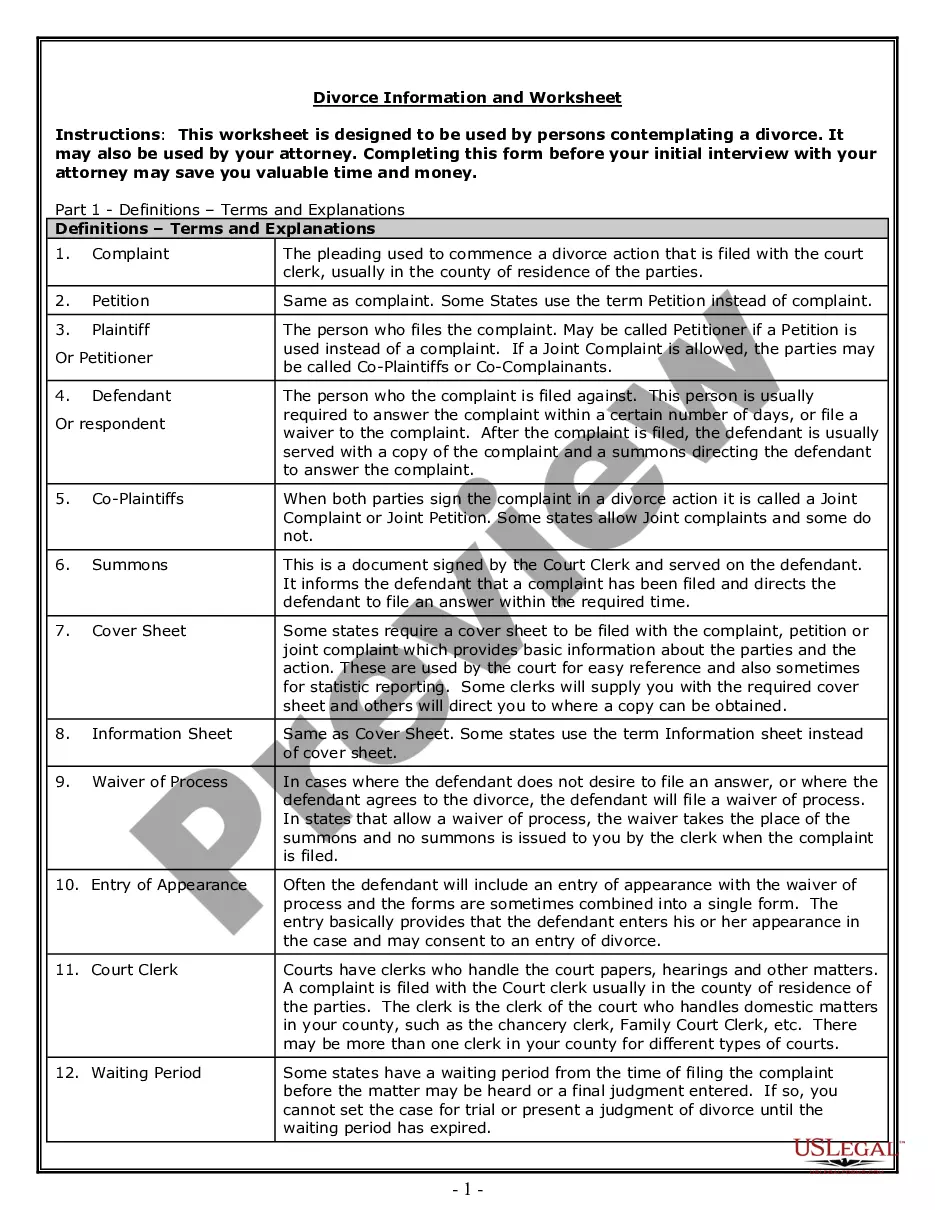

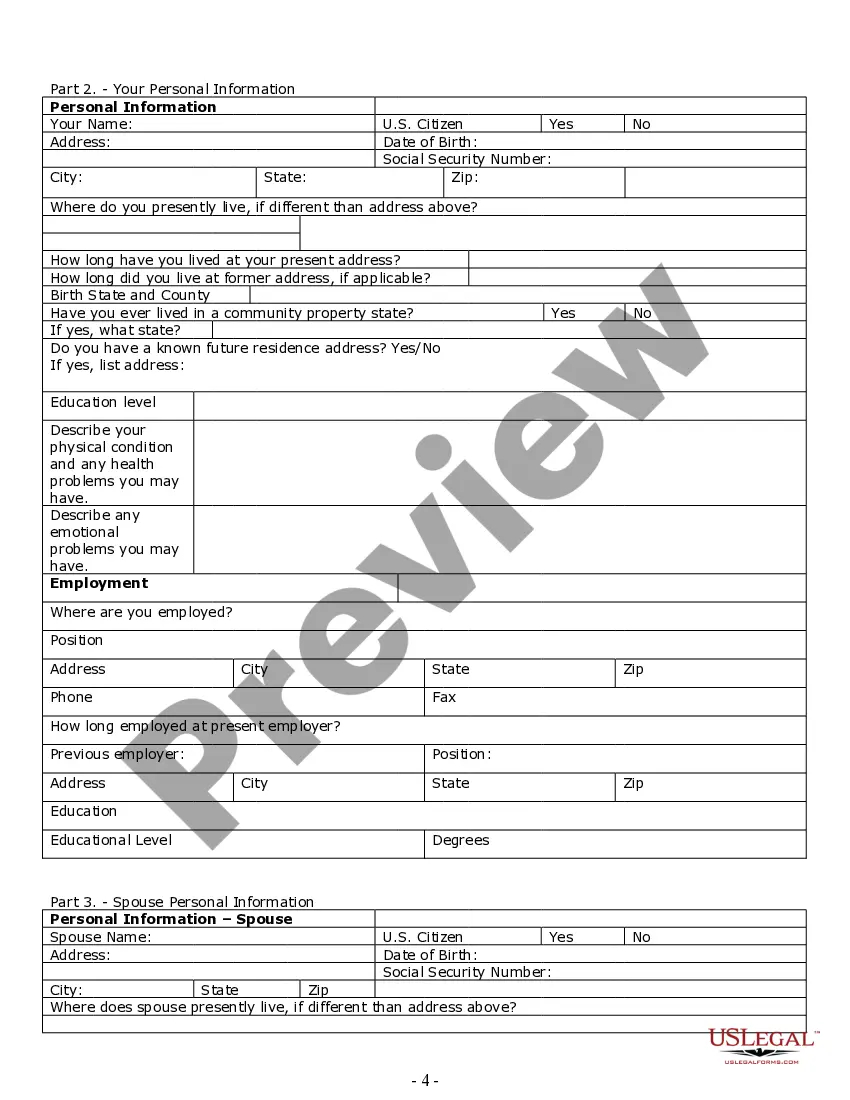

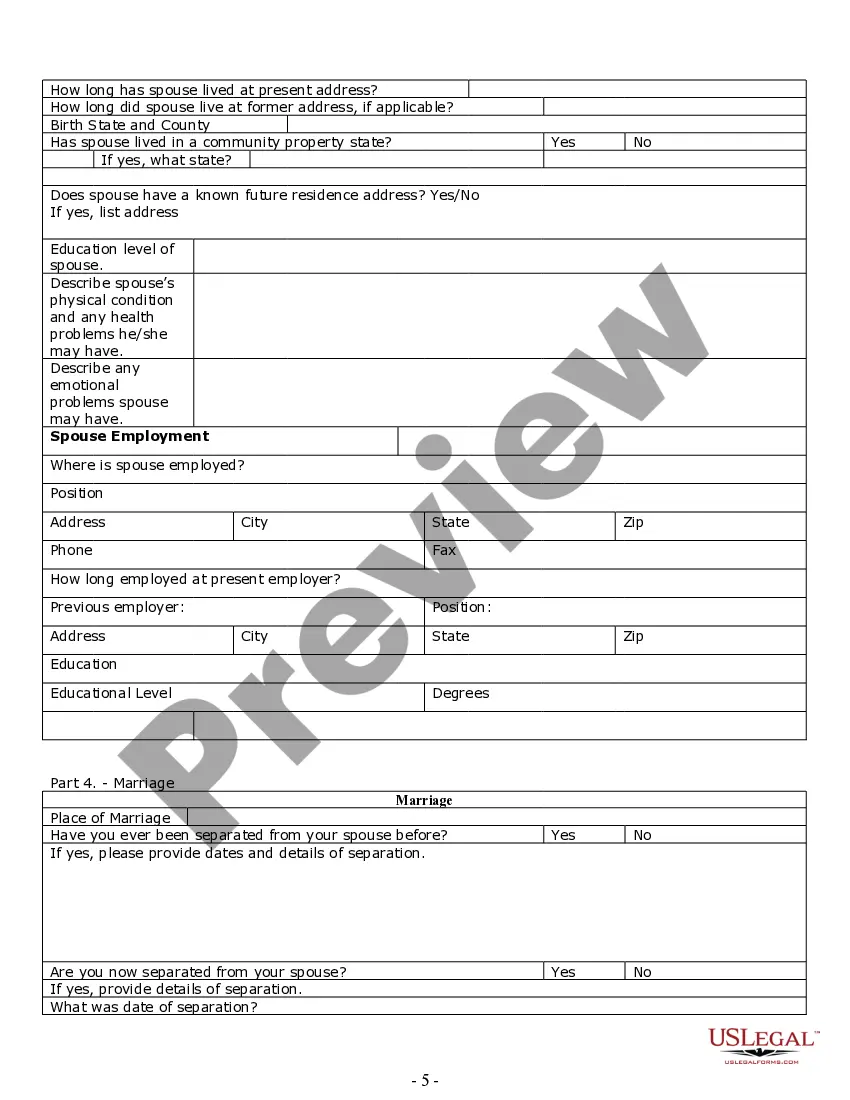

