Power Of Attorney Irs

Description

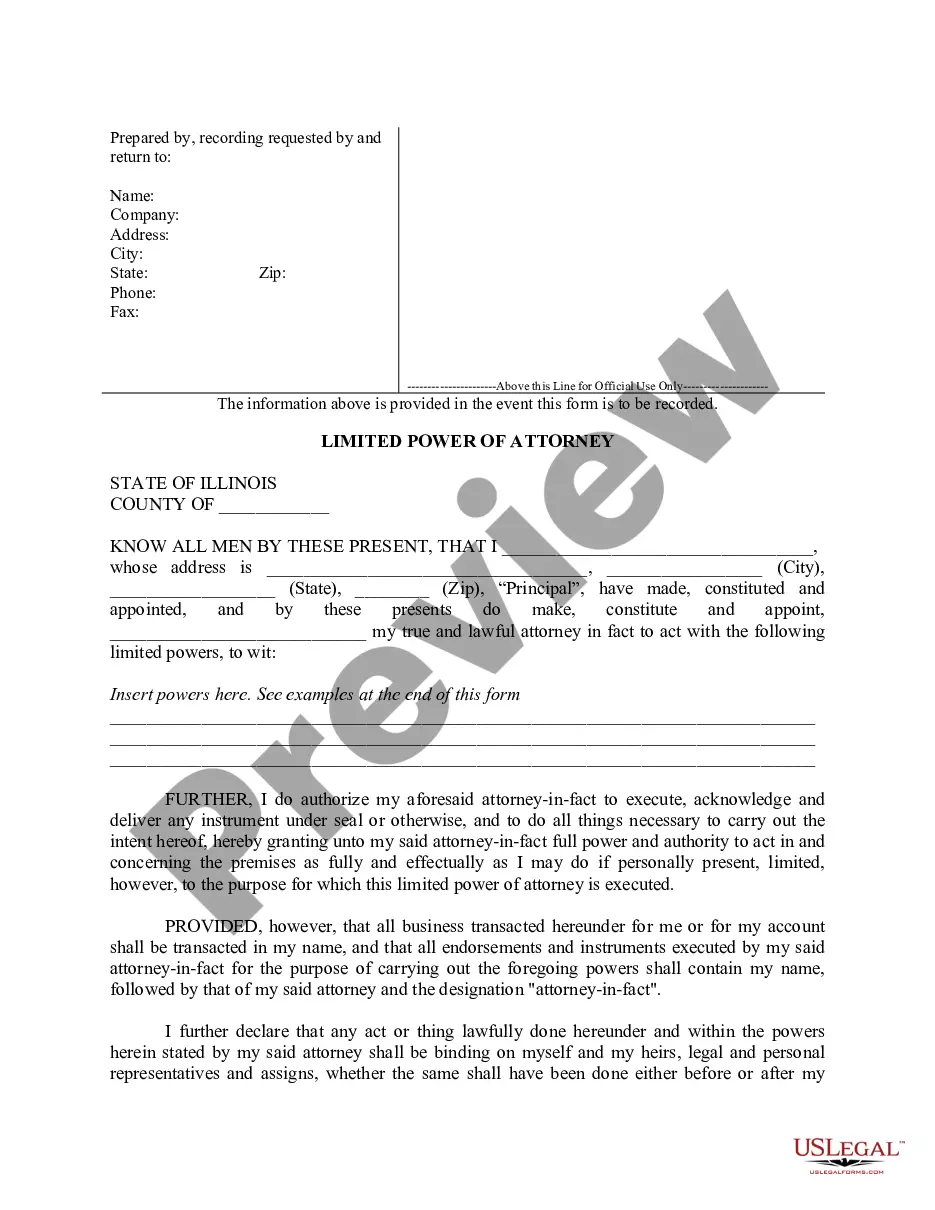

How to fill out Illinois Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Start by logging in to your existing US Legal Forms account. Make sure your subscription is up-to-date to avoid issues during download.

- If you're a new user, begin by reviewing the Preview mode for the desired power of attorney form and ensure it aligns with your jurisdiction's requirements.

- In case your initial search does not yield the appropriate form, utilize the Search tab to explore alternative templates that suit your needs.

- Once you've identified the correct document, proceed by clicking the 'Buy Now' button. Select your preferred subscription plan and create an account for access.

