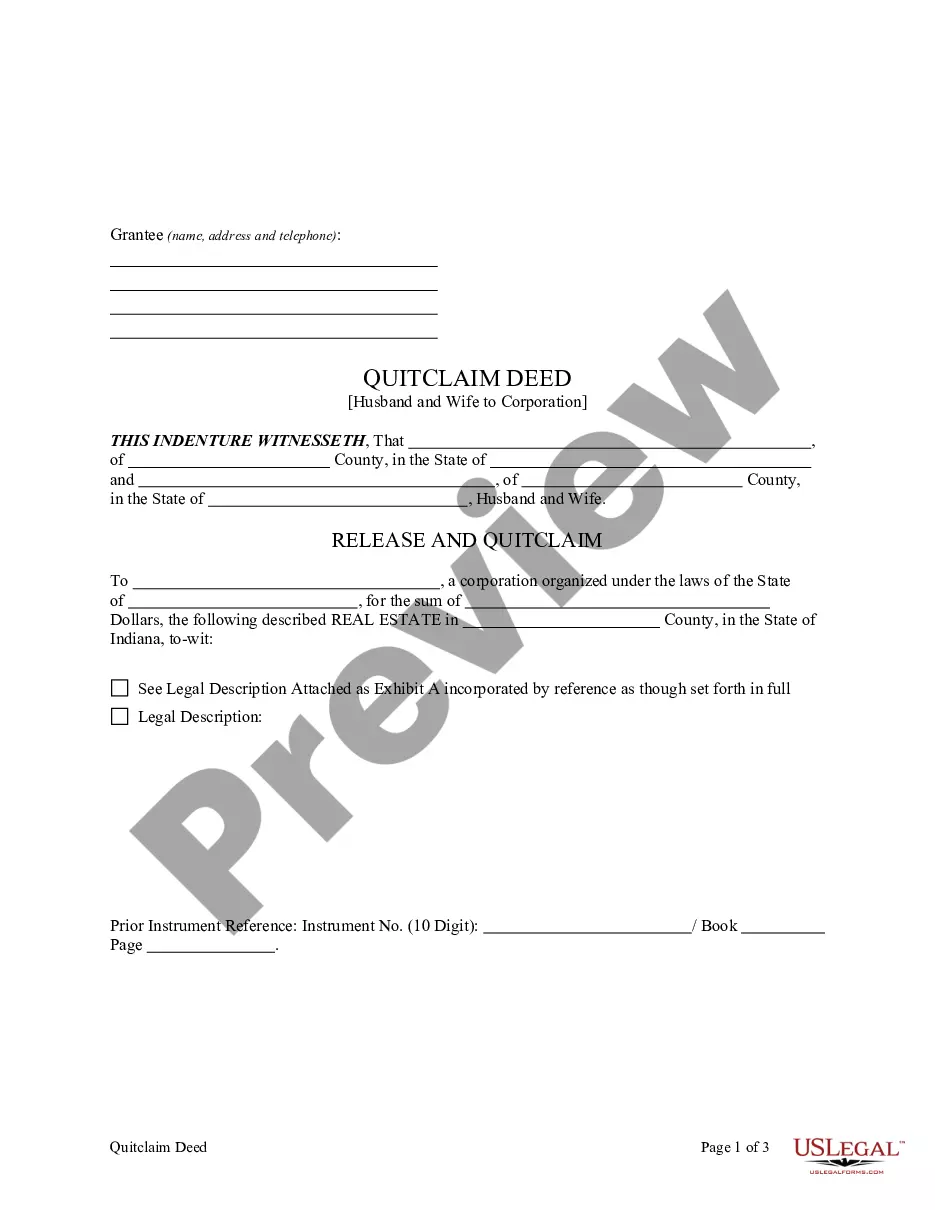

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Husband Wife Corporation Form

Description

How to fill out Indiana Quitclaim Deed From Husband And Wife To Corporation?

There is no longer a necessity to spend hours searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our website features over 85,000 templates for any business and personal legal situations classified by state and usage area.

Utilize the search bar above to look for another template if the current one does not meet your needs. Click Buy Now next to the template title once you find the appropriate one. Choose the most suitable pricing plan and either create an account or Log In. Complete your subscription payment with a credit card or via PayPal to proceed. Select the file format for your Husband Wife Corporation Form and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to work with an online editor. Completing official paperwork under federal and state laws and regulations is quick and easy with our library. Experience US Legal Forms today to keep your documentation organized!