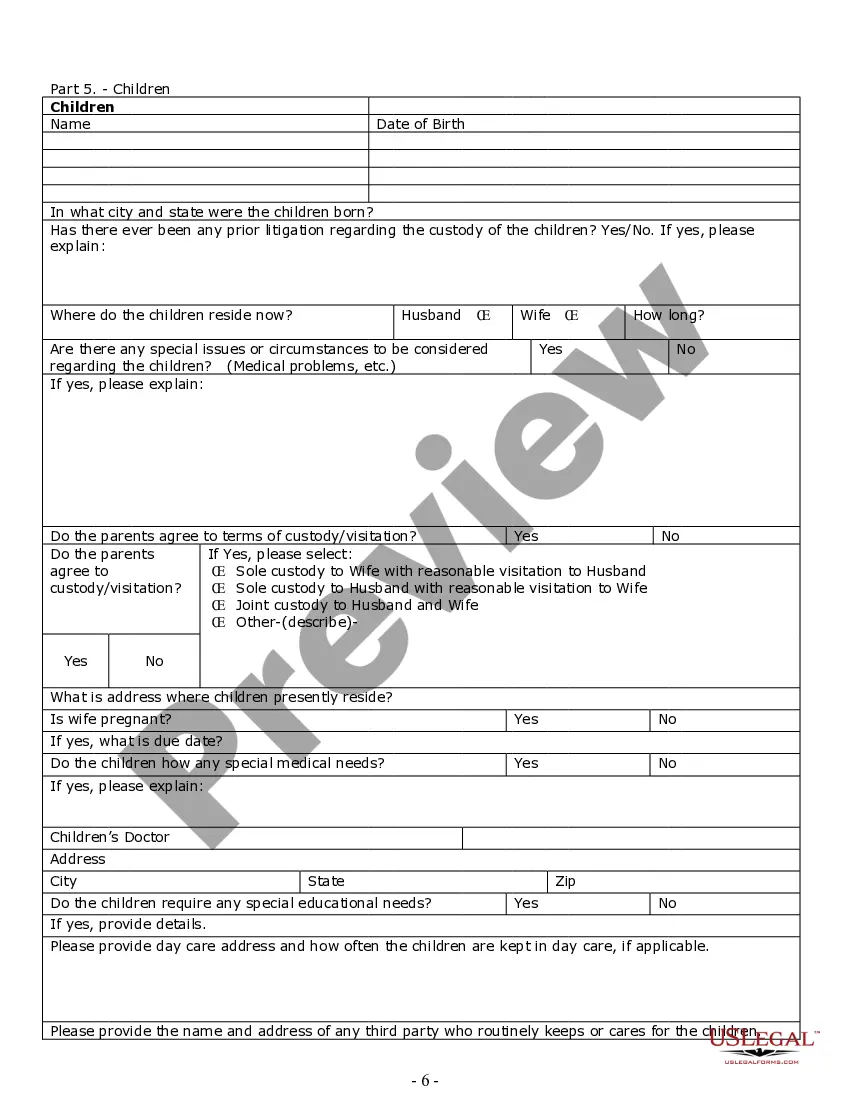

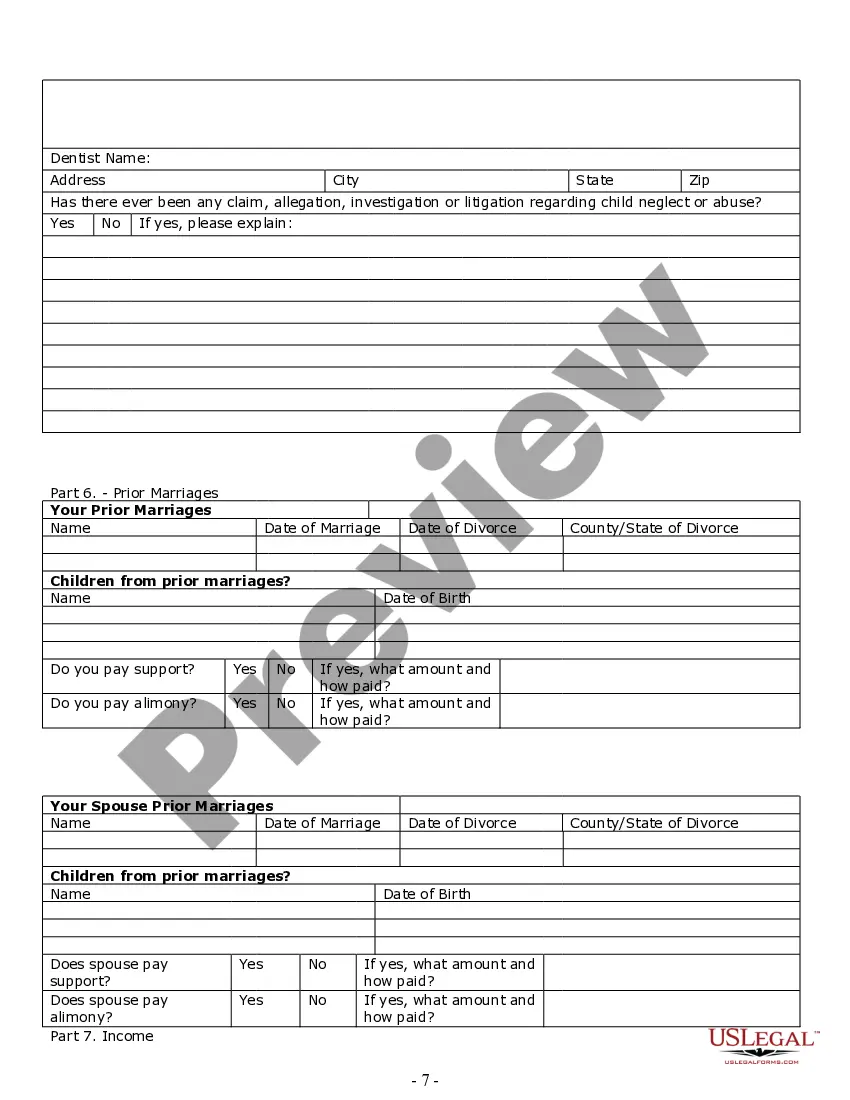

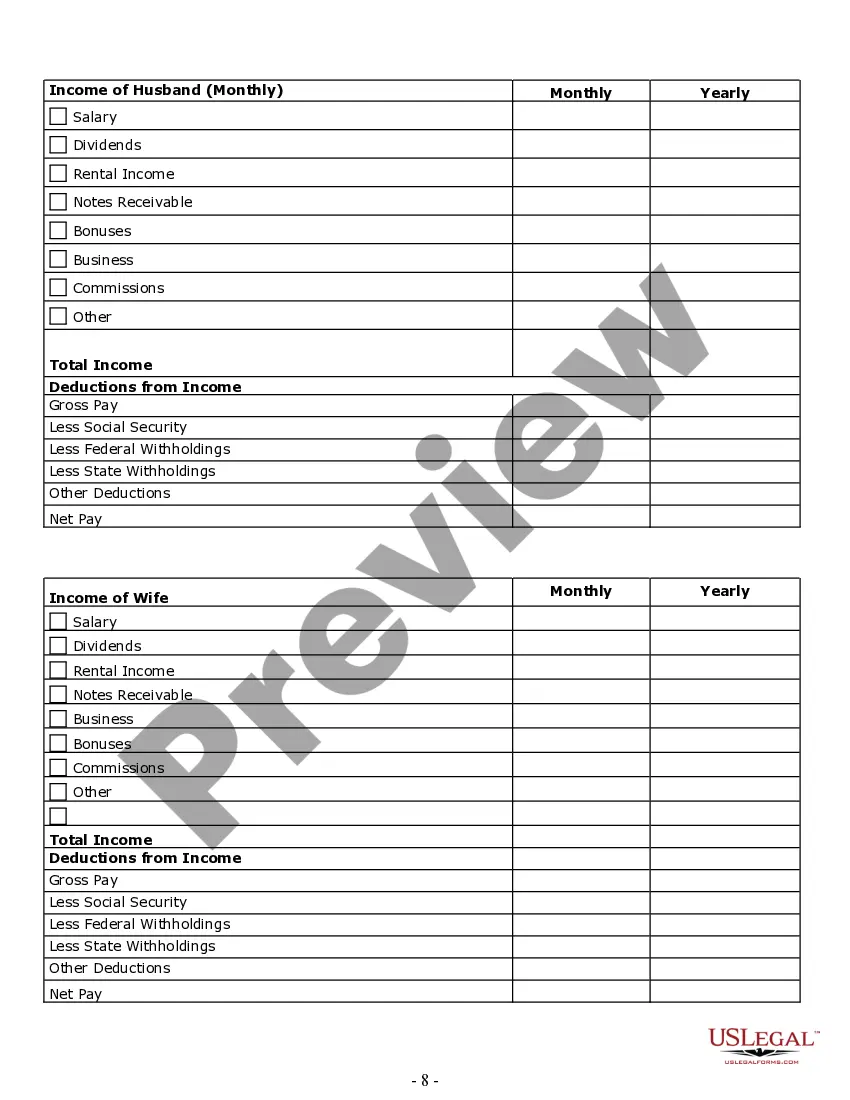

