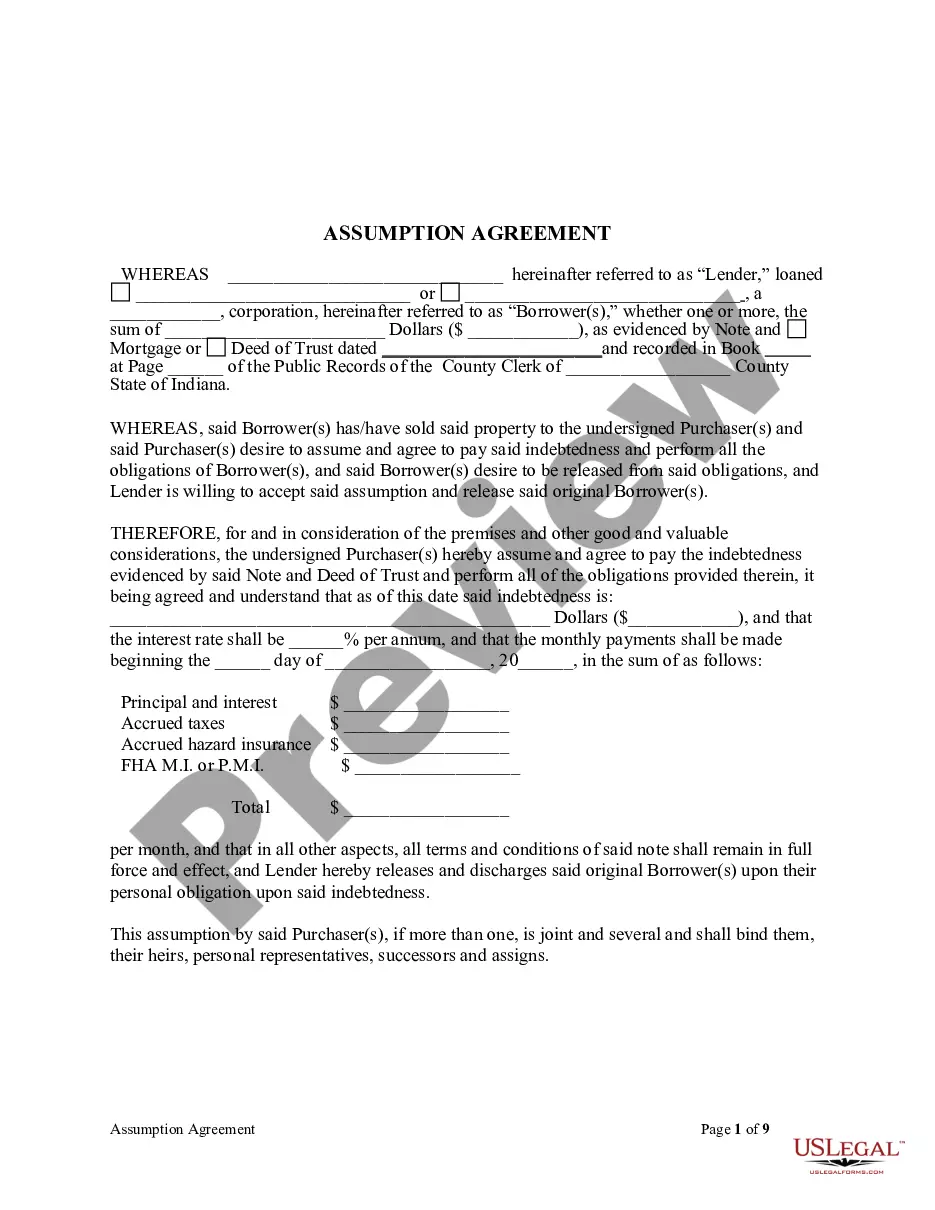

Agreement Release Mortgagors With No Title

Description

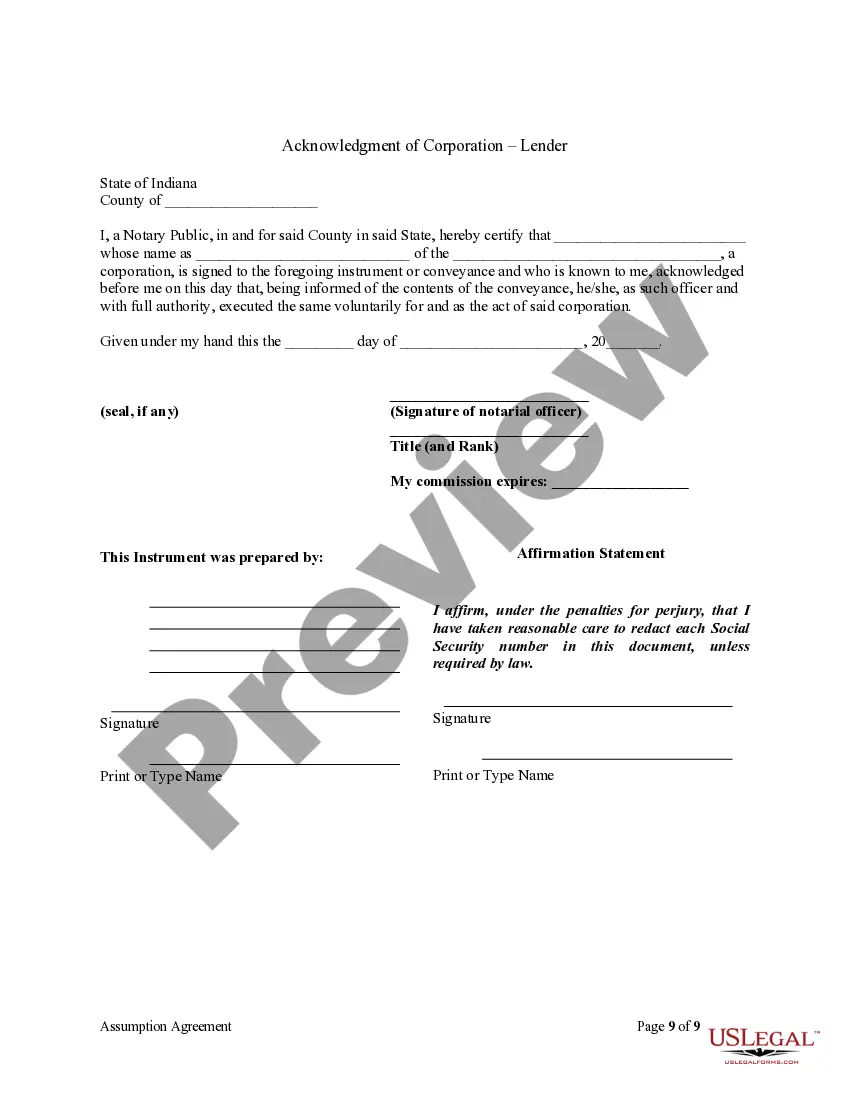

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- Log in to your US Legal Forms account if you're a returning user. If not, create a new account to begin.

- Search for 'Agreement release mortgagors with no title' using the search bar to find the relevant document.