- All forms are expertly crafted and confirmed for authenticity, so you can be confident in obtaining a current Husband Wife Corporation Form.

- If you are acquainted with our platform and already possess an account, you must ensure your subscription is current prior to accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by opening the My documents tab in your profile.

- If this is your first time using our platform, the process will require a few additional steps to complete.

- Here’s how new users can locate the Husband Wife Corporation Form in our repository.

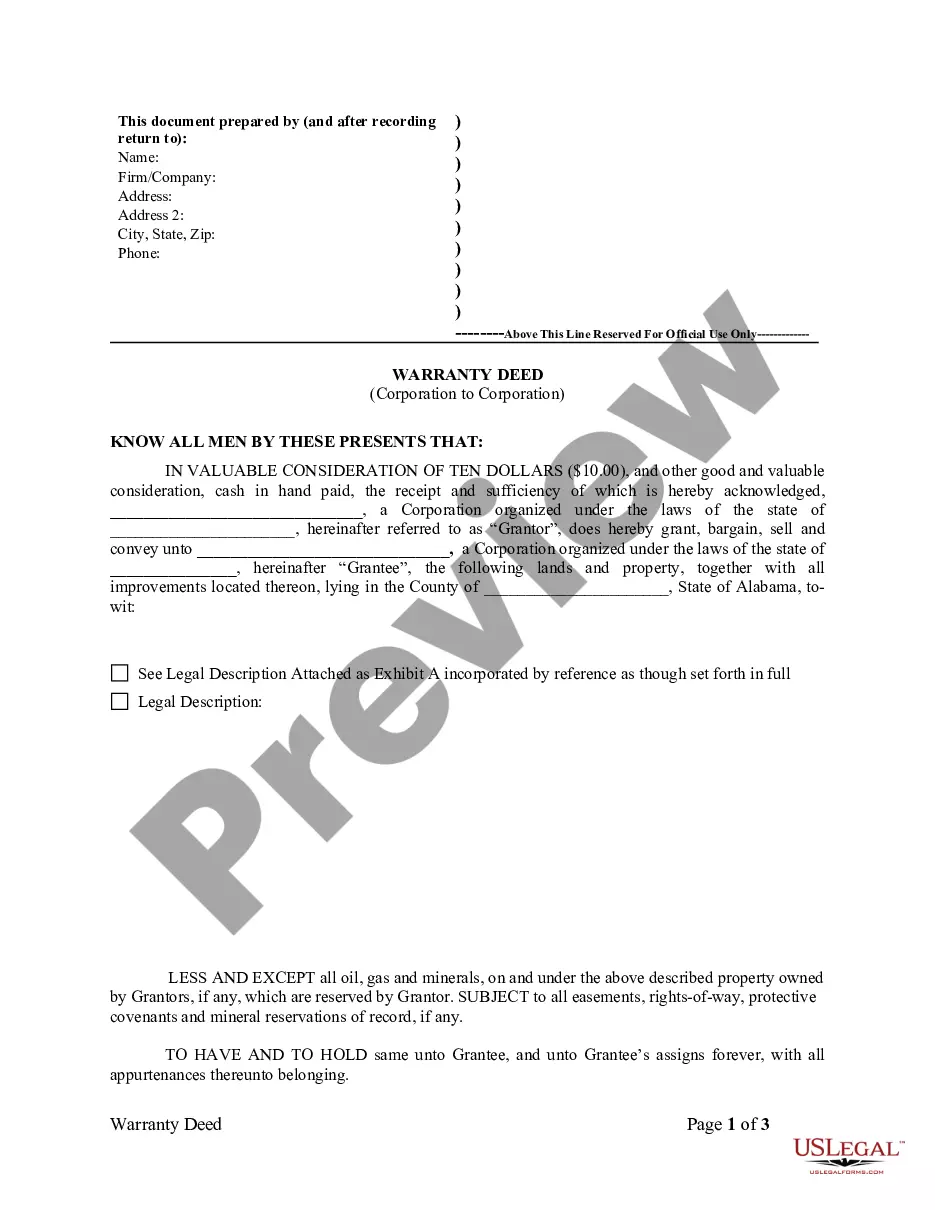

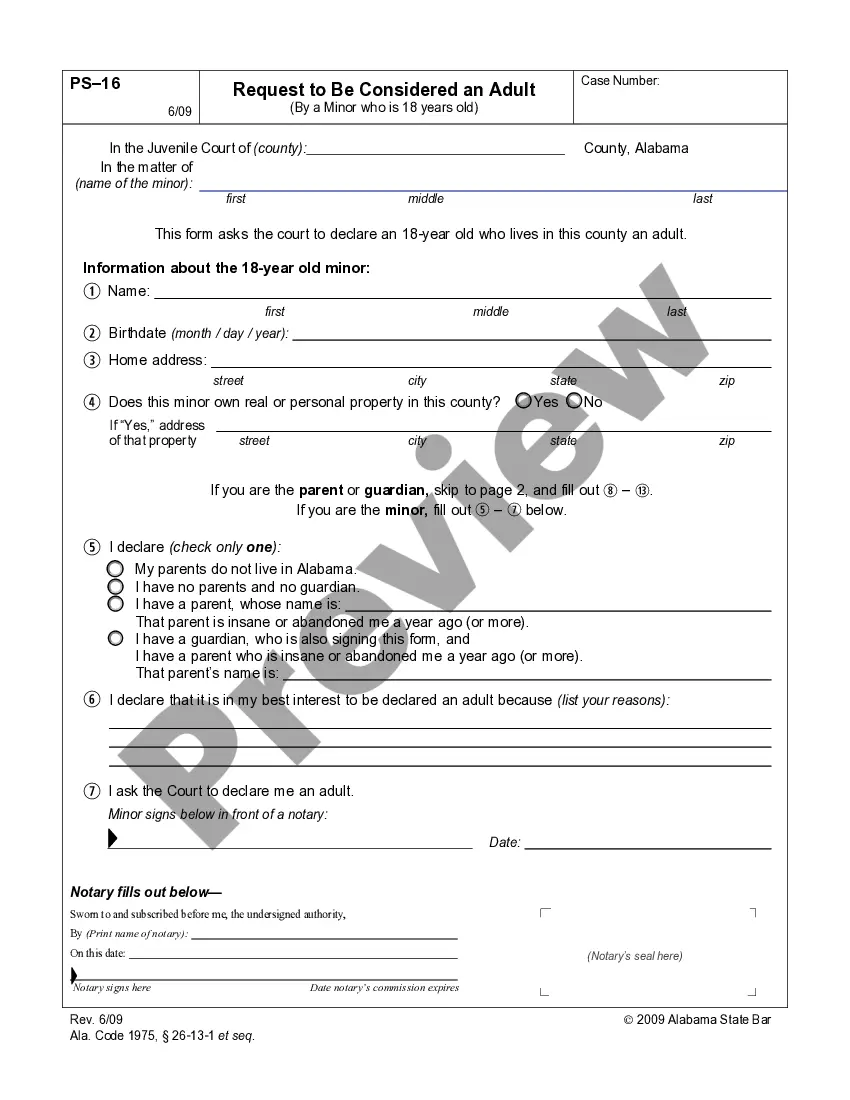

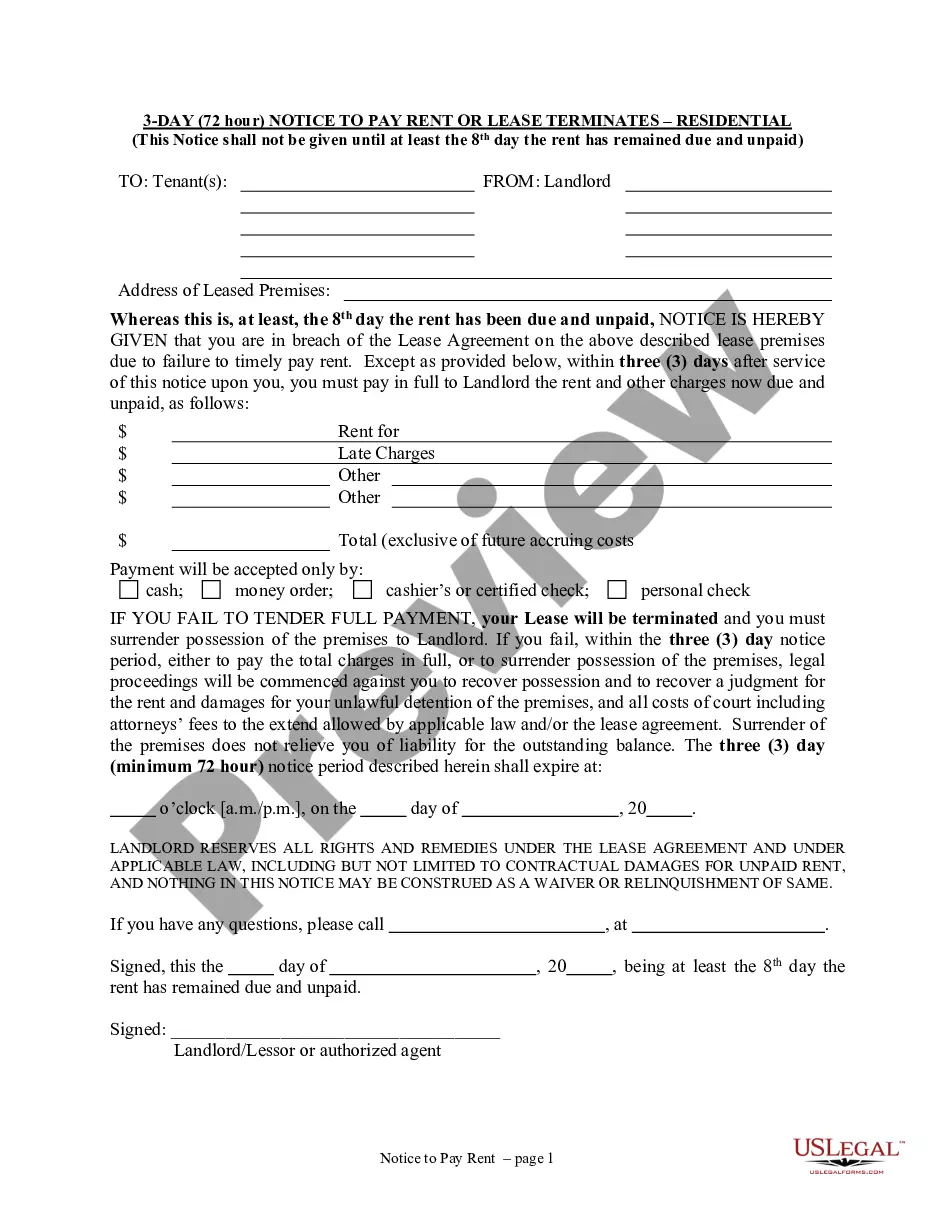

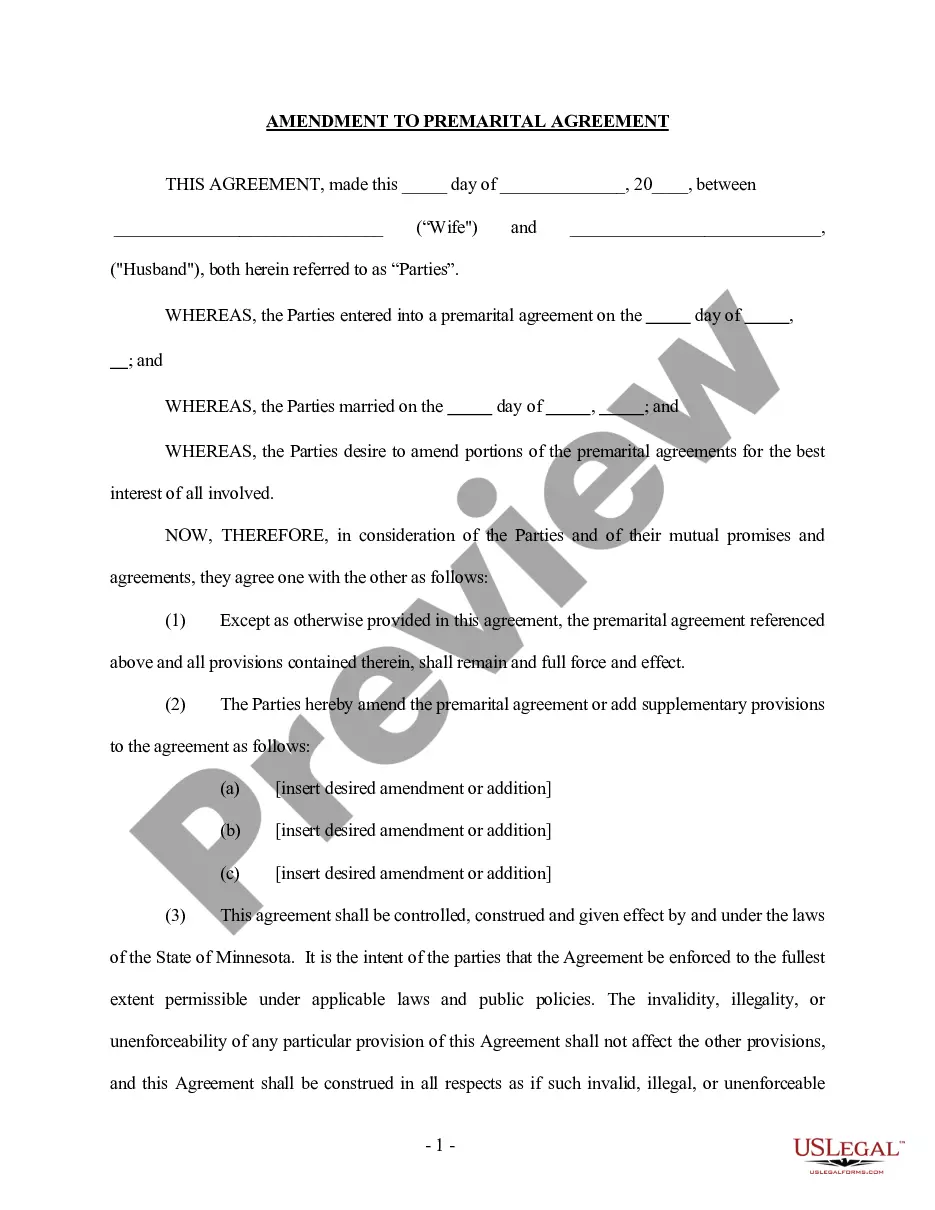

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do so, leverage the form description and preview options if available.

Form popularity

FAQ

A sole proprietorship is typically owned by one person only, which means two people cannot officially share ownership. However, a husband and wife can operate a sole proprietorship together, with one spouse as the owner using the husband wife corporation form for necessary business registrations. This setup allows both partners to work together while maintaining simple tax reporting.

