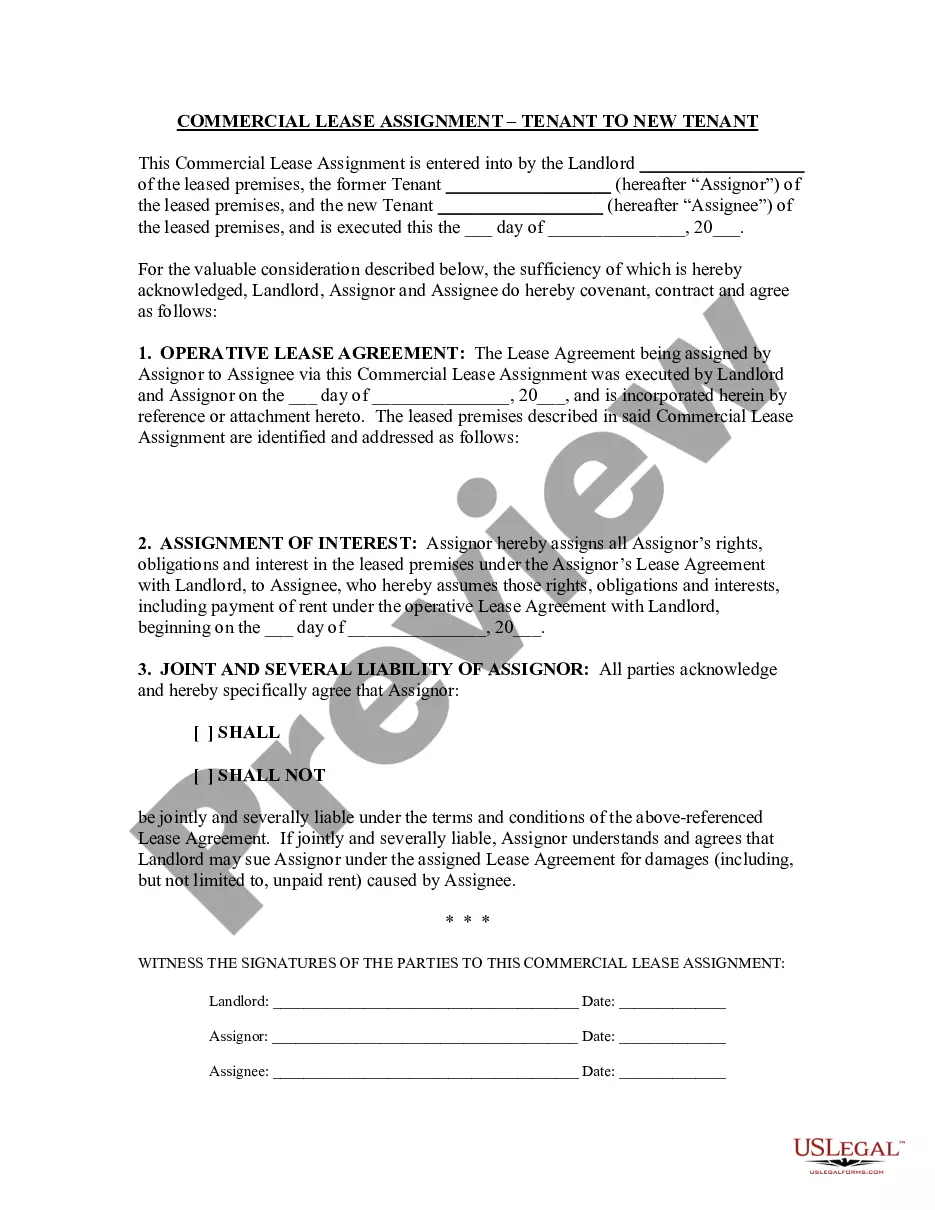

Assignment of Commercial Lease from Tenant to new Tenant, with Landlord Remaining Unchanged. This agreement provides for the initial Tenant to either be joint and severally liable or not, depending upon the agreement reached between the parties.

Assignment in legal terms means the transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. Some contracts restrict the right of assignment, so the terms of the contract must be read to determine if assignment is prohibited. For example, a landlord may permit a lease to be assigned, usually along with an assumption agreement, whereby the new tenant becomes responsible for payments and other duties of the original lessee.

Tenant in situ properties for sale refer to real estate assets that are listed on the market while having existing tenants in place. These properties provide an opportunity for buyers to invest in income-generating assets from the moment of purchase. Rental income, tenancy terms, and lease agreements already established make tenant in situ properties appealing to investors seeking cash flow and reduced vacancy risks. One type of tenant in situ property for sale is residential properties. These can include single-family homes, townhouses, or condominiums with tenants already residing in them. This type of property offers investors a steady rental income stream without the hassle of finding new tenants or waiting for a property to become occupied. Commercial properties with tenants in situ are also available for sale. These can encompass office buildings, retail spaces, or warehouses that are already leased to businesses. Investing in commercial tenant in situ properties enables buyers to benefit from the established revenue generated by businesses renting the space, eliminating the need for tenant searches or negotiations. Furthermore, there are tenants in situ properties for sale in the industrial sector. These can comprise factories, manufacturing facilities, or distribution centers that have tenants operating within them. Investing in industrial tenant in situ properties provides investors with the advantage of immediate rental income, leveraging the ongoing operations of the tenant businesses. Investors looking for maximum diversification can explore mixed-use tenant in situ properties for sale. These properties encompass a combination of residential, commercial, and/or industrial spaces within the same complex, catering to a variety of tenants. Such properties bring in multiple rental incomes and spread the risk across different sectors, making them an attractive option. The advantages of purchasing tenant in situ properties include immediate rental income, reduced vacancy risks, established tenant relationships, and the potential for long-term appreciation. However, investors should conduct thorough due diligence, including reviewing lease agreements, tenant histories, and property conditions, to ensure a sound investment decision. By considering these factors, buyers can align their investment goals with the specific type of tenant in situ property that best suits their portfolio requirements.