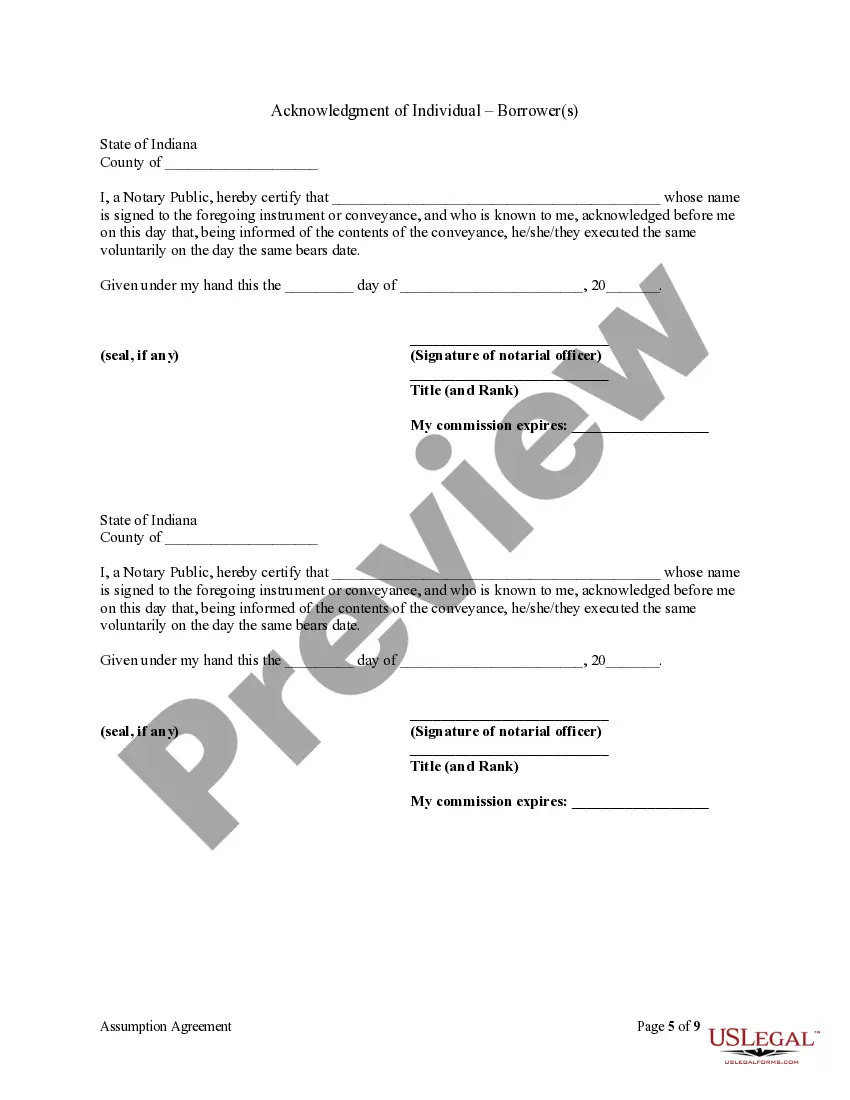

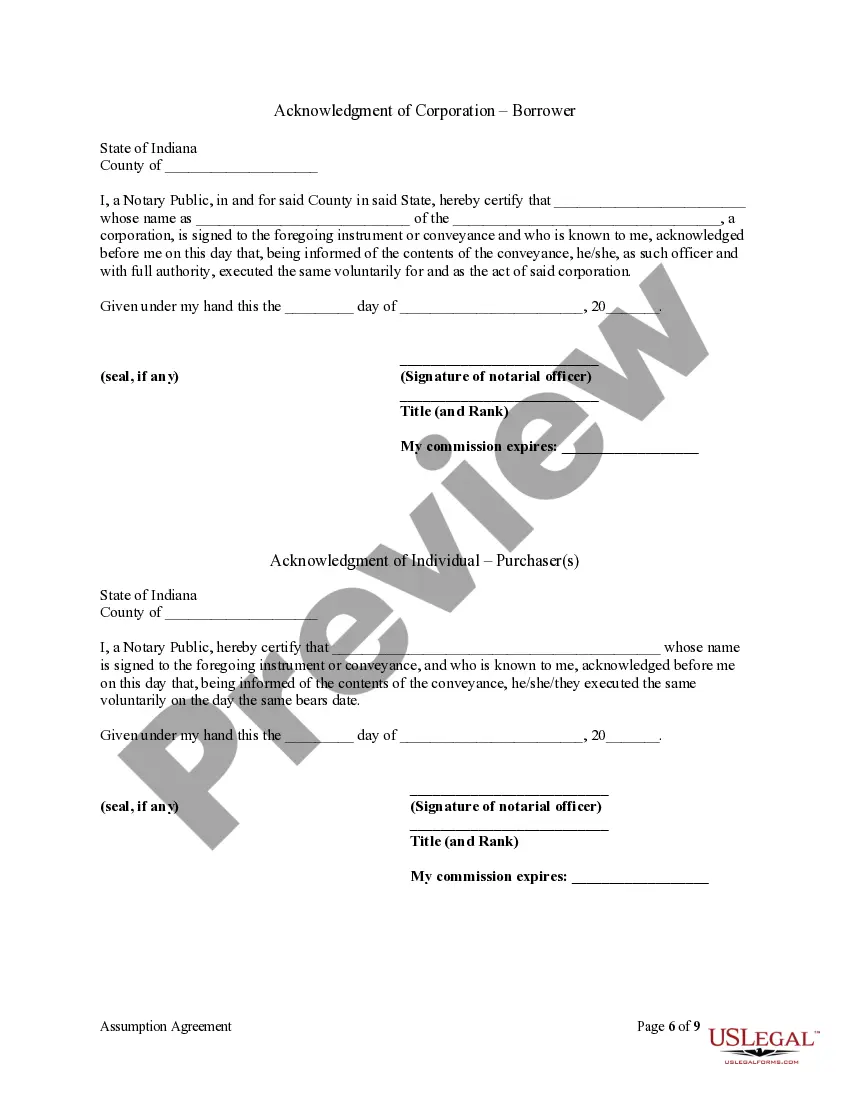

