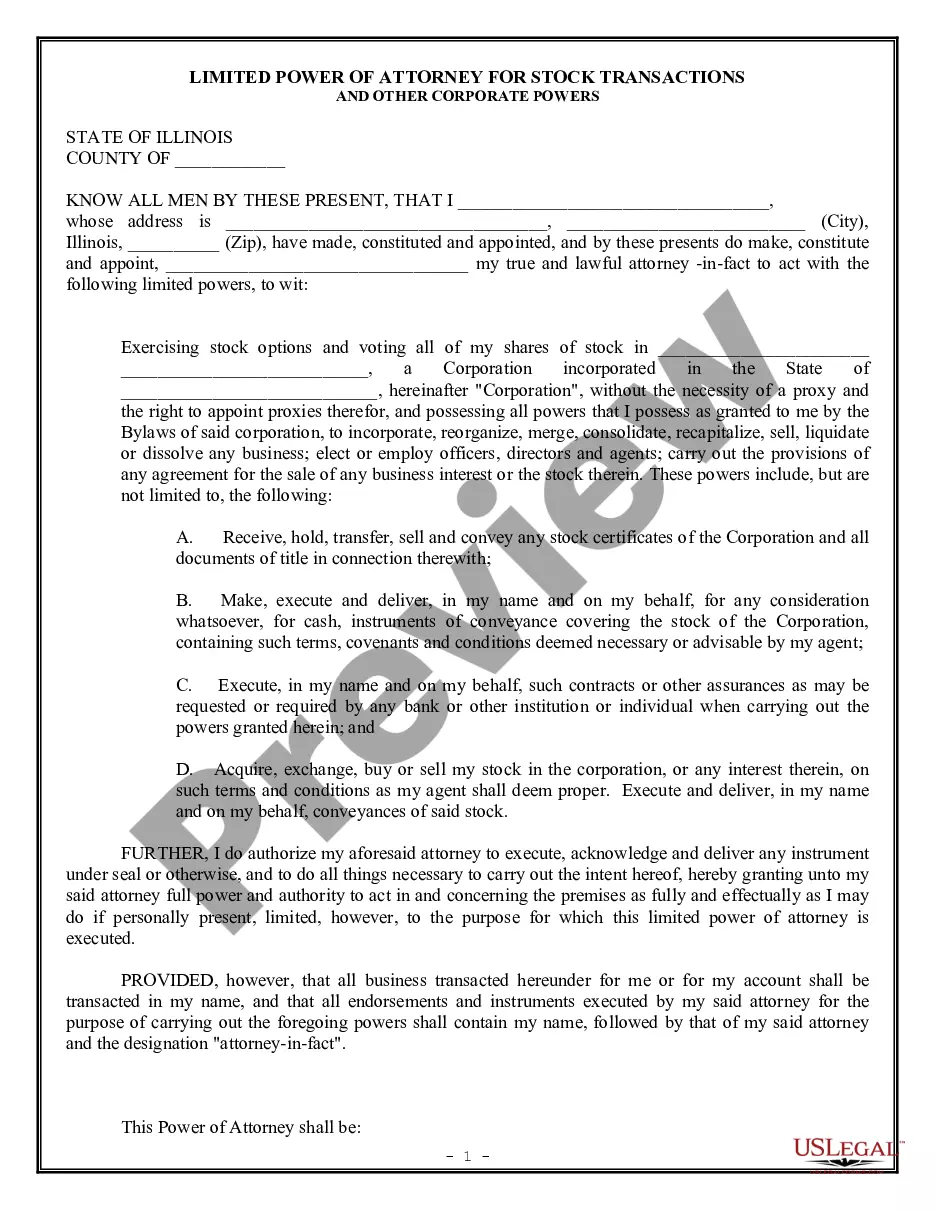

Power Attorney

Description

How to fill out Illinois Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- If you're an existing user, log in to your account, then navigate to the required form template and click the Download button. Remember to check your subscription status.

- For new users, start by browsing the extensive preview mode of available forms. Ensure the selected power attorney form aligns with your specific legal needs and adheres to local regulations.

- If adjustments are needed, utilize the Search option to find an appropriate template that suits your requirements.

- Purchase the document by clicking the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the full range of resources.

- Complete your purchase by entering your payment information, whether by credit card or PayPal.

- Download your power attorney form and save it on your device. Access it anytime via the My Forms section in your account.

In conclusion, US Legal Forms offers a user-friendly solution to obtain your power attorney and other legal documents, ensuring immediate access to a comprehensive library. With easy navigation and assistance from legal experts, you can ensure that your documents are completed accurately and efficiently.

Start your journey toward hassle-free legal documentation today!

Form popularity

FAQ

To fill up a power of attorney, start by selecting the correct form that suits your legal needs. Next, accurately enter both your details and those of your agent. Clearly outline the powers you wish to grant and add any limitations if necessary. Platforms like US Legal Forms can provide step-by-step assistance to help you complete this document correctly.

When signing as a power of attorney, you would write your name followed by 'Power of Attorney for Principal’s Name.' This format shows that you are acting on behalf of the person who granted you this authority. This signature not only validates your actions but also reinforces the legal standing of the document. Always ensure you are making decisions that align with the principal's wishes.

In South Carolina, a power of attorney must be signed by the principal and two witnesses. Additionally, the document may need to be notarized for it to carry weight. Clarity is vital; your paperwork should specify the powers granted. Using resources like US Legal Forms can ensure you meet all the state requirements effectively.

To fill out power of attorney paperwork, start by choosing the appropriate form that suits your needs. Clearly state your name, the agent's name, and specify the powers you wish to grant. Detailed instructions accompany forms on platforms like US Legal Forms. Following these guidelines helps ensure your power attorney is executed properly and legally.

To fill out a POA check, you must first ensure that it is clearly marked with the designation of power of attorney. Include your name, the name of the person holding the power of attorney, and a description of the transaction. It’s crucial to have relevant identification and legal documents ready, as they may be necessary to validate the transaction. This step secures your authority to act as a power of attorney.

The best person to act as a power of attorney is usually someone you trust deeply. This individual should understand your values and wishes, as they will make important decisions on your behalf. It can be a family member, close friend, or a professional like an attorney. Ultimately, choose someone who will act in your best interest.

A valid power of attorney in Maryland requires that the principal be at least 18 years old and have the mental capacity to make decisions. The document must be in writing, signed by the principal, and either witnessed by two individuals or notarized. It's crucial to keep these requirements in mind to ensure your power attorney holds up in all situations. The US Legal Forms platform can provide templates and guidance to create an effective document.

In Maryland, a power of attorney must be signed by the principal and be witnessed by two individuals or notarized. The document should clearly state the powers granted to the agent, and it is essential that the principal is mentally competent at the time of signing. By ensuring these requirements are met, you can create a valid power attorney that will serve your needs effectively.

To file a power of attorney with the IRS, you need to complete Form 2848, which authorizes your representative to act on your behalf. It's important to include all necessary information about both you and your appointed representative. Once completed, you can submit this form directly to the IRS, ensuring your representative can manage your tax matters effectively. Utilizing a power attorney can simplify your interactions with tax authorities.

If you do not have a power attorney in Maryland, medical decisions typically fall to next of kin. This could include a spouse, adult children, or parents, depending on the situation. Without a designated power of attorney, there may be disputes among family members regarding your healthcare choices. To avoid confusion and ensure your wishes are respected, consider establishing a power of attorney.