- Complete your purchase by entering your payment details. US Legal Forms accepts credit cards and PayPal for your convenience.

- After successful payment, download the form to your device. You can access this document anytime under the 'My Forms' section in your profile.

With US Legal Forms, individuals and attorneys can efficiently create and manage legal documents, ensuring that critical forms like the power of attorney are both accessible and compliant.

Take advantage of US Legal Forms today to simplify your legal document needs. Start your journey now!

Form popularity

FAQ

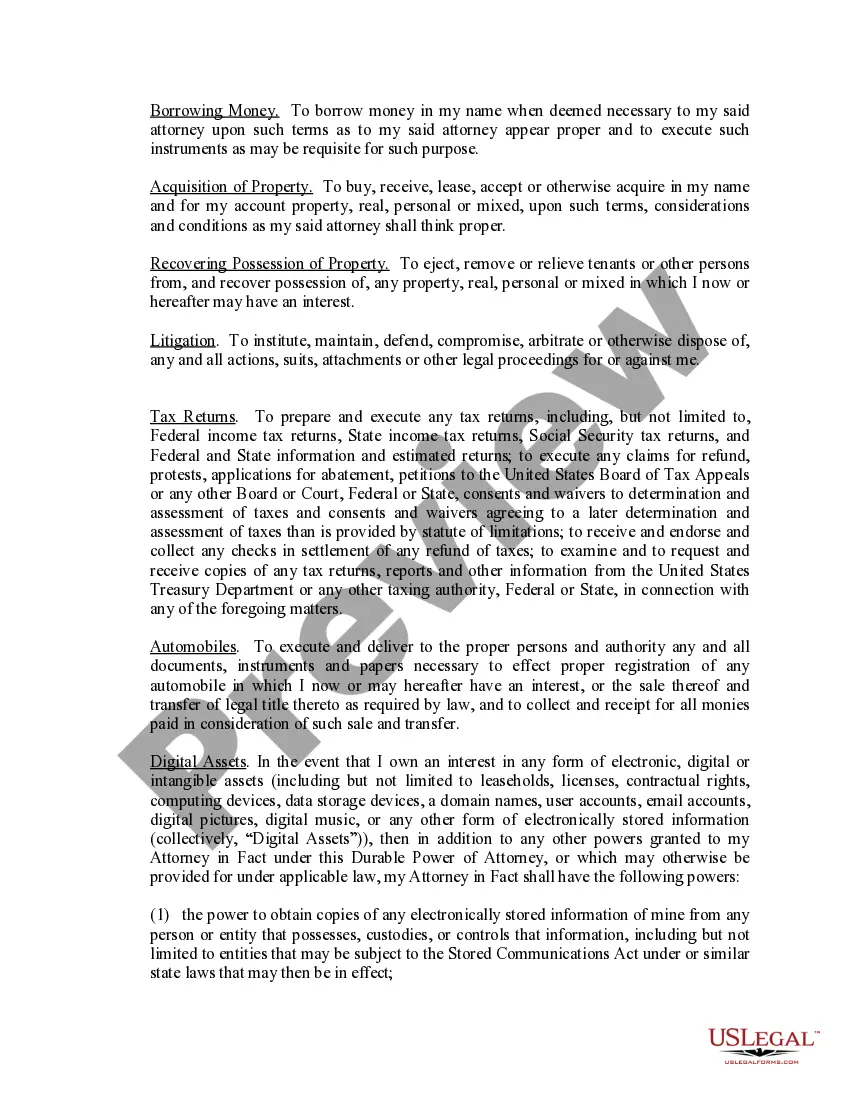

A power of attorney can indeed be signed virtually, particularly when using digital signature solutions. This method allows you to authorize someone to act on your behalf without the need for physical presence. Platforms like US Legal Forms offer tools that facilitate virtual signing, ensuring that your power of attorney for IRS is executed correctly and securely.

Yes, an IRS power of attorney can be signed electronically, providing a convenient option for taxpayers. When using e-file software approved by the IRS, you can easily sign your document without needing to print it. This electronic submission method enhances the efficiency of handling your power of attorney with IRS.

