Llc Operating Agreement Indiana With Non Voting Members

Description

How to fill out Indiana Limited Liability Company LLC Operating Agreement?

Securing a reliable source for obtaining the latest and most suitable legal templates is a significant portion of navigating bureaucratic processes.

Acquiring the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to source Llc Operating Agreement Indiana With Non Voting Members exclusively from trustworthy providers, such as US Legal Forms.

Once you have the form saved on your device, you can edit it with the editor or print and fill it out by hand. Alleviate the stress linked to your legal documentation. Explore the comprehensive US Legal Forms catalog to find legal templates, assess their suitability for your situation, and download them instantly.

- Utilize the directory navigation or search bar to locate your template.

- Review the document details to ensure it meets the criteria for your state and area.

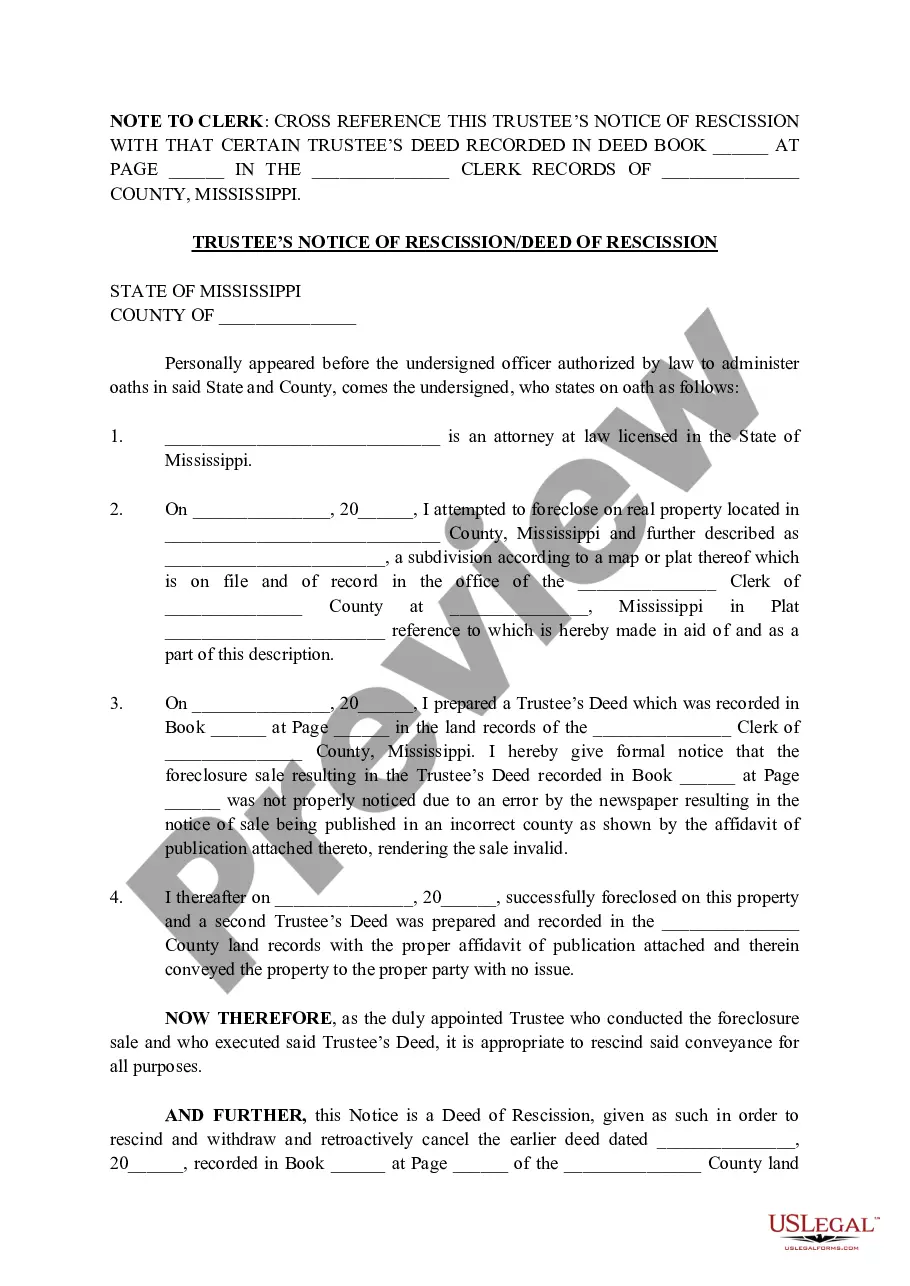

- Check the form preview, if accessible, to confirm that it is indeed the document you need.

- Return to the search to find the suitable document if the Llc Operating Agreement Indiana With Non Voting Members does not meet your specifications.

- Once you are confident about the form’s suitability, download it.

- If you are a registered member, click Log in to verify and access your selected forms in My documents.

- If you don’t have an account yet, click Buy now to purchase the form.

- Choose the pricing option that aligns with your needs.

- Proceed to register to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Llc Operating Agreement Indiana With Non Voting Members.

Form popularity

FAQ

member LLC operating agreement is a binding document between the members of a company that includes terms related to ownership (%), management, and operations. The agreement should be created when forming the company as an understanding of how the organization will run.

LLCs can create different classes of LLC Members in the Operating Agreement, with different voting rights based on factors like total ownership interest, capital contributions, or management responsibilities.

The process of adding a member to an Indiana LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

Indiana state law does not mandate that LLCs adopt an operating agreement. Indiana state code § 23-18-4-5 states that LLCs may enter into an operating agreement but does not require them to do so. Even so, it is in your company's best interest to have a written operating agreement.

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.