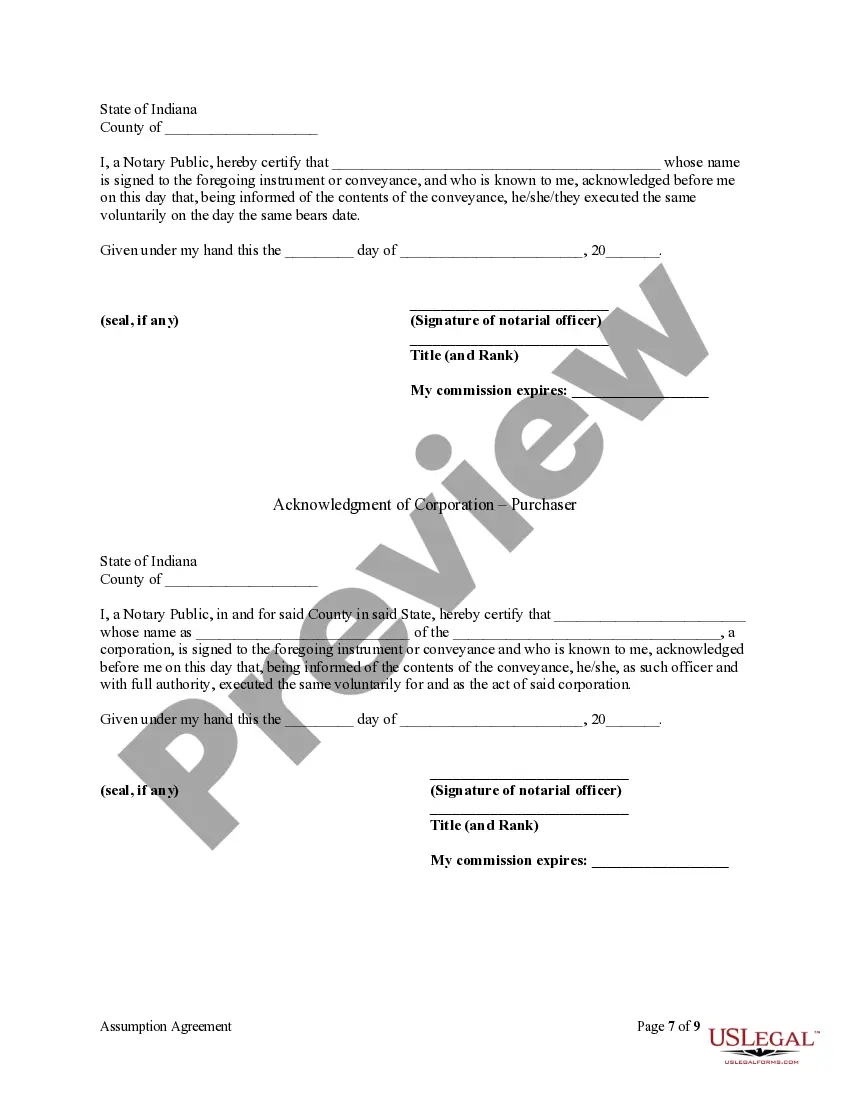

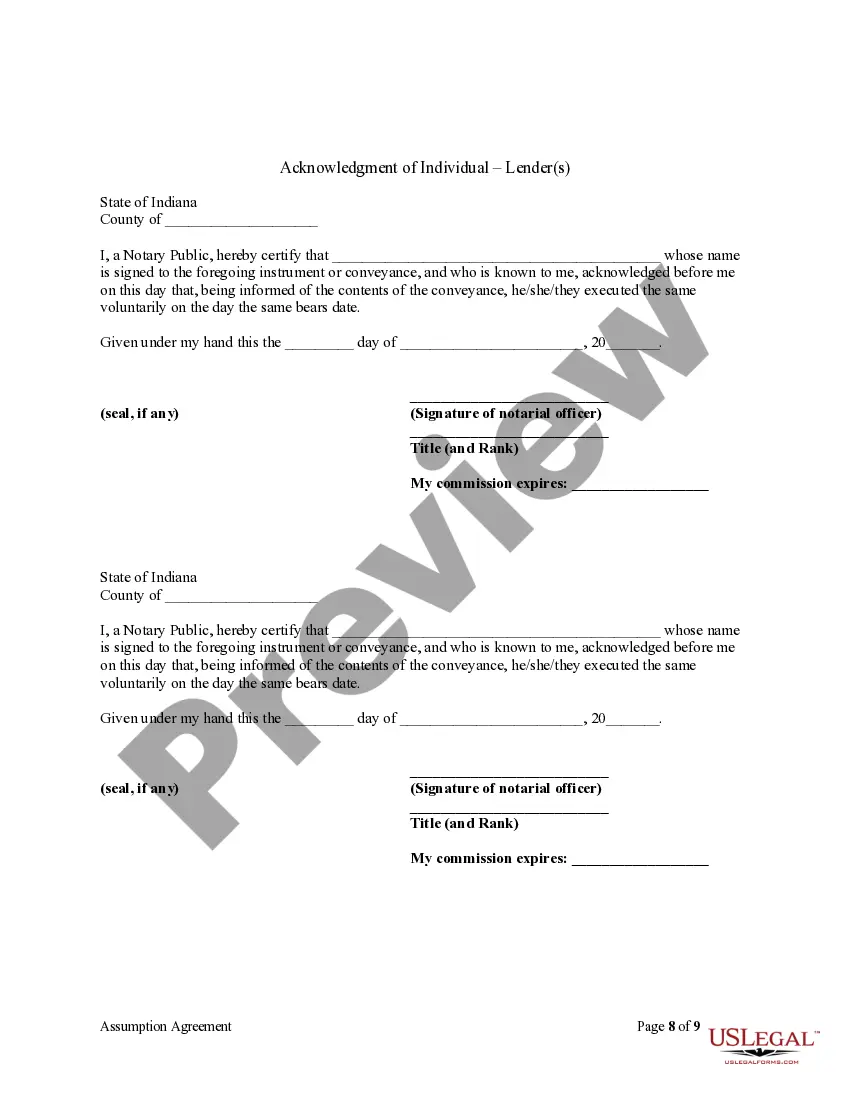

- Review the available templates by checking the Preview mode to ensure they meet your jurisdictional requirements.