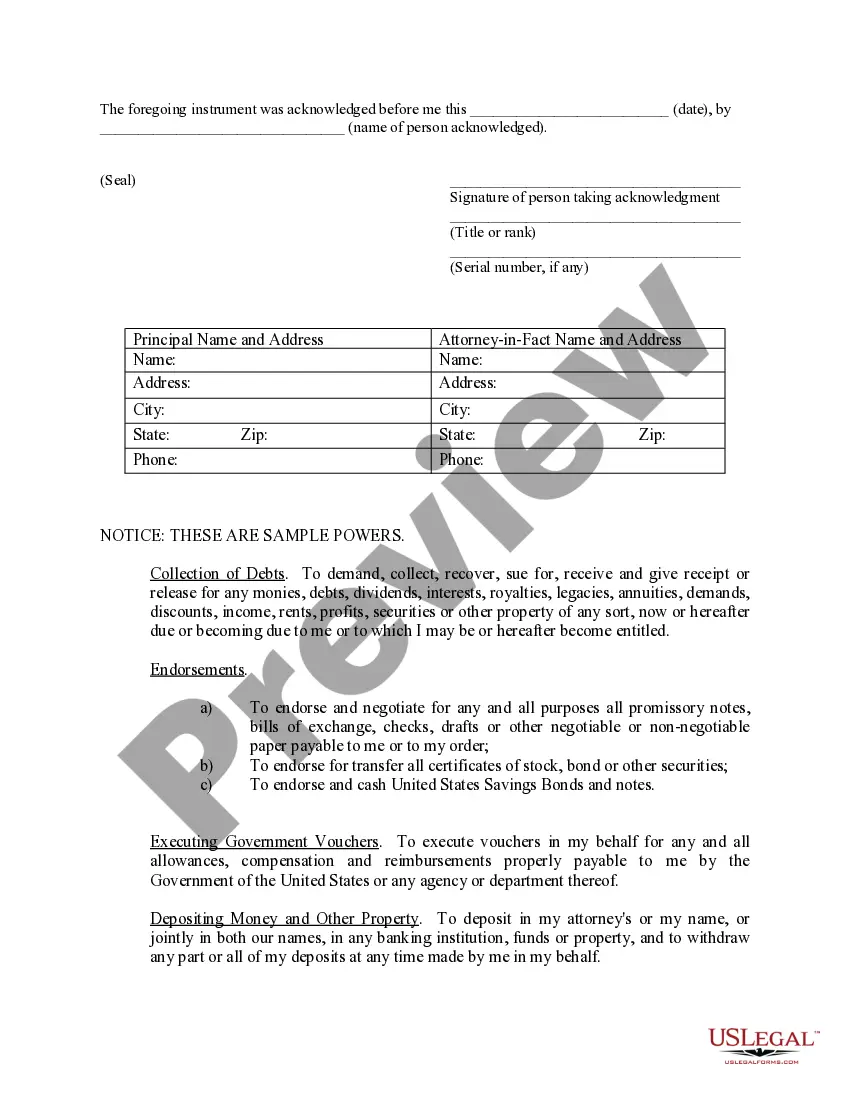

Filling out a power of attorney form involves providing your personal details, the representative’s information, and the tax matters you want them to handle. Make sure you specify the types of tax matters and years involved. For precise guidance, using resources available on the US Legal Forms platform can help you navigate the completion of the power of attorney form effectively.

To submit a power of attorney to the IRS, you'll need to complete Form 2848, known as the Power of Attorney and Declaration of Representative. Once you fill out the form, you can either mail it directly to the IRS or submit it electronically using authorized e-file software. Remember, using a reliable platform like US Legal Forms can simplify this process and ensure your submission meets all requirements.

Yes, the IRS does accept digital signatures for certain documents. This acceptance includes power of attorney forms, making it easier for you to manage your tax matters remotely. By using digital signatures, you can streamline the submission process for your power of attorney to IRS, enhancing convenience.

In most cases, the IRS does not require your power of attorney to be notarized. However, some states may have their own regulations that could necessitate notarization. To be fully compliant, check your state’s requirements and consider using US Legal Forms to access accurate information quickly. Ensuring your documents are correctly executed helps prevent any issues down the line regarding your power of attorney for IRS purposes.