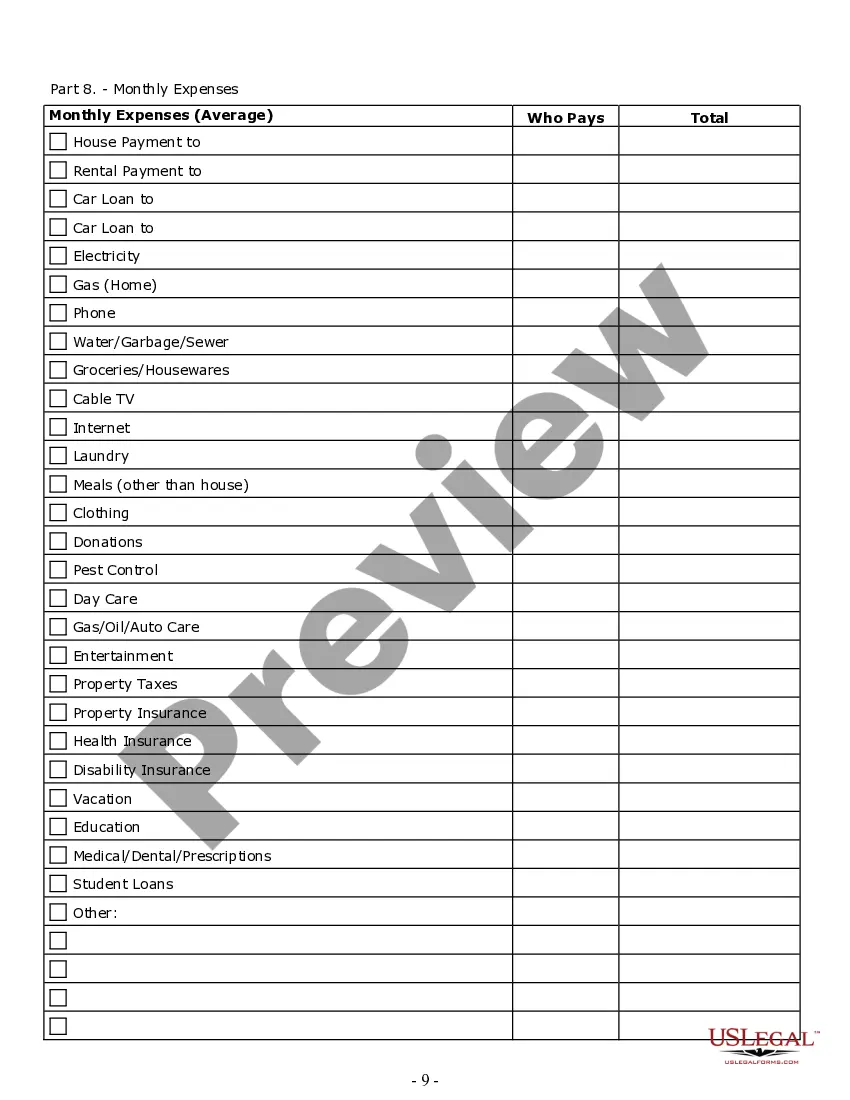

This package is over 25 pages in length and contains information about divorce in general, definitions, visitation, child support, child custody and other matters. Worksheets are also included that include detail information and financial forms. Ideal for a client interview/information form, or for you to complete prior to an interview with an attorney. This package is also ideal for you to read and complete before attempting your own divorce.