Yes, a husband and wife can form a limited partnership as long as they follow their state's specific regulations. The husband wife corporation form can play a role in structuring this partnership effectively. It may provide tax advantages and limit personal liability, making it a worthwhile consideration for couples in business together.

Claiming your spouse on your tax return requires using the husband wife corporation form. By including your spouse's income and deductions, you may qualify for various tax benefits. It's advisable to review relevant tax laws or consult an expert to ensure accuracy in your filing.

To claim your husband for tax purposes, you need to file your taxes using the husband wife corporation form. This will allow you to report your combined income and potentially benefit from tax breaks that apply to married couples. Make sure you gather all necessary income documents and consider consulting a tax professional for guidance.

When filing as a husband-wife LLC, the couple can choose to treat their business as a sole proprietorship or a partnership on their tax return. This choice allows for simplified reporting since both spouses share ownership and responsibilities. It's essential to use the husband wife corporation form to ensure compliance with IRS regulations. For further assistance, platforms like US Legal Forms provide tailored resources to help navigate the filing process effectively.

Yes, a married couple can successfully run a business together. Many couples find that teamwork enhances efficiency and fosters a strong partnership. Structuring your business as a husband wife corporation form can provide protection and clarity in operations. Embrace the strengths each partner brings to create a thriving enterprise.

Collaborating in business can be beneficial for husband and wife teams. It allows you to combine resources and talents, fostering a shared vision for success. While it’s essential to separate personal and professional lives, many couples find that working together enhances their relationship. A husband wife corporation form can help manage joint responsibilities and streamline decision-making.

Transferring ownership of your corporation to your wife involves several straightforward steps. First, review your corporate documents to understand any required procedures for transfer. You'll typically need to draft and file a formal agreement and notify state authorities. Utilize platforms like US Legal Forms to access the necessary documents and guidance to ensure a smooth transition.

Husbands and wives can collaborate on a variety of business ventures, such as a retail shop, consultancy service, or online store. The flexibility of a husband wife corporation form allows you to tailor your business to your skills and interests. Operating together not only enhances efficiency but can also improve decision-making. Pursue a business that aligns with both your passions and expertise.

For husband and wife partnerships, a husband wife corporation form is frequently recommended. This structure combines benefits like limited liability and the ability to easily manage profits and losses. It also helps in establishing a formal business presence, which can be advantageous when seeking loans or attracting clients. Evaluate your specific needs to determine the ideal choice.