Obtaining power of attorney for the IRS is straightforward. Start by completing Form 2848, which allows you to designate someone to represent you in tax matters. US Legal Forms offers templates and resources that simplify this process, ensuring you fill out the form correctly. After completing the form, submit it to the IRS and retain a copy for your records.

The best way to submit your power of attorney to the IRS is electronically, using Form 2848. You can also send it through the mail but ensure it goes to the right address based on the state your taxes are filed. When using a platform like US Legal Forms, you can easily complete and submit this form, ensuring accuracy and compliance with IRS requirements. This helps streamline your power of attorney IRS process.

The IRS typically takes about six to eight weeks to process paperwork like power of attorney requests. However, this timeline can vary based on their current workload and specific circumstances surrounding your case. To ensure a smooth process, submit your documents correctly and keep track of any communications from the IRS. Being prepared can significantly reduce delays with your power of attorney for IRS matters.

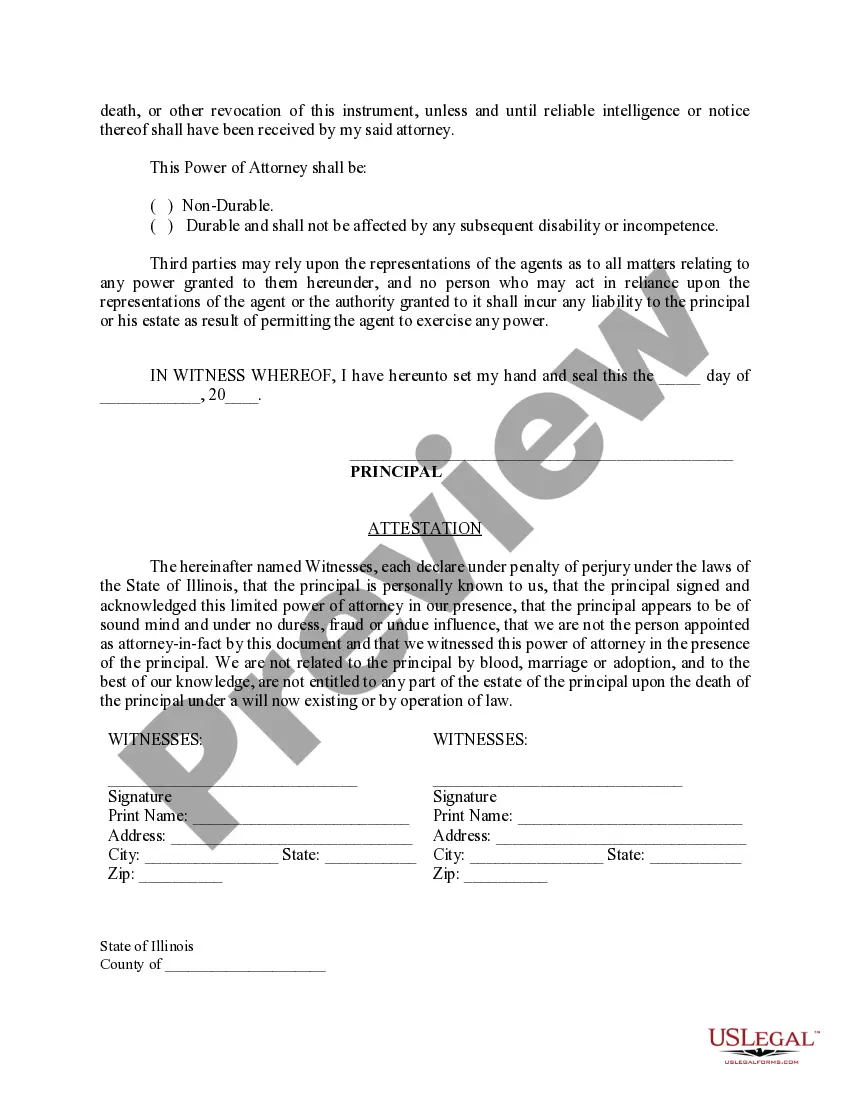

Creating a power of attorney usually takes a few hours to a few days, depending on how quickly you gather the necessary information. If you use a service like US Legal Forms, you can streamline this process significantly. Once you have completed the forms, you will need to sign them and possibly have them notarized, depending on your state’s rules. Overall, with the right resources, getting a power of attorney is efficient and manageable.