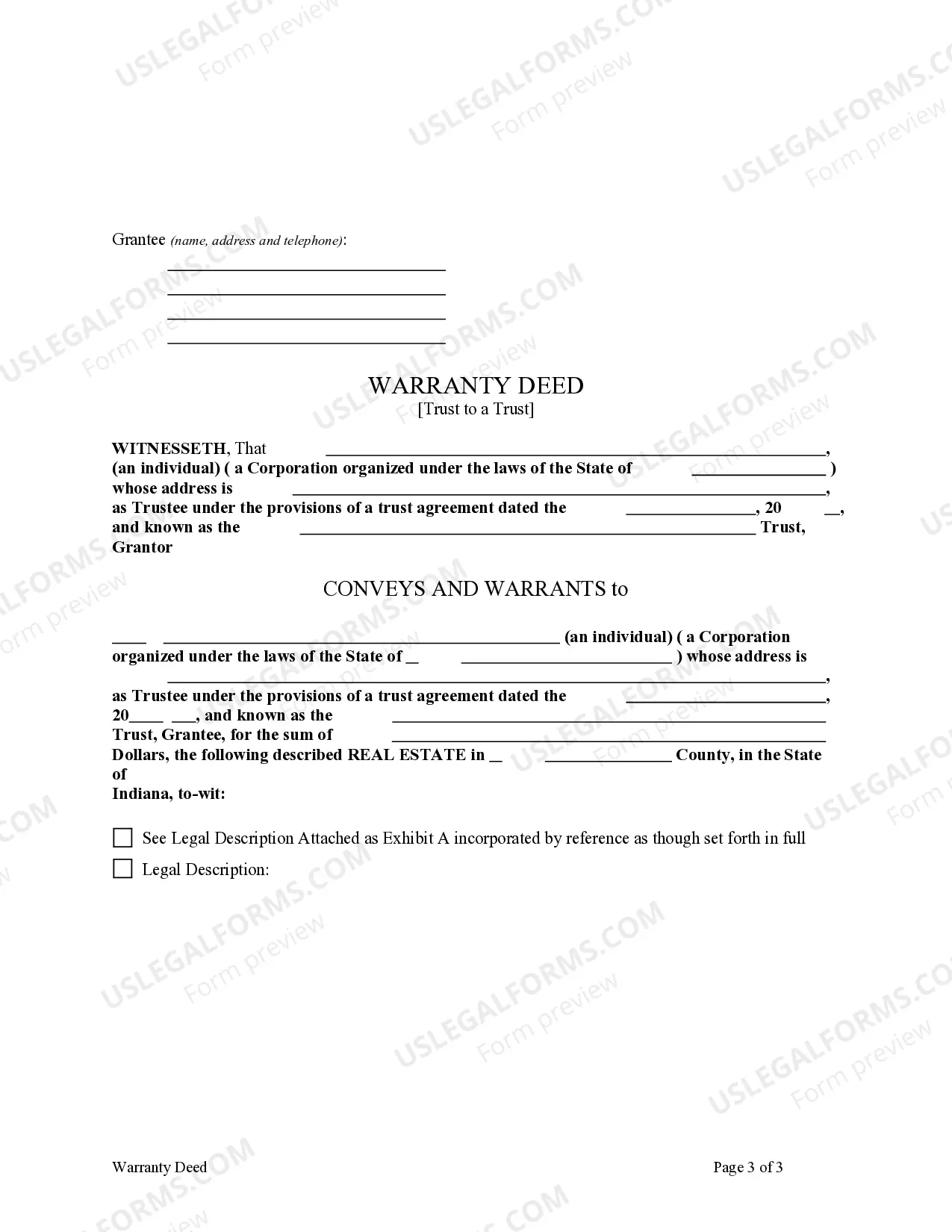

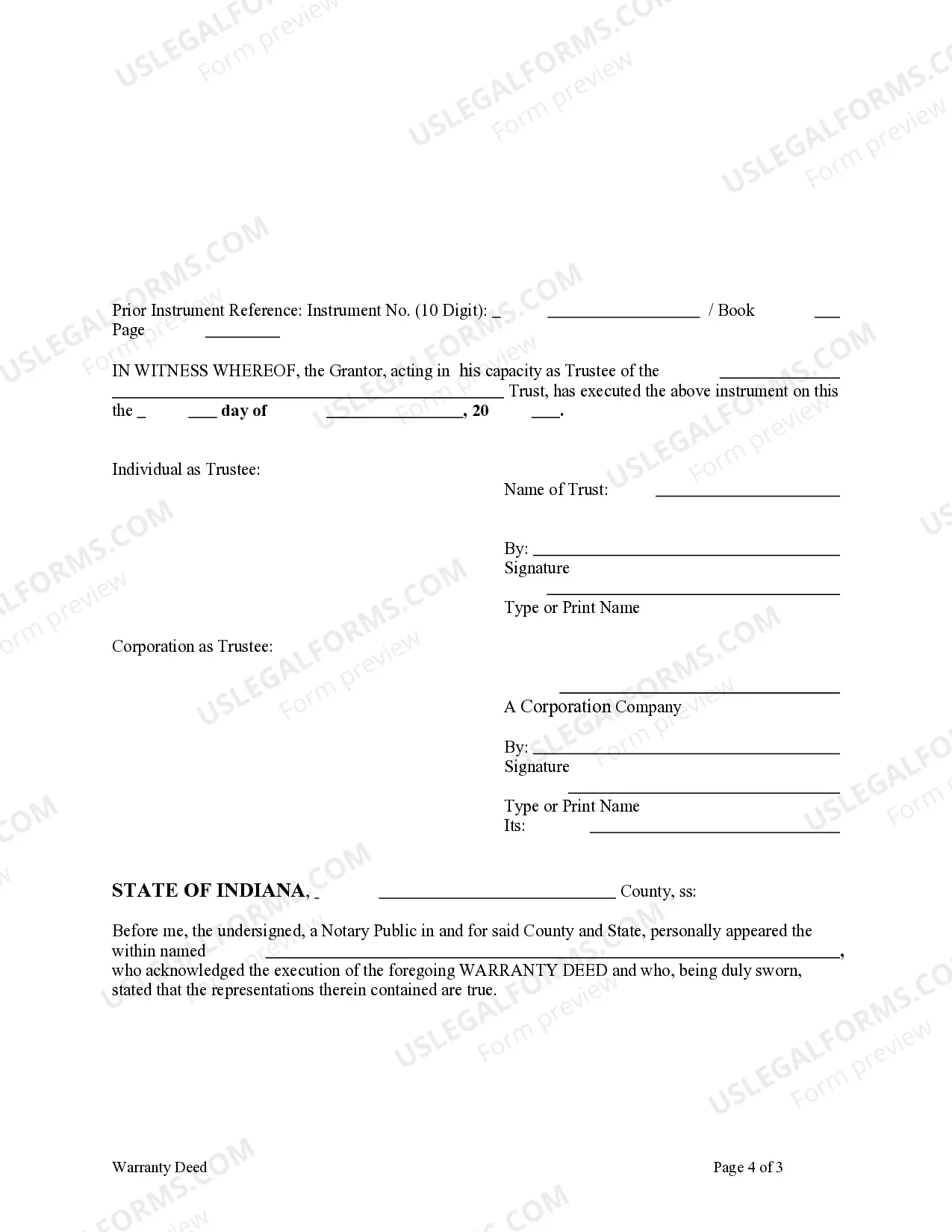

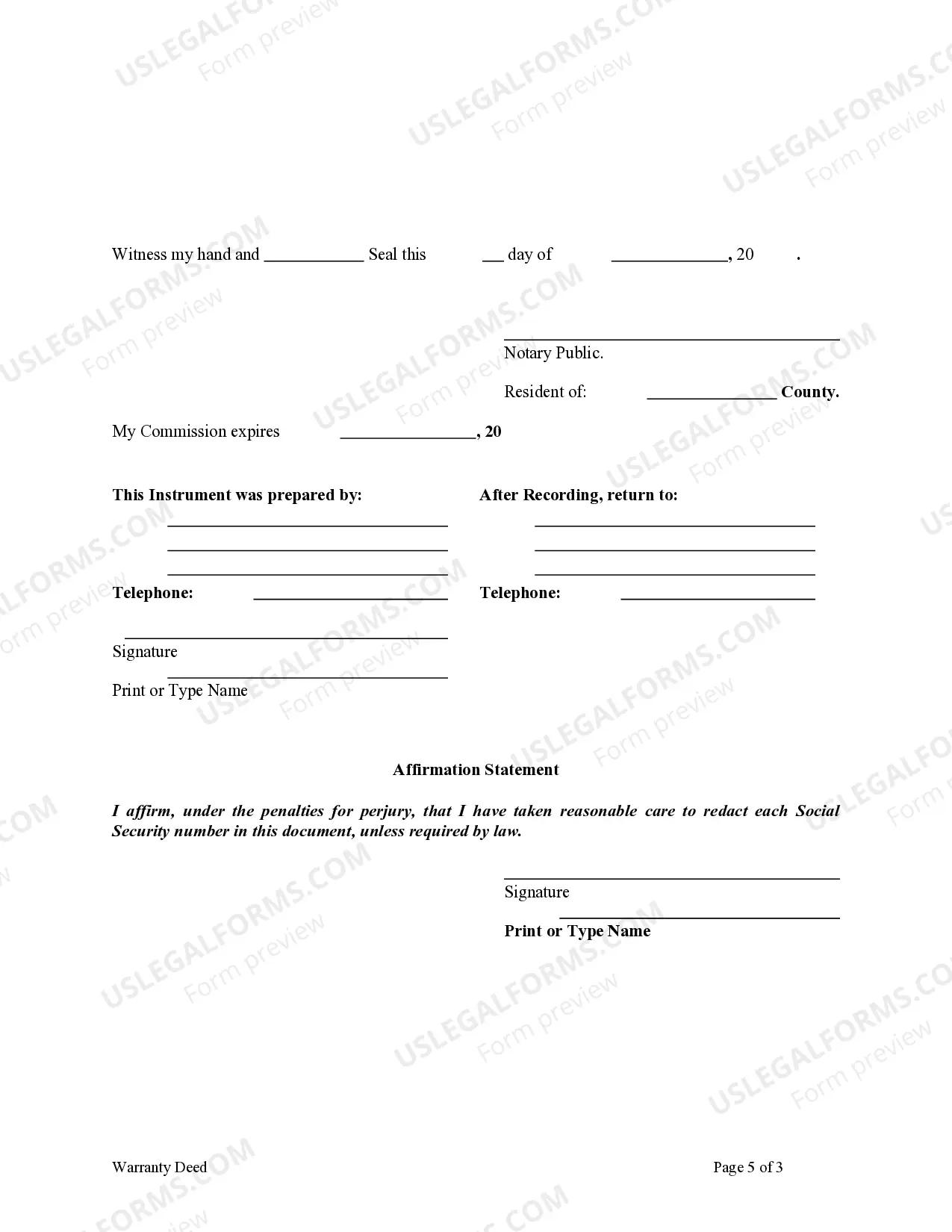

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Trust Grantor Form Withdrawal

Description

Form popularity

FAQ

Yes, you can take distributions from a grantor trust. The trust grantor form withdrawal allows you, as the grantor, to access funds without facing tax complications at the trust level. However, it’s crucial to understand the implications of these distributions on your overall tax situation. Using a platform like US Legal Forms simplifies the process by providing the necessary forms and guidance for effective management of your grantor trust.

Withdrawals from a trust can be taxable, depending on the nature of the distribution and the trust type. Generally, if the trust generates income, any distributions may count as taxable income for the beneficiary. However, corpus withdrawals typically do not incur taxes. Consulting resources on the US Legal Forms platform can illuminate issues related to tax obligations when managing your Trust grantor form withdrawal.

Withdrawal rights in a trust refer to the privileges granted to beneficiaries to take distributions from the trust assets. These rights may vary based on the trust’s terms, and they often depend on certain conditions being met. Understanding your rights ensures you can access funds as needed. If you require clarity on withdrawal rights, the US Legal Forms platform provides guidance on completing the Trust grantor form withdrawal effectively.

You should file Form 56 for a trust with the Internal Revenue Service (IRS). Specifically, send your completed form to the address indicated in the Form 56 instructions for your situation. Ensure you keep a copy for your records. Utilizing US Legal Forms can help simplify the process of completing and filing the Trust grantor form withdrawal.

To take distributions from a trust, you need to follow the guidelines set forth in the trust document. Typically, the trustee will evaluate the terms of the trust and determine the appropriate distribution amount based on the grantor's instructions. It's important to complete the necessary paperwork, which often involves a Trust grantor form withdrawal, to ensure proper documentation. You can simplify the process by using platforms like US Legal Forms, where you can find the required forms and guidance tailored to your situation.