- If needed, browse additional forms until you find the perfect match for your scenario.

- Purchase the selected document by clicking the Buy Now button and choosing your subscription plan.

- Complete your payment through credit card or PayPal and ensure your account is activated.

- Download the form to your device, making it readily available for your legal needs.

US Legal Forms stands out with an extensive collection of over 85,000 customizable legal templates, empowering you to craft precise documents without hassle. Their platform provides access to experienced professionals ready to assist, ensuring you create legally binding agreements accurately.

Once you've completed your agreement release mortgagors without a title, remember to check back for any additional documents you might need. Visit US Legal Forms today to streamline your legal documentation process.

Form popularity

FAQ

A release of a mortgage is not the same as a deed, although they are related. A deed transfers ownership of property, while a mortgage release confirms that the debt tied to the property has been satisfied. Understanding this distinction is vital, especially in situations involving Agreement release mortgagors with no title, as incorrect documentation can lead to legal issues. Clarity on these terms ensures smoother transitions in property ownership.

The time it takes to complete an Agreement release mortgagors with no title can vary widely. Typically, the process ranges from a few weeks to a couple of months, depending on factors such as lender processing times and local regulations. To ensure a smoother experience, it's wise to gather all necessary documents in advance and follow up with your lender. For further assistance, consider using US Legal Forms, which provides resources to help you navigate the mortgage release process effectively.

Yes, it is possible for someone to be on a mortgage without being on the title. This situation often arises when one party takes on the mortgage obligations while another holds the legal title. For agreement release mortgagors with no title, it is important to understand the implications of such arrangements, especially during a property sale or transfer. Consulting uslegalforms can provide guidance and ensure you address any potential issues effectively.

The timeline to receive the deed to your house varies, but it can typically take a few weeks to several months. After paying off your mortgage, the lender must file a release deed, which effectively frees you from the mortgage obligation. For agreement release mortgagors with no title, timely filing can expedite the process. Using uslegalforms can help you navigate this process efficiently.

Not filing a release deed can lead to complications in property ownership, especially for agreement release mortgagors with no title. You may face difficulties when trying to sell your property or obtain a new mortgage. Potential buyers may see unresolved claims, leading to distrust. Additionally, you might encounter legal issues if your lender decides to pursue action related to the outstanding mortgage.

To obtain a lien release letter, reach out to your lender or creditor who holds the lien. Often, they will issue a letter after confirming all debts have been settled. If you have difficulties, U.S. Legal Forms offers guidance that can help streamline the process, especially when dealing with an agreement release mortgagors with no title.

To find the title deed to your house, start with your local county recorder's office. Many counties have online databases where you can search for your deed using your property address. If you still struggle to find it, U.S. Legal Forms provides tools and resources to assist you with obtaining an agreement release mortgagors with no title, streamlining your search.

To obtain a copy of a lien release from the IRS, you must contact the IRS directly. If you had an IRS lien, the release should have been issued once the tax debt was settled. Make sure to have your tax information handy to expedite the process, especially if you are dealing with an agreement release mortgagors with no title due to some financial concerns.

Once your mortgage is settled, your lender should provide you with your property deed along with a lien release document. It’s advisable to confirm with your lender about the timeline for receiving these documents. If you encounter challenges, U.S. Legal Forms can help you navigate the process effectively, including an agreement release mortgagors with no title.

If you are on the mortgage but not the deed, you may have some financial obligations but not ownership rights. Typically, only the person listed on the deed has legal rights to the property. Seek legal advice to clarify your position, especially when dealing with agreements regarding release mortgagors with no title to ensure your interests are protected.