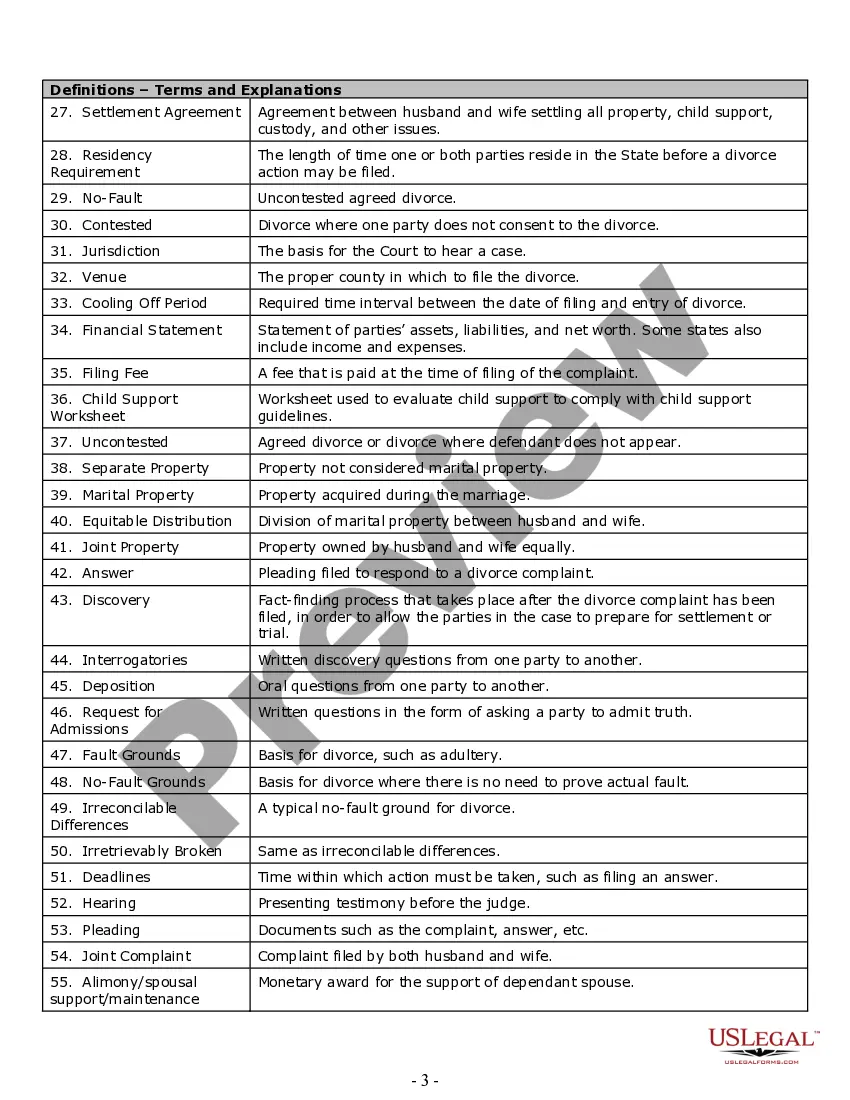

A Divorce Asset Worksheet with Answers is a comprehensive document that helps individuals going through a divorce identify, list, and assess their assets and liabilities. This worksheet serves as a crucial tool to track and evaluate the marital property division. It assists in providing an accurate overview of the couple's financial situation, ensuring a fair and equitable distribution of assets. Here are some relevant keywords for this topic: divorce asset worksheet, marital property, asset division, liabilities, financial evaluation, equitable distribution, divorce financial planning, divorce settlement, divorce financial worksheet. Different types of Divorce Asset Worksheets with Answers may include: 1. Basic Divorce Asset Worksheet: This is the most common type that covers essential aspects such as bank accounts, real estate properties, vehicles, retirement accounts, investment accounts, personal belongings, and debts. 2. Advanced Divorce Asset Worksheet: This worksheet offers more comprehensive sections, allowing for a more detailed assessment of assets. It may involve additional categories like business interests, intellectual property, valuable collections, life insurance policies, and other valuable assets. 3. Digital Divorce Asset Worksheet: In the digital era, this worksheet includes provisions for listing and evaluating digital assets such as cryptocurrencies, online businesses, domain names, social media accounts, websites, and online storage. 4. Debt and Liability Worksheet: This type focuses primarily on debts and liabilities, including mortgages, loans, credit card debts, medical bills, taxes owed, and any other outstanding obligations. It helps to determine the distribution of these financial responsibilities among divorcing spouses. 5. Retirement Asset Worksheet: As retirement accounts are often significant assets in a divorce, this worksheet specifically addresses pensions plans, 401(k) accounts, IRAs, annuities, and other retirement savings. It helps to calculate the present and future value of these assets, considering tax implications and early withdrawal penalties. Each of these Divorce Asset Worksheets with Answers aims to make the asset division process more efficient and transparent, ensuring fair settlement negotiations and reducing the potential for disputes in court.